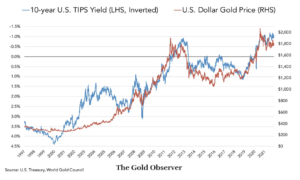

The Relationship Between the Price of Gold and the 10-Year TIPS Yield and Why it Matters

Posted on — 1 CommentFor more than 15 years, there has been a stable, inverse relationship between gold and US bond yields adjusted for inflation. Typically, higher Treasury yields have the effect of bringing gold prices down because gold, which has no yield, is less attractive in comparison.

Between 2006 and 2021, the correlation coefficient between the two has been -0.933 indicating an almost completely opposite relationship.

Today, that’s changing.

The breakdown of this correlation seems strangely fitting in today’s setting of anomalies. Consider, for example, that bonds, which tend to rise as stocks fall, are now rising alongside equities. The combination of higher rates and lasting inflation has disrupted this tendency and today the correlation of returns for the S&P 500 and long-term Treasury bonds is at a two-decade high. North is South. East is West.

The normally reliable correlation between gold prices and the 10-year TIPS yield has deviated as real yields have risen while, at the same time, gold prices have climbed amid increased geopolitical risk brought on by the bloody Hamas-Israel conflict.

Adding to this is the fact that in 2022 central banks bought a record-breaking 1,136 tones of gold, worth roughly $70 billion. As the Financial Times remarked, this staggering amount of purchasing occurred because “countries aimed to reduce their reliance on the dollar after Washington weaponized its currency in sanctions against Russia.”

The change in this historical relationship has prompted some to ask, where do things go from here?

While it’s not clear if the two trend lines will realign, there are several reasons to believe that the price of gold could remain high. One such reason is that the gold market was very short. In other words, many investors held positions that stood to gain if gold prices fell. As the price of gold resisted that expectation, those same investors were forced to cover their positions. As a result, short positions recently dropped by 31,096 contracts to 89,605. In fact, this was the second-biggest ever short-covering rally on record.

Additionally, heightened levels of gold purchasing in China have led to a dramatic premium over international prices. In some cases, this premium was over $100 per ounce. This surging demand stems from falling property values, a major store of value for many Chinese citizens. The declining yuan has likely also contributed to increased gold purchases.

The key takeaway for investors is that the power of gold to serve as a safe haven in periods of instability and uncertainty is strong enough to break a decade-and-a-half trend that would normally see gold declining in price today.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

Top 5 Gold Bullion Coins for Investors

Posted on- American Gold Eagle

- American Gold Buffalo

- Canadian Gold Maple Leaf

- Australian Gold Kangaroo

- Austrian Gold Philharmonic

For thousands of years, people around the world built wealth with gold. Today, gold remains a proven strategy for investors to diversify their portfolios and protect and grow their wealth.

Owning physical gold has many benefits over “paper” gold like exchange-traded funds (ETFs) or mining stocks. ETFs and mining stocks do not always follow the price of gold and you never take physical ownership of gold. Notably, there are sometimes outside forces at play that move paper investments at different rates and in different directions than the spot price of gold. For example, gold mining stocks can be impacted negatively by workforce strikes, political strife in the countries where minors operate, poor company management, and accounting issues. Gold could be performing strongly and a mining company’s stock may not reflect the commodity’s performance. ETFs have their own set of unique issues, including management fees, marketing fees, and storage and insurance fees. Investors putting money into ETFs also do not take possession of the gold they’ve invested in. Physical gold does not have these same downsides.

There are many different gold coins to choose from. We outlined the five best gold bullion coins for investors to consider. All of these gold coins are recognized around the world for their purity, and authenticity and are easily bought and sold.

Another benefit to the top five gold coins on our list is that they are all approved by the Internal Revenue Service (IRS) to use in your IRA account. Let’s take a look at the five best gold coins to use in investing.

1. One Ounce American Gold Eagle

One-ounce American Gold Eagle coins are hands down one of the most popular and widely recognized gold coins around the world. The U.S. Mint produces these coins, which are made of 22-karat gold, and offers investors a rock-solid investment in an ever-changing economy. The value of American Gold Eagle coins moves independently of the stock and bond markets, which offers investors strong portfolio diversification value. Indeed, historically, when the stock market crashes, the price of American Eagle gold coins soars higher. In 1986, President Ronald Reagan signed into law the program to mint American Eagles, which became the global standard for bullion coins. These coins are 100% American-made. Like all the coins on our list, you can buy and store the one-ounce American Gold Eagle in your self-directed precious metal IRA account.

2. One Ounce American Gold Buffalo

Another coin proudly produced by the U.S. Mint for investors and collectors alike is the American Gold Buffalo coin. This stunning gold coin is an homage to our nation’s early history and heritage. For many years, investors could only buy 22-karat gold. But, amid growing interest in even greater purity levels, Congress authorized the creation of the American Gold Eagle, which debuted in 2006, minted in 24-karat gold. You may recall the famous Buffalo Nickel designed by James Earle Fraser. This arresting gold coin pays homage to that era and features a Native American chief’s profile on the obverse side and an American buffalo on the reverse.

3. One Ounce Canadian Gold Maple Leaf

Moving beyond the United States, the one-ounce Canadian Gold Maple Leaf is one of the most prestigious and highly sought-after gold bullion coins after the American coins mentioned above. The well-respected Royal Canadian Mint introduced this coin in 1979 and it was the first bullion coin to feature 99.99% pure gold. The one-ounce Canadian Gold Maple Leaf coin represents extraordinary craftsmanship, featuring the iconic and cherished Canadian maple leaf.

4. One Ounce Australian Gold Kangaroo

Traveling farther around the globe, the esteemed Perth Mint has produced the one-ounce Australian Gold Kangaroo since 1986, which is another highly after coin by investors. The original version of this coin was known as the Australian Gold Nugget. However, in 1990, the Perth Mint redesigned the gold coin, which now features an iconic kangaroo design paying homage to Australia’s natural heritage. The reverse highlights a magnificent kangaroo with intricate detailing, revealing both the dignity and brawniness of this beloved marsupial. The obverse reveals Queen Elizabeth II, highlighting the country‘s connection to the British monarchy.

5. One Ounce Austrian Gold Philharmonic

Last but not least, the one-ounce Austrian Gold Philharmonic gold coins are easily one of the most popular bullion coins traded in continental Europe. The Austrian Mint began producing these elegant coins in 1986, which pay homage to the thriving musical history in Austria’s capital city of Vienna. Sometimes called Vienna Gold Philharmonics, investors gravitate to this coin for its widely recognized depiction on the obverse of the Great Organ, an iconic instrument that sits in Vienna’s esteemed Musikverein concert hall. The reverse features a collection of musical instruments, including the cello, violin, harp, flute, and horn, which represent the many sounds that meld together to create a symphony.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

Gold Climbs to 2-Week High as Middle East Conflict Escalates

Posted onGold climbed to a two-week high after military conflict and violence escalated between Israel and the Palestinian group Hamas. Investors turned to gold as the heightened geopolitical unrest increased the precious metal’s safe–haven appeal. Throughout history, during war and military conflict, gold has been used as a safe store of value.

gold as the heightened geopolitical unrest increased the precious metal’s safe–haven appeal. Throughout history, during war and military conflict, gold has been used as a safe store of value.

Gold jumped from a low of $1,822.70 early in October to as high as $1,873 mid-week. If the Middle East violence continues to escalate, Wall Street strategists point to $1,900 as the next quick upside target for gold to hit. How could the Middle East conflict impact the economy and markets?

Oil Prices: Another Inflation Spike?

If the Middle East conflict widens and begins to impact oil production in the region, the price of crude oil could trade higher for longer. As we saw with the Russia-Ukraine war, the impact of higher energy prices can be severe, impact inflation, and slow the economy, in addition to causing pain to consumer’s pocketbooks.

Interest Rates

As investors begin to price in expectations that the Middle East conflict will put the brakes on the U.S. and global economy, the odds of a Federal Reserve interest rate hike in November are falling. Only 8% of traders now expect the Fed to hike rates at its November 1st meeting, according to the CME Fedwatch tool.

2024 Presidential Elections Around the Globe

We will see presidential elections in many key countries around the globe in 2024. Of course, we have a presidential contest here in America in 2024. But, beyond our borders, Russia’s President Vladimir Putin will face a presidential election in 2024. Also, Taiwan faces a key presidential election vote next year, which could have implications for China which claims the island democracy as its own territory.

Elsewhere, many African countries will also hold elections in 2024. Africa is increasingly becoming a geopolitical hotspot. We’ve seen several military coups there recently. There are also strong China-African relations as many nations there signed on for China’s Belt and Road Initiative, which could increasingly shine a global spotlight on that region.

Turbulence Ahead

The recent surge in violence in the Middle East adds to an already complex and volatile global geopolitical situation. The Russia/Ukraine war is still consequential, U.S.-China tensions remain high and the world is facing a spate of critical elections next year. We are heading into one of the most unstable and turbulent times in the post-World War II era. Gold has served as a safe-haven investment and store of value for thousands of years. In today’s era of increasingly volatile and often unstable governments, it’s worth a look at your portfolio to see if you could benefit from an increased allocation to gold. The price of gold is going up fast—so the quicker you make your moves—the better investment you can make for the long-term.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

The 1850 $5 Baldwin & Co. Gold Coin is a Throwback to the Era of Private Minting

Posted onThe NFTs and cryptocurrencies of today might signify a growing desire to move away from government-issued currency. However, as modern as these innovations may be, the independent spirit behind them has long been part of American history dating back to the California gold rush. During that era (1848–1855) private minting was legal.

There were several reasons for this. First, at the time, the western frontier of the US had very little government oversight. Few laws at both the state and federal level regulated coinage or minting. Second, gold, in the form of dust or nuggets, was difficult to trade without some form of standardization yet there was little government-issued currency in the region. Third, free market principles were a primary influence of the American government at the time giving private enterprises unfettered access to markets.

As a result of these conditions, many private mints emerged. Many of these businesses were reputable and highly regarded. One such example was Baldwin & Co., a private minting company operated by George C. Baldwin, a prominent entrepreneur during the Gold Rush period. Originally, the company existed as a jewelry and watchmaking business on Clay Street in San Francisco in 1849. Their minting business started when they purchased it from F.D. Kohler who was starting his tenure as an assayer for California’s new State Assay Office.

The company struck various denominations of gold coins between 1850 and 1853. These coins were widely used in the local economy and played a crucial role in facilitating trade and commerce during a time when official U.S. Mint branches were not yet established in California.

The 1850 $5 Baldwin & Co. gold coin shows the head of Liberty with BALDWIN & CO. and 13 stars with the year 1850. The obverse shows an eagle with an olive branch in the right talon and three arrows in the left talon. The letters “S. M. V.” stand for Standard Mint Value. Uncirculated Baldwin & Co coins are exceedingly rare. From 1850 to 1851, Baldwin struck 4 different coins including, $5 (1850), $10 (1850), $10 (1851), and $20 (1851). In their time, the Baldwin & Co. name carried so much weight that their coins were accepted as federally sanctioned pieces. Eventually, that name was tarnished when some assayers claimed that Baldwin & Co. coins had an intrinsic value that was less than their face value. Soon after, Baldwin & Co. ended their minting operation.

Unfortunately, the private minting era in California didn’t last long. In 1853, the United States government established an official branch mint in San Francisco to regulate and standardize the coinage system. With the introduction of official U.S. Mint coins, the need for privately minted coins declined.

Today, the coins minted by Baldwin & Co. remain as valuable artifacts from the Gold Rush era, sought after by collectors and historians alike.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

The Alaska RRC Bingle: A New Deal Era Coin Used by Farmers

Posted onImagine you were struggling financially during the Great Depression. In that scenario, a government offer to move you to Alaska to farm a 40-acre plot of land could have sounded like a good deal.

Indeed, 203 pioneer families did just that in May 1935 as part of President Franklin D. Roosevelt’s New Deal plan to help move the country out of the Great Depression through massive public works projects.

The adventuresome pioneers moved to Matanuska Valley, about 45 miles northeast of Anchorage, Alaska, hoping to start a new and more fruitful life. The farmers were chosen from Minnesota, Wisconsin, and Michigan as the government theorized that those folks would be well suited to Alaska’s harsh climate, given the cold winters they were already used to.

The Alaska Rural Rehabilitation Corporation (ARRC) governed the new farming colony and the U.S. government issued coins that were legal tender and could be used in the ARRC stores. This included the one–cent Alaska RRC Bingle minted in 1935 and 1936.

The one-cent Alaska Bingle is not only one of the shortest-lived coins in U.S. history, it is also one of the most unusual.

Three factors help make this one of the most unusual coins ever minted by the U.S. government.

The first is its shape. The one-cent Bingle is an octagon, meaning it is an eight-sided coin. The second unusual factor is that it is made of aluminum. Until the government struck the one-cent Bingle, only pattern coins had been produced in aluminum. Finally, the same design is evident on both the front and the back of the coin!

This historic coin with eight sides features a large number “1” with the words: “Good for one cent in trade ARCC” encircling the coin.

The one-cent Alaska Bingle was struck along with a series of other RRC coins including the five-cent, 10–cent, 25–cent, 50–cent, one-dollar, five dollar, and 10 dollar denominations. Only the one–cent Bingle was not round. Because legal tender currency was so scarce in rural Alaska during the Great Depression, it is believed that these coins were also used as currency outside the ARCC stores.

However, after minting these coins for only two years, the government removed their legal tender status and they were recalled. Only several hundred coins were saved from the recall, which means survivors today are incredibly scarce although the few known survivors are almost all in mint condition, or close to it. Imagine the stories that these coins could tell if they could talk: settlers in faraway Alaska, who dreamed of a better life and took the opportunity to try to build that when it was offered.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

Investment Grade Bonds Heading for Third Year of Decline

Posted on — 1 CommentFor decades, the standard advice from investment professionals was to invest a portion of your portfolio in bonds – for safety and security. The general investment idea was that if the stock portion of your portfolio goes down, bonds will go up. In recent years that correlation has failed—leaving investors with big losses on both the stock and bond sides of their portfolio.

Looking back

In 2022, the S&P 500 fell 18.01%. That’s when bonds were supposed to shine. Instead, the bond market also posted double-digit losses. The Bloomberg U.S. Aggregate Bond Index represents the government and high-grade corporate bond market, and the $92 billion iShares Core U.S. Aggregate Bond ETF which represents that index plunged –13.06% in 2022.

Bonds are heading for a third year of declines

In fact, the billion iShares Core U.S. Aggregate Bond ETF, known by its ticker symbol AGG, fell by -1.67% in 2021, -13.06% in 2022 and is now heading for its third straight year of losses in 2023, with a -1.01% market return.

In hindsight, this was a good recommendation.

Looking back, this 2019 Gold Hub research report accurately warned investors of this coming shift:

“Central banks have shifted to a new regime of easy monetary policy, thus reducing expected bond returns. As negative yielding debt increases alongside stock-to-yield valuations to all-time highs, gold may become an attractive and more effective diversifier than bonds, justifying a higher portfolio allocation than historical performance suggests.”

It is evident that, following the pandemic, bonds have become a less reliable portfolio diversifier than in recent decades.

What’s an investor to do?

When seeking replacements, money managers pursue a strategy called “security dispersion” which allows investors to capture an alternative source of return. Security dispersion relates to the difference between winners and losers in the market.

When you are looking for an alternative investment, consider the three D’s of alternative diversifiers:

- Is diversifying to your portfolio,

- Is a durable source of return, and

- Is defensive when you need it

How do gold bullion and rare coins stack up?

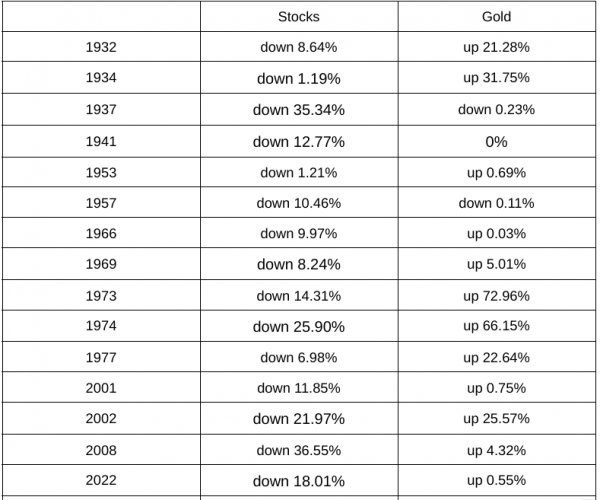

Diversification: Gold is a proven stock portfolio diversifier because it negatively correlates to stocks — simply put: when stocks go down, gold goes up. Precious metals and rare coins also react to different market conditions than stocks and bonds, making them efficient asset classes to keep portfolios balanced through economic cycles.

Here’s a snapshot of market performance to show the non-correlation between stocks and gold:

Stocks represent S&P 500, data from NYU Stern School of Business

Durability: Gold and rare coins produce a durable and reliable source of long-term returns. The average annual return of gold bullion from 1979-2022 stands at 5.6%*. For those who invest in rare coins (all types), the average annual return for that time period is even better at 9.5%.

Defensive: Both gold and rare coins act as defensive elements in your portfolio, especially during inflationary environments like we see now. When you evaluate investments to add to your portfolio to hedge against inflation, you want asset classes with the highest positive correlation level.

Here’s a snapshot of the correlation with inflation from 1979-2022*:

- Stocks: .10

- Treasury bonds: -.18

- Gold: .21

- Coins: .57

Both gold and coins have the highest positive correlation, which provides investors the best defensive hedge during inflationary times.

The bottom line

“For investors concerned with downside risk, it makes sense not to solely rely on bonds as stock market diversifiers,” said a Russell Investments research report. “Unlike bonds, the price upside for gold is not limited. In addition, the gold market is sufficiently large for investors to make significant allocations to [it.]”

If you’ve been disappointed in the bond returns in your portfolio, it’s time to explore worthwhile alternatives like gold and rare coins. Increasing your allocation to tangible assets is a proven strategy to help build and protect your wealth, especially during inflationary environments like the one we are mired in now.

*Data from February 2023 research report titled: The Investment Performance of Rare U.S. Coins by Raymond E. Lombra, Ph.D.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

Five Most Popular U.S. Commemorative Coins

Posted on- 1892 Columbian Exposition half dollar

- 1915-S Panama Pacific Octagonal

- 1921 Missouri Centennial Half Dollar

- 1986 U.S. Statue of Liberty

- 2000 $10 Library of Congress Bi-Metallic Coin

From time to time, Congress authorizes the minting of commemorative coins that celebrate and honor American people, places, historical events, and institutions. These coins are legal tender, but they are not created for general circulation. The U.S. Mint produces these commemorative coins in limited quantitites and the coin sales help raise money for various causes. Here’s a look at five of the most popular commemorative coins in U.S. history.

1892 Columbian Exposition Half Dollar

This historical gem earned a spot on our list because it is the first commemorative coin in U.S. history. It was minted to commemorate the World’s Columbian Exposition, also known as Chicago’s World Fair. These half dollars, with a face value of 50 cents, were sold for $1 to help cover the spiraling costs of the World Fair. With a fairly high mintage, only a few coins of high-grade quality show outsized value. The obverse design features Christopher Columbus in profile. The reverse features the Columbus flagship, the Santa Maria, and two globes. The reverse inscription includes: “WORLD’S COLUMBIAN EXPOSITION”, “CHICAGO”, “1492, 1892”.

1915-S Panama Pacific Octagonal

The coin commemorates the most ambitious engineering project that man had ever attempted. The 50-mile-long Panama Canal, which opened for ships in 1914, allowed business leaders to fulfill their goal of shipping goods quickly and cheaply from the Atlantic to the Pacific Ocean. It cost $375 million to build the Panama Canal and the incredible accomplishment helped cement America’s emergence as a world power.

In 1915, a year after the canal opened its shipping lanes, San Francisco welcomed visitors from around the world to its Panama-Pacific Exposition. This was a massive event to celebrate the opening of the Panama Canal. In honor of the event, the U.S. Mint produced several commemorative coins, including an octagonal $50 gold piece. Today, survival estimates of the 1915-S Pan Pac Octagonal are tiny: totaling 512 in all grades, only 27 in MS65 or better.

New York sculptor Robert Aitken designed this dramatic gold coin, minted in San Francisco. Aitkin successfully replicated classic Greek motifs on a modern coin. The obverse of this octagonal coin features a left-facing bust of Minerva, the Roman goddess of wisdom, skill, and agriculture. Minerva proudly showcases a crested helmet, open to communicate her peaceful intentions. This was considered a symbolic communication of American sentiment toward Europe, which was mired in the horror of World War I.

1921 Missouri Centennial Half Dollar

The Missouri Centennial Half Dollar features American folk hero Daniel Boone, who lived in Missouri for the last 25 years of his life, on both the obverse and the reverse of the coin. Boone, along with 30 woodsmen blazed a 200-mile trail through rugged wilderness and into the area that became Kentucky and he is most famous for his exploration and settlement of that area.

The Missouri Exposition Committee planned a large Exposition and State Fair in 1921 and wanted a commemorative coin to help fund the extravaganza. Congress authorized the striking of up to 250,000 Missouri Centennial silver half dollars. This handsome coin celebrates the 100th anniversary of Missouri’s admission into the Union in 1821. Today, known simply as “Missouris” among collectors, these coins are the rarest of all the silver commemorative series and are highly sought after.

Robert Aitken, the designer of the Panama-Pacific fifty dollar gold piece was chosen to craft the Missouri half dollar. The obverse features a striking bust of famous frontiersman Daniel Boone wearing a buckskin shirt and a coonskin cap. The reverse reveals Boone with rifle and powder horn, and a Native American with the words “Missouri Centennial” encircling the top and “Sedalia”, the location of the 100th-anniversary exhibition on the bottom. The Philadelphia Mint struck only 50,000 Missouri half-dollars in July 1921, yet many of these exquisite coins were melted down.

1986 U.S. Statue of Liberty

This is one of the biggest-selling commemorative coins of the modern era, with coins sold totaling 15,491,169. The Statue of Liberty coin was authorized in commemoration of the centennial of the Statue of Liberty.

The funds collected from the coin sale surcharge were used to restore and renovate the Statue of Liberty and the facilities used for immigration at Ellis Island. Additional funds were also used to create an endowment that would ensure the continued upkeep and maintenance of these truly magnificent American monuments. The obverse design of the coin features a close-up view of Liberty and the reverse features a design of Liberty’s torch and inscriptions.

2000 $10 Library of Congress Bi-Metallic Coin

The last coin earned a spot on our list because it is extremely unique as this is the only bimetallic coin produced by the U.S. Mint. The $10 Library of Congress commemorative is comprised of a gold ring around a platinum center. While in American coinage, bimetallic coins are rare, historically many ancient coins were struck in a bimetallic composition. John Mercanti, the designer of the American silver eagle, designed the coin’s obverse, illustrating the hand of Minerva raises the torch of learning over the Jefferson Building. On the reverse, a laurel wreath encircles the Seal of the Library of Congress.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

The Renegade Businessman Behind Oregon’s Gold Beaver Coins

Posted onDuring the 1848 California gold rush, many Oregon settlers headed south to join the fray, seeking their fortunes. Some found success in the California gold mines and returned home to the Oregon Territory with bags of gold dust. Yet, as in other Western territories, conducting commerce in gold dust created a lack of uniformity for simple everyday purchases. Gold dust was also easily contaminated and subject to fraud.

During this time, items like beaver skins, wheat, gold dust, and silver coins from Mexico and Peru were used in everyday commerce, because of a lack of standard coinage. All these items were of ever-changing and uncertain value for those making the trades. Beaver skins and wheat were also difficult to transport and vulnerable to damage, making them an unstable medium of exchange.

A standard coin system was sorely needed.

In February 1849, the Oregon Territorial Legislature passed an act authorizing the creation of $5 and $10 gold coins. However, right at this time, Oregon joined the United States as an official territory and the new governor declared the Coinage Act unconstitutional.

Since both the Federal and Territorial governments failed to create a desperately needed standardized currency, eight entrepreneurial Oregon businessmen seized the opportunity and started a private mint they called the Oregon Exchange Company.

Essentially, these eight businessman struck solid gold coins without government permission. They produced gold coins in $5 and $10 denominations, known today as Beaver coins, named for the furry mammal’s likeness featured on the obverse of the coin. Later, the beaver became the official emblem of Oregon.

The eight businessmen who founded the Oregon Exchange added their initials to the obverse of the coin. The initials O.T. or T.O., for Oregon Territory, and the date are also seen on the obverse design. Today, you can see dies for these historical beauties at the Oregon Historical Society in Portland.

During this moment in Oregon history, gold Beaver coins filled a need to smooth daily financial transactions. The Oregon Exchange company’s coins, produced with virgin gold, were quickly recognized as trustworthy currency as the minters struck their coin’s weight above federal norms. Also, the gold for the Beaver coins was not artificially alloyed with silver or copper, so there was no question regarding its value in commerce.

Commercial trade and activity in the Oregon Territory was greatly augmented with the minting of the new, standardized gold Beaver coins, as it was no longer necessary to transport items like wagons of wheat or beaver skins from place to place to use as mediums of exchange.

But the life of this legendary Oregon mint was short. Before the Oregon Exchange Company stopped its operations in September 1849, it had minted California gold into roughly 6,000 $5 coins and 2,850 $10 coins. Once the U.S. Mint opened in San Francisco in 1854, the government mandated that all private territorial coinage be turned in and melted down.

A few Beaver coins escaped the melting pot, and about 50 of these unique coins from an exciting era in U.S. history are believed to exist today. Beaver gold coins rarely surface for sale and remain one of the most sought-after and unique territorial coins ever minted.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

What is the Autumn Effect for Gold?

Posted onIn past decades gold has experienced positive and statistically significant gold price changes in September and November. This finding was first popularized by economics and finance professor Dirk Baur. He called it the “Autumn Effect.”

His research examined daily gold returns (spot and futures) over a 30-year period from January 1981 until December 2010. The data showed that September generated an average return of 2.2% and that November generated an average return of 1.8%.

In fact, since becoming legal to own in December of 1974, gold bullion in U.S. dollar terms has risen 1.8% in September. This gain is more than four times its average return of 0.4% in the other 11 months of the year. Of course, for most investors, the only September that matters is this September. Will the trend continue?

Will the Autumn Effect Continue?

The September performance of gold has been underwhelming in recent years. The price of gold dropped in September of 2018, and 2020-2022. In 2019, gold only notched a modest gain of about 0.68%. But this doesn’t necessarily mean the Autumn Effect is dead.

The price of gold may be positioned to rise in the coming months as China’s central bank continues to add to its gold reserves. By the end of June of this year, the People’s Bank of China brought their gold reserves up to 1,926 tons, marking the eighth consecutive month of increases.

This trend is visible beyond China. India, Singapore, Turkey, and the EU have all increased their gold reserves in recent months. Even last year central banks purchased a massive $70 billion of gold. This is the highest figure since 1950. Many have cited geopolitical tensions, and global economic uncertainty as the two main reasons for such big purchases. Additionally, some speculate that emerging market banks have been buying gold in an effort to diversify away from the dollar.

What Are Possible Causes of the Autumn Effect?

Baur’s research offers no definitive explanation of the effect. However, he does offer a few theories.

First, he suggests that investors buy gold during September and November because these months have been historically weak for stocks. Consider that starting in 1975, the Dow Jones Industrial Average lost an average of 1.0% in September compared to an average gain of 1.0% in all other months. In fact, since the creation of the index in 1896 stocks have dropped, on average by 1.1% in September compared to an average gain of 0.8% during the other months. As Barron’s reports, September’s “return rank relative to the other 11 months is below average in every decade since 1900 but one.”

Baur also suggests that consumer gold purchases might be strong in these months due to the festival season in India and the pre-Christmas season in several developed countries. Finally, he theorizes that investors suffering from the “winter blues” may feel a drop in confidence in the equity market and seek out safe haven investments.

Where Does Gold Go from Here?

Gold has had a good year so far in 2023 rising about 6% YTD. There are reasons to believe that it could go higher.

Recent headlines about failing US banks have weakened confidence in traditional financial institutions. This may prompt more to seek the globally recognized value of gold. Additionally, recession fears, which persist, tend to lead to a rise in gold buying. Moody’s Analytics stated that the world recession risk was elevated as recently as January 2023.

While the Autumn Effect has been less evident in recent years, the long-term picture suggests that now is the time to buy gold.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

What Research Says About Using Gold to Mitigate Downside Risk in a Portfolio

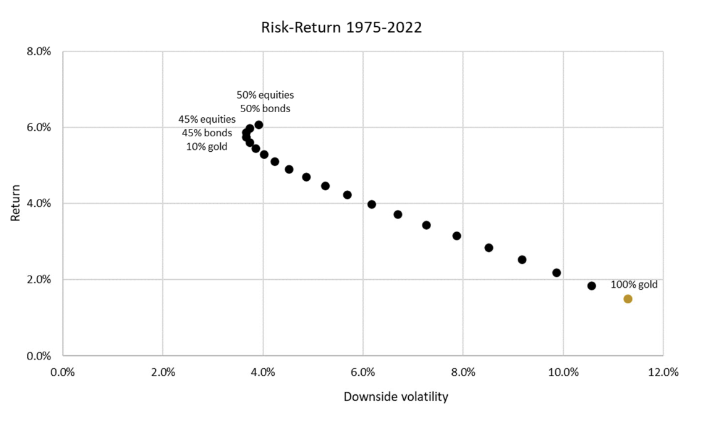

Posted on — 1 CommentMany investors use gold as a way to limit portfolio losses during down markets. This approach, however, begs one question: What portion of the holdings should be gold in order to provide protection without sacrificing a return? Researchers at the Lancaster University Management School decided to find out.

The researchers examined annual real returns for hypothetical portfolios consisting of equities, bonds, and gold. Their analysis was designed to allow all three investments to compete “head-to-head in a multi-asset portfolio context to empirically examine their ability to serve investors’ need for downside risk protection.”

They started their research with a review of gold’s performance as a safe haven asset and concluded that “gold would have served as a safe haven in some 76% of the observed down markets in equities.” However, they are quick to remind investors that this protection carries a cost because gold is down half of the time that stocks are up.

Nevertheless, data going back to 1975 shows that even a small allocation to gold within a portfolio of equities and bonds lessens the risk of capital losses by about 10% across many different equity-bond allocations. Moreover, the researchers discovered that downside risk can be mitigated even further when investors choose low-volatility equities to replace part of their bond allocation. This defensive mix consists of 10% gold and 45% low-volatility equities and bonds. This allocation represents the “nose” of the efficiency frontier resulting in a downside volatility to 3.7%.

Source: SSRN

These results were based on a 12-month investing timeline but the researchers also wanted to know how effective these allocations are over a wider range of periods. They analyzed results ranging from 1 month up to 36 months. They learned that the downside risk mitigation is stronger during longer time horizons. They also found that a 30/70 equity-bond portfolio generated an average return of 5.0% while the 45/45/10 defensive mix portfolio generated an average return of 6.2%.

The key takeaway for investors is that empirical research shows that the expected loss and downside volatility of a portfolio can be reduced with a small allocation to gold. Investors can further benefit from this approach by choosing low-volatility stocks for the equity portion of their holdings and setting their sights on a lengthy time horizon.

What makes this research so beneficial is the fact that it is so easy to execute. Most investors can easily update their allocations to match the recommended 45/45/10 blend. However, it is also important to note that these results were based on the assumption that the investor holds real gold rather than gold ETFs. As explored in other articles, gold ETFs fail to offer some of the basic characteristics that make gold such an attractive investment for so many. For example, gold ETFs introduce counterparty risk into the equation.

As uncertainty weighs on so many investors, it is important to remember that just one small adjustment to a portfolio can have protective effects over the long term.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.