Gold Sinks on Rising Dollar, Strong Jobs Data

Posted onFriday was a rocky day for the gold market.

On Friday, nervous sellers knocked the price of gold sharply lower as the latest U.S. jobs data came in better-than-expected and also revealed upward pressure on wages.

Jobs, Jobs and More Jobs

The U.S. economy added 200,000 jobs in January, the Labor Department reported on Friday. That beat analyst’s forecasts of an 185,000 job gain last month. That signals the 88th month in a row that the U.S. economy had created new jobs.

Higher Wages Too

The key factor that spooked the stock market and boosted the U.S. dollar was a big jump in average hourly earnings of 9 cents to $26.74. That marks year-over-year wage growth at 2.9% and highest rate of growth since June 2009. Why is this important? It signals that finally – inflation may be starting to accelerate.

What about Gold?

Spot gold ended Friday at $1,331.15 per ounce, down from the previous London PM gold fix at $1,341.35. Stay up to date on current gold market action via live prices from Blanchard here.

But, wait, you might be asking – why did gold fall – if the economic data showed that wage inflation is rising? Good question!

In the zero-sum game of finance, often times when one asset climbs, another falls. Gold, which is priced in U.S. dollars, often moves in the opposite direction of the dollar. When the dollar goes up, gold typically falls. And, vice versa, when the dollar falls, gold usually gains.

That inverse relationship kicked into high gear on Friday and pressured gold lower, as the U.S. dollar gained.

Blame it on the Fed

The U.S. dollar strengthen on Friday, after the latest jobs report, as traders bet that the Federal Reserve may need to hike interest rates at an even faster pace in 2018, due to a pick-up in inflation. That’s bad for the stock market, but boosted the U.S. dollar, and in turn hurt gold.

There are some on Wall Street who say the “Fed is behind the curve” or that the central bank has kept interest rates too low, for too long. Now, if inflation begins to accelerate, the Fed may be forced to hike interest rates at a faster pace in 2018. Some analysts believe the Fed could hike as many as four times this year, as opposed to the three that is already expected.

What about my portfolio?

In the big picture, rising inflation is bullish for gold. If widespread inflation begins to emerge, investors will turn to gold in droves, pushing the price of precious metals higher.

Friday’s action was a temporary blip lower for gold. In fact, for long-term precious metals investors, it creates an even better buying opportunity.

Buy low, sell high. Don’t wait to buy gold when it’s climbed sharply higher. Make your acquisitions now, at what may well be the lowest price point in 2018. Act now. 2018 is just getting started and things and markets are already heating up.

4 Reasons It’s a Great Time to Buy Silver Coins

Posted on — 1 CommentIt’s a great time to buy silver bullion. Silver gained about 6% in 2017, while the more expensive gold climbed about 12% last year. If you’ve been considering investing in gold or silver bullion, here’s four reasons why you should scoop up some silver right now.

- Industrial Demand is Forecast to Grow for Silver in 2018

Silver benefits from both investment and industrial demand. Among metals, silver boasts one of the highest levels of electrical conductivity. Silver is used across a diverse range of industries from automotive to medical devices to solar panel applications. “We expect the growth to continue this year and set another record for silver demand, driven by large scale solar capacity additions and continued strong demand uptake from individual households, particularly in China,” the Silver Institute said. Growing demand pushes prices higher. That means current levels of silver around $17.44 an ounce offer an attractive entry point for investors.

- From Rings to Bracelets to Necklaces, Consumers Love Silver Jewelry

About one-fifth of total global silver demand emerges from the jewelry sector. Silver jewelry demand grew about 1% in 2017 as consumers favor the neutral color and as a reasonably priced alternative to gold. Jewelry demand is forecast to rise by 4% in 2018. Again, more demand equals higher prices.

- Global Silver Mine Supply Is Falling

While demand for silver is growing from the industrial and jewelry sectors, global mine supply is contracting. Global silver mine supply fell 1% in 2016, shrinking for the first time in 14 years. That trend continued in 2017, as global mine supply fell another 2%. What about 2018?

“Production disruptions out of South America, along with a decline in capital expenditure among the primary producers in the past five years, is expected to constrain output again this year,” the Silver Institute said. Shrinking supply, alongside rising demand is a recipe for higher silver prices ahead. Don’t delay your investment plans. Current prices of around $17.44 an ounce could be the lowest price investors will see all year for silver.

- The Gold/Silver Ratio Is Flashing A Silver Buy Signal

The gold/silver ratio is about 79 currently.

- How is that calculated and what does it mean?

You can easily calculate the gold/silver ratio yourself by dividing the current price of gold by the current price of silver.

The ratio shows the number of ounces of silver needed to buy one ounce of gold. Investors have long turned to this ratio to identify attractive long-term entry points for precious metals purchases. A high ratio is generally viewed as a signal that silver is undervalued relative to gold. That is what we are seeing now.

The latest 79 reading is historically high, which means silver prices right now offers investors long-term value. Historically, this is what we’ve seen:

Gold/silver ratio 65 > or greater means silver is a relative bargain

Gold/silver ratio 50 < or lower means gold is a relative bargain

Getting Started

Silver bars offer investors an easy way to accumulate physical silver. For example, a 10 ounce silver bar currently is quoted at $184.63 (prices fluctuate daily).

Silver offers investors many of the same portfolio diversification benefits of gold, at a much less expensive price. How much silver do you own?

The Morgan Dollar Lost and Found

Posted on — 2 Comments1873 was the year that gave rise to the Morgan Dollar. The immensely popular coin came out of the Bland-Allison Act of the same year. The act required the U.S. Treasury to purchase an amount of silver then introduce it into circulation in the form of silver dollars. The amount to be purchased was between $2 and $4 million, largely from western mines. There were several motivating factors for the act. First, mines were yielding enormous amounts of silver. The output was beyond industrial needs at the time. Second, Germany dumped 8,000 tons of silver into the open market after converting to the gold standard.

In time, minting Morgan dollars became representative of the free-silver movement. This economic policy advocated the unlimited coinage of silver into money. Many of those supporting the free-silver movement subscribed to the concept of bimetallism. Under this system, the value of a monetary unit is based up its equivalent in gold or silver.

The Bland-Allison Act, however, was deeply unpopular with then-president Rutherford B. Hayes who had a personal financial stake in the banking industry. Though he vetoed the bill, Congress overturned the decision, and the act became official. Hayes, however, was able to limit the scope of the act by choosing to purchase minimal amounts of silver. It was a period in U.S. history when bimetallism appeared to be on the rise. However, problems occurred amid fluctuating amounts of mined silver. That is, as miners sourced increasingly large deposits, more silver entered the market eventually decreasing silver prices.

The Morgan dollar is truly unique. In fact, some argued it was too unique. The American eagle on the reverse side of the coin showed eight tail feathers. This caused a stir because all previous U.S. coins had an eagle with an uneven number of feathers. Surprisingly, the public pressure was enough to motivate a redesign. The mint would change the feathers from eight to seven. The change occurred fast because only one city – Philadelphia – minted Morgan coins. Officials collected all of the dies and restruck them with seven feather dies. As a result, some of the first new “corrected” coins had seven feathers on top of eight before the mint created entirely new, eight feather dies. Meanwhile, several of the 1878 eight feather Morgan dollars remained in circulation.

Meanwhile, the U.S. Treasury continued to purchase 140 tons of silver each month to mint coins. They made payments to the silver miners in gold. The U.S. Treasury amassed a towering stockpile of silver and, at the same time, gold stores were depleted. Before long the Treasury faced the possibility of default which ignited panic across the country. The resolution to all of this was the Sherman Act of 1893 which halted the Treasury’s gold purchases for silver production. Mints ceased production of the Morgan Dollar.

Then in 1921, they brought it back. The production lasted less than a year. Then they were done for good. The Morgan dollar was ready to fade into history.

Until 1960 when a surprising find was made.

The government executed a plan to account for all silver dollars in storage. In a dusty backroom of the main Treasury building in Washington was a forgotten hoard of uncirculated Morgan dollars totaling $2.8 million. Given the long-held demand for Morgan dollars, the government packaged the coins and sold them.

It’s reported that during the final sale in 1980 more than 200,000 orders of the 400,000 received were turned away. The demand far outpaced the find. Today the Morgan dollar is the most collected and coveted silver dollar in existence.

Build Your Coin Portfolio…On a Budget

Posted onLet’s face it. As much as we might like to, we all can’t spend $50,000 on a historic, high-grade coin.

For astute investors, the rare coin market continues to outperform the price of bullion. Looking back in 2017 that means a $20 Saint-Gaudens gold coin outperformed the gains seen in a one ounce Gold Eagle coin.

If you are looking to diversify your portfolio, which may include stocks in your 401k to some recent dabbling in cryptocurrencies, buying hard assets including gold and silver bullion, investment grade coins and circulated coins is a smart investment opportunity.

Getting Started

The good news is that there is a price point for all coin investors. For those who want to build or add to their collection on a budget, a Silver Morgan Dollar is an excellent choice. These coins are an inexpensive way to increase your silver holdings in a thoughtful and savvy manner.

- Circulated Silver

The Morgan Dollar is a U.S. coin that was minted between 1878 and 1904, and then again in a limited production in 1921. Many collectors consider The Morgan Silver Dollar to be the premier coin design created by George T. Morgan.

The Coin Description

On the obverse: Lady Liberty’s head dominates the striking face of the coin and is surrounded by the date, 13 stars and the phrase E Pluribus Unum, which is Latin for “Out of Many, One.”

On the reverse: the American bald eagle sits on a branch with his wings spread out dramatically, while gripping arrows in one of its talons. The work of art is surrounded by a 3/4 wreath and the motto “In God We Trust” is emblazoned above the eagle’s head. If there is a mint mark, it sits below the wreath.

See a photo here:

1921 Circulated American Silver Morgan Dollar $22.00*

*subject to market price changes, which occurs throughout the day

The Dramatic Meltdown of Morgans

During the initial production phase between 1878 and 1904 there were over 500 million Morgan Dollars minted. They aren’t rare. But, roughly 75% of those 500 million were melted down over the years, which has reduced the supply dramatically.

Over 270 million silver dollars were melted down in the U.S. in 1918, in efforts to help finance World War I, the majority of those were Morgans. It was the Pittman Act that called for their replacement, which opened the door to the last production cycle of Morgans ever minted in 1921.

Major melting occurred not only in 1918, but again in 1942 after the Wartime Silver Act and then again during the gold and silver price spike of 1979-1980 which saw silver skyrocket to about $50 an ounce.

Are you interested in buying these historic gems? Blanchard has created a new offering that allows you to easily increase your silver holdings, no matter your budget. Blanchard has a special right now: investors can purchase 10 Morgan dollars in a coin group set for $220 and free shipping. Learn more here.

Call Blanchard Today

Gold and silver prices are on the move. Call Blanchard today to find out more about why now is a great time to add to your coin portfolio. Our portfolio managers can easily identify the best investment opportunity for every budget.

What Will Control Gold Prices Tomorrow?

Posted onShutdown Fears

Analysts often look to gold as a broad gauge of anxiety and in these times anxiety runs high. Case in point: a U.S. government shutdown has been a repeated concern for many Americans. Gold is reacting accordingly.

Gold futures have been on the rise as indecision on capitol hill lingers. One senior market strategist at RJO Futures remarked that “Gold is shaking off an upside bounce to the dollar and looking at the possibility of a government shutdown.” That is, the dollar has fallen recently against a basket of currencies amid the same shutdown fears. That drop makes gold (priced in dollars) particularly attractive to buyers. There is often an inverse relationship between the value of the dollar and the price of gold. Even as politicians work through a deal to keep the government operating, many lack confidence in the long-term prognosis. In this first year of a new presidency staff turnover is at an all-time record high.

Global Synchronicity

U.S. and European economies are in growth mode. Meanwhile, other major world economies are also on the the upswing. For example, China is witnessing the continued growth of the middle class. This primes their economy for expansion. Why does this impact gold investors? China is the world’s largest gold market. Many of these middle class consumers are setting their sights on luxury goods, namely jewelry. Meanwhile, expectations for India are also on the rise. As the world’s second largest gold market, a revitalized economy will be important for gold’s long-term potential. Analysts at The World Gold Council project that “policies such as the demonetisation initiative and the new Goods and Service Tax (GST) will start to have a positive effect on the economy.” Rising demand for gold, however, is about more than jewelry. Citizens graduating to the middle class want access to technology (e.g. tablets, smartphones, computers, etc.) all of which use gold components including bonding wire and connector plates.

Russian Roulette

Today, tax regulations in Russia are particularly unfavorable to gold investment. The country presents a strong disincentive for institutional or individual gold purchases in the form of an 18% value added tax. However, pending amendments may change this burdensome rule. A proposal on the table may remove this tax. The result would unlock enormous purchasing potential in Russia thereby bolstering the price of gold. Additionally, in the last quarter of 2017 Reuters reported that Russia’s central bank “may start buying gold for its official reserves on the Moscow Exchange.” This would be another significant driver of future gold prices as the country’s central bank is among the largest stores of bullion. Meanwhile, the precious metals market on the Moscow exchange is relatively new having launched only five years ago. This all adds up to a picture of high potential in the country.

As the world continues to become more interconnected the complexity behind gold’s rise grows. More players and influencers are entering the market every year. Savvy investors, however, can put the pieces together and discern the long-term upside potential that can offer significant growth. In fact, in U.S. dollars the price of gold ascended 13.5% earning its largest gain since 2010.

Is The World Running Out of Gold?

Posted onIs The World Running Out of Gold?

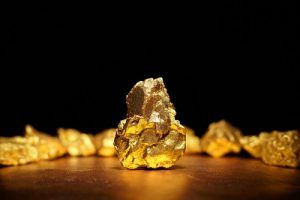

Gold. It’s getting harder and harder to find. The world’s richest gold deposits are being depleted. New discoveries are rare – few and far between.

Some industry analysts suspect we are getting close to “peak gold,” which refers to the time when the world will hit its maximum rate of gold production and then start to move lower.

Three years ago – in 2015 – a Goldman Sachs report warned that there are only two decades of “mineable” gold left. “The combination of very low concentrations of metals in the Earth’s crust, and very few high-quality deposits, means some things are truly scarce,” said Eugene King, a mining analyst at Goldman Sachs.

How much gold has been mined?

In recent years, yearly gold production has averaged between 2700 and 3200 tonnes.

“The best estimates currently available suggest that around 187,200 tonnes of gold has been mined throughout history, of which around two-thirds has been mined since 1950,” according to the World Gold Council. “And since gold is virtually indestructible, this means that almost all of this metal is still around in one form or another.”

How big is that?

If every single ounce of this gold were placed next to each other, the resulting cube of pure gold would only measure around 21 meters on each side.

Where does gold come from?

China was the biggest gold producer in 2016, mining about 14% of the total annual supply. Check out the The World Gold Council’s handy interactive gold mining map to see how much different countries produce.

The Case for Owning Gold

There are lots of reasons to own gold. It’s a safe-haven assets, a hard currency and a portfolio diversifier. Governments around the globe recognize the value in gold. The concept of “peak gold” only adds to the allure.

One of the biggest detractors of paper or so-called “fiat” money is that governments can devalue it at any time by flipping on the printing presses. The United States and other advanced economies did exactly that in the years after the 2008 global financial crisis. They called it “quantitative easing,” but that’s just a fancy term for adding more dollars into circulation. That can’t ever happen with gold. There is only so much gold that can ever be mined from the earth.

Gold has been used as a measure of wealth for 4000 years, in part because of its rarity. If we do reach peak gold in the years ahead that would be broadly supportive to future price gains.

How to Get Started

Investing in physical gold is very easy, and any investor can do it and should do it. There are different weights of gold available, so investors can buy coins that are as little as 1/10 of an ounce up to the more standard one ounce coins, in addition to larger bars for investors making a more sizeable investment.

Partner with the Best Tangible Assets Firm in the Country

Blanchard continues to lead the industry we helped launch in the 1970s. We develop innovative ways to help investors enhance and protect wealth through the strategic acquisition of tangible assets. Through our consultative approach to service, we aim to develop long term relationships that help investors achieve sustained financial success. A dedicated advisor is assigned to each client to advocate in his or her best interest. Call us today at 1-800-880-4653 to get acquainted.

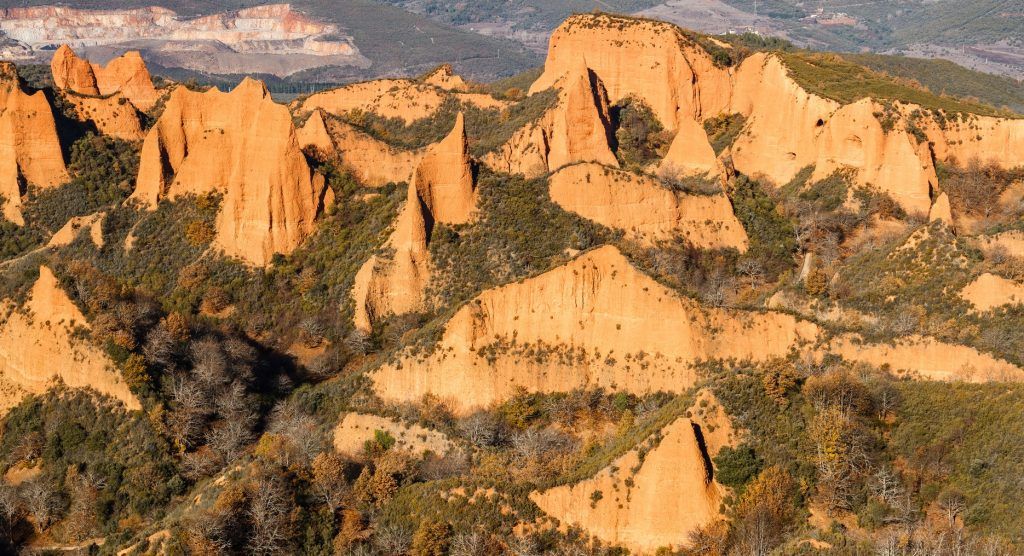

Earth’s Riches May Stay Locked Away Forever

Posted on — 1 CommentAs the old saying goes, “water, water, everywhere, but not a drop to drink.” This sentiment perfectly summarizes the question of scarcity in gold mining. Many have asked, “how much gold is there left to be mined.” The short answer: much more than you think. The long answer, however, is more complicated. Let’s look at why the Earth’s untold riches may stay locked away forever.

If melted into a single cube, all the mined gold would fit into an Olympic-sized swimming pool. Business Insider cites Goldman Sachs analyst Eugene King as calculating that there are “20 years of known mineable reserves of gold.” It stands to reason, however, that each successive year of theses 20 will present increasing difficulty to those seeking to extract the reserves. It’s likely that much more than 20 years worth of gold exists on Earth. However, much is impossible to ever capture. Millions of tiny gold particles are in the ocean and sitting on the floor of the sea.

Today, it’s unclear how much longer production can continue. While technology continues to offer solutions of growing sophistication, the cost of implementation can quickly offset the value of the find. Simply put: diminishing gold production is about more than scarcity.

Here’s why: the time between deposit discovery and production is growing. The average time needed to yield gold from a source is now 20 years. By comparison, this figure in the year 2000 was approximately ten years. With a longer time to production comes greater costs which diminish the prospects of many finds. In recent years new mines have yielded less. New mines are making less of a contribution to total, global production.

In fact, as recently as 2014 Chuck Jeannes, chief executive of Goldcorp, remarked, “whether it is this year or next year, I don’t think we will ever see the gold production reach these levels again,” as reported by The Wall Street Journal. “There are just not that many new mines being found and developed,” he concluded. Statements like this have prompted some to claim that we’ve hit “peak gold,” a new phase where all remaining gold production will require significantly greater labor than previously.

If true, this prediction bodes well for gold investors. A look at history suggests those claiming that we’ve hit peak gold might be right. Consider that in 1995 we sourced 22 gold deposits each containing at least two million ounces of gold. In 2010, only six discoveries occurred, and in 2011 there was just one. The trend is clear.

This diminishing story has altered the strategies of key players in the industry. That is, some miners are focusing their efforts and finances on acquiring other firms that already have ownership of newer mines. It’s become easier to buy a deposit rather than source it yourself.

In the meantime, many geologists are divided on the issue. Some believe we have, in fact, reached peak gold. Others claim it’s too difficult to adequately predict the remaining deposits and their accessibility. However, one fact is clear; we’re finding less gold each year.

This truth may be the reason countries like China have aggressively built up their reserves in recent years. As a global currency with diminishing availability, many are poised to win big in the long-term.

4 Reasons Gold Prices Will Keep Rising In 2018

Posted onGold just turned out its best annual return – a whopping 12% gain – since 2010. Can gold do it again in 2018? You bet.

Here’s 4 reasons that gold can continue to rally in the coming year.

- Stock Market Is Overvalued and the Bull Cycle is Old

When stocks are going up, it’s easy to forget that the market does go down. There’s bull market cycles (when stocks are rising) and bear market cycles (when stocks are falling). The current bull market phase began in March 2009 and will soon hit its 9th birthday. For bull markets – that’s old.

In 2018 it would not be a surprise to see a

- Pullback in Stocks (5% dip from recent high),

- or a Correction (a 10% sell-off from the high)

- or a Bear Market (declines of 20% or more).

Gold is an excellent portfolio diversifier and has virtually no correlation to the stock market. In fact, historically, down cycles in the stock market have seen significant gains in gold prices.

- The U.S. Deficit Is Getting Worse (Not Better)

While the deficit is not something you probably think about, well maybe not even ever – it is an issue for financial markets. There’s that old saying – and at some point the Piper will demand payment. The U.S. National Debt recently topped an eye-popping $20.6 trillion and rising. Former Federal Reserve Chair Janet Yellen recently warned that the $20 trillion national debt “should keep people awake at night.”

The recent Tax Bill passed by Congress slashed taxes by $1.5 trillion on corporations and individual Americans. Going forward, that is likely to make the deficit worse, not better.

“Solving the nation’s fiscal challenges was difficult before the tax bill was enacted, and it has only gotten even more challenging. Returning to historic averages of revenue will not be sufficient, given that historic levels of revenue have led to our current fiscal problems and will be insufficient to cover the costs of an aging population,” says the non-partisan Committee for a Responsible Federal Budget.

The U.S. dollar is falling in value and the nation’s debt load is rising. Gold becomes even more valuable as that scenario continues to unfold.

Gold is a currency without a nation – and that means there are no “debts” attached to the physical metal (unlike the $20.6 trillion debt attached to paper money).

- The Rise Of Bitcoin

One of the biggest investment stories of 2017 was the massive price increase in cryptocurrency bitcoin. There are similarities between bitcoin and gold. A key factor that has attracted interest in bitcoin is that it is a form of money outside the control of any authority or government in the world. Gold, of course, is too. “Bitcoin is paving the way for the reintroduction of gold as global money,” said fund manager, Ned Naylor-Leyland in a recent Bloomberg interview. Read more on why the pros and cons of investing in bitcoin here (Investing in Bitcoin, part 1 and Investing in Bitcoin, part 2). The appetite for bitcoin as an investment is also fueling fresh demand for physical gold.

- The Return of Inflation

Inflation, what’s that? According to official economic data, inflation has been low, extremely low for years now. Barron’s just published a new piece on inflation and warned: “We expect to see inflation go up in 2018 across developed markets relative to where it is today with the United States leading the way.”

Barron’s pointed to repricing of cell phone plans, higher car prices, the recent Congressional tax cut package, and a weaker U.S. dollar as factors that are pushing the overall level of prices higher.

Gold is a traditional inflation hedge and once higher official government readings of inflation emerge, investors will stampede into precious metals in order to hedge their assets.

Protect Your Assets with Physical Gold

Rare coins are an even better hedge against inflation than gold. If you want to lock in an insurance policy for your assets now, diversifying into rare coins offers the potential for out-sized gains. Download an exclusive report from researchers at Penn State University to learn more. The results suggest that over the longer run including rare U.S. coins within an existing portfolio could improve investment performance. Don’t delay, economists warn the cycle is at a tipping point and once the inflation numbers come out higher, gold prices will surge – probably significantly.

The Three People Who Influence Gold Prices

Posted onLike all investments, the price of gold is dictated by the markets. However, there are a few key influencers who wield significant influence over the price of gold. Their actions, in aggregate, do not directly alter the price per ounce. Rather, their broad directives serve to rally or squelch interest in the commodity thereby increasing or decreasing the price appreciation over the long-run. Here, we look at three people who may exert their influence over gold throughout 2018.

Jerome Powell

Set to take over in his new role as the Chairman of the Federal Reserve next month, Powell will be the key player in the interest rate changes expected in 2018. Today, it’s still unclear to what extent he’ll raise rates. Some have predicted a dovish approach characterized by just one increase this year. Others expect at least two or three. These rate changes will undoubtedly serve as a key driver of gold prices. In many periods, though not all, there has been a negative correlation between interest rate changes and the price of gold. A more aggressive rate increase policy from Powell may put downward pressure on prices. For the moment, Powell appears ready to make at least his first increase soon. “I think the case for raising interest rates at our next meeting is coming together,” he remarked in late November of 2017.

Kim Jong Un

Verbal tirades between the North Korean leader and President Trump show no signs of slowing and have, in recent months, escalated at a frightening pace. “I would attribute some of the rise in the price of gold to the feeling of uncertainty surrounding that [North Korean-U.S.] dialogue,” explained the Director of Financial Services Policy at the American Action Forum as reported by The Washington Post. Other experts have noted at least a mild correlation between the recent spate of missile launches and the rising price of gold. In fact, CNBC reported that gold jumped more than one percent in one day in November of 2017 reacting to heightened geopolitical fears. The risk of a nuclear threat emanating from an unstable government has reinvigorated interest in the “safe haven” appeal of gold. As Kim Jong Un’s intentions come into focus this year we’ll know more about how renewed interest in gold will unfold.

Xi Jinping

Chinese President Xi Jinping is putting the full weight of his country’s resources behind what he calls “The Belt and Road Initiative.” Essentially, the development plan is designed to boost trade and economic growth across Asia. The largest projects within the plan will be infrastructure related with some estimates that Jinping will “pump $150bn into such projects each year,” according to the Guardian. How does this tie to gold? Miners are expected to use this investing to ramp up exploration and production. The CEO of China National Gold Group Corp, explained last year that he would “intensify exploration and capital allocation in Belt and Road countries.” This move has serious implications given that China is the leading gold producer in the world yielding 455 metric tonnes in 2016 alone.

Gold investors should keep a close eye on these three key players. Their actions, in total, can make significant impacts on gold pricing.

Three Ingredients for a Gold Rally in 2018

Posted onThere’s no denying it, equities had a stellar year, Bitcoin even more so. However, as 2018 draws near major investment firms are making their predictions about the next twelve months and some see a climate forming that could be good for gold investors. Here, we take a look at three trends that may boot the commodity offering some a golden opportunity.

Weak Dollar, Strong Gold

The recent performance of the dollar is in stark contrast to the boom times of the equities market. The dollar has seen its largest annual loss in value since 2003. For 2017 the ICE U.S. Dollar Index which measure the value of the dollar against six other currencies fell 9.8%. Why does this matter to gold investors? Historically, there is an inverse relationship between the U.S. dollar and gold. This relationship stems from the fact that while the U.S. holds more gold than any other country, we do so by importing the metal. These imports, priced in USD, will become more expensive as the dollar falls. Moreover, those who own U.S., debt, namely foreign countries, become less confident in our financial standing when our currency falters. As a result, gold, a safe haven asset, rises.

Geopolitical Concerns Rise and Gold Follows

While other global economies are experiencing the euphoria seen in U.S. markets there are reasons, some argue, to exercise caution. One recent example comes from Germany where Chancellor Angela Merkel’s latest attempts to form a government failed. Meanwhile, threatening overtones from North Korea continue to escalate sendinging trepidations throughout the U.S. and countries that neighbor Kim Jong-un’s regime. In recent months we’ve seen examples of the correlation between rising fears of a nuclear engagement with North Korea and the price of gold. In early October gold prices climbed when President Trump increased his resolve to retaliate against Kim Jong-un. Meanwhile angst in Spain is on the rise as a possible Catalonia succession looms and Iran has refused to revise their nuclear deal with six world powers.

History Repeats Itself

It seems that even commodities like gold want to start a new year on the right foot. Case in point: In both December of 2015 and 2016 gold bottomed out in value. This drop was followed by a rally in January of 2015 and 2016 respectively. “Given the fact that gold’s previous lows were formed in the past two Decembers, the yellow metal could score a hat-trick if it maintains its rally in early 2018,” remarked one analyst at Forex.com. Other analysts at Casey Research compiled nearly 40 years of research dating from 1975 to 2013 showing that gold’s second strongest period based on monthly average gain is in fact January notching a little more than a return of 1.5% (September is the strongest).

With these three factors in mind gold investors might just be setting themselves up for success in a market that promises to serve more surprises throughout 2018. Over the long-term, gold offers balance to a diversified portfolio by giving investors an opportunity to profit from key market conditions like those ahead of us.