Key Takeaways from Latest World Gold Council Report

Posted on — 2 CommentsDays ago, the World Gold Council released their latest Gold Market Commentary. Here, we distill their analysis to a few important takeaways that can help investors understand what has happened with gold and where it might be headed.

Wham, Bam, Thank You GRAM

The World Gold Council’s Gold Return Attribution Model (GRAM) is a function used to quantify how the various drivers of gold’s performance contribute to monthly price changes. The model also assesses how the influence of these drivers change over time. GRAM was helpful in understanding the cause of gold’s 3% gain in December of 2022 which helped the metal end the year on a positive – albeit slightly – gain. The data within GRAM suggests that this positive return was largely due to a weaker US dollar.

Retail and Central Bank Demand Lifted Gold

Strong demand for gold from both retail and central banks was enough to offset weak demand seen among institutional investors. As the World Gold Council explains, “an unrivaled surge in real yields (coupled with a strong US dollar) failed to drag gold down in 2022.” This outcome is an example of why diverse sources of demand are critical to the long-term performance of gold especially in years that threaten to bring price per ounce down.

Gold Continues to Offer Low Correlation and Low Volatility

Gold’s correlation to a traditional 60/40 portfolio – while higher than average – was still low at 20. This is an important benefit of gold for most retail investors seeking to bring stability to a portfolio that continues to face the uncertainty of a looming recession and interest rate increases. Additional data showed that gold’s volatility was in line with its long-term average while the 60/40 portfolio experienced one of its most volatile years since 1972.

Gold Buyers Likely Want Protection From Inflation

Analysts at the World Gold Council concluded that the increasing gold purchases seen among retail investors was likely due to concerns about inflation. This was especially true within Emerging Markets according to their research. This segment of the market, which represents 60% of all retail investors, has fewer ways to counter rising inflation. Central bank purchases added to this purchasing activity as 673t was added to reserves by the end of Q3 which is a historic high.

2023 Could Bring a Mild Recession

The World Gold Council sees a “stable but positive outlook for gold prices.” Additionally, their analysis forecasts a weaker US dollar, pressure on equity prices, slightly higher bond yields, and continued geopolitical risk stemming from the uncertainty surrounding the war in Ukraine. Finally, the World Gold Council noted a seasonal rebound in gold demand in China at the end of 2022. Much of this buying was due to consumer activity being driven by the Chinese New Year. While this seasonal surge was low in comparison to historical figures, analysts at the World Gold Council expect it to improve as China continues to find its way out of their zero COVID policy.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Inflation Update: Gold Surges above $1,900

Posted onThe price of gold exploded higher last week, climbing to a fresh 9-month high above $1,900 an ounce. Gold is shining once again as investors believe that a minor drop in the headline inflation rate in December will slow the pace of Federal Reserve interest rate hikes, which is already boosting demand for the precious metal.

Gold traded as high as $1,921.50 last week as investors are flocking to the precious metal following the release of the December consumer price index (CPI) report. While the overall inflation rate fell to 6.5%, many key categories continued to see double digital price gains in December.

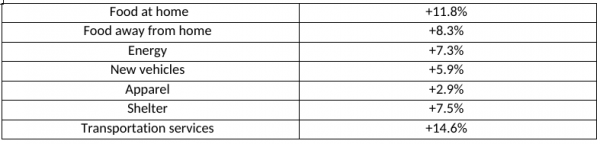

According to the Bureau of Labor Statistics, these categories continued to rise sharply in December.

How Much More You Are Paying Now

That means you are still paying sharply higher prices for everyday goods from eggs, milk, butter, and bread to homes, rent, new cars, and even the energy to heat your home and keep you warm during the cold winter months.

Slower Fed Rate Hikes Ahead

The inflation news unleashed a fresh round of gold buying as investors expect the modest decline in the headline number from 7.1% in November to 6.5% in December, will allow the Fed to slow down its aggressive interest rate hikes – which at this point are expected to trigger a recession in the United States in 2023. Despite the 2022 rate hikes, core inflation remains well above the Fed’s 2% inflation target.

The CME Group’s FedWatch Tool now reveals that 91.2% of traders expect the Fed to hike by only 0.25% — which would reveal a massive slowdown from the 0.75% interest rate hikes seen in 2022.

Recession Ahead

The damage from the Fed’s 2022 aggressive interest will soon show in the form of a recession. There is a well-documented lag between monetary policy and its impact on the economy. Here’s what Wells Fargo Economics says: “We expect a recession to begin in the United States in the second half of the year.”

Gold Is In an Uptrend

What does this all mean for gold? You can expect even higher prices ahead, with gold possibly at $2,000 an ounce, just around the corner.

“This year the global economy is facing a serious slowdown, and in many countries a recession. That could make gold more appealing now that yields and the dollar are less of a negative factor,” Craig Erlam, senior market analyst at OANDA told CNN.

In the face of stubbornly high inflation and the potential for a recession in the U.S., investors are flocking to the safety and security of gold. Precious metals have served as a store of value for thousands of years. If you are seeking a safe haven and also an asset that will grow your wealth, consider increasing your allocation to gold and silver today before prices move sharply higher.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

How Oil Could Influence Gold Prices in 2023

Posted onOil prices have a meaningful influence on gold prices. Understanding why means first examining how dollar-denominated assets work.

A dollar-denominated asset is any asset priced in US dollars. Gold is an example of a dollar-denominated asset as well as oil. This means that a rise in the value of the dollar is likely to drive down the price of those assets.

The rise and fall of gold and oil prices often occurs in tandem because both assets share this characteristic. However, this relationship is complicated by inflation which is often defined as too much money chasing too few goods.

An increase in oil prices contributes to a rise in inflation. This happens because a rise in oil increases the cost of inputs. This relationship has weakened somewhat in recent decades as oil has become less integral to manufacturing but the influence is still there. Moreover, the transportation of finished goods requires oil which also impacts the prices of those products.

This connection between oil and inflation matters to gold investors because gold tends to increase in value as inflation increases according to research showing that “there is a clear co-movement between the prices of the two strategic commodities, both in nominal and real terms.” This connection is so strong that even a dramatic short-term movement in oil prices reverberates throughout the gold market. The same body of research determined that “the signs of the instantaneous impact of oil price shocks on gold returns are all identically positive.”

This link makes sense. An increase in oil prices will hinder economic growth. Running a business becomes more expensive. This slowing of economic activity often flows through the equities market. As a result, investors tend to move towards “safe haven” investments like gold.

One of the most direct connections between the prices of gold and oil can be seen in mining. The resource-intensive process of mining demands oil for the operation of industrial machinery.

A rise in oil prices can force a mine to go off-line or shut down entirely. Even exploration requires substantial oil resources. This relationship is present within other mined resources. For example, Barron’s explains “the correlation between the daily iron ore price and oil price has been 72%.”

Other academic research supports this link. One study found that “oil is one of the main factors in causing variations in stock prices, exchange rate and gold prices.” Countries experiencing the strongest economic growth are often the largest drivers of immediate surges in oil demand. Consequently, it is plausible that emerging economies have a disproportionately large influence on gold prices in the short-term.

All of this leads to one question for gold investors: where is oil likely to go in 2023?

Today, West Texas Intermediate oil is trading at approximately $80/barrel. Analysts at JPMorgan forecast this to rise to $90 in 2023. Bank of America projects an average of $94/barrel in 2023.

Many of these forecasts are influenced by the uncertainty surrounding the war in Ukraine.

The key takeaway for gold investors is this: there are many factors influencing the price of gold and oil is among the most consequential. A rise in oil prices in 2023 – a likely scenario – should bode well for gold.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Massachusetts Coins: The First Silver Coins Struck on American Soil

Posted onThirty two years after the Mayflower landed on Cape Cod with 101 adventurous souls, Bostonians began minting silver coins. At this time the American colonies were, of course, ruled by England. And the colonial governments were run according to the charters granted by England’s king. A few of the charters permitted the colonial governments to mint coins, but most did not.

Massachusetts Bay was the first English colony to challenge this prohibition when the Massachusetts General Court in 1652 ordered that silver three pence, six pence and shilling could be struck in the English Americas.

The Massachusetts Bay government was simply trying to fill a huge need for standardized currency. Before this, the New England settlers were using “wampum” as a medium of exchange. Wampum was created from shells ground to the size of a kernel of corn. A hole was drilled through each piece so wampum could be hung on a strip of leather for convenience.

The early mint, located in Boston, was run by Mintmaster John Hull and his assistant Robert Saunderson. The first Massachusetts silver coin designs were simplistic with one side punched with a small NE for New England and the other side punched with the coin’s denomination in Roman numerals. For example, a shilling would show XII.

Surprisingly, the original legislation authorizing these coins required them to be square, not round. However, another subsequent law changed the shape to be round. Soon after, the Boston minters began creating additional varieties known today as the Willow, Oak and Pine Tree series. The Willow Tree silver coins were struck from 1653 until 1660, the Oak Trees from 1660 to 1667 and then the Pine Trees from 1667 to 1682.

These historic silver pieces were struck on handmade dies that were often individually distinct. That created a great number of die varieties for today’s advanced collector seeking levels of rarity. Nonetheless, all of these early colonial coins are scarce to rare today. The Pine Tree coinage survives in larger numbers than the Willow or Oak issues, making them the easiest to source and locate of the group.

Collectors today may find some surviving Massachusetts silver pieces to be slightly bent. At that time, due to superstitions, many of these silver pieces were bent and then straightened back out. Some people believed that bending the coin would ward off evil spirits. Many of these early Massachusetts silver coins were also holed and worn as a pendant for the same reasons.

A group of these 128 rare Massachusetts Colonial coins were sold for $2.9 million in a 2022. The coins were from the collection of numismatic researcher Christopher J. Salmon The top lot was a 1652 Willow Tree Sixpence graded NGC AU 55 that realized $312,000.

If you are intrigued by this story, reach out to a Blanchard portfolio manager today. Some of the early Massachusetts silver pieces are scarce and affordable while others are ultra-rare and costly, meaning a coin from unique and exciting era in early American history could be within your grasp, no matter the range of your investment level.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

The State of the Economy and Gold: A Look Back at 2022

Posted onAs an investor, there was nowhere to hide in 2022. Except in gold.

The carnage in the investing world was evident everywhere in 2022, with double digit losses in top-rated government and corporate bonds, to the major stock indexes, and to cryptocurrency and tech stock darlings.

Gold: One of the Best Performing Asset Classes in 2022

As inflation ravaged the value of cash, precious metals investors held their value in gold throughout 2022 – proving once again that gold is a store of value and an asset where you can not only grow your wealth but importantly preserve it.

Gold is up 11% from its November low and is nearly unchanged year-to-date. Compare that to the year-to-date asset performance below:

US Corporate Bond Index down 16%

US Government Bond Index down 13%

S&P 500 down 20%. NASDAQ down 34%

Bitcoin down 65%

Apple (AAPL) down 28%

Google (Alphabet Inc. GOOG) down 40%

Tesla down 65%

GameStop down 51%

Economic Growth

The U.S. consumer helped keep the economy afloat in 2022, despite the hefty challenges of decades-high inflation and soaring interest rates. The economy is expected to grow at a 1.9% year-over year GDP rate in 2022, according to the Conference Board.

In 2023? They expect that growth rate to slow to zero percent, with others calling for an outright recession in 2023 with negative economic growth ahead.

Inflation

Runaway inflation in 2022, along with rising interest rates tanked both the stock and bond markets. Going to the grocery store alone ate a big hole in your wallet this year. Egg prices climbed to nearly $10 per dozen in some cities, while overall grocery prices rose 12% in November from a year earlier. That marked the highest food price gains since August 1979 when food prices rose 13.5%.

If you felt like dining out, the situation was no better. Sit down restaurant meals climbed about 9% and restaurants now charge for items like bread that were formerly complimentary. For

For those who like to travel, getting on an airplane was substantially more expensive in 2022 as airline fares increased 36% in November, the biggest jump since 1991.

Interest Rates

After sitting on its hands throughout 2021, while inflation steadily increased, the Federal Reserve finally took action in 2022 to combat inflation.

While many Americans believe that Congress or even the President can control inflation, it is actually the Federal Reserve’s job to do just that. Congress, in fact, explicitly stated that the Fed’s goals are to sustain “maximum employment, stable prices, and moderate long-term interest rates.” The Fed has monetary policy levers, such as raising or lowering interest rates to perform its duties.

Well, the Fed fell down on the job in 2021 and 2022 when it allowed the Consumer Price Index to climb to a high of 9.1% in June – well above the Fed’s stated 2% inflation goal.

In order to try to tame the red-hot inflation that punished Americans at every turn in 2022, the Fed increased interest rates seven times in 2022 raising its benchmark rate to 4.25-4.50%, a 15-year high. The interest rate hikes are designed to slow the economy and thus bring inflation down.

The problem with letting inflation get out of control and so high is that the Fed will now likely cause a recession in 2023 with its aggressive interest rate hikes.

What 2022 Taught Investors about Preserving Wealth

In a year when nearly every single asset class was in the red, gold was a shining star. Gold maintained its value in 2022 offering investors a way to preserve, not lose their wealth. Looking into 2023, an increased allocation to physical gold appears to be a strategic investment move. There are a variety of forecasts that show gold increasing in value to $2,000 and even $3,000 in the year ahead. With looming economic recession on the horizon, gold offers investors a safe-haven in the current economic storm. Do you own enough?

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

What Could 2023 Bring for Gold?

Posted on — 1 CommentGold is trading around $1,800 an ounce – virtually unchanged from year-ago levels – as gold served one of its ultimate functions in your portfolio: capital preservation. That compares to double-digit losses in the stock and bond market in 2023.

While gold was one of the best-performing asset classes in 2022, what could the New Year bring?

There are four major macroeconomic factors that will keep demand for gold high in 2023, according to Gold Outlook 2023 research from GoldHub:

- A mild recession and weaker earnings have historically been gold-positive

- Further weakening of the dollar as inflation recedes could provide support for gold

- Geopolitical flare-ups should continue to make gold a valuable tail risk hedge

- Chinese economic growth should improve next year, boosting consumer gold demand

Caution Ahead: Recession on the Horizon

As Nobel Prize winning economist Milton Friedman explained: monetary policy acts with long and variable lags. That means that the Federal Reserve’s aggressive seven interest rate hikes in 2022 have yet to impact the economy. The rate hikes are intended to slow the economy and tamp down inflation and Americans will feel that economic impact in the first half of 2023.

“A recession is all but inevitable in the U.S., Euro Area, and UK: Expect a mild U.S. recession in 1H23,” according to a BofA Global Research report. That’s positive for gold ahead.

Central Bank Demand Expected to Remain High

It was a veritable gold rush in 2022, as central banks bought more gold in the first nine months of the year versus any full year since 1987. In the quarter ending September, demand for gold was up 28% year-on-year, reaching 1,181 tons, according to a World Gold Council report.

In the wake of the Russian war in the Ukraine, the U.S. and other western countries froze an estimated $300 billion of Russian foreign exchange reserves, which included tens of billions of U.S. dollars held outside of Russia. This unusual event accelerated the move away from holding U.S. dollars in official central bank coffers and increased the desire to hold gold, which is a universal currency that is not controlled by any one nation of bloc of governments.

Gazing into 2023, high central bank demand for gold is expected to continue as countries move toward a de-dollarization trend.

Epic Gold Rally Ahead?

There are forecasts that could double the price of gold in the year ahead. One factor that could drive gold sharply higher is if Russia moves to accept gold in trade for its country’s coveted oil reserves. “If Russia accepts gold for oil, gold price doubles to $3,600,” says Credit Suisse’s Zoltan Pozsar. “Crazy? Yes. Impossible? No. this was a year of the unthinkable macro scenarios and the return of the statecraft as the dominant force driving monetary & fiscal decisions,” Pozsar added.

Meanwhile, Denmark’s Saxo Bank forecasts that gold could climb to $3,000 and ultimately as high as $4,000 if inflation continues to remain high.

The Bottom Line

There are many factors that suggest gold is poised for a big leap higher. Today’s gold price gives you the opportunity to trade your dollars for more gold. Consider making an increased investment in gold today to protect and grow your financial future in 2023 and beyond.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Say Aloha to Hawaii Plantation Tokens

Posted on — 2 CommentsIf you’ve ever visited the balmy islands of Hawaii, you may have seen a sugar or pineapple plantation during your travels. Just like the “territorial” gold you may be familiar with struck by private minters in California, Oregon, Utah and Colorado, there is a charming subset of territorial coinage known as Hawaiian plantation tokens.

From 1860-1891, plantation tokens were struck for use in company stores on some of the well-known and large Hawaiian plantations. All Hawaiian plantation tokens are rare and highly sought-after today.

The Hawaiian Islands boast a rich and storied history. It was 1778 when British explorer Captain James Cook landed on the Hawaiian Islands. Indigenous Hawaiians had been living on the islands for over 1,000 years, yet there was no established monetary system there.

Hawaiians relied on Cowry shells, certain types of feathers and even sandalwood to use as money before the British arrived. However, in the years that followed, the British and sailors from other countries brought their native currency including British Sovereigns, Dutch Guilders, Spanish Escudos and these were introduced for use in commerce on the Hawaiian Islands.

Hawaii was an agrarian economy dominated by booming activity at sugar cane, pineapple and coffee plantations. In order to fill the currency void, the plantations created tokens from 1860-1891 that could be used as cash at their company stores. Many of these tokens were made in Maui by blacksmiths and were paid to plantation workers. While the plantation tokens were not legal tender, they did circulate as money throughout the Hawaiian Islands in the late 1800s

The exception appears to be the Waterhouse tokens, which were likely created as advertising pieces since they held no value at his stores.

Various tokens issued by several plantations included the Wailuku, Thomas Horton, Waterhouse and Haiku. These Hawaiian tokens are well-known within the advanced numismatic community and remain highly sought after by collectors today.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

Inflation: Not Just an American Problem

Posted onConsumer inflation rose 7.1%, down from a summer peak of around 9% this year, according to the November consumer price index report. Yet, once you dig into the data, the cost of many things you buy are still rising – like groceries, dining out, recreation services and haircuts and other personal care services.

In 2022, inflation is not just an American problem – it’s a global problem. Heading into 2023, it’s unlikely this stubborn rising price problem will go away anytime soon.

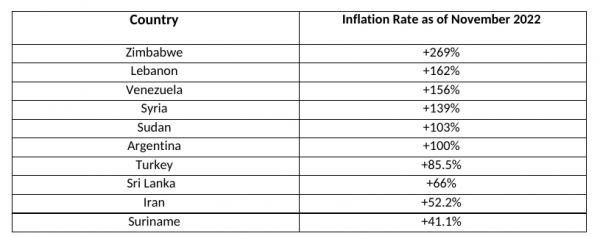

There is double-digit price inflation in almost half the world right now, with some countries even experiencing triple-digit inflation. Here’s a look at the top 10 eye-popping inflation rates around the world right now.

Source: TradingEconomics

This type of inflation is debilitating. While we hope the United States will never experience hyperinflation like the type that is hitting Venezuela, hope is not a plan. Here is a suggestion from a recent article: “How to prepare yourself for hyperinflation: tips from the Venezuelan experience.”

“Purchase a more stable currency: If the money in your bank account starts to lose purchasing power, buying another currency in which you can accumulate good savings is a must. I also recommend buying commodities like gold, but be careful where and how you store it. Purchasing real estate is not recommended since properties can lose their value quickly when distrust in the local economy collapses and people start fleeing.”

While gold is a precious metal, it is also a currency. In fact, it is a universal currency that is accepted in every country in the world today. There’s never been a better time to consider shifting some of your dollars into a more reliable currency like gold.

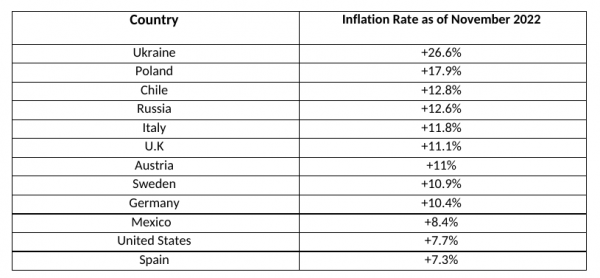

High inflation is not limited to emerging markets and developing nations – many developed nations are shouldering high levels of inflation in 2022. Take a look at the list below.

Source: TradingEconomics

Inflation Isn’t Going Away Soon

While the Federal Reserve embarked on a campaign to slow the economy and bring down inflation with sharply higher interest rates in 2022, once inflation is ingrained in an economy, or in this case the global economy, it doesn’t just disappear quickly.

Here’s what Time magazine said last month: “Economists and financial experts agree on one thing: Higher prices will likely last well into next year, if not longer. And that means Americans will continue to feel the pain of higher prices for the foreseeable future.”

How You Can Deal With Ongoing Inflation

As a consumer, it’s hard to avoid higher prices at the grocery store and restaurants – after all, we all need to eat. Many Americans are making choices however and choosing to cook at home more, eat out less and even cut back on expensive cuts of meats or eggs – which have suddenly rocketed higher in price.

Most Americans today aren’t used to shortages or sharply higher prices. We haven’t lived through an inflation crisis in 40 years. During this time, it’s important to maintain a cash reserves account – some experts recommend anywhere from 6 months to 2 years of living expenses, depending on your age and the reliability of your income. That sounds like a lot, but with a recession potentially around the corner in 2023, maintaining a healthy emergency fund could be your saving grace.

Use Gold as Your Emergency Fund

Holding your dollars in a bank account means they simply become worth less every day they sit there. Investors can consider holding their emergency fund in gold. If you need to tap your emergency fund for any reason, you can liquidate or sell your gold for dollars instantly – the same day.

Second, keep investing. In inflationary times, more than ever, it is important to keep investing – in order to prevent your purchasing power from eroding. Physical gold is up 9% since early November, with predictions it could climb as high as $3,000 in 2023.

Gold is one of the most liquid markets in the world, a reliable place to store, protect and grow your wealth. Inflation is here to stay for the foreseeable future and if you haven’t already, consider making an increased investment in gold today to protect and grow your financial future.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Five of The Most Valuable Coins in the World

Posted on — 8 CommentsCoin collecting is widely recognized as one of the most rewarding pursuits in the world. Once known as the “hobby of kings,” it is now called the “king of hobbies”. As this review of the five most valuable coins in the world will reveal, it is indeed rewarding both personally and financially.

Coin collecting has its roots in the European Renaissance among wealthy Europeans. By the late 1590s coin collecting had become extremely popular among the nobility and the first known coin auctions were held in 1598 in Holland. Historically, collectors purchased rare coins for their historical significance and beauty, but as these collections fetched significantly higher values, investors began turning to rare coins as a new type of asset class for capital appreciation, diversification, non-correlation to stocks, and as a hedge against inflation.

Here is a list of the five most valuable coins in the world.

1. 1794 Flowing Hair Silver Dollar: $10 Million

In 2013, a legendary PCGS SP66 Flowing Hair dollar sold for $10,016,875. Some experts believe this coin, considered to be one of the greatest American numismatic specimens ever, could be the very first silver dollar ever struck. This coin featured an earlier die state than any other known specimens and is the only one with proof-like fields.

The Act of April 2, 1792, authorized the silver dollar and also established the United States Mint to create our nation’s coinage. The authorization of the silver dollar was extremely significant historically as it was the standard unit on which the United States monetary system would be based. All other coins struck at the United States Mint represent either fractional parts of the dollar or multiples of that unit.

2. 1933 Saint-Gaudens Gold Double Eagle: $18.9 Million

In 1933, the U.S. Mint struck 445,500 Saint-Gaudens Gold Double Eagles with a face value of $20. After these coins were produced in 1933, President Roosevelt, took the United States off the gold standard in an effort to help the American economy out of the Great Depression.

All but 10 of these beautiful coins were lost to the melting pot. They never circulated. One of these stunning coins mysteriously landed in Egypt and into the collection of King Farouk, a voracious coin collector. When the renowned Farouk collection, totaling over 8,500 medals and coins, was sold in 1952, the 1933 Double Eagle went missing.

This extremely rare and infamous coin did not resurface until 1996 in the U.S. and was seized by the U.S. Secret Service. The coin was returned to the United States Mint as a result of the Department of Justice’s settlement of a forfeiture action and, in that landmark legal settlement, this one coin became the only 1933 Double Eagle that is legal to own in a private collection.

3. The 1787 Brasher Doubloon: $7.4 Million – placed by Blanchard & Co.

In 2011, Blanchard and Company made numismatic history by placing the famed Brasher Doubloon for a record $7.395 million with a Wall Street investment firm. The identity of the buyer was not disclosed. The coin, dated 1787, was graded AU50 by PCGS and has a green CAC sticker.

This historic rarity was minted by Ephraim Brasher, a goldsmith, and neighbor of George Washington. The 1787 Brasher Doubloon is the first American-made gold coin denominated in dollars. The U.S. Mint in Philadelphia didn’t begin producing coins until the 1790s, and in our nation’s earlier years, it was common to use foreign coins in everyday transactions. The beautiful coin contains 26.66 grams of gold — slightly less than an ounce.

At the time of the sale in December 2011, CAC founder and Blanchard partner John Albanese hailed the coin as one of the most iconic pieces in all of the numismatics and the holy grail of all collectible gold coins. And it still is. Only seven Brasher Doubloons in all survive, and the one placed by Blanchard is the sole specimen with the initials of its maker, EB for goldsmith Ephraim Brasher, punched across the breast of the eagle depicted on the coin. The other six specimens feature EB on the bird’s right wing.

Ahead of the sale, at Blanchard’s New Orleans headquarters, the doubloon sat sealed in a protective case on an office table surrounded by three armed guards. Elevators were shut off to the 19th floor of a downtown office building housing Blanchard’s offices, and doors inside the office were locked, CBS News reported at the time. The coin, which is smaller than a half dollar but heavier, was to be delivered by armored vehicle to the buyer over the weekend.

Blanchard & Co. remains proud of its part in the transaction: The Brasher doubloon indeed falls into the rarefied strata of coin collecting and remains one of the most valuable coins in the world today.

The Brasher Dubloon made history again in January 2021, when another specimen sold at auction for a mind-blowing $9.36M.

4. The 1343 Edward III Florin: $6.8 Million

This coin is 679 years old and is thought to be one of only three of the same coins to have survived the centuries thus far. Two specimens of this extreme rarity are housed in the British Museum in London, both of which were found in the River Tyne in 1857. The third coin was found by a prospector with a metal detector in 2006 and was sold at auction in the same year. It’s now estimated that the coin is valued at around $6.8 million.

The front of the coin reveals King Edward III on his throne with two leopards’ heads on either side, while the reverse shows the Royal Cross inside a quatrefoil. Because of its design, the coin is also known as the Double Leopard.

5. 1913 Liberty Head Nickel – Morton-Smith-Eliasberg: $4.56 Million

The renowned Morton-Smith-Eliasberg Liberty Head Nickel sold $4,560,000 dollars at auction in 2018. One of only five known specimens, this version is considered to be the finest known example. It was owned by Louis E. Eliasberg a legendary Baltimore banker and American coin collector. In 1950, Eliasberg completed his collection of every coin ever minted by the United States dating back to 1792. His sons eventually sold his famed collection for about $45 million.

Parting Thoughts

Wondering about the advice Blanchard gives to coin collectors and investors? Always acquire the highest quality coin that fits in your budget and you will never be disappointed.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Inflation Battle Isn’t Over Yet. Fed Hikes Rates Ahead of Holiday

Posted onThe Federal Reserve hiked interest rates for the seventh time in 2022 on Wednesday, increasing its benchmark rate to 4.25-4.50%, a 15-year high. The Fed’s rate increase of 0.5 percentage points was smaller than the last four rate increases. The gold market traded above the $1,800 level after the Fed news and the current environment for gold is positive.

- Over the past two months, gold has soared 10% higher, trading from a low at $1,638 in early November to above $1,811 this week, and the trend points to more gold gains ahead.

Despite the Fed’s aggressive rate hike campaign this year, consumer inflation remains sharply elevated at 7.1% in November. While that is down from the 9% pace in June, inflation remains well above the Fed’s stated 2% target rate.Fed’s Big Inflation MistakeInflation took hold in the spring of 2021 and accelerated quickly in the months that followed. At that time, the Fed incorrectly called inflation “transitory” and failed to act last year to stem the rising price trends.The red-hot inflation levels create financial challenges for Americans across all income spectrums and the Federal Reserve has yet to tame high prices. The Fed has driven interest rates higher for everything from home mortgages to car loans to credit cards, and many Americans say they’ve reduced their holiday spending plans this year due to the runaway higher prices.The Federal Reserve’s interest rate hikes also contributed to the plunge in stock market prices in 2022, with both stock and bond markets showing double digit declines year-to-date.Inflation Isn’t Even Close to Being OverWhile some categories like used cars and airline tickets fell in November, many consumer items saw continuing price increases. Grocery prices, dining out, recreation services (like tickets to sporting events) and prices for haircuts and other personal care services all increased. Wage inflation is also appearing amid the tight labor market which, in turn, creates conditions for a wage-price spiral, as higher wages fuel even more increases in consumer goods and services.Brace for More Fed Rate Hikes…and Recession in 2023The Federal Reserve’s projections on Wednesday reveal that most Fed policymakers expect to continue raising interest rates next year – pushing the benchmark rate as high as 5-5.25%, which is expected to push the economy into a recession.Protect and Grow Your Wealth with GoldWith the potential for a Fed-induced economic recession in 2023, the outlook is bright for gold. In the midst of the 2022 inflation crisis, precious metals are among the best performing asset classes of the year. Looking into 2023, Saxo Bank predicts gold will climb to $3,000 an ounce. Before gold climbs even more, consider using current market levels to protect and grow your wealth with an increased allocation to gold.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.