The Renegade Businessman Behind Oregon’s Gold Beaver Coins

Posted onDuring the 1848 California gold rush, many Oregon settlers headed south to join the fray, seeking their fortunes. Some found success in the California gold mines and returned home to the Oregon Territory with bags of gold dust. Yet, as in other Western territories, conducting commerce in gold dust created a lack of uniformity for simple everyday purchases. Gold dust was also easily contaminated and subject to fraud.

During this time, items like beaver skins, wheat, gold dust, and silver coins from Mexico and Peru were used in everyday commerce, because of a lack of standard coinage. All these items were of ever-changing and uncertain value for those making the trades. Beaver skins and wheat were also difficult to transport and vulnerable to damage, making them an unstable medium of exchange.

A standard coin system was sorely needed.

In February 1849, the Oregon Territorial Legislature passed an act authorizing the creation of $5 and $10 gold coins. However, right at this time, Oregon joined the United States as an official territory and the new governor declared the Coinage Act unconstitutional.

Since both the Federal and Territorial governments failed to create a desperately needed standardized currency, eight entrepreneurial Oregon businessmen seized the opportunity and started a private mint they called the Oregon Exchange Company.

Essentially, these eight businessman struck solid gold coins without government permission. They produced gold coins in $5 and $10 denominations, known today as Beaver coins, named for the furry mammal’s likeness featured on the obverse of the coin. Later, the beaver became the official emblem of Oregon.

The eight businessmen who founded the Oregon Exchange added their initials to the obverse of the coin. The initials O.T. or T.O., for Oregon Territory, and the date are also seen on the obverse design. Today, you can see dies for these historical beauties at the Oregon Historical Society in Portland.

During this moment in Oregon history, gold Beaver coins filled a need to smooth daily financial transactions. The Oregon Exchange company’s coins, produced with virgin gold, were quickly recognized as trustworthy currency as the minters struck their coin’s weight above federal norms. Also, the gold for the Beaver coins was not artificially alloyed with silver or copper, so there was no question regarding its value in commerce.

Commercial trade and activity in the Oregon Territory was greatly augmented with the minting of the new, standardized gold Beaver coins, as it was no longer necessary to transport items like wagons of wheat or beaver skins from place to place to use as mediums of exchange.

But the life of this legendary Oregon mint was short. Before the Oregon Exchange Company stopped its operations in September 1849, it had minted California gold into roughly 6,000 $5 coins and 2,850 $10 coins. Once the U.S. Mint opened in San Francisco in 1854, the government mandated that all private territorial coinage be turned in and melted down.

A few Beaver coins escaped the melting pot, and about 50 of these unique coins from an exciting era in U.S. history are believed to exist today. Beaver gold coins rarely surface for sale and remain one of the most sought-after and unique territorial coins ever minted.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

What is the Autumn Effect for Gold?

Posted onIn past decades gold has experienced positive and statistically significant gold price changes in September and November. This finding was first popularized by economics and finance professor Dirk Baur. He called it the “Autumn Effect.”

His research examined daily gold returns (spot and futures) over a 30-year period from January 1981 until December 2010. The data showed that September generated an average return of 2.2% and that November generated an average return of 1.8%.

In fact, since becoming legal to own in December of 1974, gold bullion in U.S. dollar terms has risen 1.8% in September. This gain is more than four times its average return of 0.4% in the other 11 months of the year. Of course, for most investors, the only September that matters is this September. Will the trend continue?

Will the Autumn Effect Continue?

The September performance of gold has been underwhelming in recent years. The price of gold dropped in September of 2018, and 2020-2022. In 2019, gold only notched a modest gain of about 0.68%. But this doesn’t necessarily mean the Autumn Effect is dead.

The price of gold may be positioned to rise in the coming months as China’s central bank continues to add to its gold reserves. By the end of June of this year, the People’s Bank of China brought their gold reserves up to 1,926 tons, marking the eighth consecutive month of increases.

This trend is visible beyond China. India, Singapore, Turkey, and the EU have all increased their gold reserves in recent months. Even last year central banks purchased a massive $70 billion of gold. This is the highest figure since 1950. Many have cited geopolitical tensions, and global economic uncertainty as the two main reasons for such big purchases. Additionally, some speculate that emerging market banks have been buying gold in an effort to diversify away from the dollar.

What Are Possible Causes of the Autumn Effect?

Baur’s research offers no definitive explanation of the effect. However, he does offer a few theories.

First, he suggests that investors buy gold during September and November because these months have been historically weak for stocks. Consider that starting in 1975, the Dow Jones Industrial Average lost an average of 1.0% in September compared to an average gain of 1.0% in all other months. In fact, since the creation of the index in 1896 stocks have dropped, on average by 1.1% in September compared to an average gain of 0.8% during the other months. As Barron’s reports, September’s “return rank relative to the other 11 months is below average in every decade since 1900 but one.”

Baur also suggests that consumer gold purchases might be strong in these months due to the festival season in India and the pre-Christmas season in several developed countries. Finally, he theorizes that investors suffering from the “winter blues” may feel a drop in confidence in the equity market and seek out safe haven investments.

Where Does Gold Go from Here?

Gold has had a good year so far in 2023 rising about 6% YTD. There are reasons to believe that it could go higher.

Recent headlines about failing US banks have weakened confidence in traditional financial institutions. This may prompt more to seek the globally recognized value of gold. Additionally, recession fears, which persist, tend to lead to a rise in gold buying. Moody’s Analytics stated that the world recession risk was elevated as recently as January 2023.

While the Autumn Effect has been less evident in recent years, the long-term picture suggests that now is the time to buy gold.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

What Research Says About Using Gold to Mitigate Downside Risk in a Portfolio

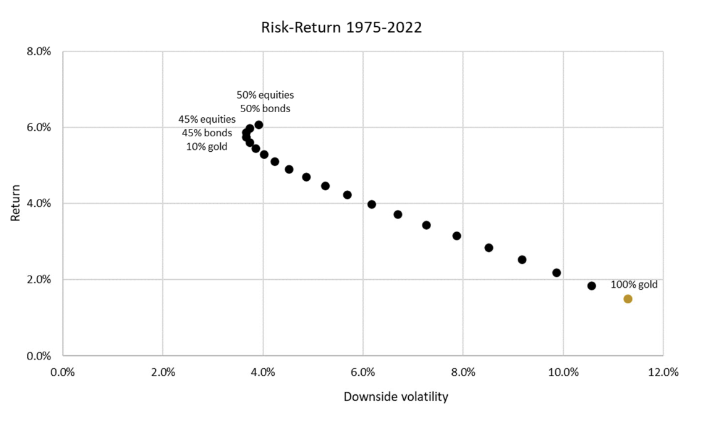

Posted on — 1 CommentMany investors use gold as a way to limit portfolio losses during down markets. This approach, however, begs one question: What portion of the holdings should be gold in order to provide protection without sacrificing a return? Researchers at the Lancaster University Management School decided to find out.

The researchers examined annual real returns for hypothetical portfolios consisting of equities, bonds, and gold. Their analysis was designed to allow all three investments to compete “head-to-head in a multi-asset portfolio context to empirically examine their ability to serve investors’ need for downside risk protection.”

They started their research with a review of gold’s performance as a safe haven asset and concluded that “gold would have served as a safe haven in some 76% of the observed down markets in equities.” However, they are quick to remind investors that this protection carries a cost because gold is down half of the time that stocks are up.

Nevertheless, data going back to 1975 shows that even a small allocation to gold within a portfolio of equities and bonds lessens the risk of capital losses by about 10% across many different equity-bond allocations. Moreover, the researchers discovered that downside risk can be mitigated even further when investors choose low-volatility equities to replace part of their bond allocation. This defensive mix consists of 10% gold and 45% low-volatility equities and bonds. This allocation represents the “nose” of the efficiency frontier resulting in a downside volatility to 3.7%.

Source: SSRN

These results were based on a 12-month investing timeline but the researchers also wanted to know how effective these allocations are over a wider range of periods. They analyzed results ranging from 1 month up to 36 months. They learned that the downside risk mitigation is stronger during longer time horizons. They also found that a 30/70 equity-bond portfolio generated an average return of 5.0% while the 45/45/10 defensive mix portfolio generated an average return of 6.2%.

The key takeaway for investors is that empirical research shows that the expected loss and downside volatility of a portfolio can be reduced with a small allocation to gold. Investors can further benefit from this approach by choosing low-volatility stocks for the equity portion of their holdings and setting their sights on a lengthy time horizon.

What makes this research so beneficial is the fact that it is so easy to execute. Most investors can easily update their allocations to match the recommended 45/45/10 blend. However, it is also important to note that these results were based on the assumption that the investor holds real gold rather than gold ETFs. As explored in other articles, gold ETFs fail to offer some of the basic characteristics that make gold such an attractive investment for so many. For example, gold ETFs introduce counterparty risk into the equation.

As uncertainty weighs on so many investors, it is important to remember that just one small adjustment to a portfolio can have protective effects over the long term.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

Are Baby Boomers Taking on Too Much Stock Market Risk?

Posted onAlmost half of Vanguard 401(k) investors—over the age of 55 who manage their own money— hold over 70% of their portfolios in stocks. That’s up from 38% in 2011.

At Fidelity Investments, nearly 40% of investors between the ages of 65-69 invest about 67% of their portfolios in the stock market.

Are older investors becoming too aggressive? Many experts say yes. By any measurement owning 70% or more of your portfolio in stocks for folks over 55 is considered aggressive—and few professional money managers would invest in such a fashion.

Typically as investors age, professional money managers trim down their exposure to stocks, which are considered risky investments, and shift more to acceptable safe alternatives like gold and silver bullion, bonds, and cash.

According to the time-honored formula of 100 minus your age, investors who are at least 55 years old should invest a maximum of 45% of their assets in the stock market. Why does this matter?

Access to Your Money When You Need It

Investing too heavily in the stock market later in life can put you at risk if the stock market goes into a downturn or even a crash. Older Americans who need cash might have no choice but to pull money out of the stock market at a significant loss.

While the U.S. stock market rebounded quickly from the Covid pandemic bear market, that was not normal. History shows that, on average, bear markets since WWII took the S&P 500 about three years to recover to a break-even point based on stock price. If you need money before that three years is up, you’d be selling stocks at a loss.

Even when you think you may not need the money you have in the stock market, health issues can arise. A 65-year-old couple can expect to spend an average of $315,000 on medical expenses during retirement, according to a Fidelity Investments study. It pays to have access to liquid investments—like gold—so you can access your money when you may need it unexpectedly, without having to sell stock investments at a loss.

Why Are Older Americans Holding So Much Stock?

There are a couple of reasons that older Americans may be so heavily invested in stocks. The first is that some Americans did not save enough money for retirement throughout their working years. These older investors are rolling the dice in the hopes they can play “catch-up” with outsized stock market returns.

Another explanation is that people, especially those who are managing their own money, forget to rebalance their portfolios at least once a year. It’s easy for allocations to get out of whack unless you make a concerted effort to rebalance on a regular basis.

Rebalancing simply means selling a portion of your stock allocation and buying more of other asset classes like gold. When you rebalance at least once a year, it allows you to maintain your desired asset allocation level appropriate for your risk tolerance level and time horizon.

Retirees with Too Much Stock Could Benefit from the Safety of Gold

If you are one of those older Americans with too much stock exposure, it could be time to consider rebalancing and increasing your allocation to precious metals.

Gold and silver bullion in physical form is an appropriate asset for a portion of any properly diversified investment portfolio and we recommend investing up to 10% of your overall portfolio in gold, depending on your financial goals and risk tolerance levels.

Want help? Call one of our Blanchard portfolio managers today for a customized portfolio review. We can provide personalized investment guidance based on your financial goals, risk tolerance, and time horizon. We’ve been helping Americans invest in the safety of gold and silver since 1975 and we can help you too.

Learn more about rebalancing your portfolio in this article: Your Mid-Year Portfolio Check-Up in Four Easy Steps.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

Central Banks Buy 55 Tonnes of Gold in June

Posted onIn 2022, central banks purchased a staggering amount of $70 billion in gold, the most since 1950, as governments around the globe clamored to add more precious metals to their coffers. This year, the gold buying hasn’t let up.

The world’s global central banks—led by the People’s Bank of China—were back in the market to buy gold in June, adding a total of 55 tonnes of the precious metal to their vaults.

Overall, in the first half of 2023, central bank gold buying was widespread among both developed and emerging market nations and hit a first-half record at 387 tonnes, according to the World Gold Council.

What exactly are Central Banks?

Central banks are government institutions that are charged with managing the money supply of their respective countries and controlling monetary policy, like official interest rate levels. In most countries, they are tasked to manage price stability (inflation), while in other countries, like the United States, they are also required by law to support full employment. Examples of central banks include the European Central Bank (ECB), the Bank of Japan (BOJ), the People’s Bank of China, and, of course, the U.S. Federal Reserve.

Why do Central Banks Buy Gold?

Central banks buy the world’s most trusted “safe haven” investment for the same reason that individual investors, family offices, pension funds, and mutual funds buy gold.

The reasons include diversification, a hedge against inflation, and a store of value. Gold retains its value no matter if paper currencies rise or fall in value.

Notably, central banks are also purchasing gold now in an attempt to diversify away from the U.S. dollar—as gold can be swapped into any currency around the world, like the European euro, Chinese yuan, Japanese yen, or even the New Zealand dollar or Swiss franc.

Increasing Geopolitical Tensions

China has been leading the pack in purchasing gold in recent months. From December through May, the People’s Bank of China purchased 2,076 tonnes of gold, alongside a number of other central banks who were buying including Turkey, India, and Singapore. China in particular has been seeking to wean its country off the U.S. dollar amid rising political tensions with Washington D.C. policymakers.

The Bank of Russia has also accumulated gold over the past year, with its bullion purchases up 1 million ounces as of March, to a total of 74.9 million ounces. Russia leaned into its gold purchases in an attempt to avoid Western sanctions related to its war in Ukraine.

Gold Outlook

In a recent research note, JP Morgan projects the price of gold will average around $2,175 an ounce by the fourth quarter of 2024.

That marks a 15% increase from the current gold price.

“We’re in a very prime place where we think gold ownership and long allocation to gold and silver is something that acts as both a late cycle diversifier and something that will perform as we look to the next sort of 12, 18 months.”

The firm also pointed to continued central bank buying as a hedge against geopolitical risk and to diversify away from the dollar as a factor boosting the price of gold in the months ahead.

In fact, 24% of central banks plan to add more gold to their reserves in the next 12 months, according to the 2023 Central Bank Gold Reserve Survey released by the World Gold Council,

An argument could be made that the world’s global central bankers are some of the savviest, smartest investors around. If they plan to buy more gold, it begs the question, should you consider buying more too?

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

What the Inflation Data Really Means for You

Posted onWhile official government inflation numbers have fallen from their peak, Americans still feel the economic pain from rising prices. The annual Consumer Price Index (CPI) inflation rate peaked at 9.1% in June 2022 and has come down in recent months, yet it’s still sharply higher than two years ago.

Inflation Impact: Americans Spend $709 More Each Month

The average American household spent $709 more in July 2023 than they did two years ago to buy the same goods and services, according to Moody’s Analytics.

That makes sense. While the July CPI hit 3.2% following the 3% increase in June—that is a cumulative number. That means the 3% June 2023 increase is on top of the 9.1% increase in June 2022. That’s a hefty number over two years ago.

Just because official government inflation numbers have fallen doesn’t mean your monthly expenses are down. Actually, it’s the opposite.

Digging deeper inside the latest CPI, the price increases are still staggering on a year-over-year basis:

- Food away from home (think restaurants) increased 7.1%

- Shelter prices (housing) were up 7.7%

- Transportation services (like airfares) were up 9%.

Will prices ever retreat to their pre-pandemic levels? It’s unlikely, experts say.

Gasoline prices are heading higher again, with regular gasoline prices up 30 cents a gallon in mid-August from a month earlier, according to OPIS. As far as food goes, a number of factors are conspiring to keep the price trend higher there including rising food transportation costs, poor weather for the crops (heat and drought), and El Niño, a weather pattern that can worsen drought.

The Last Mile Problem

Fed watchers are now pointing to the so-called “last mile problem” as it relates to inflation. Sure, inflation has come down from 9.1% to 3.1%, but it still remains above the Fed’s 2% target inflation rate, and that represents the very challenging last mile in the inflation fight.

While the Federal Reserve has already hiked interest rates to their highest level in 20 years to battle inflation, it may not be enough. Consider this: “Academic studies and other research concluding the levels of inflation seen over the last two years can’t be fixed without a downturn, and prominent economists projecting a jump in the U.S. unemployment rate to between 5% and 10% from the current 3.5% – with millions out of work – might be the price that’s paid [to fix inflation],” according to an Aug. 14 Reuters article.

Another piece of the puzzle is the catastrophic level of U.S. national debt, which currently stands at an all-time record high at $32.66 trillion. There is concern that the U.S. government may continue to print more money to pay back its debt, which creates more inflation as bondholders are paid back with devalued money.

Gold Provides Wealth Protection

In the midst of stubborn inflation, high interest rates, and government money printing, gold continues to stand alone in its value for investors.

Gold is a tangible asset that can’t be devalued by government printing presses. Gold holds no counter-party risk and isn’t attached to any one nation or its debt levels. Gold has been a store of value for thousands of years and is a recognized currency in every country on the globe.

In light of today’s economic challenges, it’s no surprise that more investors are turning to the safety and protection that gold can provide. Let us know if we can help you review your unique personalized situation and make recommendations to help you meet your long-term financial goals. We are here to help.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

How One of the Immune Columbia Coins Helped Build a Nation

Posted onRobert Morris might be one of the most important historical figures you’ve never heard of.

As one of the Founding Fathers of the United States, he was unanimously elected the first Superintendent of Finance in 1781. Shortly after his election Congress passed a resolution that approved the establishment of a mint. It was a critical step in becoming an independent country.

His work eventually led to one of the most fascinating Immune Columbia pieces, called the Nova Constellatio, which was one of the first coins struck under the authority of the U.S.

The coins were part of Morris’ plan to develop a simple system that would allow for the easy conversion of Portuguese, Spanish, British, or State currencies to U.S. money. Morris’s idea however, was more than practical, it was also innovative. He devised a type of coinage that used decimal accounting – a system based on units of 10 – which was eventually adopted by all other nations. In time, Morris gained powerful support from Alexander Hamilton and Thomas Jefferson.

Morris called for the creation of a gold piece equal to ten U.S. dollars, a silver dollar, a tenth of a dollar in silver, and a hundredth of a dollar in copper. This initiative led to the striking of the Nova Constellatio coins in 1783. The name – a new constellation- evokes images of a group of diverse people united in one nation.

This was just one of Morris’s many contributions to the success of the U.S. He is also credited with establishing the first congressionally chartered national bank – the Bank of North America – to operate in the U.S. He is widely credited with financing the Revolutionary War given his success in redirecting government funds to purchase supplies needed to fight the British. In fact, many of these supplies ultimately went to the Continental Army under General George Washington. The resources helped him win the pivotal victory at the Battle of Yorktown.

Today, five patterns of the coin exist. In silver denominations, the range of values is 1,000 units, 500 units, 100 units, and 5 units. The 500-Unit family consists of two pattern types. One side, with the all-seeing eye and rays of light, consists of 13 stars representing each state at the time. The reverse shows a laurel wreath with “Libertas Justitia” meaning “Liberty, Justice.”

Unfortunately, Morris’ plans never came to be and the currency didn’t advance beyond the Congressional committee. More than a decade passed before the first official United States Mint even opened. The few of these very rare coins that exist can be traced back to Morris himself and Charles Benjamin Dudley, a chemist, and metallurgist who was assaying various metals at the time.

The coins are a rare look at what could have been in the early days of the U.S. and a fledgling currency. Even if the coins never became part of the financial system, the innovation behind them – decimal accounting – certainly did.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

Regulated Gold: One of the Rarest Segments of Early U.S. Coin History

Posted on — 1 CommentIn early colonial America, it was common to see foreign coins in everyday commerce. Coins from Brazil, Portugal, Spain, France, and of course England all circulated as legal tender. There were challenges to this hodge podge of coinage in the early days of our nation as each of these foreign coins had a different weight and fineness.

This made commerce challenging as the merchants who traded in these gold coins were ill equipped to test each coin to ensure its purity and weight.

So, in the period before, during and even after the American Revolution, a solution emerged to level the playing field: regulated gold coins. Because different areas of the American colonies had different weight standards for gold coins, metalsmiths played a critical role in regulating the foreign coins in circulation to the appropriate local standards.

How did this work? A metalsmith would assess the coin and regulate its weight to certain standards. They were known as “regulators” and would drill into a coin and add gold in the form of a plug if it was necessary to increase its weight. If it was overweight, the regulator would clip or file its edges. Then, the regulator would stamp the coin with his silversmith mark, identifying who guaranteed the gold content of that particular coin. The marks on the coins were identical to the stamp used by the silversmith on items like silver cups, teaspoons, or even sugar bowls or cream jugs.

The regulators were highly respected members of the community and included prominent people including Ephraim Brasher, William Hollingshead and Thomas Underhill. Ephraim Brasher was a legendary New York metalsmith and jeweler. Brasher was also George Washington’s silversmith and personal friend. Today, numismatics can find his hallmark EB punched onto the coins he regulated.

While not often talked about, regulated gold coins represent an important era in U.S. coin circulation history. Famous collectors and numismatics included regulated coins in their renowned collections, including those of Louis Eliasberg, John J. Ford Jr., and Virgil M. Brand.

In 1795, the U.S. Mint began striking gold coins, which decreased the incentive to use regulated gold coins. At that time, many regulated gold coins were melted down, making these pieces some of the rarest in U.S. numismatic history. However, foreign coins were allowed to be used as legal tender in the United States until 1857, when Congress finally banned their use as legal tender in the Coinage Act of 1857, which officially ended the era of regulated coinage.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

Can You Time Gold Investing? An Empirical Analysis

Posted on — 2 CommentsGold is often seen as a long-term investment because, unlike equities, it rarely experiences dramatic up or down movement over the short term. Therefore, few investors consider the timing when buying gold. But should they? This was a question researchers wanted to explore.

Therefore, few investors consider the timing when buying gold. But should they? This was a question researchers wanted to explore.

To do so, they tested over 4,000 seasonal, technical, and fundamental timing strategies for gold using eighteen different market timing signals. For example, one signal, called the “seasonal market timing signal,” is based on research showing that September and November are the only months in which gold generates a positive and statistically significant return based on data from 1980 to 2010.

Another signal is based on the long-term corporate bond return minus the long-term government bond return. Yet another signal is based on the interest rate on a three-month Treasury bill. They even examined what they called the “kitchen sink” forecast which “incorporates all available predictor variables simultaneously in a multivariate regression model.” The analysis evaluated how these different market timing signals performed from January 1990 to December 2017.

The researchers concluded that “the best fundamental and technical market timing strategy outperformed a buy-and-hold strategy by about 2.3 percentage points per year. The best seasonal trading strategy outperformed a passive strategy by at least 2.7 percentage points per year.”

While it might be difficult for ordinary investors to implement the exact trading strategies used here, the research does show that there are times that are better than others to invest in gold. Everyday investors can time their purchases using much simpler signals like:

- Economic Uncertainty: Gold is often seen as a safe-haven asset, and its demand tends to rise during times of economic uncertainty or market volatility. In situations like economic downturns, financial crises, or recessions, investors may turn to gold as a store of value, which can drive its price higher.

- Inflationary Periods: Gold has been considered a hedge against inflation, as its value may rise during periods of high inflation when the purchasing power of fiat currencies decreases. Investors may use gold to preserve wealth when they expect inflation to erode the value of other assets.

- Geopolitical Tensions: Political instability, conflicts, or geopolitical tensions can increase demand for safe-haven assets, including gold. During times of geopolitical uncertainty, investors may seek the relative stability and perceived safety of gold

- Currency Depreciation: A weakening currency can boost the demand for gold, particularly in countries where local currencies are losing value against major international currencies like the U.S. dollar

It’s always a good time to own a safe haven investment. But for those who have the opportunity to plan their next purchase, it might be wise to consider the economic environment first.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

The 1652 Shilling Oak Tree

Posted onIn the early 1600s, the owners of the Massachusetts Bay Company founded the Massachusetts Bay Colony. The settlement, located around Massachusetts bay, was in fact the second attempt at a settlement by the company.

Ultimately, the attempt was successful, with about 20,000 inhabitants who migrated to the area around the 1630s. The colony found success in trading with England, Mexico, and the West Indies. Initially, barter was an effective form of exchange. This later gave rise to the use of English pounds, Spanish “pieces of eight”, and wampum. However, by the early 1650s, a currency shortage became a problem.

The colonists decided to authorize silversmith John Hull to create new coins. More than just a silversmith, Hull was a merchant, politician, and military officer. He is also remembered today as an early benefactor of Harvard University. The authorization gave him the right to re-mint foreign silver currency in shilling, sixpence, and three-pence denominations.

Hull chose simple designs for the pieces, spending only five months minting the coins. He stamped the obverse with “NE” for New England. On the reverse, he stamped them with one of three Roman numerals, “III”, “VI” or “XII.” The central image of a willow tree eventually changed to an oak tree on pieces minted starting around 1660. The final version, minted between 1667 and 1682, features a pine tree and became the most popular of the set. The reason for its popularity was likely due to the fact that the image signified the export of pine timber used to construct the mainmasts in British warships.

The coins, however, would eventually become a point of contention between the colonists and England. Hull and others were, according to the English, in violation of the Navigation Acts which was intended to regulate the way trade was conducted within the colonial empire.

Today, the imperfections of the pieces are a perfect representation of the difficult and rugged conditions in which the colonists lived, with many sleeping in dugouts or wigwams. The roughness of the willow tree version is sometimes evident in what appears to be double or triple striking likely caused by cylindrical dies which had a tendency to rotate. In time, prismoidal dies took their place. These dies, which had four, six, or eight sides, could be clamped ensuring that the die would not rotate. The pine tree shillings remain the most commonly known of the coins due mainly to the fact that they were produced in the largest quantity and that they were the latest version minted.

Eventually, Hull went on to become Boston’s treasurer in 1658 holding the office for almost a decade. He later became treasurer of the Massachusetts Bay Colony from 1676 to 1680. In 1681, Hull became instrumental in acquiring the Province of Maine for the Massachusetts Bay Colony. Unfortunately, shortly after in 1683, Hull died. Today, Hull Street in Boston is named after him and his coins remain a sought-after piece of American history.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.