2024: An Extraordinary Year for Precious Metals

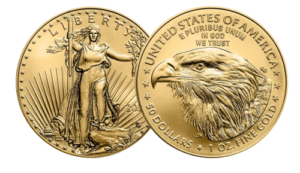

Posted onGold and silver delivered extraordinary performances in 2024. It was a record-breaking year as gold climbed to multiple new all-time highs throughout the year. Gold’s remarkable ascent to a new record above $2,700 an ounce was driven by multiple factors including central bank buying, geopolitical tensions, monetary policy easing, persistent inflation, and increased safe-haven demand from investors.

year. Gold’s remarkable ascent to a new record above $2,700 an ounce was driven by multiple factors including central bank buying, geopolitical tensions, monetary policy easing, persistent inflation, and increased safe-haven demand from investors.

Precious metals outpaced returns in most other asset classes. Gold climbed as much as 33% annually through the fourth quarter, while silver gained 29%.

Key Bullion Trends in 2024

Several factors contributed to gold’s stellar performance in 2024 including aggressive central bank buying, geopolitical tensions around the globe, stubborn inflation and monetary easing.

- De-Dollarization: The geopolitical landscape, particularly actions such as the freezing of Russia’s dollar assets by the Biden administration, prompted countries to reconsider the amount of their reserves held in dollars. This contributed to the increased demand for gold as a secure, long-term reserve internationally.

- Long-term Position Building: Central banks are buying and stockpiling gold, and these are long term positions. This trend emerged amid a fundamental shift in how central banks manage the composition of their reserves. Notably, they are decreasing their U.S. dollar reserves and increasing their gold reserves. Central banks like Russia, along with emerging markets like China, India, and Turkey, have been significant buyers of gold recently. This increase in central bank gold holdings has created a strong stable base for gold prices at these higher prices levels. Central banks are the ultimate buy and hold investors, and tend to hold their assets for decades.

- Geopolitical Tensions: Ongoing conflicts in Ukraine and the Middle East, coupled with broader global uncertainties, heightened gold’s appeal as a safe-haven asset.

- Monetary Policy Shifts: Federal Reserve and other central bank’s interest rate cuts in 2024 boosted gold’s attractiveness. As interest rates decrease, non-yielding assets like gold become more appealing to investors.

- Inflation Concerns: Persistent inflationary pressures in many economies, including the United States, increased investor interest in gold as a method to protect and preserve the purchasing power of their wealth.

- Strong Investor Demand: The record-breaking performance of gold in 2024 attracted more investors into bullion, creating a self-reinforcing cycle of demand. As prices climbed, more investors entered the market, further driving up prices.

Investor Behavior: Fractional Gold Emerged As a Popular Bullion Strategy in 2024

Over the past year, new and seasoned investors actively accumulated fractional gold in a long-term wealth building strategy. There has been significant focus on fractional gold, which is seen as a practical, affordable, and the perfect emergency-use currency.

These smaller denominations of gold, typically weighing less than one ounce, provide a more accessible entry point into the precious metals market. One of the benefits of fractional gold is its affordability. With options like 1/10 oz, 1/4 oz, and 1/2 oz coins investors can build their bullion portfolios on an on-going basis, over time, using a strategy known as dollar-cost averaging.

Another benefit to fractional gold is increased liquidity—as smaller denominations are seen as easier to sell or trade compared to larger coins or bars. This liquidity is a valuable hedge against periods of economic uncertainty or panic—especially as a number of American states advance legislation to recognize gold and silver as legal tender. Already, 12 states have laws on the books that make gold and silver legal tender. Additionally, other states are exploring similar initiatives.

The push for legalizing gold and silver as currency is driven by several factors. Advocates argue that precious metals offer stability in value compared to fiat currencies, which are subject to inflation and economic fluctuations. The growing interest among states suggests that this trend could expand in the coming years as more lawmakers consider alternatives to traditional fiat systems amid economic uncertainties.

Investor Confidence and Wealth Building

Successful wealth building includes taking a long-term view to your investments. As Wall Street legend Ben Graham advised: “The individual investor should act consistently as an investor and not as a speculator.”

Investors are increasingly confident in the stability, peace of mind and wealth preservation opportunities that precious metals offer. Investors view these investments as part of a steady, long-term wealth-building strategy, adding to their portfolios whenever possible. Steady accumulation of bullion has proven to be the most successful approach to building wealth over the long term.

Precious metals have stood the test of time, providing people for thousands of years a store of value that not only protects and preserves wealth, but helps to grow it. The great gold rally is far from over. Gold broke records this year and is expected to set new records in 2025.

If you desire to build wealth for yourself and future generations, Blanchard can help you achieve your goals. Over the past 50 years, we have helped clients invest in American numismatic rarities and investment grade silver, gold, platinum and palladium bullion to protect and grow their wealth. We can help you too.