Global Stock Sell-Off Signals New Phase: Volatility Ahead

Posted onIn a blink of an eye, stock markets around the world began careening sharply lower on Aug. 1. Bad economic data and disappointing earnings started the crash and the stock rout accelerated as traders around the globe began unwinding leveraged stock market trades from Japan to the United States.

What Triggered the Stock Market Sell-Off?

A series of bad U.S. economic reports showing weakening employment, manufacturing and construction data pushed the stock market sharply lower on August 1.

Then, the sell-off escalated the following day with the release of a lousy July employment report. The data showed a significant cooling in the labor market, as the unemployment rate jumped to 4.3% in July. Meanwhile, employers added only 114,000 new jobs to the economy last month, well below the expected 185,000 number.

Stocks Get Battered at Home

Here in the U.S., the technology-heavy Nasdaq 100 index has now plunged 16% from its highs scored last month. U.S. small cap stocks have tumbled 13% from last month’s highs and on one day alone – the S&P 500 fell 3% on Aug. 5, marking the biggest daily loss since September 2022.

Stock Slump Quickly Spread Around the Globe

There was no place to hide as the stock losses spread from one time zone to another.

Japan’s Nikkei 225 stock index crashed 12% overnight on Aug. 5, which marks the biggest single-day drop there since the Crash of 1987. Over in Europe, stock markets there officially entered so-called correction territory, with total losses of over 10% from their recent high. Chinese stocks fell roughly 8% from their recent high. And, emerging market stocks tumbled about 7%.

What Lies Ahead?

The swift stock market collapse warns of more volatility ahead. What can you watch for?

The Fed: Quickly, the narrative on Wall Street has shifted to: Did the Federal Reserve wait too long to cut interest rates?

Many now believe the Fed should have cut rates at its July meeting amid signals of an already slowing economy. Some on Wall Street now expect the Fed may even pull the trigger on a larger than expected .50 basis point rate cut at the September meeting, versus the previously expected .25 bp rate cut. This would be a positive for gold as the precious metal historically trends significantly higher during Fed easing cycles.

Recession: Some investors are now worried the U.S. could face a recession in the months ahead as new economic data reveals a slowdown and amid the impact from the Fed’s still high interest rates. If the economy were to weaken into an official recession, this would further weigh on corporate earnings and the stock market. That in turn would increase demand for assets like gold that perform well during economic downturns and stock market declines.

Geopolitics: Beyond our shores, heightened focus is on the potential for military conflict to escalate in the Middle East, with the potential for Iran to get more directly involved in the Israel-Hamas war. A widening of the war could have broad implications for the price of oil, inflation, global equities and would likely be a catalyst for a fresh move higher in gold amid safe-haven buying.

What Does It Mean For You?

As an investor, there are steps you can take to protect your wealth and your portfolio against the uncertainty and potential for increased stock market volatility that lies ahead.

Gold and silver historically climb in value when other markets like stocks crash. Owning a percentage of your portfolio in precious metals helps offset the losses that can occur in stock, bond and even real estate markets during economic, political and military shocks and crises.

Wondering what size allocation could be right for you? New research from the well-respected CPM Group stated that over the past 50 years, the best return of a portfolio including stocks, bonds, and gold was for portfolios that had around 25% – 30% of their value in gold. Do you own enough?

John Albanese: A Titan in the World of Numismatics

Posted onCelebrated for his significant influence in the numismatic community, John Albanese has left an indelible mark on the industry through his numerous contributions and innovation.

John began his numismatic journey in 1978, with the establishment of his own company. It wasn’t long before his expertise and dedication opened up additional opportunities. In 1986, John co-founded the Professional Coin Grading Service (PGCS) which, at the time, set the gold standard for professional coin grading. The following year, John founded the Numismatic Guaranty Corporation (NGC) where he personally graded over one million coins and served as president, cementing his reputation and establishing himself as a top authority in his field.

A Master of Innovation

In 2007, John founded the Certified Acceptance Corporation (CAC), a service that elevated the reliability and accuracy of coin grading. CAC evaluates coins that have previously been graded by other major services, confirming their grade and ensuring that only those meeting the absolute highest standards receive the coveted green CAC sticker. In 2023, CAC expanded to include a separate grading entity, CACG, providing rare coin owners with the absolute pinnacle of rare coin grading and certification. CAC-stickered coins have positively impacted the numismatic market because that sticker will often command prices higher than more traditionally graded coins.

John’s expertise isn’t limited to grading, however. In 2001, he created Intercept Shield, products specifically designed to protect coins from corrosive gasses. And in 2005, he founded the Numismatic Consumer Alliance (NCA), which has helped recover millions of dollars for buyers who fell victim to unscrupulous coin dealers.

His keen eye for quality and rarity has allowed him to handle some of America’s greatest numismatic treasures, including an 1804 Silver Dollar, a 1794 Specimen Silver Dollar and a Brasher Doubloon. And if that weren’t enough, he also served as the only numismatic marketing strategist for coins recovered from the shipwreck S.S. Central America.

Awards and Recognition

John’s contributions have been widely recognized. He has received prestigious awards such as the Abe Kosoff Founder’s Award and the Sol Kaplan Award from the Professional Numismatic Guild (PNG), and he was inducted into the PCGS CoinFacts Coin Dealer Hall of Fame.

In 2022, he was awarded the National Silver Dollar Roundtable Lifetime Achievement Award. And in 2023, John was named Numismatist of the Century by COINage.

Legacy and Current Work

Today, John Albanese remains a pivotal figure in numismatics. His lifelong dedication to the field, coupled with his numerous achievements, have cemented his legacy as one of the most influential leaders in the field.

John’s career is a testament to his passion and commitment to excellence. His work has elevated the standards of coin grading and he is responsible for protecting and educating countless collector and investors in the rare coin market.

At Blanchard, we are immensely proud of our longstanding partnership with John. His dedication to excellence and integrity aligns perfectly with our values and we are honored to work alongside him.

The Truth about Gold and Fed Easing Cycles

Posted onThere is an often-quoted market adage: “In Wall Street, what has happened before will happen again.” It’s true. Investors who look at market cycles and invest accordingly can benefit from the knowledge of history.

That leads us to one of the biggest economic questions of 2024 for gold investors:

What does history tell us about how gold performs during Fed easing cycles?

New research from the Wells Fargo Investment Institute provides the answer: “the average price of gold has tended to rise quite nicely and for nearly 21 months, following the start of past Fed interest-rate easing cycles.”

Short answer is simple—gold trends higher and for almost two years once the Fed begins cutting interest rates.

What else does Wells Fargo say in their July 22nd research report?

“The bottom line is that gold fundamentals remain solid, and inflation rates have likely fallen enough for the Fed to begin cutting interest rates later this year. If this indeed occurs, history suggests that gold prices could move significantly higher for some time. We continue to recommend Precious Metals as one of our favorite Commodities sectors.”

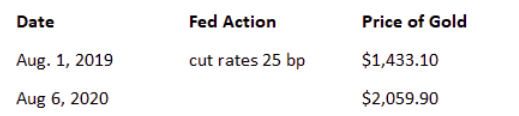

Let’s explore what happened the last time the Fed started cutting interest rates.

One Year Later Where Was Gold?

On August 6, 2020, a year after the Fed started cutting rates, gold had climbed 44% to $2,059.90.

2024 Outlook for Gold

Let’s take a look at what J.P. Morgan said in mid-July about gold: “Many of the structural bullish drivers of a real asset like gold — including U.S. fiscal deficit concerns, central bank reserve diversification into gold, inflationary hedging and a fraying geopolitical landscape —have lifted prices to new all-time highs this year despite a stronger U.S. dollar and higher U.S. yields, will likely remain in place regardless of the U.S. election outcome this autumn,” said Natasha Kaneva, Head of Global Commodities Strategy at J.P. Morgan.

How high could gold climb in the months ahead?

J.P. Morgan predicts new all-time highs for gold. “The direction of travel is still higher over the coming quarters, forecasting an average price of $2,500/oz in the fourth quarter of 2024 and $2,600 in 2025,” according to Gregory Shearer, Head of Base and Precious Metals Strategy, at J.P. Morgan.

So, there you have it. History shows we are about to enter another big upswing for gold with the start of a new Fed easing cycle. Will you benefit from the knowledge of history? Explore current gold investment opportunities now.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly

Breaking news: Fed says rate cut could come in Sept. Gold climbs!

Posted onFed Signals Rate Cuts May Come Before Election

Gold traded higher after the Federal Reserve held interest rates steady at its meeting today. However, the central bank made an important pivot in how it talked about the economy, signaling to Wall Street that it is getting closer to an interest rate cut.

Gold is climbing in afternoon trading at $2,449.90, not far from its record high set earlier this month at $2,469.70.

At the Fed’s post-meeting press conference, Fed chair Jerome Powell confirmed that an interest rate cut “could be on the table” at its next meeting on September 18.

With the U.S. presidential election front and center for so many Americans, Powell addressed that head on and said he “absolutely” believed that Fed can stay out of politics with its monetary policy actions. Powell added that “Anything we do before, during or after the election will be based on the data,” as opposed to trying to help one political party or another.

In fact, Congress has deemed that the Federal Reserve is an independent central bank and must make its decisions without taking politics into consideration, though that hasn’t stopped political figures from making requests of the central bank around election time.

Progress has been made on inflation.

The Fed used today’s meeting to prepare the financial markets that interest rate cuts are coming, as the inflation rate continues to retreat. In June, the consumer price index fell 0.1% to an annual rate of 3.0%. While it is still above the Fed’s 2% inflation target, there has been significant progress made from the sky-high 9.1% inflation reading from June 2022.

How fast could rates fall once the Fed gets going?

The Fed’s benchmark interest rate stands today at a two-decade high of 5.25-5.50%, but lower rates may be in store by the end of the year.

The Fed’s most recent economic projections from June revealed that the central bank could lower rates about every other meeting once they begin cutting. That could tug the Fed’s benchmark interest rate down to 4.1% by the end of the 2025 and as low as 3.1% at the end of 2026.

Fed shifts focus back to its dual mandate

Digging into the Fed’s meeting statement today, the bankers said that employment and inflation goals “continue to move into” better balance.

Fed-speak translation

This implies that the central bankers are ready to treat both sides of their dual mandate, inflation and employment more equally, as opposed to the sharp focus on inflation following the major jump in consumer prices during and after the pandemic.

More gold gains ahead

Key takeaways? Expectations are rising for interest rate cuts later this year and that’s positive for gold. Once the Fed starts cutting interest rates, research shows that the price of gold tends to rise on average for the next 21 months.

Is it time for you to consider increasing your allocation to gold? The next upside targets for gold lie at $2,500 and $2,600 and with the way the precious metal has been trading this year, it could achieve those levels in a couple of blinks of the eye.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Chasing the Dream: An Olympic Gold Medal

Posted onThis summer in Paris, 10,500 of the best athletes from around the globe will compete across 32 different sports for the ultimate prize: an Olympic gold medal.

As billions of viewers around the world watch the hope, glory and defeat, competing at the Olympic Games is the moment these athletes trained a lifetime for.

To these athletes, the value of winning a gold medal at the Olympic Games could never be measured in dollars, but the intrinsic value of the medal most certainly can.

So, just how much is an Olympic gold medal actually worth?

If the Olympic gold medals awarded to the victors this summer in Paris were made of pure gold, the intrinsic value would be just north of $41,000.

Spoiler alert. The gold medals aren’t made of pure gold.

Due to the surging value of precious metals prices over the decades, the last time pure gold medals were given out was in 1912.

Today, the cost of the combined metals in a 2024 Olympic gold medal totals about $950. That includes gold, silver and even a piece of iron from the Eiffel Tower in Paris! Both the gold and silver medals are made with over 95% silver.

Looking Back

The history of the Olympic Games has deep roots in ancient Greece, beginning in 776BC. Spanning twelve centuries, the games took place every four years.

From farmhands to soldiers and royal heirs, all free Greek males were allowed to compete in the games. The cherished event lasted five days and included competitions for running, jumping and throwing, boxing, wrestling, pankration (a combination of boxing and wrestling) and chariot racing. It is estimated that 40,000 spectators packed into the stadium each day to witness the dramatic events.

There are a few differences in the Olympic rules from back then to today.

For example, at the ancient Greek Olympic Games all athletes competed naked as a tribute to the Greek God Zeus. They wanted to show off their physical power and muscles to the gods.

Back then, there was no first, second and third place—only one winner for each event. Instead of a medal, the winner received a crown made of olive leaves. Plus, once they arrived back in their hometown, they were given a cash gift roughly equivalent to $100,000 today. Not too shabby.

Other differences between the ancient games and today? Corporal punishment was given to those guilty of a false start on the track. And, for athletes competing in combat sports, surrender was achieved by raising their index fingers. Sometimes, the athletes died before they could do this. Thankfully, times have changed.

Just Like Rare Coins, Olympic Medals Feature Unique Designs

So, what’s featured on modern Olympic medals? According to tradition, the design of the Olympic medals falls to the host city’s organizing committee. That means every Olympic Games medals feature a different and unique design, just like rare coins! The Paris 2024 medals feature the Olympic flame, and the face of Marianne—a cherished symbol of the revolution and the people of France. The words “Paris Olympics” and the Olympics logo of five rings are featured under the emblem.

Check out a few photos below of past Olympic medals.

Beijing 2022

London 2012

Atlanta 1996

All medal images courtesy of Olympics.com

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Is This An AI Stock Market Bubble?

Posted onCracks in the 2024 stock market bull are starting to appear.

In just five trading days in mid-July, the so-called Magnificent Seven (Nvidia, Microsoft, Alphabet, Tesla, Apple, Meta and Amazon) tumbled lower, shedding a stunning $1.128 trillion in market capitalization. That marks the biggest loss since May 2022.

Many Wall Street pros have been voicing worries about the rapid increase in stock prices this year, along with the high valuation levels and the euphoria around the artificial-intelligence technology—which many say is reminiscent of the late 1990’s dot.com boom.

Just look at the history-making run in Nvidia, a leader in artificial intelligence computing today. Nvidia’s stock price skyrocketed nearly 4,300% over five years. That has many on Wall Street remembering back to the dot.com boom, when for example Cisco ballooned about 4,500% over five years leading up to its peak in 2000.

The worry? The AI-driven 2024 stock market price surge will face the same ending as the dot.com boom in 2002: a catastrophic bust and stock market crash.

Back in the late 1990’s, the Nasdaq Composite index quadrupled in just over three years climbing at a dizzying speed amid widespread adoption of the internet and a wide-array of venture-capital fueled dot.com start-ups firms.

Yet, once the dot.com boom reached its peak in March 2002, the Nasdaq Composite index crashed nearly 80% into the October 2002 low.

The S&P 500 index fell nearly 50% in that same time period.

Looking back at that era, several internet stocks—Amazon—for example survived and thrived in the decades ahead. While other dot.com start-ups faced bankruptcy and shut down. Sifting through the artificial intelligence stocks of today, no one really knows which companies will survive and be sustained, long-term winners. But the odds suggest that many companies will simply fizzle out and not make it.

The evidence suggests this is a high-risk stock market. The price of a stock can go to zero. It’s happened before with companies that go bankrupt and close down. And it will happen again.

While no one knows for sure if this is a stock market bubble and if a crash is just around the corner, there is certainty in the safety and diversification properties of precious metals.

Gold is up over 16% since the start of 2024, making it one of the best performing asset classes in the world. Gold is one of history’s most traditional and enduring currencies. It has a 5,000-year track record as a vehicle to store, protect and grow your wealth.

There is an old saying in the stock market. Stock prices take the stairs higher but take the elevator down. Once a market crash begins, things happen fast. And it can be difficult to get your money out of a falling market.

Have you considered your asset allocation levels lately? It could be time to increase your allocation to gold. Check out your portfolio now and take action to help ensure you don’t get trapped by a falling market

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

An Elusive Rarity: 1793 Flowing Hair Wreath Cent Vine and Bars

Posted onThere are rare coins and then there are ultra-rare coins. The 1793 Flowing Hair Wreath Cent Vine and Bars is a landmark coin, which is virtually impossible to find in high grades today. The survival estimate stands at only 8 for grades 65 or better. It is still an extremely hard-to-find rarity in grades 60 or better with only 40 survivors.

What makes this large copper cent one of the most desirable specimens for astute collectors of early American coins?

Large cent coins were first struck in copper in 1793 at the Philadelphia Mint. The first version known today as the Chain Reverse was criticized widely with newspaper articles decrying that the chain design made it appear as if “Liberty was in chains.”

Swiftly, Mint Director David Rittenhouse ordered a new design for the large cent and the Wreath Reverse version was minted later that year. The 1793 1C Flowing Hair Wreath coin represented a substantial step up in both design artistry and engraving execution from its predecessor: the Chain Reverse.

The coin’s obverse features Liberty with voluminous hair flowing back as she gazes steadily upward. The reverse features an intricate and attractive wreath, with berries depicted on long strands, some of which intertwine delicately with the branches. The long leaves are believed to be the laurel species (Laurus nobilis) which was native to ancient Greece and used to crown the winners of sporting events. Numismatic historians believe this depiction of the laurel wreath may have been featured on this coin as a symbol of America’s hard-fought freedom won through the Revolutionary War.

Who designed this hard-to-find beauty? While there is no absolute proof and various candidates have been put forward throughout history, today it is believed that Henry Voight designed this coin. Voight was a watch maker and machinist who notably repaired clocks and watches for Thomas Jefferson. He was appointed as Chief Coiner at the Philadelphia Mint in January 1793.

However, just a few months after the Wreath design was introduced, the Mint moved to yet a third design for the 1793 large cent, known as the Liberty Cap style. Liberty Cap style cents were minted from 1793 until 1796.

So, the 1793 Flowing Hair Wreath Cent Vine and Bars design was produced only one year in American history. When a 1793 Wreath cent surfaces for sale, it is usually a short-lived event as this coin commands intense interest and desirability in the numismatics community.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Gold Leaps to 6-Week High After June Jobs Report

Posted onIf you are looking for a new job, the latest U.S. employment report won’t come as a surprise. It is getting harder to find a new job.

Spot gold jumped to over $2,300 an ounce—a six week high— following the June jobs report, which painted a decidedly weaker-than-expected economic picture, and boosted odds that the Federal Reserve will cut rates twice in 2024.

Silver prices also rose on the news, trading over $31.00 an ounce. The U.S. dollar fell to a three-week low following the jobs report, which makes gold less expensive for foreign buyers of the precious metal.

Mid-Year Report Card on the Jobs Market? Thumbs Down

In June, the overall unemployment rate rose to its highest level since late 2021 at 4.1%. And, while U.S. non-farm payrolls grew by 206,000 in June, big downward revisions to March and April job growth numbers show the labor market is cooling and reveal a worrisome trend.

When you remove new government jobs created in June, private payrolls grew by only 136,000. Key takeaway? Be skeptical when the jobs market growth is largely supported by new government jobs.

Digging into the details, job growth numbers for April and May were revised down a big 111,000 meaning that jobs rose only 108,000 in April and 218,000 in May.

For perspective, with the newly reported revisions, jobs growth over the last three months averaged 177,000, which is down from a 249,000 three-month average in the prior month.

Three Strikes and You Are Out

The increase in the unemployment rate to 4.1% in June follows a rise in May from 3.9% to 4.0%. If there is another increase in the unemployment rate in July, one of the best available recession indicator’s known as the Sahm Rule will start flashing red.

Former Fed economist Claudia Sahm developed this rule, which is based on the idea that, when people start losing jobs, they cut back on spending, and this in turn causes even more job losses throughout the economy. It technically is triggered when the unemployment rate rises to at least half a percentage point above its low point from the past year, which is the signal that a recession has begun.

Will Gold’s 2024 Rally Continue?

Gold has gained over 12% since the start of the year and Wall Street analysts say more record highs are on the way. The gold market’s reaction after the employment report was a bullish signal and opens the door to a new all-time record high later this year in the $2,538-$2,643 area, according to a BofA Global Research report. Investors are piling into precious metals to protect and grow their wealth. If you act now, you can trade your dollars for gold before the next big upswing begins.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

6 Mistakes High Net Worth Investors Make

Posted onTraditional economic theory is based on the idea that investors make rational decisions. However, humans are emotional beings, which means investment decisions can sometimes be driven by emotional factors.

Indeed, the latest Capgemini World Wealth Report 2024 discovered that 65% of high net worth individuals are influenced by behavioral finance biases when making investment decisions—especially during emotional life events such as marriage, divorce and retirement.

Throughout their lifetime, investors make many decisions including whether to buy physical gold and silver or rare coins, real estate, stocks and bonds and in what proportion to each other, or allocation levels.

Emotional investment decisions can have a long-lasting impact on your financial goals and your financial security. Do you recognize any of these six investment biases, which Capgemini found impact high net worth individuals (HNWI)?

- Confirmation bias: This refers to the idea that you seek information from sources that already aligns with your views. 65% of HNWI were susceptible.

- Activity bias: This means you are open to grab opportunities without extensive deliberation. 47% of HNWI were susceptible.

- Disposition effect: This means you hold onto bad-performing investments for an extended period. 45% of HNWI were susceptible.

- Risk aversion: This means you are too conservative to grab potential opportunities. 43% of HNWI were susceptible.

- Anchoring bias: That means sticking to past investment decisions without regular re-evaluation. 43% of HNWI were susceptible.

- Overconfidence: This means you invest based on your own market predictions. 37% of HNWI were susceptible.

If you recognized any of these biases, you aren’t alone. They are very common and even among high-net worth individuals. However, when you are making investment decisions, you want to ensure you are making the right decision for your financial future. Fortunately, there are four simple strategies you can employ to help you avoid these behavioral finance traps, and Blanchard is here to help.

Set Clear Investment Goals

What are your financial goals? Blanchard will take the time to learn your investment objectives, investment time horizon and risk appetite before recommending products for your consideration.

Invest for the Long-Term

Blanchard’s investment philosophy is based on a long-term outlook. We believe in the long-term investment value of high end rare and ultra-rare coins. Download a 45-year study on the long-term investment performance of gold bullion and U.S. rare coins to learn more about performance returns.

Diversify Your Portfolio

Gold and silver bullion in physical form is an appropriate asset for a portion of any properly diversified investment portfolio. We recommend investing up to 10% of your overall portfolio in gold, depending on your financial goals and risk tolerance levels. Learn more about a proven gold diversification strategy.

Rely on Proven Professionals

Talking with a financial professional before you make an investment decision can help alleviate some or all of the investment biases shown above. Take the time to get a second opinion and professional guidance with your most important investment decisions.

Blanchard believes that most of our clients benefit by talking to one of our Portfolio Managers before they make a purchase. The precious metals market is complicated and in constant flux. We follow it closely and getting a second opinion before you buy can dramatically improve your purchasing power and help you avoid making a bad purchase. We can also help educate you on topics such as IRA’s, inheritance, storage, diversification and many more topics.

Investing doesn’t have to be complicated, nor ridden with bad emotional decisions. If you follow these four steps it will help you feel confident and secure that you are moving your financial future forward. Blanchard is here to help

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

An American Treasure: 1799 Funeral Medals Honored George Washington

Posted onFollowing President George Washington’s death on December 14, 1799 at Mount Vernon at the age of 67, the entire nation went into a deep state of mourning.

With his passing, Washington transcended into a truly legendary American hero, and today schoolchildren are still taught in great detail about the Father of Our Country—the Revolutionary War general who became the first president of the United States of America.

In the days after his death, local governments in nearly every American city and town planned their own memorial tributes to honor his memory and his long-lasting achievements that helped launch a new nation.

Esteemed engraver, inventor and member of the Masonic Brotherhood, Jacob Perkins designed memorial Funeral Medals as a tribute to the Founding Father to be “worn by all ages of people.”

Perkins’ first Washington medal was documented at the funeral procession in his hometown of Newburyport, Massachusetts. Perkins’ most popular and well-known of the Washington Funeral Medals are the “Urn and Skull and Crossbones” types.

However, a little seen medal was one that Perkins designed just for the ladies. This is an oval-shaped, uniface Funeral Medal, created for women to wear inside in a locket or other jewelry setting.

Advertisements promoting this unique Washington Funeral Medal ran under the newspaper headline: “FOR THE LADIES” with the description: “A new impression of General Washington in the form of a miniature, calculated for the ladies and may be worn in any common size locket. Considered by those acquainted with him a very striking likeness; executed in gold, at the low price of a dollar and fifty cents.”

Demand for all Washington Funeral Medals has been on the rise in recent years, which is understandable given the multiple audiences that covet such a remarkable piece of American history. From numismatists who pursue owning trophy rarities to those collecting rare, antique jewelry to collectors of Washingtoniana, the society of collectors who pursue any and all memorabilia relating to the life and times of George Washington—these Funeral Medal survivors are highly sought after.

Today, all Washington Funeral Medals are extremely pricey and exceptionally rare. Fewer than six of the Ladies medal are believed to exist. The fact that any of these medals survived is a miracle. Survivors are truly a national treasure—a rare, early federal-era artifact that represents the magnificent story about the birth and infancy of the United States.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.