Four Gold Hordes We’re Still Trying to Find

Posted onFew things fire up the imagination like lost treasure, buried away just waiting to be found. We take a look at four gold hordes that people continue to look for to this day.

The 1715 Spanish Treasure Fleet

A fleet of twelve Spanish ships was en route to Spain from the New World when a catastrophic hurricane hit. Only one ship survived. The other eleven sank off the eastern coast of Florida. Each carried immense wealth. However, one, in particular, carried the motherload. The San Miguel is considered by many to be one of the most valuable treasure galleons ever lost. To this day, treasures from this ship and others from the fleet wash up on Florida beaches. In September of 2013, one lucky family found $300,000 worth of gold less than 200 yards offshore. The total value of the San Miguel and other ships is well into the hundreds of millions and people continue to search the seas for the fortune.

Fenn’s Folly

Nothing changes one’s perspective like a terminal diagnosis. In 1988, art dealer Forrest Fenn learned that he had cancer. Doctors told him he had less than two years to live. This ticking clock inspired him to bury $1 million of his wealth. He encouraged treasure hunters to find the horde and even provided cryptic clues. He wrote a poem with confusing lines like, “Begin it where warm waters halt And take it in the canyon down, Not far, but too far to walk.” Though the idea came to him after his diagnosis, he buried the treasure twenty years later after beating the illness. No one has found the stash though Fenn claims some seekers have come as close as 200 feet to the site. Fortune hunters be warned: two people have died searching for Fenn’s legacy.

Victorio Peak

Some gold hunters believe the Southern Rocky Mountains of New Mexico are hiding millions in god buried within a collapsed mine shaft. The story begins with Milton Ernest “Doc” Noss. He was on a deer hunting trip when he made the find. Liberating the treasure proved difficult. There was only one way out of the mine, and the opening was too narrow to effectively remove the gold. Foolishly, the “Doc” decided to use dynamite to blast a larger opening. This attempt, unsurprisingly, collapsed the entrance sealing the riches away. Doc Noss lived only a few years more; an associate shot him amid a dispute. Thought the Noss family continued to press for access the US government stepped in taking control of the area for use as a nuclear testing site. Officials claim they never found Noss’s alleged gold. To this day we don’t know who is telling the truth.

Schultz’s Shuffle

The life of a crime boss is hard. Dutch Shultz was a New York Mobster living large in the 1920s and 1930s. He made a fortune bootlegging and conducting organized crime. It wasn’t long, however, before the tax man came knocking. Eventually, he was indicted by a Grand Jury. He arranged for a professional to build a special watertight safe in which he stashed $7 million to keep away from other mobsters and the Federal Government. He hid it in the Catskill Mountains with the intention to retrieve it later in life. Schultz was eventually shot and killed. Many believe his fortune remains buried. Find it, and it’s yours.

Gold During the Changing of the Guards

Posted onWith a relatively new president in office many have cited the uncertainty of our times with regard to investing. However, this notion that a US president can single-highhandedly control the economic landscape of the country is misguided. In truth, policy changes from Federal Reserve hold much more sway over the state of our markets. Now is an especially good time to revisit this fact as Janet Yellen, the current Chair of the Federal Reserve prepares to step down. Jerome Powell will soon be taking over prompting many to question how this new leadership will influence our economy.

Many consider Powell to be a continuation of Yellen’s policies. “A Powell Fed might look a lot like it has since Mr. Greenspan retired in 2006,” remarked The Wall Street Journal. Though many are comfortable with Powell as a successor this changing of the guards has become a reminder of how administration changes can wield influence. A clearer, though less discussed, example is the news that William Dudley, the leader of the Federal Reserve Bank of New York, announced that he’ll be stepping down early than expected. This move has led some to speculate on “the uncertainty over whether the central bank will be more hawkish with its rate increases moving forward depending on who fills the open positions.”

Why does this matter for gold investors? Unexpected events like this help stabilize gold prices by effectively creating a “floor” even in times of falling value.

Gold prices have fallen in recent weeks hitting multi-month lows. This comes at a time when gradual increases in rates has reinvigorated investors’ appetites for yield-bearing investments. However, uncertainties in other areas, like the Federal Reserve Bank of New York, keeps investors vigilant. This cautiousness helps prevent further slips in gold prices.

On a global scale, instability in Spain’s government and Venezuela’s economy are also fueling the fire. Investors can get a concise, holistic measure of uncertainty around the world with the Economic Policy Uncertainty Index. This single number represents a reading based on two components. The first quantifies uncertainty within newspaper coverage of economic policies. The second gauges how many federal tax code provisions will expire in the coming years. A reading of this figure from January 1, 1997 to October 1, 2017, shows a clear upward trend reaching an all-time high in January of this year. Until October of 2008 the figure had never risen above 200. Since then the index has broken the 200 mark on six occasions.

This is a visual illustration of the pervading uncertainty that makes gold a worthwhile, long-term investment. While many eager investors get caught up in the moment, the long-term is what counts. Recent events, which are pushing gold down, are fleeting. However, the supportive elements that prevent a complete collapse of gold prices are consistent because they’re based in the inherent uncertainty of an increasingly complex world.

The key for success remains the same; investors must maintain perspective on the wider picture while ignoring the headlines that pray on passing fears.

Proof Coins: The Gifts for Kings

Posted onIn the 1800’s, American proof coins were minted primarily as gifts for kings and foreign dignitaries. In later years, fortunate U.S. congressmen and senators were also bestowed with these exceptional gifts.

President Andrew Jackson’s 1836 gift of a U.S. proof coin set to the King of Siam is a numismatic legend.

The first U.S. envoy to the Far East, Edmund Roberts, took the coin set with him on a voyage aboard the USS Peacock in 1835 and arrived in Siam in the spring of 1836. Roberts presented the coin set to King Ph’ra Nang Klao (Rama III) of Siam in April 1836.

The King’s son, Rama IV, was the inspiration for the famous Broadway musical, “The King and I.”

A Gift to his Governess

For over a hundred years, this exceptional coin collection was unknown to numismatics around the world. It wasn’t until 1962 that the set emerged in London. It is believed the King of Siam’s son, Rama IV, gave the coin set to his British governess, Anna Leonowens, who died in 1915. It was their relationship that was the basis for the musical “The King and I.” Over 120 years after the coins had been gifted to the King, two descendants of Leonownes sold the coins to a London, England dealer.

The Gift

The proof coin set included nine denominations ranging from half cent to eagle. The set was stored in a custom made case covered in yellow leather – the color of Siamese royalty. Inside the case, each coin was secured in a slot depressed into a lining of blue velvet.

Its value is astounding. The King of Siam proof set sold in 2005 for $8.5 million. Previously, the set changed hands for over $4 million in 2001.

What Sets Proof Coins Apart

Proof coins are the highest quality coins created by the United States Mint. Today, collectors highly value Proof gold U.S. coins and when they appear on the market they are quickly snapped up. Most proof coins have extremely low mintages. Some issues may emerge only once or twice every few decades.

Blanchard recently acquired 9 awe-inspiring proof coins. The uniquely rare and valuable coins sold within a week.

Many proof gold coins today are housed at the Smithsonian, or in the hands of a fortunate collectors.

“American currency is a reflection and a record of our history,” noted Brent D. Glass, director of the Smithsonian’s National Museum of American History. Proof coins are the pinnacle of currency minted by our government.

Why Proof Coins Are Important

Because of their unbelievable beauty and rarity, discerning collectors covet gold proof coins as an extremely valuable part of their collections.

Proof gold coins are struck twice, resulting in a more defined and intricate result. The end result is that typically a proof coin of the same date will be more expensive, rare and valuable than a non-proof uncirculated.

How Proof Coins Are Graded

- Proof – the term itself suggest superior condition of a coin.

- PR 70 is the highest grade possible for a proof coin and represents a perfect coin.

- Gem Proof (PF-65) – The surfaces are brilliant. There are no noticeable blemishes or flaws.

- Choice Proof (PF-63) No major flaws. The surface of the coin is reflective, with only a few blemishes.

- Proof (PF-63) The surface may be dull and have a few contact marks or hairlines.

What’s the difference between Proof and Mint?

The United States Mint began producing Mint sets in 1947. These are uncirculated coins that are specially packaged, but have nowhere near the value of proof coins.

Gold Coins: The Ultimate Charity Gift

Posted on“You have not lived today until you have done something for someone who can never repay you.”― John Bunyan

Each year at Christmas time, generous donors around America walk up to a Salvation Army Red Kettle and drop a gold coin in as a donation. It makes headlines each December, when the “first gold coin” donation is excitedly found.

Last year, on a cold and snowy night in late December in Green Bay, Wisconsin, a benevolent soul was busy making his or her own Christmas miracle. On Thursday December 22, 2016, a donor dropped a total of 40 coins into six different kettles. On Friday, December 23, the donor repeated the magic, dropping 40 more gold coins into Salvation Army kettles in Manitowoc County, Wisconsin.

The coins of choice? The coins were American Eagle 2016 One Ounce Gold Coins valued at that time at $1,130 each. That meant the total donation of 80 gold coins was valued at $90,400.

This is a recurring theme for the Salvation Army. You may have heard of the mystery of the gold coins that kept appearing each December in a small town in Gettysburg, Pennsylvania. For years, a shiny South African Kruggerand kept appearing in the bell ringer’s buckets. For 15 years, the benefactors managed to keep their identity hidden, which was a feat in and of itself in a town of less than 8,000.

In December 2012, the donors fessed up. “It made us feel good to give,” said Dick Unger.

Unger had bought six South African Krugerrands in the 1980s as an investment: one for each of his four daughters, one for himself, and one for Ruth Jean. After keeping them in his safety deposit box for years, he was inspired to drop them into the Salvation Army bucket with no note or hint to their identify.

Even after Unger donated the original six gold coins. He wanted to keep up the tradition. He bought more to donate. As the price of gold skyrocketed, his donations became worth more and more. In 1997, the coin Unger slipped in the bucket was worth $287. As gold prices climbed to their all-time highs in 2011, the coin was worth $1,700, reported Priority, the magazine of the Salvation Army.

In 2014, in Libertyville, Illinois, another generous well-wisher dropped seven gold coins into a Salvation Army bucket outside a Jewel grocery store along with a note. Those coins were gold Swiss Francs each made up of .19 ounces of gold. That donation was valued at about $1,500, the Salvation Army said.

These heartwarming stories make a real impact. Nearly 70 percent of the Salvation Army’s funding comes from donations dropped into the red kettles during the holiday season. The Salvation Army’s Red Kettle Campaign is the largest and oldest charitable fundraiser of its kind in the United States. It started in 1891 in San Francisco.

Three Things That Should Scare Some Investors this Halloween

Posted onAs equities continue to ride high investors are seeking aggressive ways to amplify their earnings. However, beneath the euphoria of today’s bull market are risks that hide in the shadows. Here, we take a look at three things that might give investors the creeps.

BATs and FANGs

No, I’m not talking about Dracula. In recent months investors have flocked to this core of outperforming stocks. BATs consist of Baidu, Alibaba, and Tencent. Each are major players in the Chinese economy and have posted strong gains. Meanwhile, FANGs are more recognizable to U.S. investors. That group includes Facebook, Amazon, Netflix, and Google. Profits have been substantial here also. Lured by performance, many investors fail to notice the high costs of some of these holdings. Consider, for example that today Baidu trades for 44 times earnings. Alibaba is trading at a whopping 59 times earnings and Tencent at 53. Not cheap. These high prices mean each will need to generate major revenue to support the heavy expectations. Facebook, Amazon, Netflix, and Google are all pricey as well at 39, 280, 242 and 37 respectively. These high costs are representative of the stock market as a whole.

Interest Rates are Back from the Dead

Federal Reserve Chairwoman Janet Yellen has made clear her willingness to keep the option open for another rate rise before the year ends. Moreover, three additional rate increases are expected in 2017. What does this mean for exuberant equity investors? It means the surge in stock prices will face pressure in the coming months because as Russell Investments has reported “On average, U.S. equities perform somewhat worse in rising interest rate periods than in falling rate environment.” Even the Wall Street Journal has reported in recent weeks that “The stock rally could stall if the Fed moves to normalize monetary policy faster than expected, investors and analysts say.” Investors should take caution but few are allowing this reality to temper expectations.

The Man in the CAPE

Nobel Laureate Robert Shiller is the man in the CAPE. The specter of his cyclically adjusted price-earnings ratio (CAPE) looms large. This valuation measurement is at a near historic high. In fact, it has only been higher in 1929 and 2000, periods of catastrophic decline in the stock market. “We are at a high level, and it’s concerning,” he remarked in June of this year. This lofty figure has prompted some to warn that valuations are running too high and that a correction is due. Of course no one can (or should) attempt to time the market, however, when a measurement like this is at its second highest level since the late 1800s it’s time to consider how risks are growing.

Is doom around the corner? Likely not. But, investors would be wise to reevaluate their diversification strategy with commodities like precious metals. Gold and silver help spread out risk. Also, the same research cited from Russell Investments above noted that commodities “showed superior returns rising vs falling rate periods.” Sometimes the scariest things are those we don’t see until it’s too late.

5 Must-See Charts for Gold Investors

Posted onYou’ve surely heard the saying: “A picture is worth 1,000 words.” We found five charts that show why gold is a smart investment for everyone.

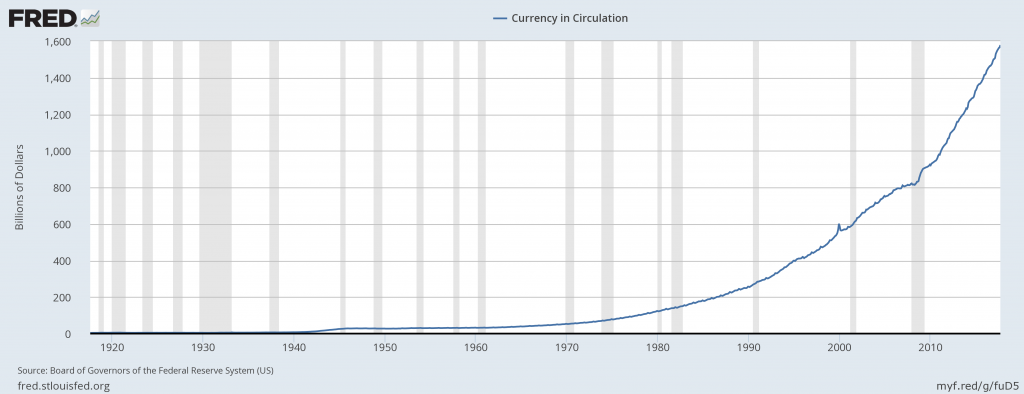

Chart 1: Currency in Circulation

The amount of currency in circulation continues to rise and is at an all-time high. This is paper currency, not backed by a hard asset. The printing presses remain in high gear.

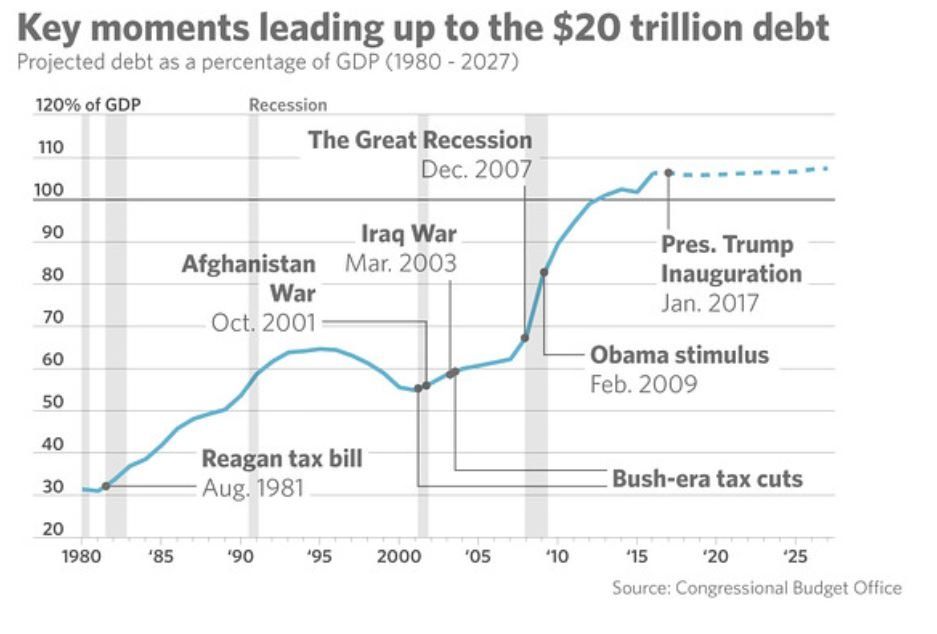

Chart 2: Total U.S. Debt at $20 Trillion

Total U.S. debt continues to rise. The price of big wars, tax cuts and economic stimulus packages have boosted debt levels over the years. Is the problem getting better or worse? Will policymakers ever be able to right the debt ship? If not that leaves Americans vulnerable to higher interest rates and eroded purchasing power with paper money in the years ahead.

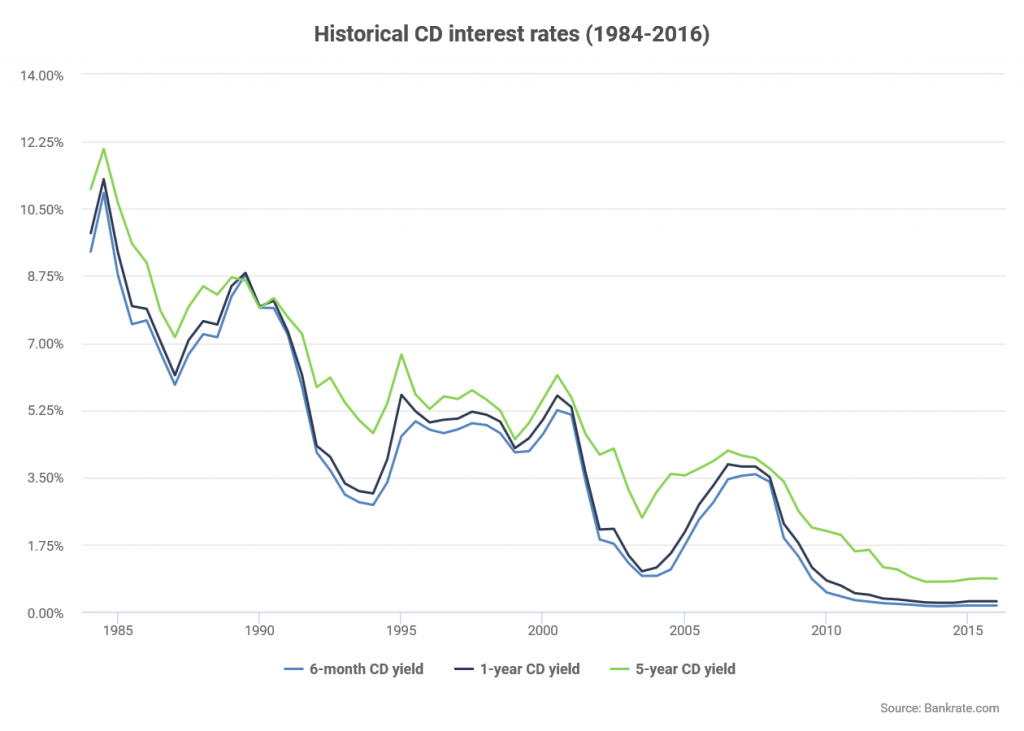

Chart 3: Long-Term CD Rates

You may remember several decades back when CD rates were at double digits. Many retirees used CDs as a safe way to generate income on their savings. Today, you are lucky if you can generate 1.00% on a savings account. There is no return on paper money and your purchasing power with paper money continues to decline (see chart 4).

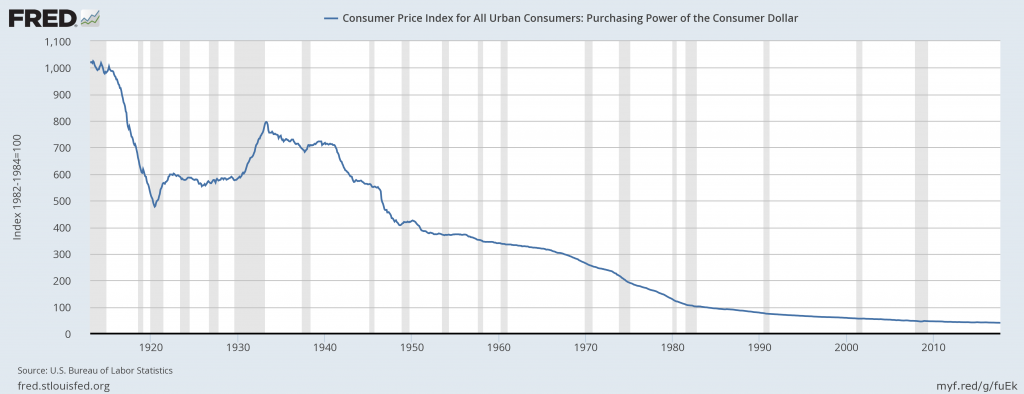

Chart 4: Purchasing Power of the Dollar

The purchasing power of your dollar continues to decline. It’s been a steady erosion since the Great Depression ended. While you may amass more dollars through your income, or capital gains in the stock market, what is that dollar really worth?

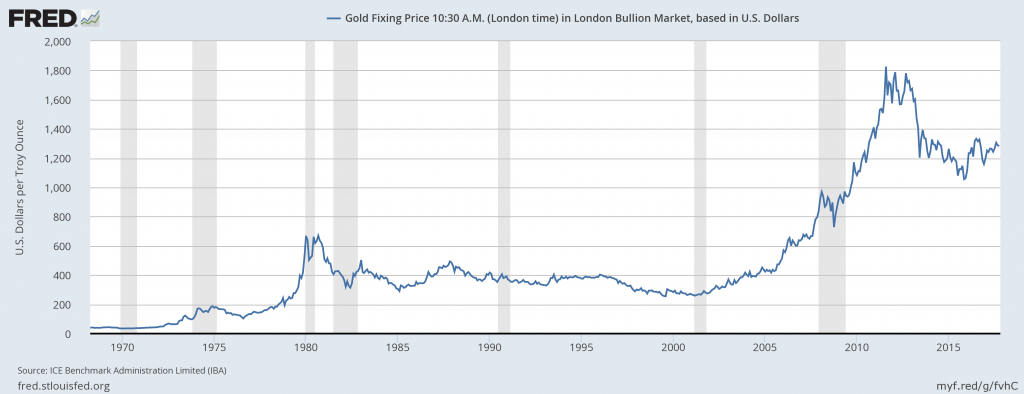

Chart 5: Long-Term Gold Chart

In 1973, an ounce of gold was worth $100. In 2011, an ounce of gold traded over $1,800 an ounce. The long-term trend remains up. Well-known forecasters predict the price of gold will surge as high as $2,000 an ounce by 2020. For investors who are keen on protecting the true value of their assets, gold is a vehicle that preserves and protects your future purchasing power.

Wall Street money managers are now recommending diversification up to 30% in physical gold. How confident are you in your current investment plans? Contact a Blanchard portfolio manager today at 1-800-880-4653 for a confidential, personalized evaluation of your individual financial goals and learn how tangible assets can help you achieve the financial freedom and security you desire.

How to Lose $80 Million in Gold Coins

Posted onSome events are so rare they last only for moments. This was the case for the Langbord family in 2003 when they found $80 million in rare gold coins. One such coin fetched $7.5 million at a Sotheby’s auction in 2002. The family made the discovery after drilling into a safety deposit box that belonged to their deceased father, Israel Switt. Inside were 10 coins, each a 1933 Saint-Gaudens. They are among the rarest coins in history and the Langbord family didn’t hold them for long.

The family took the coins to the Philadelphia mint for authentication. It was the last time they would hold the fortune in their hands. The government promptly seized each coin. “This is a case that raises many novel legal questions, including limits on the government’s power to confiscate property,” remarked the family’s lawyer.

445,500 of these coins were minted in 1933, however, none were officially circulated. The mint received a mandate to melt them all down into gold bars when president Franklin D. Roosevelt ordered banks to abandoned the gold standard. Two coins were intentionally left untouched. Today they both reside in the U.S. National Numismatic Collection. Over the years authorities have learned of 20 coins that somehow escaped melting likely as a result of theft. In time the Secret Service found 19 of them and melted down all but nine. The gold content and rarity are what make this coin so valuable today.

When the Langbords learned that their coins were gone they received no compensation. The reason: it’s believed that Switt had access to various stages of the minting process in the 1930s and was able to obtain the coins illegally. However, the Langbords have argued that it’s possible that the coins were, in fact, obtained legally during a very narrow “window of opportunity.” This argument rests on the fact that the mint first struck the double eagles on March 15th and it wasn’t until April 5th that Roosevelt enacted the executive ban on the coins.

In 2011 a jury determined that the coins are in fact the legal property of the U.S. Government agreeing with the argument from the mint’s attorney who stated “these coins didn’t go out through the front door – they went out the back door.” The ruling resulted in the family filing an appeal, which was struck down by the Eastern District Court of Pennsylvania, citing that “the coins in question were not lawfully removed from the United States Mint.”

The family eventually appealed to the U.S. Supreme Court in April of 2017. However, the court denied to hear the case. It’s likely that the Langbord’s discovery will go down in history as the singles largest find of the ultra-rare double eagle coins. To this day the coins are legendary to collectors because they represent a pivotal moment in the U.S. economy when the nation moved away from gold and into dollars backed only by confidence.

Even if they could turn back the clock to the day of their find it’s unlikely that the Langbords could have done much differently. Selling them would have been illegal resulting in a prison sentence. Keeping them secret wouldn’t offer any financial value. For a few days they were among the richest elite, until they weren’t.

Gold as Wearable Wealth: More Than a Fad in India

Posted on — 1 CommentAmerican women are fond of saying “Diamonds are a girl’s best friend.” Not as well-known are the origins of that saying, which can be traced to a 1947 De Beers mining company advertising campaign.

In the Indian culture, “No gold, no wedding” is a popular saying. That underscores the significance of gold in the fabric of Indian society. Rare is a marriage that takes place without some sort of gold being presented to the bride. Gold coins are common gifts. Even in the poorest family a simple gold nose ring is presented.

In India, families build and save their wealth in the form of physical gold. This is often in the form of extravagant jewelry pieces worn by the women of the family. The finest Indian wedding dresses include thread made of actual gold. These gowns are wrapped away in protective coverings and stored in family homes as a protection against hardship or a “rainy day.”

Indian households control an estimated $600-$800 billion of gold, at 2014 estimates and prices, or four times the amount of gold held in Fort Knox. Given the significant price increase in gold in recent years that number is even higher now.

Owning physical gold in India is a type of “insurance policy.” Women stockpile gold. It begins as gifts from their mothers and extends to gifts from in-laws, her husband.

Facts about India:

- The economy is healthy in India. The IMF forecasts the Indian economy to expand at a 7.2% pace in FY 2017-2018.

- It is the world’s largest democracy.

- It is the second largest country in the world by population, home to over 1.2 billion people.

- India is the world’s second largest gold market. Indians typically buy and hold gold – for generations. Gold is passed down from generation to generation.

What this means to American investors:

The Indian economy continues to develop. As more individuals and families become educated and get well-paying jobs, they will continue to funnel a portion of their assets into saving in gold.

Indian gold demand is a long-standing driver of upward pricing in the metals market. And, it is not going away. Instead, it is expected to continue to grow as Indian citizens are lifted out of poverty and into the middle class. This will mean even more gold demand in the future.

American investors turn to gold for many reasons. A portfolio diversifier, an inflation hedge, a protection against paper money devaluation. Indian investors turn to gold as a cultural wealth building tool. It is deeply ingrained in their culture and gold demand will grow as more Indians have the ability to purchase the metal. More demand means higher prices.

Gold that you are buying now will help preserve and grow your wealth too.

Stay on top of news and trends with the Blanchard eNewsletter

Get the latest tangible assets news, insights and buying recommendations delivered to your inbox every month. Enter your email address at the bottom of this page to subscribe.

What’s Trending Now? Read More:

Since 2017 Started, Your One Dollar Bill Is Now Worth 91 Cents

Follow David Beahm, CEO of Blanchard & Company, on LinkedIn to read his weekly articles on the metals markets, the economy and how investors can thrive in today’s uncertain times

Three Incredible Gold Coin Finds, and One Devastating Loss

Posted on

- Out for a Stroll

The weather was nice one day in northern California, so a couple took their dog for a walk. They left their house as a regular pair of middle-class Americans. When they returned home, they were multi-millionaires. The woman noticed the edge of a rusted can sticking up from the ground and dug it out to get a closer look. Inside they discovered a hoard of 1,427 gold coins totaling $10 million. Incredibly, the coins were uncirculated and in mint condition dating between 1847 and 1894. They find, so rare, captured the attention of one gold expert who explained, “you don’t get an opportunity to handle this kind of material, a treasure like this, ever.” In fact, some believe this represents the largest single find of gold coins on U.S. property in history. Many of the coins carry $5, $10 and $20 denominations, however, now, so many years later, their worth has skyrocketed.

- Rise and Fall of the Roman Empire

This year a woman, out for a hike in Israel, came across a glimmer in the soil. That little glint was a coin so rare that experts believe there is only one other like it in the world. “The coin was struck by Roman Emperor Trajan in the year 107,” reported NPR. One side shows Augustus, the founder of the Roman empire. On the other side are images symbolizing Roman military legions. The piece was most likely used to pay a soldier. However, such a large, single payment was less desirable to the Romans. Due to its value, it was difficult, at the time, to use the coin for everyday purchases because it was so difficult for merchants to make change. Sadly, the woman was unable to sell the piece. Instead, she was asked to hand it over to The Israel Antiquities Authorities so it could be put on public display.

- Massacre Remains

Sometimes the thrill of a gold find carries surprisingly dark overtones. This was the case when archaeologists made a recent discovery on an island in the Baltic Sea. The location was the site of a mass murder occurring in the 5th century. The coins at the site have led some to theorize that the attack was motivated by a desire for the valuables held by the inhabitants. Atlas Obscura explains that “The face of the coin depicts Western Roman Emperor Valentinian III, who ruled between 425 and 455, with his foot crushing the head of a barbarian.” Others, however, question that the attack was purely for financial gains as many other precious items, like gold rings and bracelets, were also left at the site untouched. Moreover, details of the mutilations seem particularly personal. For example, archaeologists found several skeletons with their mouths stuffed with either goat or sheep teeth.

- The Berlin Heist

Want to get rich? Apparently, all it takes is a ladder and a wheelbarrow. In March of 2017 thieves broke through bulletproof glass at the Bode Museum in Berlin, Germany and stole a single gold coin. Why would burglars face so much risk for just one coin? Because it’s one big coin. It weighs 220 pounds and is 99.999 percent pure gold. It’s worth over $4 million. Police are uncertain how the group was able to evade the alarm. It’s believed that the coin has been melted down into bars to further elude authorities. Recently, four suspects were arrested. However, police have not recovered any gold.

The Five Pillars of the Central Bank Gold Agreement

Posted onGold is critical on the stage of the global economy. In fact, it’s so important that eleven nations formally agreed that the commodity is a mainstay of sovereign nations. While die hard equity investors often eschew gold as a relic of the past, the fact remains that our world’s economy requires gold as an international reserve. This is the belief underpinning The Washington Agreement on Gold first signed in 1999. It includes five major statements on which countries like England, France, Italy and the U.S. agree.

First, they all agree, that gold will remain an important element of global monetary reserves. This belief is illustrated not just by nations agreeing to the statement, the numbers also support their conviction. As MarketWatch reports, “Around 20% of all the gold ever mined is held by central bank and governments, with the biggest official holdings at the U.S. Treasury with 8,134 tons.” Research from the Official Monetary and Financial Institutions Forum posits that central bank activity surrounding gold can be delineated into “Seven Ages,” the most recent of which started in 2008 in response to the global financial crisis. They explain that since that upheaval “central banks in both developed and developing countries have shown a new fondness for the yellow metal, rebuilding gold’s importance as a bedrock of most countries’ foreign reserves.”

The second component of the agreement asserts that “The above institutions will not enter the market as sellers, with the exception of already decided sales.” This statement helps preserve the longevity of the agreement ensuring that the included countries maintain an equilibrium. Third, the document states that any sales arraigned before the agreement will occur over a period of five years with annual sales not exceeded 400 tons. Fourth, the countries agree that they will refrain from expanding gold leases and gold futures and options over the period of the agreement. This statement is, in effect, an extension of the promise to not enter into the market as sellers.

Finally, the countries agreed to review the agreement after a period of five years. History shows they all held up with end of the bargain and renewed the agreement in 2004, then extended in again in 2009. This is the reason that “Central banks have been net buyers of gold since 2008, and today comprise a significant portion of annual gold demand,” according to the World Gold Council.

What is most striking for investors about this agreement is the powerful message it sends regarding the importance of gold in global markets. It stands to reason that if all of these countries can pledge their commitment to hold reserves of gold then ordinary investors can have faith in the immutable value of the commodity. Case in point: we’ve seen central bank gold holdings increases steadily since 2007 where total holdings were nearly 30,000 tons. By comparison, in Q1 of 2017 that figure is over 33,000 tons. The longevity of the agreement may be rooted in the fact that in times of crisis gold outperforms US Treasuries, Japanese government bonds, German “bunds,” and UK gilts. Here, “crisis” includes events like the 1987 market crash, the Dot-Com bubble, September 11th and the global financial crisis of 2007.

If holding gold for the long-term is good enough for global nations it’s good enough for investors.