Blanchard in the News: Wall Street Journal Highlights Gold’s Explosive Growth

Posted onEveryone is a gold bug now, according to a new Wall Street Journal article, which featured Blanchard. It’s no surprise that gold is making headlines. The precious metal has soared an extraordinary 20%+ since the start of the year, while the U.S. stock market has tanked.

What’s notable about the latest wave of gold buying is that it attracting a new generation of buyers, according to the Wall Street Journal:

The metal is attracting first-time buyers, many younger than traditionally seen, seeking a stable investment as Trump’s policies rattle the stock market and escalate global political tensions. Other longtime devotees are increasing their holdings.

“Owning physical gold is moving more toward the mainstream.”

Blanchard has also noticed gold gaining followers during the dot-com bubble, the 2008 financial crisis, and the COVID-19 pandemic.

New Generation Embraces Blanchard’s Investing Philosophy

Younger Americans are recognizing the value of the key investment principle that Blanchard has employed with our clients for the past 50 years:

- We believe that gold and silver bullion in physical form is an appropriate asset for a small portion of any properly diversified investment portfolio.

In other words, everyone should own physical metals. Other key tenets of the Blanchard tangible assets investment approach are:

- Everything we do is based on a long-term outlook.

- We believe in the long-term investment value of high-end rare and ultra-rare coins.

- We take the time to understand your investment objectives, time horizon, and risk appetite before recommending products for your consideration.

Historic Multi-Year Gold Rally Is Underway

Both long-time gold owners and first-time buyers are benefiting from an explosive rally in the gold market, one of the most significant seen in decades. This is a continuation of the uptrend we’ve seen in recent years. In 2024, the price of gold set forty record highs and finished the year with a 27% gain.

This year, gold continues to make history. In March 2025, gold hit a major milestone as it soared above the $3,000 barrier for the first time and then quickly eclipsed the $3,100 level. Year-to-date, gold has sprinted 20%+ higher and is still climbing. This year marks the fourth consecutive year that gold has reached new all-time highs.

What’s Driving Gold Higher Now?

Gold and silver are both benefiting from a massive flight to safety in 2025.

On April 2nd, deemed Liberation Day, the White House rolled out tariff increases of 10% to 50% on most trading partners. The expansive tariffs spooked the market amid worries that corporate profits could turn south. Some economists bumped up their recession odds forecast to 50% following the tariff news. The price increase from tariffs is expected to mean less disposable spending power in American consumers’ pockets, slowing economic growth and hiring.

The jury is still out on how the tariffs will impact the economy, but some American business owners have expressed concern about current supply channels that could become more costly.

Gold Offers Safe Haven

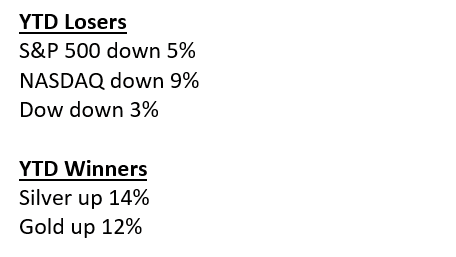

In the meantime, the safety of gold and silver is appealing. Gold has served as a store of value for 5,000 years and is a proven vehicle to protect and grow your wealth, especially during uncertain economic times. Because gold has a low correlation to the stock market, when stock prices crash, gold prices historically soar. Here’s a snapshot of just a few of the major indices and selected stock price performance.

Year-to-date performance

Winners

- Gold up 22%

- Silver up 16%

Losers

- Nasdaq Composite Index down 14%

- S&P 500 Index down 8%

- Nvidia down 23%

- Nike down 26%

- Dell down 32%

- Best Buy down 27%

- Williams Sonoma down 25%

- Wayfair down 45%

- Norwegian Cruise Lines down 36%

- Advanced Micro Devices down 22%

Gold Is Still Climbing

What we are seeing now is just the start of the current gold rush. As highlighted in the Wall Street Journal, Bank of America analysts raised their price target to $3,500. Do you own enough?

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

Bullion Exempted in Liberation Day Tariffs: What This Means for Gold Investors

Posted onAs the world digests the impact of the White House’s Liberation Day tariffs, an exemption for metals—including bullion—tucked quietly inside the White House fact sheet. Let’s dig into the details.

According to the White House fact sheet released on April 2nd, metals are exempt from the reciprocal tariff. You can read this exemption in section (5) below. Bullion refers to precious metals like gold and silver in bulk form, like gold bars or coins.

“Some goods will not be subject to the Reciprocal Tariff. These include: (1) articles subject to 50 USC 1702(b); (2) steel/aluminum articles and autos/auto parts already subject to Section 232 tariffs; (3) copper, pharmaceuticals, semiconductors, and lumber articles; (4) all articles that may become subject to future Section 232 tariffs; (5) bullion; and (6) energy and other certain minerals that are not available in the United States.”

How Did Precious Metals React to the News?

Gold and silver prices tumbled sharply on the tariff exemption. This can be confusing even for the most seasoned investors. It’s complicated.

The sharp pullback in precious metals relates to a massive arbitrage trade occurring in recent weeks as traders rushed to get gold and silver out of London vaults to the U.S. ahead of the expected tariffs. Planes and ships have been loaded with bullion as U.S. firms and banks rushed to get gold and silver to the U.S.

The unexpected tariff exemption for bullion caused the premium for gold and silver to fall, resulting in lower prices. However, prices have soared back to new records as Friday, April 11th.

Here’s how a Bloomberg news article described it: “On Thursday, US premiums for precious metals tumbled after a list of exemptions from the tariffs included gold, silver, platinum and palladium. The difference between front-month Comex gold and spot gold in London dropped to $21 an ounce from over $62 on Wednesday. For silver, the differential — known by precious metals trader as the “exchange for physical” or EFP — tumbled from more than $1 an ounce to just 8 cents.”

What Does This Mean for Gold and Silver Investors Now?

Gold has soared more than 20% since the start of 2025 as investors around the globe have piled into the safety of precious metals. In a world where the U.S. dollar is falling, the stock market is crashing, and bond yields are in decline, there are few places for investors to turn to protect and preserve their wealth. Precious metals are a safe haven in the economic storm of uncertainty. The surprise tariff exemption for metals created a short-term dislocation in gold and silver prices as the premiums collapsed.

Bottom line? This is a short-term dip buying opportunity for long-term precious metals investors that won’t last long.

The underlying uptrend in gold and silver prices hasn’t changed, and the reason investors big and small have been rushing into gold this year hasn’t changed. If anything, the economic and market uncertainty has increased.

Recession and Bear Markets Rise

Following Liberation Day, J.P. Morgan raised its odds for a U.S. and global recession to 60% this year. S&P Global, Goldman also hiked U.S. recession probabilities following the new White House tariff policy, which imposed tariffs on dozens of countries around the globe. On April 4, the Nasdaq Composite traded more than 20% off its December high. Sustained declines of 20% or more is the definition of a bear market in stocks.

If you have money invested in the market, there is no historical playbook over the last 100 years for what the sweeping tariff policy changes will mean for the U.S. economy. Uncharted economic waters lie ahead, and the waves of selling likely aren’t over. The U.S. stock market hasn’t fully priced in a recession yet.

Trade Your Dollars for Bullion Now

Morgan Stanley predicts that gold could reach $3,400 in 2025, Bank of America raised its forecast to $3,500, and Goldman Sachs said gold could reach $4,500 in a low probability “extreme tail scenario.” There are few places investors can park their money in 2025 for wealth preservation and growth—and precious metals offer you that opportunity today.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

Current Geopolitical Risks and How They Influence the Price of Gold

Posted onWhen conflicts arise or economic systems face pressure, investors frequently turn to gold as a store of value. Today, we find ourselves in a period of significant geopolitical risks. From ongoing tensions in Eastern Europe to conflicts in the Middle East and evolving trade relationships between major powers, the global landscape is marked by uncertainty. Many investors question how these developments influence the price of gold in both short and long-term scenarios. This article aims to shed light on the relationship between geopolitical events and gold prices by discussing:

geopolitical risks. From ongoing tensions in Eastern Europe to conflicts in the Middle East and evolving trade relationships between major powers, the global landscape is marked by uncertainty. Many investors question how these developments influence the price of gold in both short and long-term scenarios. This article aims to shed light on the relationship between geopolitical events and gold prices by discussing:

- How geopolitical events affect gold.

- Future geopolitical risks and their potential impact on gold markets.

- Investing in gold through trusted dealers like Blanchard.

Watch this informative video to find out more about how geopolitics affect the price of gold

How Geopolitics Affect the Price of Gold

Throughout human history, financial markets have responded dramatically to world events and political shifts. Investing in gold during crises has been a consistent strategy for wealth preservation when uncertainty strikes. Here, we will explore not only how gold responds to global instability but also why it continues to attract investors during turbulent times. Understanding these dynamics can help investors make more informed decisions about precious metals allocation in their portfolios.

Geopolitical Risks and Their Influence on Markets

Geopolitical risks fundamentally alter investment landscapes across the globe. When nations face political tensions, armed conflicts, or economic sanctions, market participants react swiftly, often triggering volatility across asset classes. These disruptions can manifest as currency devaluations, stock market corrections, or commodity price spikes. Given the interconnected nature of the global economy, regional conflicts rarely remain isolated – trade disruptions, energy price fluctuations, and supply chain interruptions can quickly spread economic impact worldwide. This ripple effect often leads investors to reassess risk exposure.

Throughout history, certain patterns have emerged during geopolitical crises. Equity markets typically experience increased volatility, while government bonds from stable nations attract capital flows. At the same time, commodities – particularly precious metals – see increased demand.

Gold, with its limited supply and universal value recognition, becomes especially attractive when currency stability comes into question. In response to these risks, central banks also adjust their strategies, diversifying reserves through increased gold purchases. This is evident in actions by institutions like the People’s Bank of China, which seek alternatives to dollar-denominated assets.

Why Gold is a Safe Haven Asset

Gold stands apart from most investment assets due to its enduring ability to maintain value during turbulent periods. Among safe haven assets, gold has demonstrated remarkable resilience through centuries of economic and political upheaval. Unlike currencies or securities, gold cannot be devalued through government policy decisions or corporate failures.

Several key attributes explain gold’s safe haven status. First, gold has intrinsic value independent of any issuing authority. Second, it offers portfolio diversification, typically moving inversely to stocks during market stress. Third, gold maintains high liquidity even during crises, allowing investors to convert holdings to cash when other markets freeze.

Gold’s price history confirms these protective qualities. During the 2008 financial crisis, gold appreciated approximately 25% while equity markets collapsed. Similarly, when the COVID-19 pandemic struck in 2020, stimulus measures and economic uncertainty pushed gold to record highs above $2,000 per ounce. Recent market events continue to reinforce gold as a safe haven, with prices climbing above $3,000 in early 2025 as U.S. technology stocks tumbled amid Chinese AI competition.

Geopolitical events consistently trigger gold price movements. The 1973 oil crisis saw gold prices triple. The 2014 Crimea annexation drove a 14% increase in gold prices. More recent conflicts in Eastern Europe and the Middle East have also produced notable, if temporary, price spikes.

Central banks recognize these properties, increasing their gold reserves substantially in recent years as a hedge against both geopolitical uncertainty and potential dollar depreciation.

Historical Trends: How Past Geopolitical Events Moved Gold Prices

Examining historical gold price trends reveals consistent patterns when major geopolitical events unfold. These patterns provide valuable insights into how gold might respond to future crises, though the magnitude and duration of price movements have varied considerably.

The 1979 Soviet invasion of Afghanistan contributed to gold prices rising sharply, culminating in a peak of $850 per ounce in January 1980 – a 66% increase over previous months. Similarly, when Iraq invaded Kuwait in 1990, gold jumped 15% within two months. The September 11 attacks in 2001 prompted a swift 6% price increase in the immediate aftermath.

Nevertheless, not all geopolitical events impact gold equally. In the lead-up to the 2003 Iraq War, gold prices rose approximately 4% in the month before the conflict, peaking near $385 per ounce. However, once military operations began, gold quickly declined by over 15%, demonstrating the “buy the rumor, sell the news” phenomenon that occasionally characterizes gold markets.

More recently, conflicts in Ukraine initially drove significant gold appreciation, with prices rising about 10% due to geopolitical factors. However, these gains were limited as market participants adjusted their expectations.

The data consistently shows that while geopolitical events frequently trigger immediate gold price increases, the sustainability of these gains depends heavily on broader economic conditions and monetary policy. Particularly notable is how Federal Reserve interest rate decisions often determine whether conflict-driven gold rallies persist or fade, with higher rates typically constraining long-term price appreciation.

Predictions: How Future Geopolitical Risks Might Shape Gold Markets

Forecasting market trends requires analyzing both established patterns and emerging global risks. Experts generally agree that several developing situations merit close attention when it comes to developing gold investment strategies in the coming years.

The evolving relationship between major powers, particularly the United States and China, represents a significant variable. Economic competition, technology restrictions, and potential Taiwan-related tensions could all trigger market volatility favorable to gold. Similarly, ongoing conflicts in Eastern Europe and the Middle East may periodically influence prices, especially if they threaten energy supplies or shipping routes.

However, the Federal Reserve’s monetary policy will likely remain the dominant factor influencing gold market trends. While geopolitical events typically provide short-term price catalysts, interest rate levels determine long-term price sustainability. Analysts suggest watching for signs of rate reductions, which would likely provide substantial support for gold prices.

Central bank purchasing behavior represents another critical indicator. If institutions continue diversifying reserves away from the U.S. dollar, as seen with China’s recent acquisitions, this consistent demand could establish higher price floors for gold.

Investors should monitor inflation trends particularly closely, as real, inflation-adjusted interest rates historically show the strongest correlation with gold prices. Additionally, they should watch for signs of market stress in traditional investments, which often precede capital flows toward gold as a protective mechanism against broader instability.

Conclusion

The interplay between geopolitical risks and gold prices presents valuable insights for investors navigating uncertain markets. While short-term price fluctuations often follow global crises, long-term trends depend on a complex interplay of central bank policies, inflation rates, and international currency dynamics.

Gold as an investment offers unique advantages during turbulent times. Its historical performance demonstrates resilience when traditional assets falter, providing both wealth preservation and potential appreciation opportunities. For those concerned about current market volatility, precious metals allocation can serve as a stabilizing force within diversified portfolios.

Those interested in investing in gold can visit Blanchard’s gold purchasing page to explore a selection of investment-grade coins and bars, with options suitable for every budget and strategy. The company’s expert advisors can help select the right products to meet specific financial goals and risk tolerance. Investors should also regularly monitor the price of gold today to make informed timing decisions.

FAQ Section

1. How do geopolitical risks affect gold prices?

Geopolitical risks typically drive the price of gold higher as investors seek safety amid uncertainty. When conflicts, trade disputes, or political instability threaten financial markets, gold often experiences increased demand. This relationship has been demonstrated repeatedly throughout history, from the Cold War era to present-day tensions. However, the magnitude and duration of price increases depend on multiple factors, including the severity of the crisis, market expectations, and prevailing monetary conditions.

2. Why is gold considered a safe-haven asset?

Investors have long valued gold as a safe haven because it maintains value independent of government stability or corporate performance. Unlike paper currencies, gold cannot be devalued through inflation or monetary policy. It has a negative correlation with most traditional investments during market stress, providing crucial portfolio diversification when it is most needed.

3. Can gold prices drop despite geopolitical tensions?

Yes, the price of gold today can decline even during geopolitical crises if other market factors exert stronger downward pressure. For instance, rising interest rates can make non-yielding assets like gold less attractive compared to income-producing investments. Strong dollar performance also typically weighs on gold prices. Moreover, when investors need liquidity during market panics, they sometimes sell gold holdings to cover losses elsewhere.

4. How does inflation impact gold prices?

Historical gold price trends show a generally positive correlation with inflation, particularly during periods of elevated price growth. Gold’s strongest performance typically occurs when real interest rates turn negative, eroding the purchasing power of cash and bonds. However, the relationship isn’t perfectly linear. During periods of moderate inflation with high interest rates, gold can struggle as income-producing assets become more attractive. The key metric for investors to watch is real yields on government bonds, which historically show a stronger correlation with gold than headline inflation figures alone.

5. Where can I buy gold as an investment?

When it comes to buying quality precious metals, working with established dealers with strong industry reputations and transparent pricing structures is paramount. Blanchard offers investment-grade gold coins and bars that meet exacting standards for purity and authenticity, backed by a company with over 40 years of experience in the precious metals industry. For those seeking gold as an investment, contacting Blanchard is an excellent first step toward building a precious metals portfolio. Blanchard’s team of experts can help determine the most appropriate products based on investment goals, budget, and risk tolerance, along with secure storage solutions and liquidation assistance when the time comes to sell.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

6 Best Silver Bars to Stack in Times of Crisis

Posted onHistory has consistently shown that precious metals are a reliable haven during times of crisis. With geopolitical tensions and economic uncertainties currently reshaping the global landscape, today’s world is more complex and unpredictable than ever. For this reason, savvy investors are turning to precious metals to protect their wealth, with silver emerging as an exceptionally attractive option. This article will explore the best silver bars to buy, highlighting:

- 1 oz silver bars that are perfect for beginners.

- High-value bars for serious investors.

- The best place to buy silver bars online.

Silver Bars Worth Collecting

When it comes to protecting one’s wealth, understanding market trends is crucial. Learning the best way to buy silver bars is vital, as many financial experts suggest. Below are some of the most popular silver bar options available through Blanchard.

1. Best silver bars to buy: the classic 1 oz. option

1 troy-ounce silver bars offer an excellent entry point for new investors, combining quality and affordability. Their standardized weight has driven their popularity since the late 20th century, making them an accessible way to own physical silver. These .999 fine silver bars feature clean, elegant designs, typically displaying the mint’s logo, weight verification, and a unique serial number. To secure the best price on silver bars like these, investors should monitor market fluctuations before purchasing from a trusted dealer like Blanchard.

1 Troy Ounce Silver Bar (W/Assay, Types Vary)

- Metal: Silver

- Year: N/A

- Check our most current price here.

2. 1 oz silver bars: a patriotic investment choice

Featuring an intricate American flag design, the 1 oz. flag silver bars blend patriotic symbolism with precious metal investment. As some of the best silver bars to buy, they appeal to those who value both national pride and intrinsic worth. Each .999 fine silver piece showcases the 50 stars, symbolizing the original colonies. This unique fusion of investment value and American heritage makes them especially attractive to collectors and investors seeking precious metals that reflect national ideals.

1 oz Flag Silver Bars

- Metal: Silver

- Year: N/A

- Get our most current price here.

3. Best silver bars for mid-size investment: 5 oz bars

The 5 oz silver bar is an economical way to invest in precious metals, offering better value than smaller units. 5 oz silver bars best price points reflect their cost-efficient nature, as larger bars typically come with lower premiums per troy ounce than coins or smaller units. Each bar contains .999 fine silver and comes with an assay certificate from respected manufacturers. While their designs can vary from simple to intricate, all maintain the same high-quality silver content and trusted manufacturing standards.

5 oz Silver Bar (Types Vary)

- Metal: Silver

- Year: N/A

- View our most current price here.

4. Best 10 oz silver bars to buy for portfolio building

10 oz silver bars are a strategic choice for investors seeking better value. They are considered the best silver bars by those looking to accumulate larger amounts while avoiding the higher premiums of 1 oz units. Manufactured by both sovereign mints and private refiners, these .999 fine silver bars combine affordability with practical storage benefits. Their standardized size makes them easy to stack in safes or safe deposit boxes, while their established weight ensures smooth trading.

10 oz. Silver Bullion Bars (Types and Conditions Vary)

- Metal: Silver

- Year: N/A

- See our most current price here.

5. Best silver bars to buy for global portfolios: the premium kilo choice

The 1-kilo silver bar is a great option for international investors, being the global standard unit in many markets worldwide. The best way to buy silver bars for those seeking international flexibility, these 32.15 oz units are widely recognized across borders. Each .999 fine silver kilo bar features the manufacturer’s logo and weight verification in both grams and troy ounces, making them easily tradeable in any market. Their stackable design and anti-counterfeiting patterns ensure secure storage, while their standardized metric weight makes them particularly appealing for global portfolio diversification.

1 Kilo Silver Bar (Types and Conditions Vary)

- Metal: Silver

- Year: N/A

- Check our most current price here

6. Best silver bars to buy for investment: 100 oz bars

100-oz silver bars stand as the industry standard for substantial silver holdings. They are some of the best silver bars to buy for investment purposes when seeking the lowest possible premiums over spot price. These bars are produced by prestigious manufacturers, including sovereign mints like the Royal Canadian Mint and private refiners such as Credit Suisse and PAMP Suisse. Each bar features identifying marks, including the manufacturer’s name, weight, purity, and unique serial number, with textured backing for easy stacking. Available in both struck and poured varieties, these bars are IRA-acceptable when meeting purity standards, making them an excellent choice for serious silver investors.

100 Oz Silver Bars (Types Vary)

- Metal: Silver

- Year: N/A

- Have a look at our most current price here

Browse Blanchard’s complete silver collection – the best place to buy silver bars and a trusted source for all precious metals

Where to Find Best Silver Bars (FAQ)

Here are the answers to the most common questions investors ask about buying silver bars.

-

Why are silver bars a good option during a crisis?

Silver is an excellent investment option during times of crisis because it is a reliable store of value when traditional financial systems face uncertainty. During economic downturns, geopolitical tensions, or currency devaluation, silver maintains or increases its purchasing power, unlike paper currency.

Silver bars, in particular, have distinct advantages over other forms of the precious metal during turbulent times. Firstly, they are typically more cost-effective than coins as they generally carry lower premiums over the spot price. Moreover, their standardized weight and purity make them easily tradeable and universally recognized, which is crucial when markets are volatile. Storage is also straightforward and secure, with bars being stackable and compact compared to collections of smaller units.

-

How can I check the authenticity of silver bars?

Verifying the authenticity of silver bars is crucial for protecting one’s investment, and there are several reliable methods to ensure you’re purchasing genuine silver. The first and most important step is buying from reputable dealers like Blanchard, who provide assay certificates confirming the bar’s authenticity and specifications. These certificates contain vital information, including the bar’s weight, purity, serial number, and manufacturer.

In addition to that, physical inspection can also help verify authenticity. Genuine silver bars should have clear, precise markings showing the manufacturer’s name, logo, weight, purity (.999 fine silver), and unique serial number. Many bars feature security elements like textured patterns or distinctive designs that make counterfeiting more difficult. A magnet test can provide additional confirmation, as silver is not magnetic – if a bar attracts a magnet, it’s not pure silver. For ultimate peace of mind, professional dealers also use specialized equipment like ultrasound machines or XRF analyzers to verify the metal’s purity without damaging the bar.

-

Can I easily sell silver bars easily?

Silver bars are among the most liquid precious metal investments available, making them easy to sell when needed. Their standardized weights, well-established purity standards (.999 fine silver), and universal recognition contribute to their high marketability.

However, it should be added that the ease of selling depends partially on the size of one’s bars. 1 oz, 5 oz, and 10 oz bars are particularly liquid due to their manageable size and lower price points, making them accessible to more buyers. Larger bars like kilos and 100 oz units might have a slightly smaller buyer pool but still maintain strong liquidity.

-

How do I store my silver bars safely?

Proper storage of silver bars is crucial for maintaining both their condition and security. There are several safe storage methods, each with its own advantages. The most common approach for personal storage is a high-quality home safe. For larger collections or higher-value holdings, bank safe deposit boxes offer institutional-grade security.

Regardless of storage method, it’s important to keep bars in their original packaging or protective sleeves to prevent scratching and tarnishing. While silver is durable, proper storage protects both its condition and value over the long term.

-

Can I buy silver bars with cryptocurrency?

Yes, Blanchard accepts cryptocurrency as payment for silver bars, making it convenient for digital currency holders to diversify into physical precious metals. The purchase process is straightforward: simply select your desired silver bars through the website and choose cryptocurrency as your payment method during checkout. The entire process is designed to be seamless, allowing you to diversify your investment portfolio efficiently while maintaining the highest standards of security and service.

For more insights into silver’s strong performance and promising outlook, read a thorough analysis on Blanchard’s – the best place to purchase silver bars – blog here.

Investing in silver bars is a time-tested strategy for preserving wealth, particularly during uncertain economic times. From the accessible 1 oz bars perfect for beginning investors to the internationally recognized kilo bars for global portfolios, and the industry-standard 100 oz bars for substantial holdings, there’s a silver bar option for every investment goal.

The key to successful silver investment lies not just in choosing the right bars but also in working with a trusted dealer. Blanchard stands out in the precious metals industry thanks to its rigorous authentication processes, secure storage guidance, and many decades of trusted expertise.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

Money Market Funds Hit Record High at $7 Trillion As Investors Seek Safety

Posted onInvestors are scared and it’s showing up in money flows.

Investors are seeking refuge from the turbulent stock market, which has slid into correction territory, marked by a decline of 10% or more. They are also searching for safety amid the global tariff trade war, fearful about its impact on inflation and the economy. To protect themselves, some investors are turning to money market funds. In March, total assets in money market funds hit a record high of $7 trillion.

But what is less talked about is the rush into precious metals.

Since the start of the year, gold has quietly surged to new record highs, with an over 18% gain. Silver has rocketed 18% higher, too. That compares to an annual money market return of about 4%.

In one week, ending March 5, inflows into gold and precious metals topped $1.22 billion, according to LSEG. What’s more, that marked the fourth consecutive weekly inflow into precious metals.

It’s no surprise. In the face of rising stock market volatility, investors want stability and safety. Gold and silver have a 5,000 year proven track record of acting as a store of value and as a vehicle to grow your wealth safely.

Precious metals act as an insurance policy, a hedge against further stock market declines, and protects your purchasing power as inflation remains unchecked. Holding gold paid off for gold investors after the 2008 global financial crisis when per ounce prices went from $700 to $1,900, and it’s paying off again today.

In 2024, gold gained 29%, while silver climbed 33%. The great gold rally is far from over.

Gold broke records in recent days and is expected to set even more new record highs throughout 2025 and into next year. Bank of American just raised its price target for gold – forecasting gains to $3,350 in 2026.

Nobody can say for sure when the stock market correction will end. But many warn that the decline in stocks can get worse before it gets better. Some on Wall Street are warning that there is a 50% chance of a bear market (20% decline or more) this year in stocks.

You may already have an allocation to gold and silver. But is it enough? You may need more than you previously thought.

Recent research from the well-respected CPM Group stated that over the past 50 years, the best return of a portfolio including stocks, bonds, and gold, was for portfolios that had around 25% to 30% of their value in gold. If you have been thinking about increasing your allocation to gold, there’s never been a better time. It’s easy to increase your wealth protection, so why not do it today?

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

Say Aloha to this Key Coin: Hawaiian Half Dollar Silver Commemorative

Posted onIf you’ve ever visited the Hawaiian islands, you know how special that destination is—from gently blowing trade winds and gurgling volcanoes to rain forests and sparkling blue ocean water.

Advanced collectors within the numismatic community know how special this coin is: the 1928 Hawaiian 50c Silver Commemorative is one of the keys to the U.S. Silver Commemorative set. As you probably know, a key coin is one of the hardest and most expensive coins to acquire within a series.

There is a remarkable story behind this handsome silver Hawaiian commemorative. Until Captain James Cook, one of England’s greatest maritime explorers, arrived in 1778, the Hawaiian Islands were untouched by Western civilization. Before Captain Cook’s visit, the Hawaiian Islands existed in virtual isolation from the rest of the world, allowing the indigenous population to develop a unique culture, which is still beloved and celebrated today.

Captain Cook went ashore on the island of Kauai and spent two weeks there while taking on water and other provisions for his ship. Captain Cook named the Hawaiian Islands the Sandwich Islands. He discovered these islands by chance while sailing from Tahiti to the mainland of northwest America. To honor the 150th anniversary of Cook’s discovery of the islands, the people of Hawaii sought a commemorative coin to help finance the Captain Cook Memorial Collection in the Archives of Hawaii.

The Act of March 7, 1928 authorized the Mint to produce 10,000 commemorative coins and the result was memorable. Juliette May Fraser, a well-known artist from Honolulu, created the original design for the intricate silver coin, and sculptor Chester Beach modeled the actual coin from her work.

Even with the record-high issue price of $2, demand for the 1928 Hawaiian 50c Silver Commemorative was huge. Originally, there were plans to sell half of the 10,000 mintage on the mainland, but Hawaiian buyers rushed and purchased most of them. Today, this is a rare and valuable coin, with survival estimates for grades 65 or better at only 1,325.

A Beautiful and Intricate Coin Design Filled with Meaning

Their obverse features an imposing figure of Captain Cook facing left. On his left, the words CAPT. JAMES COOK DISCOVERER OF HAWAII, along with a tiny compass pointing north, which indicates he was looking due west toward the mid-Pacific region. The words UNITED STATES OF AMERICA and IN GOD WE TRUST, are featured at the top and right-hand side. The value HALF DOLLAR highlights the bottom of the coin, surrounded by eight small pyramids—four on each side—which represent Hawaii’s eight largest volcanic islands.

The reverse features a warrior chief atop a hill, which was meant to represent Hawaii’s rise from obscurity. He wears a feathered cloak and holds a barbed spear. His right hand is extended in welcome, signaling his intentions are peaceful. A coconut tree behind him denotes romance, while the landscape in the distance represents part of Waikiki Beach, with Diamond Head looking down on a row of grass huts. The motto E PLURIBUS UNUM stands at the lower left, and the dual dates 1778-1928 are seen along the bottom.

Would you like to see this beautiful Hawaiian silver half-dollar? We have just one. Look quickly, this special silver commemorative coin won’t last long.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

Supply Demand Outlook Favors Higher Prices for Silver Ahead

Posted onGold isn’t the only precious metal moving sharply higher in 2025. If you haven’t been watching the markets, silver has soared an astonishing 15% since the start of the year.

It’s not just investment demand that is driving silver higher. Industrial demand for silver is also growing and is helping to create an imbalance between global supply and demand.

While total silver supply is forecast at 1.05 billion ounces for 2025, total silver demand is expected to come in at 1.20 billion ounces. That creates a deficit in the supply/demand balance—which equals higher prices ahead.

On the manufacturing front, new applications for silver are being discovered all the time. Silver is being utilized in everything from electronics and medical devices to manufacturing and even futuristic shielding suits that essentially keep wearers off the grid by protecting them from being seen with infrared cameras and blocking radio waves to the wearer’s smartphone.

Here’s a peek at some of the new developments helping boost industrial demand for silver, recently highlighted by the Silver Institute.

Medical device: monitoring stent sends patient data to healthcare workers

Roughly 1.2 million coronary stents are implanted in American patients each year in the U.S. Now, a new type of stent that measures artery stiffness and narrowness has been developed using sensors composed of layers of silver, stainless steel, gold, and a polymer. It sends this information to healthcare workers wirelessly and without the need for batteries.

Silver nanoparticles help make rubber tire production safer for workers

Adding silver nanoparticles into rubber tires is helping to keep workers safe from breathing unhealthy rubber particles during tire production. The problem: during new tire production, rubber particles are sent into the air during the drilling, grinding, cutting, and regrooving phases. It can be dangerous for workers to inhale these rubber particles. Knowing exactly how many of these particles are in the air is the first step to keeping workers safe. The silver particles are easy to track through electronic sensors and can be used as a tracer to determine how many particles were released during production. Facilities can then improve ventilation systems to help keep workers safe.

Shielding suit allows wearers to get “off the grid”

A UK company, Vollebak, has developed a futuristic shielding suit that blocks radio waves. Silver particles are built into the fabric of the jacket and pants, totaling 17% of the nylon shell. While it will set you back over $5,000, here’s how the company describes it: The outer shell of the Shielding Jacket is embedded with pure silver that blocks radio waves and microwaves in the frequency range 0.2GHz to 10GHz – which includes WiFi, Bluetooth, Ku-band satellites and radar systems. It also deflects mid and long-wave infrared radiation so it can’t be seen on infrared cameras. And it comes with a phone shielding pocket that works like a Faraday cage – blocking access to your devices, regardless of whether they’re switched on or off.

From futuristic suits, to medical devices to American Silver Eagle coins for stacking, demand for silver is ramping up. It’s easy to accumulate silver as it is less expensive than gold. Get started today here.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

The Stock Market is A Leading Indicator: It’s Flashing Red

Posted onFifty days after Inauguration Day, the stock market is registering its worst performance of a new Administration since President Obama’s first term in 2009. Jittery investors have sold stocks at a record pace, following the implementation of President Trump’s tariffs on a wide range of countries including Canada, Mexico, China, and the European Union.

Jittery investors have sold stocks at a record pace, following the implementation of President Trump’s tariffs on a wide range of countries including Canada, Mexico, China, and the European Union.

While stocks crash, gold and silver roar higher. Gold just reached a new record high above $3,000 an ounce.

So what does this mean for your stock portfolio and the economy? Recession risks in the United States are rising fast. In a new Reuter’s survey, 95% of economists polled across Canada, the U.S. and Mexico said recession risks in their economies had increased as a result of the new tariff policy.

While the stock market tumbled, tangible assets like gold and silver have provided investors a safe haven amid market volatility and economic uncertainty.

Performance since the start of 2025

The stock market is considered a leading indicator for the economy as it reflects investor sentiment and overall economic health. Worries for a meaningful slowdown in growth or even a recession are on the rise as the trade war continues to unfold on a daily basis.

In the latest move, President Trump threatened the European Union with a 200% tariff on imported wines and champagnes, if the bloc does not remove a duty on whiskey. The EU duties follow Trump’s 25% tariff on European imports of steel and aluminum.

The tit-for-tat tariffs have businesses and the stock market reeling. Businesses dislike uncertainty as it makes planning difficult. The risks for a deeper stock market correction are rising as reciprocal tariffs are expected to slow overall economic growth and hurt corporate profits. And, tariffs are expected to mean higher consumer prices on a range of imported goods, which could boost inflation.

What’s an investor to do? Investors can play defense in the current environment by increasing their allocation to precious metals. Gold is expected to continue to soar in the current environment with fresh investor demand fueled by geopolitical uncertainties, rising inflation expectations, and stock market volatility.

With gold hitting the $3,000 an ounce level, Goldman Sachs has now upped its 2025 gold target to $3,100 an ounce. And, Macquarie Group just issued a research note saying that gold’s safe-haven appeal could push prices to a record high of $3,500 an ounce in the third quarter of this year.

While the stock market tumbles and the economic uncertainty increases, there is safety and peace of mind in precious metals. Do you own enough?

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

The 1879 $4 Flowing Hair Stella: America’s Gilded Age Legacy

Posted onIn the 1870s, in the wake of the Industrial Revolution, international trade was rapidly expanding. The United States exported cotton, iron, copper, and manufactured goods. However, American businesses faced a major challenge: currency compatibility. While countries like Spain had the 20-peseta, Italy the 20-lire, and Britain the sovereign—all widely recognized in global markets—the U.S. lacked a coin that was similarly accepted in international trade.

In 1879, John A. Kasson, the U.S. envoy to Austria-Hungary, proposed a U.S. $4 gold coin that would state its metallic content in the metric system, making it more simple for Europeans to use.

Some in the U.S. government thought this coin could be the basis for a new international monetary system and could facilitate international trade and travel for U.S. citizens.

Today, that $4 gold coin is reverently known as Stella and the stories around this legendary coin abound in the numismatic community.

To explore the idea of a new $4 gold coin, the U.S. mint developed a pattern coin—never circulated—as an example for the U.S. Congressmen to review. The beautiful $4 gold coin which features a five-pointed star on the reverse was quickly nicknamed Stella. Why? The Latin word for star is stella.

Designed by Charles Barber, the Flowing Hair $4 Stella had a tiny mintage of 425. While never circulated and never offered for sale to the public, these fascinating coins were emerging in the most unlikely places.

Following their release to Congress for review, these coins made with 7 grams of gold, were famously spotted as medallion necklaces hung on madam’s bosoms in high-end brothels in Washington D.C. These brothels were known to serve illustrious clientele – like U.S. Congressmen.

These fancy D.C. brothels were infamous for large oil paintings, fancy red plush parlor furniture, pricey European carpets, and real silver on the table. Guests and residents feasted on gourmet meals. The expensive French champagne was ever-flowing. And in these brothels, Washington’s most famous madams proudly flaunted these exceedingly rare coins. Some Stellas can be found today that reveal traces of the necklace loops.

Congress ultimately rejected the idea of an international coin. Today, the $4 Stella is extremely rare and in high demand as an example of America’s outstanding numismatic art. As a “type” coin, some might call it one of the most influential and sought after 19th century gold coins ever minted. In an unusual twist for American coinage, because Stella was intended for international commerce, the obverse states its metallic content in the metric system and the coin bears an unusual inscription “★6★G★.3★S★.7★C★7★G★R★A★M★S★” on the obverse stating the gold content.

These storied gold coins were minted just over 100 years after America gained independence from England. Our nation’s economy was growing rapidly and part of America’s historic Gilded Age. Wealthy industrialists and businessmen like John D. Rockefeller, Andrew Carnegie, J.P. Morgan, and Cornelius Vanderbilt built storied empires and contributed greatly to society through their philanthropy. The $4 Stella is a historic gem from this exciting time in American history. Oh the stories this coin could tell, if it could only talk.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

True Value of Indian Head Gold Coins: 5 Outstanding Examples

Posted onRepresenting a significant chapter in American numismatics, Indian Head gold coins were produced from 1907 to 1933. Roosevelt eventually recalled these coins in 1933, leading to their melting and creating a lasting impact on Indian Head gold coin value today. This article will explore their historical significance and highlight the key pieces every serious collector should consider, emphasizing:

- How the gold Indian Head coin evolved from concept to creation

- The unique role of these special coins in shaping American currency

- Where to source an authentic 1910 gold Indian Head coin and other key dates

Watch an amateur collector discuss Indian Head Quarter Eagles in this fascinating video:

Indian Head Gold Coins worth collecting

President Theodore Roosevelt’s vision for more artistic American coinage led to one of the most significant transformations in U.S. Mint history. In 1907, he commissioned renowned sculptor Augustus Saint-Gaudens to redesign the nation’s gold coins. Before his untimely death, Saint-Gaudens managed to create the stunning $10 Eagle which featured Liberty wearing an Indian headdress, a design that would influence all subsequent Indian Head gold pieces.

After Saint-Gaudens’ passing, his former student Bela Lyon Pratt took on the $2.50 Quarter Eagle and $5 Half Eagle designs. Building on the legacy of the first $2.5 Indian Head gold coin, Pratt replaced the allegorical Liberty figure with a realistic Native American portrait. His innovative approach also introduced incuse (sunken) designs, a feature never before seen on American coins.

Production of Indian Head coins continued until 1933 when Franklin Roosevelt’s gold recall brought the era to an end. Many coins were melted, making certain dates particularly rare today. The series spans three denominations: the Quarter Eagle ($2.50), Half Eagle ($5), and Eagle ($10), each with its unique history and varying levels of rarity. Their combination of artistic merit, historical significance, and relative scarcity makes them particularly appealing to modern collectors.

Here are ten exceptional specimens from the Blanchard collection that showcase the series’ finest examples.

1. A beautiful $2.50 1908 gold Indian Head coin

While Saint-Gaudens’ $10 Indian Head designs debuted in 1907, Bela Lyon Pratt’s innovative Quarter Eagle first appeared in 1908. The Philadelphia Mint struck 564,821 pieces, introducing a revolutionary incuse design where both the Native American portrait and eagle are sunken into the coin’s surface. This MS63 1908 Indian Head gold coin showcases the series’ characteristic medium greenish-gold color and frosty luster. While the obverse portrait shows strong detail, the eagle’s wing on the reverse typically lacks full definition due to the original die work, a feature common to this first year of issue. Many examples were preserved by collectors intrigued by the novel design, making this historically significant piece an essential addition to any serious collection.

1908 $2.50 Indian NGC MS63 CAC

- Metal: Gold

- Year: 1908

- Check our most current price here

If you’re interested in other exceptional CAC-verified pieces, beyond this stunning $2.5 Indian Head gold coin, explore Blanchard’s premium CAC collection here.

2. A $2.50 1913 gold Indian Head coin that survived the melting pot

Despite being more available than some dates in the series, this MS63 example showcases the 1913 coin’s distinctive characteristics. The Philadelphia Mint’s output this year featured above-average luster and strong striking detail, evident in this specimen’s light to medium yellow-gold surfaces. While the 2 1/2 dollar Indian Head gold coin value varies widely by condition, this carefully preserved piece offers collectors an excellent entry point into the series.

1913 $2.50 Indian NGC MS63

- Metal: Gold

- Year: 1913

- View our most current price here.

3. A distinctive $2.50 Indian Head gold coin from 1914

The Philadelphia Mint struck just 240,000 of these Quarter Eagles in 1914, creating what would become one of the series’ key dates. This MS65 $2.50 Indian Head gold coin specimen showcases exceptional strike quality and beautiful greenish-yellow gold surfaces with superior luster. Such pristine examples rarely appear (typically only once or twice annually at auction) making this CAC-verified piece especially desirable for seasoned collectors.

1914 $2.50 Indian PCGS MS65 CAC

- Metal: Gold

- Year: 1914

- Get our most current price here.

4. Another special 1914 $2.50 Indian Head gold coin

While $2.50 Indian Head gold coin value varies significantly by mint mark, this Denver Mint example represents an important variant of 1914 production. Unlike its Philadelphia counterpart, the 1914-D shows characteristics unique to coins struck at the Denver facility. This MS63 specimen exhibits a better-than-typical definition, as many 1914-D pieces show less distinct details on both the obverse and reverse. Though not as widely celebrated as the Philadelphia issue, the 1914-D is more elusive in higher grades, making this well-preserved example particularly noteworthy.

1914-D $2 1/2 Indian NGC MS63

- Metal: Gold

- Year: 1914

- View our most current price here.

5. A $5 1909 Indian Head gold coin that stands the test of time

From a limited mintage of 297,200 pieces, this San Francisco Mint $5 gold Indian Head coin is among the rarest in the series. Most examples entered circulation immediately, making this MS62 CAC-verified specimen particularly significant. The 1909-S typically displays sharp striking detail, including a bold mintmark, and exhibits rich coppery-gold coloring with frosty luster. Of special note is its status among San Francisco issues: it rivals the 1915-S in rarity and surpasses the lower-mintage 1908-S in scarcity.

1909-S $5 Indian PCGS MS62 CAC

- Metal: Gold

- Year: 1909

- See our most current price here.

6. A scarce $5 Indian Head gold coin

With just 72,500 pieces minted, this 1911-D Half Eagle is one of the series’ prime rarities. This AU58 Indian Head gold coin $5 example represents the highest circulated grade, just shy of Mint State condition. The Denver Mint’s characteristic well-defined strike is evident, including a fairly bold mintmark. While most 1911-D pieces entered circulation, this near-mint specimen displays exceptional preservation, retaining much of its original granular surface texture and luster.

1911-D $5 Indian NGC AU58 CAC

- Metal: Gold

- Year: 1911

- Get our most current price here.

7. A $5 1915 Indian Head gold coin in pristine condition

The Philadelphia Mint’s 1915 $5-dollar Indian Head gold coin stands out for its exceptional preservation and visual appeal. This MS64 example showcases the date’s characteristic sharp strike, finely granular surfaces, and vibrant luster. The coin displays rich tangerine-gold and peach-orange tones, particularly visible in the recessed areas of the incuse design. While the 1915 coin is more obtainable than some dates in the series, finding examples this well-preserved remains a significant challenge for collectors.

1915 $5 Indian CACG MS64

- Metal: Gold

- Year: 1915

- Have a look at our most current price here.

8. A magnificent $10 Indian Head gold coin minted in 1907

This first-year Saint-Gaudens design represents the “No Periods” variety, distinguished by the absence of periods before and after the inscription “TEN DOLLARS” on the reverse. This MS63 gold Indian Head coin displays the characteristic satiny surfaces and excellent luster typical of the issue, with rich yellow-gold to greenish-orange toning. While some weaknesses in Liberty’s hair curls and parts of the eagle are common to the date, the stars and legends show bold definition. Many 1907 pieces were preserved as first-year keepsakes, though finding high-grade examples can be challenging.

1907 $10 Indian NGC MS63 CAC

- Metal: Gold

- Year: 1907

- Check our most current price here.

9. A remarkable $10 Indian Head gold coin from 1908

This coin represents a pivotal design change in the series, i.e. the addition of “IN GOD WE TRUST” to the reverse, mandated by Congress after public outcry over its omission from Saint-Gaudens’ original 1907 design. While Indian Head gold coin value varies by date and condition, this MS62 example shows the typical sharp strike and excellent luster characteristic of the date, with satiny surfaces displaying rich yellow-gold to greenish-yellow coloring. Collectors particularly value this transitional year for its historical significance in the evolution of American coinage design.

1908 $10 Indian With Motto PCGS MS62 CAC

- Metal: Gold

- Year: 1908

- See our most current price here.

10. Another exceptional $10 1910 gold Indian Head coin

This MS63 Indian Head gold coin features the exceptional strike quality that makes 1910 Eagles stand out in the series. Most coins from this year display a distinctive frosty finish with finely granular surfaces, showing attractive orange and greenish-gold coloring. Some specimens, like this one, retain their original satiny luster with light to medium yellow-gold tones. This date represents an excellent opportunity for collectors seeking a high-quality example of Saint-Gaudens’ classic design.

1910 $10 Indian CACG MS63

- Metal: Gold

- Year: 1910

- Have a look at our most current price here.

Discover more exceptional $10 Indian Head gold coin specimens and other rare collectibles in Blanchard’s premium rare coin collection here.

Where to find Indian Head Gold Coins

The Indian Head gold coin series represents one of the most artistic and innovative periods in American coinage. These pieces combine historical significance, artistic merit, and genuine rarity, particularly in higher grades. For collectors seeking to acquire such important numismatic treasures, working with an established dealer like Blanchard ensures authenticity and quality. Trust Blanchard to help you build a distinguished collection of these historic American coins and more.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.