Only Four 1830 Templeton Reid $5 Gold Coins Are in Private Hands

Posted onIn the late 1820s, gold was discovered in the Georgia woods near a mountain town called Dahlonega. Soon after, the Georgia Gold Rush was in full swing as thousands of Americans descended upon the area in search of riches.

The Georgia Gold Rush lasted for over a decade, from 1829 to the early 1840’s. In 1831, it was estimated there were as many as 10,000 miners prospecting between the Etowah and Chestatee Rivers alone.

Some fortunate mining prospectors did strike it rich with millions of dollars of gold found in the area. Yet, the Philadelphia Mint was deemed too far away by some for safe travel and the lack of a nearby U.S. Mint at that time opened the door for entrepreneurs to strike private gold coins.

So, in July 1830, a man named Templeton Reid, who had worked as a blacksmith, gunsmith, silversmith and a jeweler, seized the opportunity and decided to set up his own private mint in Milledgeville, Georgia. Reid produced gold coins in three denominations: $2.50, $5, and $10.

Today, the legendary Templeton Reid $5 gold coin is one of the great early American rarities among private and territorial gold issues. Only six Templeton Reid $5 gold coins are known to survive and two of those are safely ensconced in the National Numismatic Collection at the Smithsonian Institution.

Only four Templeton Reid $5 gold coins are in private hands. These exceedingly rare early American treasures rarely surface for sale.

While the original mintage for the Templeton Reid $5 gold coin was estimated at 300, most of these coins met their fate in the melting pot. The public lost confidence in Reid’s coins after a letter was published in the August 16, 1830 edition of the Georgia Courier stating that one of his $10 coins only contained $9.38 in gold.

It is thought that Reid was an honest man and although his weights were accurate, the assays were not, so his coins were slightly below the intended value. Soon after, however, Reid closed down his mint in October, 1830.

Reid’s total mintage for all three gold coin denominations was estimated at only 1,600. Most of Reid’s coins were melted down and very few survivors are known today. When a Templeton Reid $5 gold coin surfaces for sale it is truly a once in a lifetime event in the numismatic community.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

Inflation and Gold: Looking Back into 2023 and Ahead to 2024

Posted onDespite persistent forecasts for a U.S. recession, 2023 may well be remembered as the year a recession never happened. Yet, the jury is still out on whether or not the Federal Reserve can engineer a so-called “soft landing” in 2024 – or bring down inflation to the central bank’s 2% target without triggering a recession. Throughout it all in 2023, gold served investors well as a safe-haven and a hedge against inflation as we saw the precious metal push to a new all-time record high above the $2,100 an ounce level.

A quick look back: how inflation started

During the Covid pandemic, a mix of economic factors including global supply chain pressures, labor and material shortages and loose monetary and fiscal policy conspired to drive inflation sharply higher.

Starting in March 2022, the Fed aggressively raised interest rates from 0.25-0.50% to its current 5.25-5.50% level in an effort to battle inflation down. While it took time, the impact from higher interest rates have helped slow down inflation.

Inflation: by the numbers

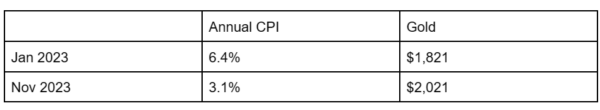

While many Americans may still feel that prices of goods and services are still too high, the pace of inflation has slowed during 2023.

Since January, the Consumer Price Index (CPI) fell from an annualized 6.4% rate to 3.1% in November. As inflation fell, gold increased in value. While inflation is one of the drivers for gold, other factors also support the precious metal including its role as a global safe-haven asset during times of war and military strife. The breakout of the Israel-Hamas war triggered fresh buying into gold in the fourth quarter of 2024.

While progress has been made on inflation, it is too early for the Fed to declare victory. Inflation still stands above the Fed’s 2% target. Many economists warn the “last mile” to the 2% target rate may be the hardest to achieve.

For now, the higher interest rates haven’t triggered an economic recession but the U.S. economy isn’t out of the woods yet. A number of Wall Street firms, including bond giant PIMCO, Deutsche Bank, Vanguard, PNC and LPL Financial, all expect a mild recession to emerge in the U.S. in 2024. Many consumers are shouldering high debt burdens as American credit card debt recently hit a new all-time record high which will weigh down consumer spending in the New Year.

Inflation remains, but Fed may be forced to cut rates

As we roll into 2024, gold can benefit from both falling interest rates and inflation that remains too high.

While Americans will continue to keep an eye on everyday prices, slowing economic growth may force the Fed to cut interest rates—even if inflation still remains above its 2% target rate. Indeed, at its December meeting, the central bank already revealed that it has penciled in three rate cuts in 2024.

What does this mean for gold? Higher interest rates typically compete with gold, which pays no interest. So, when rates fall, gold generally climbs. The falling interest rate environment is a positive driver for gold, while above target inflation creates a floor under the precious metal.

Gold has proven value to investors in all parts of the business and investing cycle and, throughout 2023, acted as a strong ballast to diversified portfolios. As we head into a New Year, have you considered if you own enough?

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

How to Get Started in Collecting Rare Coins on a Budget

Posted onOn a tight budget, the world of rare coin collecting can seem daunting, even to seasoned numismatic enthusiasts. This piece will unveil a treasure trove of strategies and clever tips to invest in a rare coin collection without breaking the bank. Our discussion will focus on:

- The factors that determine a coin’s rarity.

- The motivations that drive coin collectors.

- Rare coin collecting money-saving tips.

Watch an expert’s advice on how to collect coins on a budget in this informative video:

https://www.youtube.com/watch?v=JheVso1yXYA

What are rare collectible coins?

Understanding what makes a coin rare involves discerning myriads of factors, including its historical significance, design, and market demand. Among the many aspects influencing a coin’s rarity, three main determinants stand out prominently:

- Mintage: The concept of mintage plays a pivotal role in determining a coin’s rarity due to its direct correlation with supply. Mintage refers to the quantity of a specific coin produced during a certain period. When a coin has a limited production run, fewer specimens enter circulation or collector markets, intensifying its rarity.

Additionally, historical events, errors in production, or changes in economic conditions might influence low mintages, making certain coins even scarcer. Consequently, coins with low mintage figures become sought-after treasures within the numismatic community, commanding higher values.

- Condition: A coin’s condition, i.e. its preservation over time, significantly impacts its scarcity. Coins in pristine condition, with minimal wear, scratches, or damage, are scarce due to the natural aging process. When it comes to graded coins, those maintaining higher grades, indicating exceptional preservation, scarcity, and original luster, become rarer and more sought-after by collectors. The rarity of coins in remarkable condition is further accentuated by the scarcity of such specimens in the market.

- Age: A coin’s age is another factor that significantly influences its rarity. The passage of time inherently limits the availability of older coins, especially those from ancient or distant historical periods. Coins from antiquity or specific eras become rarer due to natural attrition, loss, or destruction, contributing to their scarcity.

For example, one can’t help but admire this beauty that we recently placed on Blanchard:

Why collect rare coins?

Humans’ fascination with collecting rare coins spans centuries. Mostly driven by the desire to preserve historical artifacts and the excitement of obtaining unique and scarce specimens, people have always been drawn to rare coins. This appreciation of rarity continues to fuel the enduring fascination with collecting rare coins.

Some of the main motivations that drive contemporary coin collectors are the following:

- Pleasure: One of the biggest reasons behind the pursuit of coin collecting is simply pleasure. Coin collecting is an enjoyable and deeply gratifying hobby. The joy derived from it lies in the thrill of the hunt as collectors seek elusive or unique coins. Furthermore, the sense of accomplishment and pride from building a curated collection fuels a feeling of personal satisfaction.

- Wealth Preservation: Investment Investment is a compelling reason for contemporary coin collecting. Certain coins possess inherent value and the potential for appreciation over time. Investors view rare coins as tangible assets with the capacity to diversify their portfolios beyond traditional options.

- Family Legacy: Rare coins are not only sought after for their scarcity but also serve as enduring heirlooms, passed down through generations. Old coins encapsulate stories of bygone eras, fostering a tangible link to ancestry. As such, they offer younger generations a glimpse into the past, igniting curiosity and a sense of connection with their heritage. The shared stories behind rare coins bridge generational divides, instilling a profound appreciation for familial legacy.

The pursuit of rare coins more often than not involves researching their origins, understanding their significance, and deciphering their stories, fostering a deeper understanding of history and artistry. Moreover, the process of collecting encourages critical thinking, research skills, and the development of a discerning eye, contributing to a well-rounded education.

Money-saving tips for rare coin collecting

Contrary to a prevalent misconception, acquiring rare coins within budgetary constraints is entirely feasible. How to get started in collecting rare coins on a budget? The secret lies in sticking to these ingenious tips:

1. Start collecting rare coins by purchasing lower-grade ones

A solid tip for foraying into rare and collectible coins on a budget is starting with lower-grade coins. Opting for coins rated on the lower end of the grading scale often presents an advantageous entry point for collectors.

These coins, while exhibiting more wear or imperfections, typically command lower prices compared to their higher-grade counterparts. Embracing coins with lower grades allows collectors to assemble a foundational collection without stretching their budget constraints.

Additionally, these lower-grade coins may still possess historical significance, unique designs, or belong to limited mintage series, providing an opportunity to delve into specific eras or themes within numismatics. As collectors advance and their budget permits, they can gradually upgrade their collection by acquiring higher-grade specimens.

2. Do research before building your rare coin collection

Conducting thorough research before commencing a rare coin collection proves to be a prudent money-saving strategy for enthusiasts on a budget. Delving into comprehensive research about the rarest coins to collect allows collectors to familiarize themselves with various aspects of coins they’re interested in, including historical contexts, mintage numbers, and market trends.

By acquiring this knowledge, collectors can make informed decisions and avoid overspending on overhyped or misrepresented pieces. Moreover, understanding the nuances of grading standards and recognizing reputable sources for purchasing coins ensures that collectors obtain genuine and fairly priced specimens.

Research also unveils underrated or undervalued coins, presenting opportunities to acquire noteworthy pieces within budgetary constraints.

To facilitate your research, Blanchard is readily available to assist. Our experts can provide personalized guidance on beginning, or adding to a coin collection, ensuring a well-informed and rewarding collecting experience.

3. Read books about rare coins collecting

While on the topic of research, books must, of course, be mentioned. Consulting a rare coin collection book may sound obvious, but it is instrumental for building budget-friendly collections. Books often highlight undervalued coins, offering valuable tips for identifying hidden treasures within budget constraints. To start, you can’t go wrong with The Guide Book of United States Coins, a.k.a. The Red Book.

4. To successfully collect rare coins on a budget, be selective

It is easy to get carried away when choosing one’s rare coin collection for sale. However, successfully collecting rare coins within a budget necessitates a selective approach.

Being discerning allows collectors to focus on acquiring coins that align with their specific interests, goals, and budget constraints. By honing in on particular series, themes, or historical periods, collectors can avoid overspending on expansive or diverse collections.

Selectivity encourages patience, enabling enthusiasts to wait for opportune moments or favorable pricing for coins of higher significance or rarity within their preferred categories. This approach fosters a curated collection of exceptional coins, ensuring quality over quantity.

5. When it comes to collectible rare coins, start small

Many great numismatists started their collections with small, inexpensive coins. Indeed, that is a brilliant way of going about building one’s rare coin collection.

Starting with either smaller denominations or less costly coins enables individuals to build a foundational assortment without significant financial strain. This approach cultivates experience, providing an opportunity to understand preferences, grading standards, and market dynamics before venturing into higher-value acquisitions.

An excellent and economical rare coin to start one’s collection is the Morgan Dollar:

- Metal: Silver

- Year: 1878 – 1904

Get our most current price here.

Another worthy contender is the coin created to take its place, i.e. the Peace Dollar:

- Metal: Silver

- Year: Varies

Get our most current price here.

For help deciding which Peace silver dollar to add to your collection, ask a Blanchard expert.

6. Rare coin collecting is a marathon, not a sprint

Viewing building rare coin collections as a marathon rather than a sprint proves beneficial for budget-conscious collectors. Patience becomes a valuable asset as collections appreciate over time. Rare coins often increase in value gradually, rewarding collectors who hold onto their acquisitions.

Understanding this long-term growth potential allows enthusiasts to focus on strategic acquisitions aligned with their budget, rather than rushing into costly purchases. Additionally, over time, coins may gain historical significance or become rarer, increasing their value.

7. Rare collectible coins are all about quality

Prioritizing quality over quantity is paramount for building a rare classic coins collection on a budget. Opting for coins of superior quality, even if fewer in number, ensures lasting value and potential appreciation. Higher-quality coins tend to retain value and appeal, making them more desirable among collectors.

While initial costs of quality coins like this one may be higher, investing in coins with better condition, limited wear, and superior preservation often proves financially astute in the long run:

1885 Type III Gold $1 NGC PR65 CAC MS60

- Metal: Gold

- Year: 1885

View our most current price here.

8. Look for American rare coin collectibles at coin shows

Exploring rare coin collectibles at coin shows can be a savvy strategy for budget-conscious collectors. These events offer a diverse array of coins, providing opportunities to find unique and often undervalued pieces.

Coin shows facilitate direct interactions with dealers and sellers, allowing enthusiasts to negotiate prices or discover coins priced below market rates. Additionally, the variety of coins available at these shows, ranging from lesser-known series to rarities, presents a chance to unearth hidden gems that may not be easily accessible elsewhere.

Rarities like this beautiful coin can sometimes be found at coin shows:

1902 $2.50 Liberty PCGS MS65 CAC

- Metal: Gold

- Year: 1902

See our most current price here.

Click here to view more American rare coins and collectibles with CAC grading.

9. Joining a coin club is a great way to find rare coins to collect

Joining a coin club is an excellent avenue for budget-minded rare coin collectors to discover coveted pieces. These clubs foster a sense of community among enthusiasts, providing access to shared knowledge and trading opportunities for building a rare historical coin collection.

Members often offer coins for sale or trade at reasonable prices, allowing collectors to acquire rarities without hefty markups. Additionally, club meetings or events facilitate networking with experienced collectors who may offer guidance on finding undervalued or overlooked coins.

For example, an experienced numismatist might tell you that old commemoratives, like this one, are often a great investment:

1935-S San Diego 50c Commemorative PCGS MS65

- Metal: Silver

- Year: 1935

Have a look at our most current price here.

Read this piece to find out more about valuable commemorative rare coins and collectibles.

10. Use free apps and resources to build your rare coins collection

Leveraging free apps and online resources can prove invaluable for budget-conscious rare coin collectors. Utilizing free apps and online platforms provides access to a vast array of information, including market values, historical insights, and grading standards on a rare collectible coin, without incurring additional costs. This wealth of knowledge aids collectors in making informed decisions when acquiring rare coins.

Moreover, dedicated numismatic communities and forums on these platforms facilitate discussions, enabling enthusiasts to seek advice, exchange insights, and, on occasion, even discover potential acquisitions, like this great-value rare coin:

- Metal: Gold

- Year: 1857

Check our most current price here.

If you found this article engaging, you can delve further into the nuances of how to collect rare coins by consulting our rare coins guide.

Where to buy collectible rare coins

Embarking on rare coin collecting within a budget demands a strategic approach. Some of the keys to success include conducting extensive research, having patience, and prioritizing quality over quantity. To start building a valuable rare coin collection on a budget, simply use Blanchard. As the premier choice for precious metals investing, it is synonymous with quality coins at competitive prices.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

The 1903-S Barber Half Dollar: A Remarkable Coin

Posted onFirst minted in 1892, the Barber Half Dollar remains a treasured collectible among numismatists due to its historical significance and iconic design. However, as seasoned collectors understand, not all Barbers are created equal. One notable stand-out is the 1903-S Barber Half Dollar. In this article, we delve into different facets of this coin, exploring 1903-S Barber Half Dollar value and more, including:

- The history of the Barber Half Dollar.

- Characteristics of the 1903-S Barber Half Dollar coin.

- Grading considerations for Barber Half Dollar collectors.

To find out more about Barber Liberty Head Half Dollar grading, watch this informative video:

https://www.youtube.com/watch?v=2Y3d4G8afmk

What is a Barber Half Dollar

The Barber Half Dollar was a coin minted in the United States from 1892 to 1915. It was named after its designer, Chief Engraver Charles E. Barber, one of the most famous U.S. coin designers of all time. Also known as Liberty Head Half Dollars, Half Dollar Barber coins were a result of the U.S. Mint’s initiative to introduce a new design for the half dollar denomination.

The Barber Half Dollar’s bold design marked a pivotal change from its predecessor, the Seated Liberty Half Dollar. On the obverse, Barber Half Dollars depict a bust right of Liberty wearing a Phrygian cap with a laurel wreath. She is encircled by 13 six-pointed stars. The coin’s reverse design features a heraldic eagle holding 13 arrows with his left claw and an olive branch with the right. In the eagle’s mouth is a scroll that reads “E PLURIBUS UNUM”.

The Barber Half Dollar held a pivotal role in early 20th-century America, especially among American settlers venturing westward. In a frontier where trade relied heavily on currency, it was very useful to have coins worth their actual weight in precious metal. Barber Half Dollars swiftly emerged as one of the most widely used coins for day-to-day transactions. Consequently, a majority of these coins remaining today are very worn down.

The scarcity of uncleaned Barber Half Dollars in AU condition or better, coupled with the fact Barber Half Dollars had a minting span of less than 25 years and relatively limited mintage numbers, enhances their allure among collectors.

What is a 1903-S Barber Half Dollar

As its name, alluding to its mint mark, implies, it was struck in 1903 by the San Francisco Mint. A well-struck coin with a mintage of 1,920,772, the 1903-S Barber Half Dollar doesn’t hold the distinction of the lowest mintage among Barber Halves. Nevertheless, its relative scarcity compared to more prevalent dates within the series elevates its allure among collectors.

Beyond its scarcity, collectors are drawn to this coin for its ability to narrate a tale of a bygone era. 1903-S Barber Half Dollars serve as tangible links to a very dynamic time in American history, a period brimming with transformative milestones that shaped the nation’s trajectory. Minted amidst events like the founding of Ford Motor Company, the United States’ acquisition of control of the Panama Canal Zone, the inaugural baseball World Series, and the Wright brothers’ pioneering flight, this coin encapsulates the essence of a pivotal epoch.

Today, securing a 1903-S Barber Half Dollar in superior condition can be challenging, augmenting its value among collectors pursuing pristine specimens.

History of the silver Barber Half Dollar

The story of the Barber silver Half Dollar began long before the first one of them was struck in 1892. The coin owes its existence to the Mint Act of September 26, 1890. This legislation allowed for the redesign of coins utilized for a minimum of 25 years, catalyzing Mint Director J.P. Kimball’s pursuit to revamp the nation’s coinage.

While Barber Halves are today appreciated for their intricate yet clean design, arriving at it was far from straightforward. Initially, the redesign process was envisioned as a competition among artists to submit innovative designs.

However, this plan quickly faltered due to a multitude of issues, including disputes over artists’ compensation and a lack of noteworthy submissions. With none of the proposed designs meeting expectations, Mint Director Edward O. Leech turned to the Mint’s Chief Engraver Charles Barber to lead the design efforts.

Even though Barber was renowned for his engraving prowess, many of his initial designs were met with rejection. The disagreements between Leech and Barber extended to every minute detail of the coin’s design from the depiction of Lady Liberty on the obverse to the number of olive branches held by the eagle on the reverse.

One particularly heated dispute had to do with the number of points on the stars depicted on the coin. Barber advocated for five-pointed stars over six, symbolizing a distinction from English coinage and aligning with American symbolism, ultimately convincing Leech to go with his version.

The painstaking design process endured for years. The finalization of the design came down to the wire, with the reverse remaining a contentious subject until November 1891 when Barber presented the last patterns, differentiated by the presence or absence of clouds above the eagle. Ultimately, Judd-1763 was chosen as the approved design by President Harrison and his cabinet.

In January 1892, after years of meticulous craftsmanship and disputes, the first Barber coins were struck at the Philadelphia Mint. However, the silver Barber Half Dollar’s unveiling and subsequent circulation received a mixed response, deemed rather dull by the majority of people. This lukewarm reception prompted Congress to approve another design change, culminating in the coin’s replacement in 1916 by the iconic Walking Liberty design crafted by Adolph A. Weinman.

Barber Half Dollar: key dates

It is important for Barber Halves collectors to consider the coins’ timeline, as it also helps put into perspective the value of Barber Half Dollars.

- 1892: The inaugural batch of these coins emerged from the presses at the Philadelphia Mint on January 2, 1892.

- 1901: Modifications to the obverse hub for die production for use in coins were introduced. This resulted in a difference that can be seen in the area of Liberty’s ear, with Type II featuring a fuller lobe.

- 1903 and 1905: Significant changes in Mint marks are made. Namely, the New Orleans Mint, which predominantly featured a medium-sized O Mint mark, transitioned to a more open O in later years like 1903 and 1905.

There are several pivotal dates over the coin’s 25-year span that Barber Halves collectors need to consider. However, a basic set of the Barber Half Dollar series comprises 73 coins, categorized by date and Mint mark. Notable among these are the following key and semi-key coins: 1892-O, 1895-S, 1913, 1914, and 1915.

Collectors seeking a Barber Half Dollar for sale will find that acquiring one in good condition proves to be an intriguing and rewarding challenge.

Characteristics of the 1903-S Barber Half Dollar coin

Outlined below are the defining attributes of the 1903-S US Barber Half Dollar.

Barber Half Dollar weight

A 1903-S Barber Half Dollar weighs 12.50 grams in total. The exact Barber Half Dollar silver weight is 11.25 grams.

How much silver is in a Barber Half Dollar

The Barber Half Dollar silver content is 90%. The remaining 10% is copper.

Barber Half Dollar mintage

Barber Half Dollars mintages were significantly lower than other Half Dollars. They averaged at under 2 million annually. The 1903-S Barber Half Dollar had a mintage of 1,920,722. It bears the characteristic S Barber Half Dollar mint mark, indicating its San Francisco origin.

Grading Barber Half Dollars

Barber Half Dollar grading, as numismatist David Lawrence points out, is relatively easy. The main thing to be considered when grading the series, he argues, is strike. Specifically, many Barber Halves from the New Orleans Mint are weakly struck, lacking detail on Liberty’s forehead. A well-struck Barber Half Dollar typically exhibits sharper details, lending it enhanced aesthetic allure and subsequently greater value within the numismatic market.

The most valuable Barber Half Dollars

Barber Half Dollars in lower grades (AG to VG) can be found easily at affordable prices. The most valuable Barber Half Dollars, however, are the ones in higher grades. These can be very difficult to find. In fact, in mint state, 22 out of 73 dates have an R4 rarity rating.

Top-valued Barber Halves include the 1904 S Barber Half Dollar, estimated at nearly $30,300, the 1893 S Barber Half Dollar at over $20,000, and the 1895 S Barber Half Dollar at $12,000.

Another one of the key date Barber Half Dollars is the 1892-O Micro O variety Half Dollar, selling for tens of thousands of dollars. This coin has less than a dozen known specimens across all grades.

Remarkably, almost half of all proof Barber Half Dollars, despite their limited annual mintage, remain available today.

1903-S Barber Half Dollar value

1903-Silver Barber Half Dollar coin value largely depends on condition. More specifically, the price of a 1903-S Barber Half can range from $30-40 for a coin in good condition to several thousand dollars for pristine, uncirculated condition.

For rare Barber Half Dollars and more collectible coins, visit Blanchard’s silver shop.

Where to find Barber Half Dollars for sale

Barber Half Dollars are widely collected. Beautifully crafted coins with a limited run, Barber Halves can be a prized addition to any numismatist’s collection. The well-struck 1903-S Barber Half Dollar, with its historical significance, is a noteworthy piece for collectors.

For further insights and assistance in navigating the world of Barber Half Dollar coins and other rare pieces, do not hesitate to reach out to Blanchard. Our team of experts is readily available to provide comprehensive information and guidance on building and expanding your coin collection.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

5 Factors That Will Drive Gold in 2024

Posted onGold has been one of the best performing commodities in 2023, up over 12% as the precious metal set a new all-time record high in late November. Traders like to say: “the trend is your friend” and in this case the trend points higher for gold. Here’s a look at five factors that will impact gold in the year ahead.

1. Geopolitical tensions boiling hot

From China-U.S. tensions to the Russian war in the Ukraine and the Israel-Hamas war in the Gaza strip, military and political hot spots are seen around the globe. What will the January presidential election in Taiwan bring and what could it mean for China’s desire to annex the island nation? Will Asia become another military flashpoint next year? Investors flocked to gold as war broke out in the Middle East in a traditional flight to safety. Increased geopolitical tensions in 2024 could open the door to another big upswing in gold.

2. Election year politics: a major uncertainty on the horizon

Presidential elections are always a source of market volatility. In 2024, we could see a more dramatic market impact, given that U.S. polarization is on the rise. At this point it appears that a rematch between President Biden and former President Trump is likely. But, a lot could happen between now and next November. Financial markets do not like uncertainty and just like the election in 2020, this presidential contest could be a nail biter that comes down to the wire. The greater the political uncertainty, the more risk for stock market volatility in 2024. Gold will benefit as the precious metal represents a long-standing safe-haven asset and ballast to portfolios.

3. The economy: soft or hard landing?

The economy will be a key driver for gold in 2024 as forecasts for slowing growth and potential for a mild recession will increase investor interest in gold as a hedge and portfolio diversifier.

While the stock market began pricing in a “soft landing” in December, which would mean a return to a 2% inflation rate without a recession, that is by no means a done deal. The Consumer Price Index (CPI) stood at 3.1% in November, an improvement from levels seen earlier in the year, but still above the Federal Reserve’s 2% target inflation rate.

Will there be a “hard landing” scare in early 2024 as GDP numbers weaken and inflation remains sticky? If yes, look for stocks to tumble and gold to climb. A number of Wall Street firms including bond giant PIMCO, Deutsche Bank, Vanguard, PNC and LPL Financial all expect a mild recession to emerge in the U.S. in 2024. Inflation and interest rates have been two major drivers of gold market performance over the past several years, and they will remain important in 2024.

4. Fed policy: rate cuts ahead

In December, the Federal Reserve started talking about interest rate cuts, suggesting the current monetary policy cycle has peaked with the federal funds rate at 5.25%-5.50%. Gold surged after the mid-December Fed meeting, when central bank officials suggested that they see three interest rate cuts in 2024. As higher interest rates typically compete with gold, which pays no interest, falling interest rate environments are historically positive for gold.

When interest rates fall, gold climbs. Looking into 2024, the falling interest rate environment will be a positive driver for gold and is a key reason many strategists expect gold to see new all-time highs in the $2,300-$2,400 region in the New Year.

5. Central banks: expect the buying spree to continue

Global central banks were voracious buyers of gold throughout 2023. Gold purchases from central banks are 14% higher through the end of the third quarter, versus the same time last year, the World Gold Council said. Peering into 2024, 24% of all central banks intend to increase their gold reserves in the next 12 months, as they increasingly grow pessimistic about the U.S. dollar as a reserve asset, a recent WGC survey said. This continued strong demand stream for gold will propel prices ever higher.

The bottom line

No economist or market analyst can accurately forecast what lies around the corner. Yet, prudent investors can capitalize on the uncertainty and take action to protect, preserve and grow their wealth with a diversified portfolio that includes an allocation to gold. We’re here to help.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

David’s Christmas Pralines

Posted onWhen I was a kid, I’d always bug my mom to make pralines. Pralines were my absolute favorite treat! My mom would always reply with they’re too hard to make, you need a marble slab, and the humidity must be just right to make them. I remember trying to figure out what humidity and the weather had to do with cooking. I assume she was just, as my mom would say, “pulling my leg” on the humidity part.

(mom and myself- late 1970s. This is the only picture I have of the two of us. the rest were lost in Katrina. But, do I really need any others?)As mom’s do, she tried to find a way to make me happy. Without me knowing she asked around trying the find a recipe for pralines that didn’t rely on a marble slab or the weather. Of course, in the early 1980s she didn’t have access to the internet. Recipes had to actually be passed from hand to hand. Simpler times for sure. Her persistence paid off, to my delight, and one day she came home with what she called an “easy praline” recipe. The only catch was that I would have to come up with the pecans for the recipe.

Fortunately, we had a wonderful pecan tree in the yard that we loved. And, that tree loved us back every year by dropping so many pecans on the ground that we would fill up several paper grocery bags full. Some days I’d just stand on the around in the yard eating pecans. I got pretty good at cracking them against each other.

The pralines turned out fantastic. The tough part was having to ration myself to the two or three a day that mom allowed me to eat.My mom passed away in 1993. For years I kept her handwritten recipe. Somewhere along the way the recipe was lost, but I can still see the blue ink on the notebook paper and the title “Easy Pralines” written across the top of the page. Years later I dug around on the Internet and found the same basic recipe. It really is easy and doesn’t require a marble slab or a certain humidity level. I’ll include it below and hope you get a chance to try it out. Feel free to ask me any questions. And of course, let me know how they turn out and how many people you made smile with your homemade pralines.Easy Pralines: (this same basic recipe is online in many places, but I’ll include my tips) 1 package butterscotch pudding (NOT instant, cook and serve) 1 cup sugar 1/2 cup brown sugar 1/2 cup evaporated milk 1 tablespoon butter 1 1/2 cups pecans (pieces or halves) Mix sugar, pudding, milk and butter in medium saucepan. It’s best to use a non-stick pan of you have one. Cook on medium heat, constantly stirring, until boiling. Turn down heat to medium and bring to 234 degrees. Some would say use a candy thermometer. I don’t have a candy thermometer but do have an instant read thermometer that I use for the grill. This works great). Remove from heat and add the pecans. Now, comes the hard part. Beat with a wire whisk until thickened. The obvious question is how thick. Rather than how thick the best way to judge it is by the color of the mixture. When you remove the mixture from the heat it will be shiny. As you start to stir it with the whisk the shine will go away and turn dull. At that point, you can start to spoon the mixture on to wax paper.You have to move fairly quickly at this point because the mixture will start to harden in the pot. If you’ve stirred it long enough they will harden within thirty minutes and peel off the wax paper very easily. The official instructions would say to let harden overnight. I’d say there is no chance that I’ve ever gone that long. As soon as they can peel off the paper I’m “testing” a few.

This recipe will make about two dozen pralines. Feel free to raise or lower the amount of pecans. Just remember, they aren’t really pralines without pecans. I hope you find as much joy as I do in sharing pralines with those around you. The world needs more smiles and I’ve yet to see someone NOT smile when eating a praline. May you and your family find many blessings in the New Year. And now that I truly appreciate the opportunity you give me to assist with all of your precious metals investments.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

Top 3 Rarest Carson City Mint Coins

Posted on- 1870-CC Double Eagle

- 1871-CC Double Eagle

- 1876-CC Twenty Cent Piece

Many collectors only dream of owning a coin with the famed “CC” mintmark, which stands for the Carson City Mint in Nevada. The western mint was operation for a mere 21 years of remarkable Wild West history. Here’s how it all began…

In 1857, Henry Comstock laid claim to what eventually became known as the giant Comstock Lode in Nevada. Many prospectors struck it rich at this lode. Word of the silver discovery spread quickly and with more people came the need for coinage. Soon, demand for a second Mint in the West was strong.

Nevada was isolated from the rest of the nation. Transporting raw metal to the San Francisco Mint was challenging and dangerous. The railroads had not yet been built into Nevada, which meant the only way to transport precious metal for processing was on horseback or a mule train.

In 1870, only six years after Nevada became a state, the historic Carson City Mint opened its door to process the huge amount of silver and gold being mined in the area. The Carson City mint primarily struck silver coins due to the large silver lode nearby. Due to the scarcity of gold coins struck at the Nevada branch mint, all Carson City gold coins are hard to find and avidly sought after by numismatics. Here’s a look at the top three rarest coins produced at the Carson City mint.

1870-CC Double Eagle

For nearly a century, the U.S. produced gold coins worth $20. These “Double Eagle” coins were minted from 1849 to 1933.

Today, the 1870 Carson City $20 gold coin is the rarest and most valuable Double Eagle in existence. The 1870-CC Double Eagle is also the most famous and highly sought after gold coin struck at the Carson City Mint. This impressive rarity is listed as one of the 100 Greatest U.S. Coins.

The 1870-CC Double Eagle boasts a miniscule mintage of only 3,789, and there are only 41 known survivors today in all grades. Simply put, there is no such thing as a common Carson City Double Eagle. Every date is considered scarce and valuable. Considering the infrequency that this extreme rarity emerges on the market for sale, it’s no wonder that this owning this coin remains only wishful thinking for most collectors.

1871-CC Double Eagle

The 1871 Carson City $20 gold coin is only the second double eagle issue from this fabled frontier era mint with a tiny mintage at 17,387. Indeed, the 1871-CC Double Eagle is widely considered to be the second rarest $20 gold coin from the Carson City Mint, after the famous 1870-CC Double Eagle. Legendary numismatic David Akers notably said the 1871 Carson City Double Eagle ranks in the top 15% of all double eagles for overall rarity.

Coins minted in Carson City typically immediately entered circulation as coinage was sorely needed to fuel the growing economy in the region. Because of this, most Carson City survivors are typically well worn and no doubt could tell many tall tales if they could talk of the rough and tumble times in the Wild West. James Barton Longacre designed this exceptional coin.

1876-CC Twenty Cent Piece

Called by some, the “Duke of Carson City coins,” the 1876-CC twenty cent piece is a highly desirable western rarity. The Carson City Mint only produced 10,000 twenty cent pieces—also known as “double dimes”— in 1876.

As the story goes, in January 1876, the Carson City Mint Cashier reported that he still had 4,261 twenty cent pieces from the previous year in his stock. That represented more than enough to cover circulation demand for some time. So, in May 1877, Mint Director Henry Linderman sent this message to the Carson City Mint.

“You are hereby authorized and directed to melt all 20-cent pieces you have on hand, and you will debit ‘Silver Profit Fund’ with any losses thereon.”

Thus, a majority of the 1876-CC twenty cent pieces were lost forever. Today survival estimates of these impressive coins in all grades is a tiny 19.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

The Intrigue Behind The 1913 Liberty Head Nickel

Posted on — 2 CommentsThe 1913 Liberty Head Nickel, one of the most valuable coins in the world, also has one of the most mysterious backstories in American numismatic history. No one knows exactly how, when, or why these legendary coins were struck.

Today, there are only five known 1913 Liberty Head Nickels in existence. One is housed at the Smithsonian, a second at the ANA Money Museum in Colorado, and the remaining three 1913 Liberty Head Nickels are in the hands of private collectors.

These ultra-rarities rarely surface for sale and when they do it is a major numismatic event. Our firm, Blanchard placed a 1913 Liberty Head Nickel with a collector in 2004.

The History

The story behind the 1913 Liberty Head Nickels is sprinkled with both intrigue and scandal. In 1912, the U.S. Mint retired the Liberty Head Nickel and replaced it with the Indian Head (Buffalo) nickel design. However, five Liberty Head Nickels were struck either by accident or on purpose – and then kept secret.

As one theory goes, someone in the wee hours of the night at the Philadelphia Mint, struck these five surviving 1913 Liberty Head Nickels before the dies were destroyed in preparation for the change to the Buffalo Nickel.

Numismatists embrace this theory, as the five known coins reveal evidence that they were made from the same high-quality dies that produced Liberty Head Nickels since 1883. Yet, while it could have been an accident, many historians believe these five rarities were minted by Samuel W. Brown, a U.S. Mint employee in Philadelphia.

Here’s why.

The existence of these five coins remained a secret until 1919 when the statute of limitations for prosecuting the mint official expired. Convenient, right?

It became public that Samuel Brown, of North Tonawanda, New York had possession of the five nickels. Despite already having them, Brown placed an advertisement in the periodical: The Numismatist, offering to pay $500 each for 1913 Liberty head nickels. Later he raised the offer to $600. Brown knowingly was creating hype around these coins, which he later displayed at the 1920 ANA convention before selling the pieces to a Philadelphia dealer.

Highly Sought-After Coins

Today these coins are indeed a holy grail for numismatic collectors because they were produced in 1913 at the Philadelphia Mint, without official permission. That year, only the new Buffalo nickel design was supposed to be minted. But somehow, these five Liberty designs were elusively produced.

King Farouk of Egypt, an avid coin collector, reportedly owned two different 1913 Liberty Nickel specimens in his world-renowned coin collection at different times.

The notoriety and fame of these coins have crept into pop culture as well. In 1973, an entire episode of the TV show: Hawaii Five-O featured the 1913 Liberty Head Nickel as it was about to be auctioned off at a coin show in Hawaii, while a European master criminal attempted to switch the authentic version with a fake. We won’t tell you what happened, you’ll just have to watch the episode called: “The 100,000 Nickel.”

In recent history, a U.S. Ambassador, Henry Norweb, claimed ownership of one of these nickels, as did L.A. Lakers owner Jerry Buss. Each time a 1913 Liberty Head Nickel came onto the marketplace and changed hands, the price went up. In 2022, one sold for $4.2 million.

The Design

Charles E. Barber, the sixth Chief Engraver of the United States, designed the now famous 1913 Liberty Head Nickel. Barber had a long and prolific career as a coin designer. Today, one of his best-known coin designs is the Liberty Head coins including the “V” Liberty Head nickel, known for the large V on the coin’s reverse.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

Gold soars as Fed pencils in 3 rate cuts in 2024

Posted on — 1 CommentThe Fed Starts Talking About Rate Cuts

Breaking news. The Federal Reserve started talking about interest rate cuts for the first time today during this monetary policy cycle. At the conclusion of the Fed’s two-day meeting Wednesday, the central bank held interest rates steady as expected at 5.25%-5.50%. This marked the third consecutive Fed meeting where the central bank stood pat, suggesting the interest rate cycle may have peaked.

Gold surged after the meeting, which revealed that Fed officials expected three interest rate cuts in 2024. Gold traded as high as $2,016.80, up $37.10 this afternoon.

All eyes were focused on the Fed’s latest economic projections, known as the “dot plot,” which signaled a drop in the fed funds rate to 4.6% by the end of next year, which is lower than the September forecast of 5.1%. The lower interest rate forecast is supportive for gold and opens the door to a new rising price cycle for precious metals ahead.

Fed changed their tune on inflation

The Fed also changed the way it discussed inflation at the end of today’s meeting. For the past six meetings, the Fed has said “Inflation remains elevated.” Today, that sentence was revised to “Inflation has eased over the past year but remains elevated.”

It’s a subtle change, but in Fed-speak it says volumes.

Inflation has come down but…

Inflation has come down from its peak at over 9% during this economic cycle, but still remains above the Fed’s 2% target. Earlier this week, we saw fresh inflation numbers. The annualized Consumer Price Index rose 3.1% in November over the last 12 months. Drilling down, the monthly CPI figure rose 0.1%, which showed that inflation was slightly hotter than expected, as economists forecast for unchanged reading.

The future is bright for gold

Investors bought gold after today’s Fed meeting and the current uptrend has farther to go. Recent forecasts from major Wall Street players call for new record highs in gold in 2024. JP Morgan expects a series of interest rate cuts between the second half 2024 and the first half of 2025 which they say could lift gold to $2,300 an ounce. Bank of America is even more positive on gold. They say, if the Fed does begin to slash interest rates in 2024, that gold could climb to an impressive $2,400 an ounce next year.

As the year comes to a close, it’s a good time to consider, do you own enough gold?

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

Top Three Oldest Mints in the World

Posted on- Lydia: 7th century BC

- Monnaie de Paris: AD 864

- British Royal Mint: AD 880

Today the U.S. Mint is the largest mint in the world, producing as many as 28 billion coins in a year. The Philadelphia Mint stands as the largest physical site in the U.S., which covers over 650,000 square feet and can produce up to 32 million coins in a year. However, there is a rich history of coin production that spans thousands of years. Here’s a look at the three oldest mints in the world.

Lydia: 7th century BC

Historians believe the oldest mint in the world existed in the ancient kingdom of Lydia in the seventh century BC. While the name of that mint has been lost throughout history, the oldest coins on the planet were produced there. Today, the coinage of the Lydian kingdom is known mostly for the coins of its last king, Croesus (561–546 BC). Croesus produced both gold and silver coinage. Earlier Lydian kings, however, produced electrum coins, which were made of an alloy of gold and silver with a dash of copper added to harden the coin. The royal Lydian coins created the first known series of coins in the Western hemisphere and these early coins served as a model for all subsequent gold and silver coins throughout time.

Monnaie de Paris: AD 864

The Monnaie de Paris in France is the world’s oldest continuously running mint, founded in AD 864 and it is also the world’s eighth-oldest company. In 864, King Charles II, also known as Charles the Bald, issued an edict to create a Parisian monetary workshop attached to the Crown. The King issued this edict in an attempt to concentrate the power to mint and issue currency under the Throne, making currency production a State Power. Previously, the King shared the power to mint currency with a variety of lords, barons and ecclesiaticals from the provinces. In the early days, the currencies were hand-minted using a hammer. It wasn’t until the reign of Louis XIV at the end of the 17th century that mint production advanced to a screw press, which allowed for the currency minting to become more standardized.

British Royal Mint: AD 880

Similar to the French mint, the British Royal Mint was founded in part to centralize coin production, in this case from all of Great Britain, the United Kingdom and all nations across the Commonwealth. In 880, the Royal Mint produced its first coin: an Alfred the Great silver penny, which was struck during the resettlement of London after the Viking occupation. In 1279, the Mint moved to the Tower of London, which was known as “the little tower where the treasure of the mint is kept.” In 1489, the Royal Mint produced its first sovereign coin: King Henry VII decreed a ‘new money of gold’ to establish the might and power of his reign. Today, the Sovereign coin is still known as the “coin of the monarch” and remains one of the Royal Mint’s flagship coins. In 1662, King Charles II introduced new production methods at the Royal Mint. Coins were then produced using horse-drawn rolling mills and screw presses instead of the previous hand struck method. Notably, in 1696, Isaac Newton Isaac Newton was appointed Warden of The Royal Mint, and he became the Master of the Mint in 1699, a post which he held until his passing in 1727.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.