Fed cuts rates 1/2% pushing gold to new record, up 24% YTD

Posted onFederal Reserve Starts Easing Cycle with a Jumbo Sized Rate Cut

The record-shattering gold rally of 2024 saw another burst of investor buying on Wednesday, following the Federal Reserve’s first interest rate cut of this easing cycle. The Fed came in big Wednesday with an aggressive half percent cut in benchmark fed funds rate.

Investors immediately bought gold after the news, which drove the precious metal to another record high above $2,600 an ounce on Wednesday afternoon. Stocks initially gained on the news, but quickly gave back some of the strength and the U.S. dollar fell following the Fed announcement.

New Fed Easing Cycle is Bullish for Gold

Gold is up an attention grabbing 24% since the start of the year and the Fed’s new monetary easing cycle is fresh gas in the tank for the rising bull trend in precious metals.

The Fed policymaker voted to cut the benchmark interest rate by half a percent at today’s meeting to 4.5% to 5.00%. In the Fed’s policy statement, it said the move reveals “greater confidence that inflation is moving sustainably toward 2%” and that the central bank “judges that the risks to achieving its employment and inflation goals are roughly in balance.”

While inflation remains above the Fed’s 2% target rate, it has fallen from a peak of 9.1% in 2022. The most recent consumer price index (CPI) came in at 2.5% annualized in August.

The 50 basis point rate cut was more aggressive than some on Wall Street had expected. But, the jumbo-sized rate cut was warranted given the recent sign of slowdown in the labor market.

Also bullish for gold was news from the Fed’s so-called “dot plot” which features future interest rate cuts.

Deeper and faster interest rate cuts are now forecast, which will be jet fuel for the current rising price cycle in gold. Fourteen of the nineteen central bankers expect interest rate cuts of at least two full percentage points by the end of 2025.

Wall Street Eyes Next Big Gold Target at $3,000 an Ounce

The start of the Fed easing cycle will help gold continue higher. New forecasts from Citi Research reveal analysts there say gold could reach $3,000 an ounce by mid-2025 amid the interest rate cutting cycle and strong physical demand.

Are You Sitting on the Sidelines?

Today’s news is the start of a fresh move higher in gold. It’s the perfect time to consider your personal financial situation. Have you bought gold or increased your allocation in 2024?

How much is enough? Recent research from the well-respected CPM Group stated that over the past 50 years, the best return of a portfolio including stocks, bonds, and gold was for portfolios that have around 25% -30% of their value in gold. This new phase in the gold rally is just getting started, with $3,000 as the next major target. If you’ve been considering buying gold, this is the perfect time to make your move. Give us a call, we are here to help.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

8 Most Valuable Rare Presidential Dollar Coins

Posted onPresidential dollar coins were first released in 2007 as part of an initiative to honor former U.S. presidents. With their unique designs and special role in commemorating American history, they quickly became very popular with collectors. However, with the series rapidly growing over time, collectors frequently wonder: “Which presidential dollar coins are rare?”. This piece will answer that question, highlighting:

- The most valuable rare presidential dollar coins.

- Collectible presidential bills.

- Sourcing rare presidential gold coins online.

Watch this informative video to learn more about the rarest presidential coins:

Rare president dollar coins

Throughout American numismatic history, presidents were notably absent from dollar coins until the inception of the Presidential $1 Coin Program in 2007. While they adorned other denominations of circulating coinage, such as the Jefferson nickel, Lincoln cent, and Roosevelt dime, design preferences for the dollar favored depictions of Liberty and allegorical representations of freedom, with few exceptions found in older rare president dollar coins commemorative designs.

The Presidential $1 Coin Program marked a historic departure, representing the first concerted effort to systematically and chronologically honor the nation’s presidents on circulating dollar coins. Since its inception, presidential dollar coins have not only gained monetary value but also garnered widespread interest among collectors, igniting a surge in popularity for collecting by president.

1. 2007-S John Adams Proof: A special find among rare $1 US president coins.

One of the most common answers to the question “What is the rarest presidential dollar coin?” is the 2007-S John Adams proof dollar. Struck at the San Francisco Mint, this coin features an image of John Adams, the second President of the United States, on its obverse side. The reverse design showcases a striking image of the Statue of Liberty.

The reason why this coin is particularly highly coveted among collectors is two-fold:

- Firstly, as it was sold exclusively as part of a four-piece proof set, it stands out for its limited availability.

- Secondly, unlike circulation strike presidential dollars, which have their edge inscriptions applied by a Schuler Edge Lettering Machine, this proof coin’s edge inscriptions were struck by a segmented three-part collar die.

2007-S $1 John Adams (Proof)

- Metal: Copper

- Year: 2007

Photo by PCGS

2. 2007 Missing Edge John Adams: A presidential dollar coins rarity.

When it comes to numismatics, rare error coins can make all the difference in one’s collection. Presidential coins are no exception and a case-in-point is this particular piece.

In 2007, some of the John Adams $1 coins bypassed the edge-lettering process at the Philadelphia Mint. This resulted in the absence of the standard edge inscription found on presidential coins, which includes the year of minting, the mint mark, and the motto “E PLURIBUS UNUM”.

2007 $1 Missing Edge Lettering John Adams

- Metal: Copper

- Year: 2007

Photo by PCGS

3. 2007 Missing Edge Thomas Jefferson: one of the most valuable rare presidential dollar coins of all time.

Another fascinating anomaly as far as rare $1 US president coins are concerned, this 2007 coin is also distinguished by its blank edge. While the Jefferson missing edge coin is the third in the series of presidential coins with blank edges (following the George Washington and John Adams coins), it is believed to be the rarest. With exceedingly few specimens surfacing for sale since its initial release, the 2007 missing edge Jefferson dollar today holds a coveted status within the numismatic community.

2007 $1 Missing Edge Lettering Thomas Jefferson

- Metal: Copper

- Year: 2007

Photo by PCGS

4. 2009 James K. Polk: the rarest presidential dollar coin featuring a visionary expansionist.

A popular answer to the question “Which presidential dollar coins are rare?” is the 2009 $1 James K. Polk Position A coin. Featuring James K. Polk, the 11th president of the United States, on its obverse side, and an image of the Statue of Liberty on the reverse, this piece is a collector’s favorite for its Position A edge lettering. This means its edge lettering reads upside-down when the president’s portrait faces up, a unique design aspect that captivates numismatists.

2009 $1 James K. Polk Position A

- Metal: Copper

- Year: 2009

Photo by PCGS

5. Satin Finish 2010-D Abraham Lincoln: one of the rare $1 US president coins honoring the Great Emancipator.

Paying homage to the 16th president of the United States, this special coin debuted in 2010, as part of an 8-Piece presidential dollar mint set, and then later reappeared in a 28-piece uncirculated mint set of the same year. Created at the Denver Mint, this Abraham Lincoln dollar is prized by collectors seeking the presidents of the United States of America rarities for its relatively low mintage and satin finish, which gives it an elegant look.

2010-D $1 Abraham Lincoln Pos B Satin Finish

- Metal: Copper

- Year: 2010

Photo by PCGS

6. 1903 McKinley Commemorative: a noteworthy addition to a rare presidential gold coins collection.

As savvy numismatists will know, the answer to “Which presidential dollar coins are rare?” is layered, encompassing not only the presidential dollar series but also commemorative pieces featuring presidents.

One such notable commemorative piece is the 1903 McKinley gold dollar issued as a tribute to McKinley’s contributions to the nation during his presidency, including his leadership during the Spanish-American War and his efforts to promote economic prosperity and industrial growth. Its obverse features a portrait of McKinley, while the reverse depicts an eagle perched atop a shield, symbolizing strength and resilience.

With its historical significance and limited mintage, this coin is cherished by collectors looking for a tangible link to a pivotal era in US history.

1903 McKinley $1 Gold Commemorative NGC MS66

- Metal: Gold

- Year: 1903

- Check our most current price here.

7. 1903 Louisiana Purchase Jefferson: a sought-after gem among rare presidential gold dollar coins.

Commemorating one of the most significant events in the nation’s expansion, this coin was issued to mark the centennial anniversary of the historic acquisition of the Louisiana Territory from France in 1803. As this transaction was orchestrated by President Thomas Jefferson, his portrait graces the obverse of the coin. A tangible reminder of America’s territorial growth and Jefferson’s visionary leadership, this exquisite piece is one of the most highly valued rare president dollar coins.

1903 Louisiana Purchase Jefferson $1 PCGS MS65 CAC

- Metal: Gold

- Year: 1903

- Get our most current price here.

8. 1922 Grant Commemorative: a unique specimen of rare president dollar coins.

Rare presidential gold coins enthusiasts will undoubtedly treasure the addition of this gem to their collections. Created to honor the 100th anniversary of the birth of General Ulysses S. Grant, the 18th president of the United States, this 1922 commemorative gold coin is known for its striking design. Its reverse features a beautiful rendition of the historic log cabin in Point Pleasant, Ohio in which Grant was born. With a mintage of only 5,000 pieces, the coin today is sought after by discerning collectors for its scarcity.

1922 $1 Grant Gold Commemorative PCGS MS65

- Metal: Gold

- Year: 1922

- View our most current price here.

Browse through more rare presidential gold coins and other valuable collectibles.

Rare presidential bills

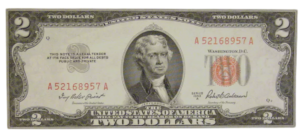

Popular game shows or trivia questions often include inquiries like “the likeness of which president is featured on the rare $2 bill of USA currency?” Naturally, this makes many people wonder if it would be worth collecting those too. After all, numismatics is a field that encompasses paper currency.

While coin collecting often focuses on metal compositions, mint marks, and coinage errors, paper money collecting delves into factors like serial numbers, printing errors, and historical significance. Understanding what makes bills rare is crucial before embarking on the quest to find them.

Even though American presidents have been featured on paper money since the early days of the United States, some dollars are more rare than others. One such case is the aforementioned $2 bill, featuring a portrait of Thomas Jefferson on the obverse and an engraving of John Trumbull’s painting Declaration of Independence on the reverse of the note.

Despite having circulated for over 150 years, today it is produced in smaller quantities compared to other denominations as it is generally thought of as awkward to use in everyday transactions. Collectors will find that $2 bills from 1862 to 1917 with red, brown and blue seals are especially valuable today.

Where to buy rare coins

Presidential dollar coins are a tribute to former U.S. presidents, immortalizing their leadership and impact on the nation. Originally intended for circulation, these coins are today exclusively minted for collectors, with some issues commanding higher values than others.

For those seeking to add rare presidential dollars or other coveted pieces to their collections, Blanchard stands as a trusted source, renowned for their exceptional curation and expertise in numismatics. With Blanchard’s dedicated team on hand to address any inquiries about rare presidential gold coins and more at all times, collectors can embark on or enrich their numismatic journey with confidence.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

The 1857 Flying Eagle Cent: Beloved by Collectors for Many Reasons

Posted onThe year 1857 in American history included many significant events. These included the tragic sinking of the S.S. Central America off the coast of North Carolina, the Panic of 1857 (exacerbated, in part, by the financial loss from the S.S. Central America) which saw New York banks close in October, not to reopen until mid-December of that year, and Congress banned the use of foreign coins as legal tender.

In the numismatic world the Flying Eagle cent was released for circulation in May of that year—and collectors today still eagerly search out this popular series.

The 1857 Flying Eagle Cent marked a major shift in copper cents from large cents to small cents. There were a few reasons why this change was made. First, the price of copper was rising, increasing the costs to produce large cents. The second reason was more pragmatic. Americans simply didn’t like them. They were ugly, heavy and cumbersome.

In 1856, as Congress deliberated on legislation that would allow the production of new coinage, Mint officials created the 1856 Flying Eagle cent pattern coin present. It was well received and Congress passed the Coinage Act of 1857, authorizing a new small cent made from a mixture of copper and nickel.

This Act also outlined a process for Americans to turn in their large cents in exchange for the new small cent. The public loved it and when the Mint began official distribution of the Flying Eagle Cent in May 1857, long lines formed as people waited to trade in their old coins for the shiny new smaller cent.

Dramatic Coin Design

Mint Chief Engraver James Barton Longacre designed this dramatic coin. The obverse features a left-facing eagle with its wings outstretched in flight. Around the top, UNITED STATES OF AMERICA encircles the top two-thirds of the coin, with the date at bottom. The image of the eagle was influenced by work from Longacre’s predecessor, Christian Gobrecht.

On the reverse, a detailed wreath comprised of leaves, corn seed heads, wheat, cotton and tobacco is wrapped in a ribbon. Centered on the reverse are the words ONE CENT. All coins were minted at Philadelphia and so there are no mint marks on the coins.

In High Demand

The Flying Eagle was only minted until 1858. Striking problems occurred with the high-relief design, which triggered a design shift. The Indian Head cent replaced the Flying Eagle in 1859, making the Flying Eagle a short-lived but beloved coin series. The exciting history, show stopping design and its place in numismatic history as the first small cent make Flying Eagle Cents a highly collected series. Collectors typically want to acquire the 1856 pattern and the 1857 and 1858 coins. When they emerge for sale, they typically don’t last long. We have just one of these beautiful coins. See the 1857 Flying Eagle Cent here.

Related Reading:

Jobs Data Misses the Mark: All Eyes on Sept Fed Meeting

Posted onWall Street is counting on the Federal Reserve to cut interest rates at its upcoming September 18 meeting. The question is how big will that rate cut be—25 or 50 basis points?

The latest U.S. jobs data came in weaker-than-expected by a smidge, showing further signs the labor market is cooling. But, it appears to be a coin toss on whether this will push the Fed to cut rates in a bigger way this month.

No matter the size, the start of a new interest rate cutting cycle is positive for gold.

Looking at the jobs data, hiring has slowed from earlier this year. In August, non-farm payrolls rose by 142,000, the Labor Department said last week. However, that missed the mark of the 160,000 new jobs that economists had expected. The sectors which generated the most new American jobs in August included the hospitability sector with 34,000 new jobs, health care at 31,000 new jobs and construction with 34,000 new jobs.

Meanwhile, the overall unemployment rate edged down to 4.2% in August from July’s 4.3% reading—which was a sigh of relief to economists.

The verdict? The jobs report was a mixed bag.

Job growth was weaker-than-expected, but the drop in the unemployment rate was a slight positive. Investors who have been banking on a 50 basis point interest rate cut didn’t see the fuel from that report needed to push the Fed to definitively cut rates by that large of an amount.

Gold dipped modestly lower following the jobs report, but investors quickly used the price dip to buy more gold. Declines were limited and short-lived. Gold is trading just shy of its all-time record high at above $2,500 an ounce.

So whether the Fed cuts interest rates by 25 or 50 basis points it may not matter that much because a new trend is beginning for gold. Lower interest rates reduces the opportunity cost of owning gold, which will help increase the already heightened demand for the precious metal we’ve seen this year. The Fed is on the cusp of starting an interest rate cutting cycle that could help propel gold toward $3,000 over the next year. If you see any dips in gold, don’t wait too long to use them to accumulate precious metal. Dips aren’t lasting long in today’s market environment and before you know it gold may be sitting with a $3 and not a $2 at the beginning of its value.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly

The Admiral Gardner Coin Treasure

Posted onThe Admiral Gardner was a significant vessel of the late 18th and early 19th centuries. Renowned not just for its role in the British East India Company’s trade, but also for its unfortunate end, the ship met a tragic demise in 1809 on Goodwin Sands. Admiral Gardner’s precious cargo of coins, salvaged years later, has been highly sought after by collectors ever since. This piece will uncover the full story of this iconic vessel, exploring topics such as Admiral Gardner shipwreck coin value and more, including:

- The significance of the 1808 Admiral Gardner shipwreck coin.

- What makes the 1809 Admiral Gardner shipwreck coin unique.

- Where to buy rare shipwreck coins online.

Watch this fascinating video about recovering the precious Admiral Gardner shipwreck coin cargo:

Admiral Gardner shipwreck story

Not to be confused with the Gardner island shipwreck, which took place in the Pacific Ocean and is often linked to the Amelia Earhart disappearance, the Admiral Gardner shipwreck occurred in 1809 on the treacherous Goodwin Sands. While it is true that the wreck is most famous for the 28,000 coins found on it, that is not even the most interesting fact about it. Here are some captivating facts about it, beyond the 1808 and 1809 Admiral Gardner shipwreck coin value:

- Ship name origin

The ship was named after Alan Gardner, the first Baron Gardner, who had a distinguished career in the Royal Navy before transitioning to political life as a Member of Parliament in 1796. Naming ships after prominent individuals to honor their contributions and legacy was a popular tradition at the time.

Alan Gardner was renowned for his leadership and strategic acumen as a naval officer. He participated in numerous naval engagements during the 18th century, including the American and the French Revolutionary Wars. The naming of Admiral Gardner after him honored his legacy as a respected naval commander and statesman of his era.

- Years of operation

The Admiral Gardner operated from 1797 to 1809. During its brief but impactful 12 years of operation, the ship played a crucial role in the transcontinental trade between Britain and the East Indies, carrying valuable cargoes and other goods essential to the economic interests of the British Empire during that period.

- Country of origin

The Admiral Gardner was built in 1796 in Blackwall, by the River Thames in Great Britain. It was specifically constructed and operated under the auspices of the British East India Company. Its home port of London, a bustling hub of commerce and naval activity, facilitated its voyages to and from the lucrative markets of the East Indies.

- Ship size

With a tonnage of 813 tons burthen, the Admiral Gardner was a substantial ship. It measured 44.4 meters in length overall, with a keel length of 36.1 meters. The ship had a beam of 11 meters, making it well-suited for transporting goods across long distances during its time in service.

- Ship function

Admiral Gardner was an East Indiaman. East Indiamen were large, sturdy sailing ships specifically designed for trade between Europe and the East Indies during the Age of Sail. These ships were operated primarily by European trading companies such as the British East India Company and the Dutch East India Company.

The Admiral Gardner’s primary role was to transport goods such as spices, silks, and porcelain, crucial for commerce between Europe and Asia during the late 18th and early 19th centuries.

- Shipwreck history

The English East India Company dispatched a fleet of ships to India and China annually. These ships carried valuable goods such as spices, textiles, and porcelain. One of them was the Admiral Gardner, which typically transported these essential trade items.

On January 24, 1809, Admiral Gardner set sail from London bound for Madras and Bengal as part of a convoy that included several ships. On that occasion, she was carrying a significant cargo of copper coins minted in England, intended for use in trade within the East Indies.

Unfortunately, the convoy of ships did not make it far before encountering a severe storm in the English Channel. Despite desperate efforts by the crew to save the vessel, she succumbed to the elements and was wrecked two days later, on January 26.

Buffeted by fierce winds, Admiral Gardner was driven onto the Goodwin Sands, a notorious stretch of submerged sandbanks off the coast of Kent, England. Alongside the Admiral Gardner, two other East Indiamen, the Britannia and the Carnatic, also suffered the same fate, getting wrecked onto the Goodwin Sands.

While historical records of the number of survivors vary, the Admiral Gardner captain and crew managed to reach safety, rescued by local lifeboats and vessels that braved the violent weather conditions to aid the stricken ship.

- Recovery

In 1984, a fisherman reported that his nets were repeatedly snagging on what was locally known as the wreck of the Admiral Gardner, leading to its discovery and subsequent recovery efforts. A team of divers located the remains of the vessel on the Goodwin Sands off the coast of Kent. They found the ship buried under layers of sand and silt, preserving much of its cargo and structure from the ravages of time. The ship’s cargo comprised primarily barrels of copper coins, along with cannon balls, anchors, iron bars, and copper ingots.

The primary focus of the recovery efforts was the vast quantity of copper coins minted by the British East India Company, which were intended for use in trade in the East Indies. The Admiral Gardner coin recovery operation was a meticulous process, involving careful excavation to avoid damaging the artifacts. The divers used advanced underwater archaeology techniques to map the wreck site and document the precise locations of the coins and other items. In the end, over 28,000 coins were recovered. All of them were remarkably well-preserved due to the protective sedimentary layers.

- Maritime preservation

The Admiral Gardner wreck site was designated as a Protected Wreck under the Protection of Wrecks Act 1973. This status recognizes its historical and archaeological significance, ensuring that any activities at the site are carefully managed and regulated.

In the late 180s, diving at the Admiral Gardner wreck site was suspended and no one is currently permitted to explore it. Located on the treacherous Goodwin Sands, the site posed significant risks to divers due to strong currents, shifting sands, and poor visibility. Moreover, there was growing recognition of the need to protect the wreck from unauthorized salvage operations and potential damage caused by unregulated diving activities.

Gardner rare coins to collect

In the mid 18th century, the Royal Mint struggled to meet the nation’s demand for bronze coins, which resulted in a shortage. Entrepreneurs saw a lucrative opportunity and, in response, began issuing privately minted tokens to fill the gap.

One such example was Matthew Boulton, who distinguished himself by producing high-quality tokens that gained widespread acceptance alongside official coinage. When issues emerged with the production of copper coinage in India, he was commissioned to make copper coins which would be later shipped out on Admiral Gardner.

While it is known that the Gardner coins never reached their intended destination, they were eventually recovered from the wreck site. They totaled 28,000 coins of two different types. This was unlike the SS Republic shipwreck coins, which included multiple types. Here is what we know about their historical significance and value.

1. 1808 Admiral Gardner coin

Minted under the direction of Matthew Boulton, this Admiral Gardner coin (1808) was intended for circulation in the East Indies. A stunning copper piece, it features a design of East India Company’s coat of arms on the obverse and the numeral “10” along the word “Cash” on the reverse. “10” indicates the coin’s denomination, while the term “cash” originates from the Tamil word “Kasu”, meaning “coin”.

In the early 19th century, due to the growing demands of trade and commerce within the British Empire, India was facing a significant currency shortage problem. For this reason, the Court of Directors instructed Great Britain to mint coins for them. More specifically, they authorized the production of a new series of copper coins, including denominations such as 20, 10, 5, and 1 cash, to replenish the circulating currency and stabilize economic transactions. Concurrently, the new Madras mint in India produced copper coins in 1807, ranging from 40 to 2.5 cash, aligning with local currency needs.

What makes the 1808 Admiral Gardner coin value especially high is its role in maritime history. Today, these coins serve as tangible relics of Britain’s colonial ambitions and economic pursuits in Asia. They are greatly sought after by collectors for offering insights into the intricate web of global commerce during the Age of Sail and their accessibility at reasonable prices, which makes them an ideal purchase for those interested in rare coin collecting on a budget.

However, it should be mentioned that collectors should exercise caution when purchasing this historic coin. With counterfeits of these coins increasingly prevalent in today’s market, it can be easy to buy an Admiral Gardner coin fake replica by mistake.

1808 Admiral Gardner Shipwreck 10 Cash coin NGC encapsulated

- Metal: Copper

- Year: 1808

Photo by PCGS

2. 1809 Admiral Gardner coin

Another remarkable relic of maritime history, the 20 Cash Admiral Gardner coin (1809) was also minted under Matthew Boulton with the intention of being circulated within the East Indies. Like its previous year predecessor, on the obverse, it features the distinguished East India Company’s coat of arms. The reverse displays the numeral “20”, indicating its denomination, alongside the inscription “Cash”.

Today, like 10 Cash coins, the 20 Cash Admiral Gardner coin is prized by collectors and historians alike for its historical context and numismatic value. It is particularly special because it showcases the craftsmanship of Boulton’s mint and the British Empire’s strategic use of currency in expanding its influence. These factors together enhance its 1809 Admiral Gardner coin value in numismatic circles.

20 Cash Admiral Gardner shipwreck coin (1809)

- Metal: Copper

- Year: 1809

To see more rarities, beyond Admiral Gardner shipwreck coins, click here.

Where to buy rare coins

The Admiral Gardner shipwreck and its recovered Admiral Gardner coins are poignant reminders of Britain’s maritime history and colonial ambitions in the East Indies. From their minting under Matthew Boulton to their recovery centuries later, these rare artifacts offer invaluable insights into global trade during the Age of Sail.

For those seeking exceptional coins like those from the Admiral Gardner, consider Blanchard. Contact Blanchard’s team for professional guidance on Admiral Gardner coin value and any other numismatic needs. They are dedicated to providing expertise and assistance whenever you require it.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly

The Intriguing Story of the 1801 $10 Draped Bust Gold Eagle

Posted onAs America hurtles toward a significant presidential election in just a few months, Thomas Jefferson’s inaugural address in 1801 carries an instructive theme.

Students of American history will remember that in 1801, Thomas Jefferson was sworn in as the third president of the United States.

His victory over incumbent president John Adams marked the first time the American presidency changed from one party to another—shifting from the Federalist party to the Republican party.

After a bitter and hard fought election season, Jefferson sought to unite the nation during his inaugural speech. He famously said: “We are all Republicans, we are all Federalists” and he called on Americans “unite in common efforts for the common good.”

In that year, one of the most beautiful and popular gold coins was minted in Philadelphia: The 1801 $10 Draped Bust Gold Eagle. Ten dollar gold eagles of this time are one of the most sought after early American gold coins. Collectors are attracted to the beauty of these significant gold coins from a historic era when our young nation was coming into its own.

The $10 Gold Eagle was the highest denomination coin authorized in the Mint Act of 1792. The $10 Gold Eagle represented a great deal of money at that time. Because of its high street value, the Gold Eagles of this era proved to have little demand in domestic circulation.

The Philadelphia Mint struck only 44,344 $10 Draped Bust Gold Eagles in 1801. Most of these gold eagles were shipped overseas and ultimately melted down for their bullion value. That led to a survival estimate today of only 750 known specimens in all grades. These coins are rare.

Robert Scot, Chief Engraver at the U.S. Mint, designed the memorable coin. The key themes of Scot’s work included ideals like unity, liberty, and rebellion, which were at the core of the American Revolution—and they are represented in this coin as well.

Today, the Draped Bust represents Scot’s biggest legacy in the numismatic world and his most famous and sought after design: the Draped Bust depiction of Liberty.

The reverse of the 1801 $10 Gold Eagle is known as the Heraldic Eagle type, and features Scot’s famous rendering of the Great Seal of the United States: the Eagle and the Shield. The Great Seal, of course, represents America’s strength, unity, and independence and remains a powerful symbol today.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly

Are You Ready for Changes to U.S. Tax Law?

Posted onIn a few short months Americans will go to the polls to elect our next president. Depending on who wins, your taxes might go up or they might go down. But no matter who wins—changes to U.S. tax laws are coming that will impact all Americans.

The Tax Cuts and Jobs Act of 2017 included many tax breaks that will automatically expire in 2025 unless Congress acts.

Both presidential candidates: Donald Trump and Kamala Harris are floating potential tax hikes and tax breaks aplenty. What shape these take and which proposals could actually become law are anyone’s guess at this point. There are many variables including who wins the White House and which party controls Congress.

After all, both the House of Representatives and the Senate must pass any future tax bills and then the President can either sign or veto it. If the President vetoes the tax bill, then Congress could try to override that with a 2/3 vote.

Make no mistake. Along the way, there will be plenty of negotiation, compromises and deal making around various aspects of any proposed tax laws.

You may remember, the 2017 tax law temporarily changed a number of key provisions in U.S. tax code including lower tax brackets, a higher standard deduction and an increase to a number of deductions.

Notably, the uber-wealthy are facing big changes to estate tax law that could significantly reduce the amount of wealth that families can transfer tax-free to the next generation.

For example, in 2024 the tax-free limit on gifts increased to $13.61 million per person. Once the 2017 tax cuts expire, that limit will fall by about half in 2026, without new legislation from Congress.

With the estate tax level on track to decrease by nearly half after 2025, that significantly reduces the wealth you can give to your heirs, as the government will take a much larger portion of your family’s money.

Given the tax changes that will occur, many high-net-worth individuals are taking action now to remove assets from their estate by making lifetime gifts.

No matter your net worth or income level, gold and silver are excellent vehicles for the private preservation of wealth.

Gold and silver bullion and rare coins have long been touted by trust attorneys as an efficient and discreet method of transferring wealth from one generation to another.

Looking ahead, Americans of all income levels will face higher tax rates and lose out on a number of deductions, meaning your bill to Uncle Sam will be higher than it has in recent years if the 2017 tax cuts are allowed to expire.

You can’t control what tax legislation Congress passes or doesn’t pass. You can control how you prepare and position your finances to limit the impact of taxes reverting back to 2017 levels.

One of the many advantages of investing in gold, silver and rare coins are the privacy these investments give to you. These are tangible assets outside of the banking system and aren’t tracked in a digital database, online brokerage account or bank savings account.

You simply own your gold and silver coins and can store them anywhere you choose: a home safe, a safe deposit box, you could add them to a self-directed IRA or choose an international vault like the International Depository Services (IDS) of Canada, a precious metals depository in Toronto. Assets there are stored in an international personal custody account, which is off depository balance sheets and beyond the reach of the U.S. government.

Changes in the tax laws are coming. If you act soon there’s still time for you to explore and implement proven strategies with tangible assets to protect, preserve and grow your wealth. Questions? We are here to help.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly

6 Rules for Coin Collecting

Posted onYou may agree that coin collecting is one of the most rewarding pursuits in the world. After all, it was once known as the “hobby of kings” due to its roots during the European Renaissance among wealthy Europeans. Historically, collectors purchased rare coins for their historical significance and beauty. But as these coin collections were sold for significantly higher values, investors began turning to rare coins as an asset class of their own, to gain capital appreciation, diversification, non-correlation to stocks and as a hedge against inflation.

As you look to acquire your next coin, it’s useful to keep in mind several rules around coin collecting. These ideas can enrich you both personally and through the value of your coin portfolio.

1. Education

Learn as much as you can about numismatics. Study the amazing history of coins, which brings to life past eras in our country and world. Learn about the current market dynamics. Read publications like Coin World and Numismatic News and follow our blog here at Blanchard. Talk to other collectors. Talk to one of our Portfolio Managers who will gladly answer any and all questions and take the time to get to know you personally, along with your interests and goals within numismatics. Don’t be afraid to ask questions—that’s how you learn!

2. Acquire the finest available

This one is simple. Here’s what we at Blanchard tell our clients: Always acquire the highest quality coin that fits your budget and you will never be disappointed.

3. Specialize

Serious investors don’t need a large variety of products to build a solid portfolio.

4. Know what you are buying

Take the time to learn about coin grading. The PCGS Grading Standard is a reliable method to understand the coins you are considering.

Here at Blanchard, we work with the best numismatists in the country to personally purchase and curate every coin that we sell. Any coin that we sell has been reviewed and graded in advance.

5. Buy coins for the long term

Coins are a long-term investment. Never assume a coin investment will make you rich overnight. The greatest collections of all time were built over decades, which leads us to our last rule.

6. Think like a collector: $400,000 to $45 million

You may have heard of Louis Eliasberg. He is a legend in the numismatic world. Starting in 1925, Eliasberg began purchasing U.S. coins and by 1950 his collection was considered to be one of the greatest coin collections in U.S. history.

He compiled his entire collection for less than $400,000. After his death in 1976, Eliasberg’s collection passed down to this two sons. Neither of them shared their father’s passion for numismatics and eventually they auctioned off the collection. It sold for an estimated $45 million.

This shows that one of the best ways to invest in rare coins is to collect rare coins. Eliasberg’s collection is proof that collections are sold as a whole for dramatically more than the total value of the individual coins.

How have you found coin investing to be rewarding? Share a comment below

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly

8 Rare John Adams Dollar Error Coins

Posted onCollectors who appreciate the rich history of the United States highly value presidential coins for their meticulous craftsmanship and stories they tell about the nation’s leaders. To add depth to their presidential coin collections, enthusiasts often go beyond the standard issues. They seek out interesting varieties and errors of coins featuring their favorite leaders. Among the most sought-after presidential coins are those featuring the two Adams presidents, John Adams and John Quincy Adams. This piece will discuss rare John Adams dollar coin value, highlighting:

- Riveting facts about the Adams presidents.

- Notable John Adams dollar coins errors.

- Where to buy rare John Adams dollars online.

Watch a presidential coin collector show off his rare pieces in this amazing video:

Two presidents that John Adams coins are devoted to

Born in 1735 in Massachusetts, John Adams was a lawyer and political philosopher who played a pivotal role in shaping the United States. After graduating from Harvard College in 1755, Adams began a successful legal career, which eventually led him to become a delegate to the Continental Congress. There, he advocated for independence and played a crucial role in drafting the Declaration of Independence.

In 1777, Adams left the Continental Congress to serve as a diplomat in Europe. During his time abroad, he honed skills that would prove to be instrumental in negotiating the Treaty of Paris, which ended the Revolutionary War and secured the United States’ independence from Great Britain.

Adams’ extensive experience in law, politics, and diplomacy prepared him for his role as the second president of the United States. In 1796, he was elected to succeed George Washington and served from 1797 to 1801. Adams’ tenure was marked by navigating political turbulence and external threats, such as the Quasi-War with France.

Committed to peace, Adams chose to pursue diplomatic negotiations rather than full-scale conflict, despite considerable pressure from his party and the public. While this affected his popularity at the time, today he is remembered for his integrity, strong principles, and dedication to the nation, as is evidenced by the fact he is commemorated on the 2nd president U.S.A John Adams coin.

John Adams’ legacy extended through his son, John Quincy Adams, who would follow in his father’s footsteps to become the sixth president of the United States. Like his father, Quincy Adams studied at Harvard College and established a distinguished diplomatic career in Europe before serving as Secretary of State.

During his presidency from 1825 to 1829, Quincy Adams focused on modernizing the American economy, promoting education, and improving infrastructure. He also maintained a strong stance against slavery and, later, as a member of the House of Representatives, successfully argued for the freedom of illegally captured Africans before the Supreme Court in the Amistad case. His dedication to public service and reform mirrored his father’s legacy, further shaping the young nation.

Both Adams presidents left lasting legacies of service, integrity, and dedication to the United States. Honoring them through the Presidential $1 Coin Program celebrates their significant contributions and ensures their impact on American history is remembered. The John Adams $1 coin was released in May 2007, followed by the John Quincy Adams coin in June 2008.

Noteworthy John Adams dollar coin errors

John Adams coins offer a tangible connection to a pivotal figure in American history. These pieces are must-haves for enthusiasts of presidential numismatics, who are seeking the maximum John Adams commemorative coin value to enrich their collections with both historical and monetary significance.

1. $1 John Adams presidential coin (Position A)

As the second coin released in the Presidential Dollar Series, this John Adams dollar holds a significant place in the collections of presidential coin enthusiasts. Designed by Joel Iskowitz and Don Everhart and minted in Philadelphia, it showcases a portrait of John Adams on the obverse and a striking rendition of the Statue of Liberty on the reverse.

Notably, being a Position A coin, its edge lettering appears upside-down when the President’s portrait faces up. With limited availability in high grades, this John Adams coin value appreciates significantly, underscoring its desirability among collectors.

2007-P $1 John Adams Position A

- Metal: Copper

- Year: 2007

Photo by PCGS

2. $1 John Adams presidential dollar (Position B – First Day of Issue)

This $1 John Adams Position B coin is highly coveted among John Adams dollar coins due to its Position B designation and status as a “First Day of Issue” coin. Unlike Position A coins where the edge lettering is upright when the President’s portrait faces up, Position B coins have the edge lettering inverted in relation to the portrait. Additionally, being a “First Day of Issue” coin means it was among the first batch of coins released to the public on the day of its issue, adding historical significance and rarity.

2007-P $1 John Adams Position B – First Day of Issue

- Metal: Copper

- Year: 2007

Photo by PCGS

3. $1 Doubled Edge Lettering John Adams 2nd president coin

The best answer to the question “Are John Adams coins worth anything?” lies in unique specimens like this notable error coin. This Doubled Edge Lettering John Adams dollar is prized by collectors for its unique characteristics. Unlike standard issues which have inscriptions on the edge only once, this particular piece features doubled or overlapped edge lettering, a semi-minor error that adds a fascinating dimension to it.

2007-P $1 Doubled Edge Lettering Overlap John Adams

- Metal: Copper

- Year: 2007

Photo by PCGS

4. $1 Missing Edge Lettering John Adams president coin

The $1 Missing Edge Lettering John Adams coin is a rare gem among presidential dollars. What sets it apart is its unique error: the absence of edge lettering, which typically features the coin’s date, mint mark, and motto. This error occurs during the minting process when a coin fails to pass through the edge lettering machine properly, resulting in a blank edge.

Remarkably, it is only the second coin found in the presidential series with this error, contributing to its significant rare John Adams 1797 to 1801 coin value. Compared to its predecessor, the Missing Edge Washington dollar, the Missing Edge Lettering John Adams coin is scarcer, making it a desirable choice for numismatists.

$1 Missing Edge Lettering John Adams

- Metal: Copper

- Year: 2007

Photo by PCGS

5. Weak Edge Lettering dollar coin with John Adams

With its multitude of distinctive attributes, this John Adams coin serves as a great answer to the question “Is the John Adams dollar coin rare?” A remarkable specimen, this coin is primarily coveted for its weak edge lettering error, characterized by faintly struck inscriptions along the coin’s edge. This distinctive feature, coupled with its Position B designation and status as a “First Day of Issue” release, contributes to its rarity and desirability among collectors.

$1 Weak Edge Lettering Adams – Position B – First Day of Issue

- Metal: Copper

- Year: 2007

Photo by PCGS

6. 2008 Missing Edge Lettering Quincy Adams dollar coin

Continuing the tradition of commemorating American presidents, the U.S. Mint honored John Quincy Adams with a dollar coin in 2008. While standard issues of Quincy Adams coins are appreciated by collectors, the real treasure lies in error coins like this Missing Edge Lettering John Quincy Adams error coin. Holding even greater value due to its omission of edge lettering, this unique piece stands as a testament to the enduring appeal of rare US error coins and numismatic anomalies.

$1 Missing Edge Lettering John Quincy Adams

- Metal: Copper

- Year: 2008

Photo by PCGS

7. 2008 Weak Edge Lettering Quincy Adams dollar coin

Another error coin that provides a compelling response to the question “How rare is a John Adams dollar coin?” is this Weak Edge Lettering $1 John Quincy Adams. Not only does its weak edge lettering error set it apart, but its Position B designation, denoting the portrait’s specific orientation on the coin, further enhances its uniqueness. These distinctive characteristics make it an outstanding addition to any numismatic collection.

$1 Weak Edge Lettering John Quincy Adams, Pos. B

- Metal: Copper

- Year: 2008

Photo by PCGS

8. John Adams silver dollar medal

Collectors of John Adams coins may expand their collections beyond the Presidential Dollar Series to include other notable pieces, such as this John Adams Silver Medal issued by the US Mint. While the Presidential Dollar Series honors Adams’ presidency, this silver medal was released to commemorate his broader contributions to American history. Crafted in 99.9% fine silver, this medal offers collectors a unique opportunity to own a piece of history while diversifying their numismatic collections with a high-quality item. While there may not be a gold John Adams coin available yet, acquiring this silver medal can still enrich a collector’s portfolio.

Coin name

- Metal: Silver

- Year: 2018

Photo by United States Mint

To browse through valuable silver coins beyond John Adams dollars, click here.

FAQ about the John Adams dollar coins

Here are the answers to some of the most commonly asked questions about John Adams dollars.

What coin is John Adams on?

The Adams presidents are featured on coins from the Presidential $1 Coin Program, which began in 2007.

When was the John Adams dollar coin made?

The John Adams dollar was minted in 2007, while the John Quincy Adams coin was released by the US Mint in 2008.

Where is the mint mark on a John Quincy Adams dollar coin?

The mint mark on Adams dollar coins, like other Presidential dollar coins, is located on the edge of the coin.

How much is a John Adams dollar coin worth?

The value of a John Adams dollar coin depends on various factors such as its condition, rarity, and collector demand. In circulated condition, it is typically worth its face value of $1. However, rare versions like the ones discussed in this article have a higher value.

Is John Adams on a dollar bill?

No, John Adams is not featured on any current U.S. dollar bill.

What dollar bill is John Adams on?

John Adams is not on any U.S. paper currency.

Treasured for their historical significance, presidential coins are beloved by numismatists worldwide. Notably, John Adams coins boast unique variations and errors, making them highly sought-after additions to any collection. To acquire these rarities, trust Blanchard‘s exceptional curation of numismatic treasures. Blanchard’s expert team is always on hand to address all inquiries regarding presidential dollar coins, John Adams coins and beyond.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Inflation Data Gives Green Light for Fed Rate Cut

Posted onThe Federal Reserve finally got what it was waiting for.

Inflation appears to be under control and trending lower. It’s been a long wait for not only the Fed, but for millions of Americans who have been battered by the double whammy of high inflation and high interest rates. That has put big ticket purchases like homes, cars and other items out of reach and on hold for many consumers.

In July, the Consumer Price Index slowed to 2.9%, from 3.0% a year ago, marking the first time the annual inflation rate dipped below 3.0% since March 2021.

Translation? The inflation report gives the Fed the green light to start cutting interest rates at its September meeting. While inflation still stands above the Fed’s target at 2%, many economists say the Fed has enough evidence that progress is being made toward its target rate.

Traders on Wall Street are locked and loaded, expecting a rate cut at the Fed’s next meeting on September 18. Indeed odds for a 25 basis point rate cut stand at 72.5%, according to CME Group Fed Watch. Meanwhile, odds for a 50 bp rate cut total 27.5%.

Given the current set-up, financial markets would be very disappointed if the Fed fails to pull the trigger and starts to lower its benchmark interest rate from a 23-year high.

What about gold?

Investors have been piling into gold since the start of the year amid safe-haven buying and also on expectations for Fed rate cuts. The precious metal is up nearly 19% year-to-date. Gold is trading just below its all-time record high set in July at $2,469.70—with major banks targeting additional gains in the months ahead toward targets at $2,500 and $2,600.

The start of the Fed rate cutting cycle is expected to support another up leg in the gold market, with prices historically climbing for nearly 21 months following the beginning of a rate-cutting cycle.

The Bottom Line.

Rate cuts are on the horizon. The uptrend in gold is strong, with higher prices seen ahead. That means today’s gold prices offer long-term precious metals investors an opportunity to lock in what could seem like bargain prices just a couple years from now.

Consider this. A mere two years ago in the fall of 2022—the price of gold traded $1,625 an ounce. Today it trades over $2,400 an ounce. Time goes fast. Investors who strike at opportune times like today will thank themselves in the future.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly