Are You Prepared for the Inflation Tax?

Posted onInflation affects us all.

If it feels like a dollar doesn’t go as far as it used to, you aren’t imagining it. You are experiencing the powerful impact from inflation.

Inflation is the steady rise in price for everyday goods and services – things like groceries, cars and homes – that’s known as the rising cost of living.

When inflation causes prices to rise, but our paychecks don’t, it reduces our purchasing power, and thus reduces our quality of life.

Inflation erodes your purchasing power over time.

A simple example is the price of milk. In 1913, a gallon of milk cost 36 cents. In 2013, a gallon of milk cost $3.53, nearly ten times higher in 100 years. The higher price of milk reflects, not a scarce supply, instead it represents the steady decrease in the value of money over time – due to inflation.

Inflation, while deadly to your pocketbook and portfolio, is silent and slow right now. It creeps steadily higher over the years almost without your noticing. Yet, over the course of years and decades – the power of inflation is profound. It severely reduces your purchasing power of your money.

Brief history of inflation in the U.S.

In recent years, inflation has been low. It hasn’t always been this way in our country.

The period from 1965-1982 is known as “The Great Inflation” in the United States. In 1964, inflation measured at 1% per year. By 1980, inflation climbed to an astounding 14%.

Notably, during this period, President Nixon halted the exchange of dollars for gold, severing the U.S. dollar’s link to a physical hard asset. That set the stage for easy money policies from the Fed and rampant inflation.

Looking back what have economists learned about the Nixon era: “Their larger error was that most often they wanted to increase money growth to reduce the unemployment rate,” according to the Federal Reserve Bank of St. Louis.

Fast forward to today. We are seeing the Federal Reserve doing the same and more!

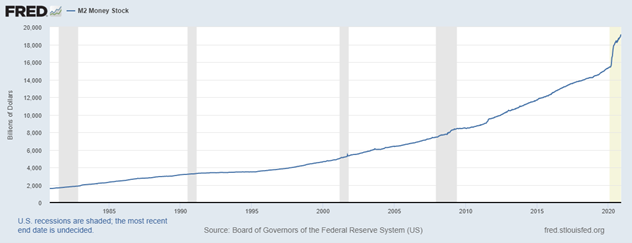

U.S. money supply growth has skyrocketed.

Figure 1: Rising Money Supply Growth

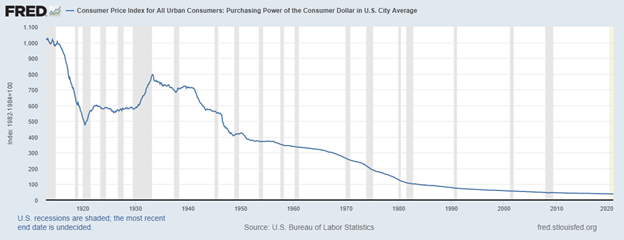

Look what rising money supply growth has done to the purchasing power of the U.S. dollar in Figure 2.

Figure 2: Falling U.S. Dollar Purchasing Power

It’s not rocket science. As the Fed creates more and more U.S. dollars, their value decreases.

For you – that is inflationary. You need more dollars to buy the same good or service.

What can you do to protect your financial future?

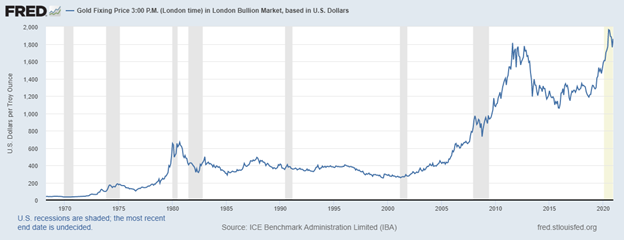

For thousands of years, gold has been a proven store of value. While the purchasing power of your dollar declines, the value of gold is rising. See Figure 3.

In 1975, one ounce of gold cost $35. In 2020, one ounce of gold costs $1,875.00.

The value of your dollars is decreasing.

Gold is a proven store of value. For thousands of years gold has not only held its value , it’s become more valuable – the exact opposite of U.S. dollars! Gold has a limited supply, it is very difficult to mine and experts say we are close to peak gold, or simply running out. While the Federal Reserve simply prints more U.S. dollars – all the time!

Could we see higher inflation ahead?

Yes. History guarantees it. Even more, the Federal Reserve’s policies over the past decade have created the perfect storm, not only for run of the mill inflation, but hyperinflation.

The national debt now stands at over $27 trillion. Who’s buying all that debt? Indeed, it used to be China and Japan, but no more. Foreign buyers used to hold more than half of outstanding U.S. Treasury debt. Times have changed. In 2020, the Federal Reserve stepped in to be the buyer of last resort.

How is the Fed funding its bond-buying purchases? It’s printing new dollars out of thin air. Yes, that’s right. Essentially, the U.S. Treasury is selling bonds (issuing debt to raise money) and the Fed is printing money to buy them.

What could go wrong with this? Stay tuned. Next week we’ll show you the charts you need to see.

It’s surprising how many investors today disregard the impact of inflation on their retirement savings, their portfolios and their financial future. Don’t make that same mistake.

What are you doing to protect your financial security?

These unprecedented economic times call for action. The Fed’s money printing and the rising federal debt is a ticking time bomb for your financial future.

If you want to protect your retirement savings, your hard-earned dollars, consider increasing your allocation to physical gold. Why keep your wealth in an asset that is declining in value like dollars?

If you are unsure how much you need to allocate to physical gold to protect your financial future, please talk with a Blanchard portfolio manager today for a personalized portfolio review and recommendation matched to your unique personal situation.

Follow Our 3-Part Series

Check back next week for the second installment of our in-depth three part series on inflation. The causes, the impact and what you can do to protect your financial future.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.