Gold Alert: Fed Meeting, Jobs Data This Week

Posted onGold prices gained modestly on Friday, boosted by news that the U.S. economy registered its slowest economic growth reading in three years, which triggered doubts over the health of the current expansion phase.

Spot gold traded up to $1,268.80 an ounce on Friday after the government reported first quarter GDP rose a weaker-than-expected 0.7%.

No government shut-down, this week: Congress on Friday passed a one-week stop-gap spending bill to avoid a partial government shutdown. The stop-gap measure keeps the government open until May 5, so fresh solutions will need to emerge this week.

Gold Market News

A number of key events lie on the docket this week that could impact the gold market including the Federal Reserve’s meeting and Friday’s release of the monthly U.S. jobs report.

1. Fed Meeting This Week

The Fed’s two-day policy setting meeting begins on Tuesday and concludes on Wednesday when the committee will release its policy statement at 2 pm.

The current Fed funds rate stands at 0.75-1.00%.

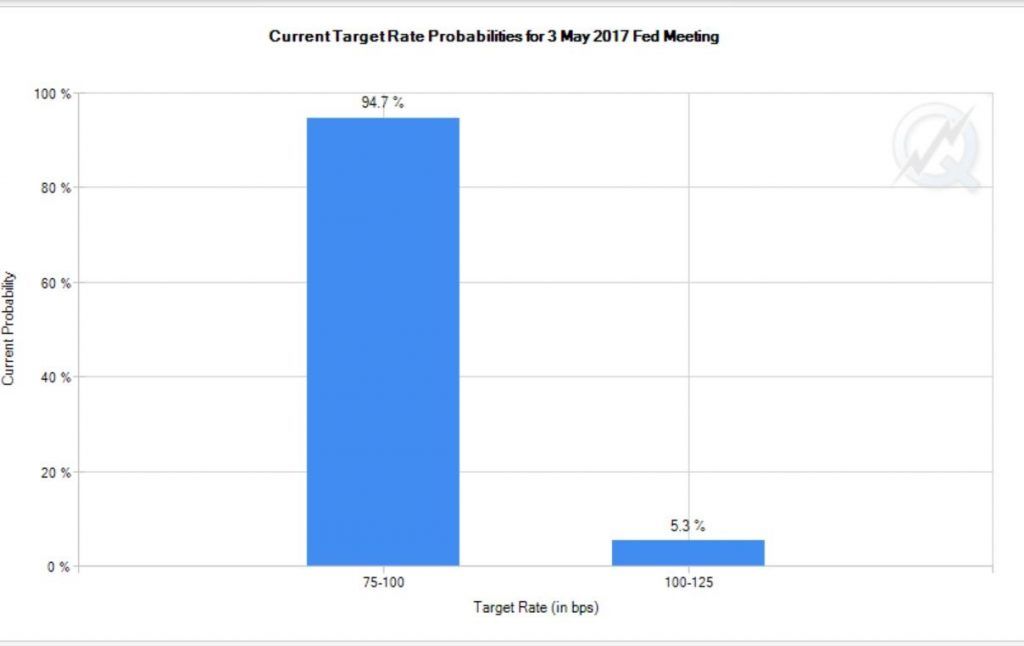

The CME FedWatch tool is a handy guide to show what the market expects to happen at Fed meetings. The chart below shows only 5.3% odds the Fed will hike interest rates to 1.00-1.25% on Wednesday.

Yes, Wall Street expects the Fed to keep policy on hold at this week’s meeting. There is no press conference scheduled or updated economic projections expected with this meeting. Economic growth and inflation data have been sluggish lately and traders will be watching for clues regarding the Fed’s next moves in the statement on Wednesday afternoon.

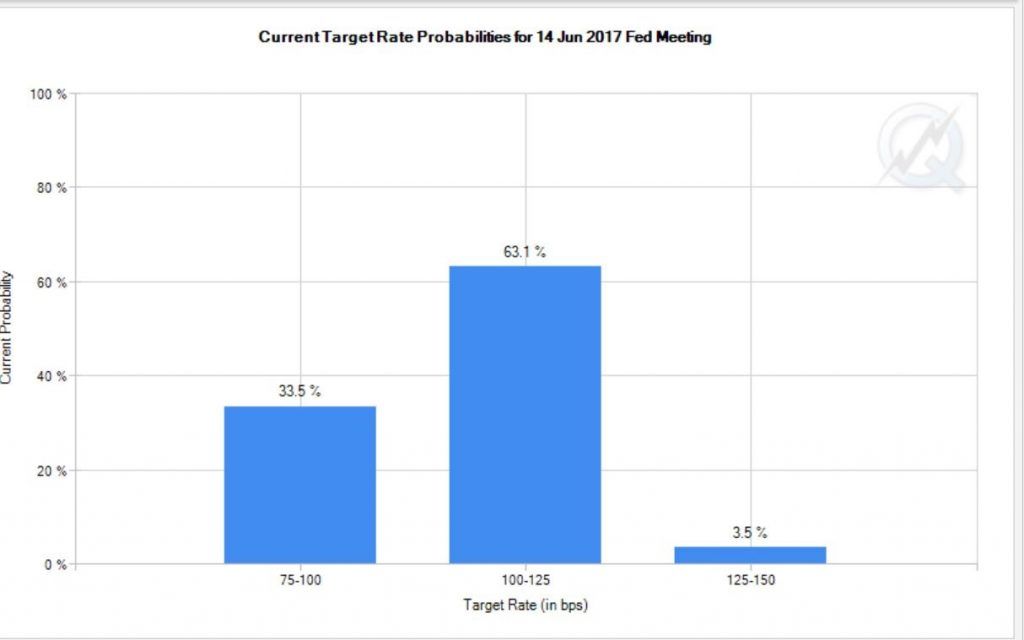

Looking ahead: the Fed meets next on June 13-14, and that meeting will be accompanied with a Summary of Economic Projections and a press conference with Fed Chair Yellen.

The picture looks very different for expectations in June. The CME FedWatch chart below shows the market is currently pricing in 63.1% odds of a rate hike next month.

2. Friday’s release of the April U.S. jobs report

After financial markets have digested any fresh news from this week’s Fed meeting, focus will turn swiftly to Friday’s release of the key U.S. employment report for April. After the surprising slowdown in March, Wall Street will be looking for payroll gains to bounce back in April. Credit Suisse forecasts a 210,000 increase in new non-farm jobs created in April.

Investor alert: If that fails to occur, it could weigh on stocks and boost gold prices.

China, Indian Buyers Scooping Up Gold Bargains

Gold investors around the globe are using current price levels in the yellow metal as a buying opportunity.

“China’s imports of gold via Hong Kong and Switzerland, surged in March. Chinese buyers tend to be price-sensitive and could have seen the correction in the price of gold at the start of March as a buying opportunity. At the same time, India’s imports of gold reached the highest level since December 2015,” according to a Capital Economics commodities note on April 28.

Current levels offer good buying opportunity: At its current $1,268 an ounce level, gold is well off its 2016 highs around $1,375 an ounce. The price trend is bullish for gold and higher prices are forecast for year-end. Now may be the best time of 2017 to scoop up gold or silver at relative bargain prices. If you are looking to diversify your portfolio with tangible assets, act now before prices move significantly higher.

How Much Gold Is Needed to Reduce Portfolio Risk?

Posted onConventional wisdom holds that including some commodities, like gold, in your portfolio reduces downside risk. Research supports this theory by illustrating that gold reduces volatility due to its lower correlation to stocks. However, recent work from Sweden reveals a surprising detail about this concept. Researchers at the Umea School of Business discovered that the optimal commodity weighting in a portfolio isn’t what most expect.

The authors used a series of statistical models relying on measurements like deviation, variation, and regression to understand how different commodity weightings reduce risk. The authors approached the study from a global perspective. In addition to the S&P 500 index, the researchers examined the Nikkei 225, which is more appropriate for Japanese investors. Other indices included in the study like the DAX 30 and Sensex relate to German and Indian investors respectively. Despite the variety of indexes used, the optimal commodity weighting was surprising across the board.

The results “imply that adding at least 49% commodity index would improve the overall performance of the portfolios.” This “improved performance” is reduced volatility and therefore lower risk. The data studied covered the period starting in January of 1997 and ending in March of 2017.

Why is this finding unexpected? Common advice suggests allocating as little as 5 – 10% towards commodities in a portfolio. For example, in a recent Charles Schwab whitepaper analysts recommended committing just 1-5% of a portfolio to precious metals. “Our results are not in line with the experts’ suggestions since we get considerably high proportions of commodities in investors’ portfolios,” explain the researchers.

Additionally, the 49% weighting is the lowest optimal amount discovered among the indices. When using the Hang Seng Hong Kong index, the researchers found the optimal weighting was a whopping 69%.

It’s important to note that these findings are relative to a portfolio consisting of just two asset classes, stocks, and commodities. Therefore, an optimal commodity weighting of 49% means holding the balance of the portfolio (51%) in stocks. The average optimal commodity index weighting across all indices was 60.5% with a balance of 39.5% in stocks.

The researchers went further and explored why the optimal weighting was so high. This question brought them to gold which “has a volatility close to the lowest one of the stock indices at same time with a noticeably high return, for all time frequencies.” All other commodities studied had higher volatilities. This finding is significant given that the commodity index used in the analysis consisted of 24 components including platinum, sugar, and cotton.

Do these results mean investors should allocate nearly half of their portfolio to gold? Perhaps not, however, the research does give reason to reconsider how powerful gold can be as part of a risk management tool in portfolio design. Gold offers not only the opportunity for substantial long-term asset growth but also stability when it’s needed most. These research results come at a critical time. Geopolitical tensions are rising, volatility is growing, and U.S. policy is an uncertain as ever.

How Does Trump’s First 100 Days Stock Rally Rate?

Posted onThe first 100 days of a new President’s administration historically has been viewed as a barometer of the type of governance that will unfold during a four-year term.

The historical comparisons harken back to the days after President Franklin D. Roosevelt took office at the height of the Great Depression. Amid economic turmoil and human hardship, the new President ultimately signed 76 bills into law in his first 100 days and ushered out his New Deal programs swiftly.

All U.S. presidents have since been compared to the accomplishments achieved by FDR in his 100 days.

President Trump will reach his 100-day mark on Saturday April 29.

How does President Trump’s first 100 days stock rally rank?

The answer may surprise you: about average.

Middle of the Pack

“The Dow over the first 100 days has been higher with the past five presidents by 4.6% on average, and the Dow is currently up 2.9% since President Trump took office. With a median return of 2.7%, this would rank near the middle of the pack for all presidents going back to 1900,” says Ryan Detrick, senior market strategist at LPL Financial.

“Most might find that surprising, but of course, much of the Trump rally took place prior to his inauguration, and those gains don’t count in this case,” Detrick says.

Stock Investors Are Losing Faith

Stock market bulls are simply running out of gas.

During the post-election rally phase, U.S. stocks priced in a significant amount of “expectations” and good news to come. To date, the new Republican controlled Congress has delivered little in the way of the economic growth boosting proposals it promised. Stocks are beginning to look heavy.

Optimism among individual investors about the short-term direction of stock prices is at a new post-election low, according to the latest American Association of Individual Investors (AAII) Sentiment Survey. (The AAII Sentiment Survey has been conducted weekly since July 1987 and asks AAII members whether they think stock prices will rise, remain essentially flat or fall over the next six months.)

Bearish sentiment, or expectations that stock prices will fall over the next six months, hit 38.7% in the AAII’s latest survey. The rise keeps pessimism at or above its historical average of 30.5% for the 10th consecutive week and the 13th out of the last 14 weeks.

Stocks Are Entering a Seasonally Weak Period

May 1 is just around the corner. You may have heard the old stock market adage: Sell in May and Go Away. The stock market historically underperforms in the May through October period. This year’s off-season for stocks could be even worse than normal. The stock market bull cycle that began in March 2009 is old and stretched by historical and valuation standards.

Act Now To Protect Your Portfolio

The dominoes are lined up and ready to tip over at any time for the stock market. The first 100 days or the so-called honeymoon period is just about to end.

Gold is a proven portfolio diversifier and typically rises significantly when stocks enter a correction or bear market. Move quickly to properly protect your assets. Contact Blanchard today at 1-800-880-4653 for a personalized portfolio review.

What’s Going on in the Markets?

Posted onIn the wake of a smorgasbord of positive earnings from a wide-range of different companies, US stocks were mostly higher for the week. Since tax reform is certainly at the top of every investor’s list, stocks were also buoyed by comments from the Treasury Secretary, Steven Mnuchin. He said that the new administration is “pretty close” to bringing forward new tax reform.

Investors interpreted this comment as bullish news since the original anticipated time frame for tax reform appeared to be several years down the pipeline. Mnuchin also noted how regulatory reduction was a top priority for the Trump administration as well.

“It looks like the Trump administration wants to reignite the market’s expectations for policies,” said Hideyuki Ishiguro, a senior strategist at Daiwa Securities with over $196 billion in assets under management. Given the markets recent sputter with news of US military strikes, this desire to refuel the investor expectation rocket certainly seems plausible. Equity markets have largely meandered and since the all-time high in the S&P 500 on March 1st. With the exception of a few surprising sell-offs, markets have yet to breakout significantly in a particular direction.

Looking overseas, The Governor of the Bank of Japan, Haruiko Kuroda, said he will keep accommodative monetary policy in place, and this caused the yen to weaken. As such, Asian equities were mostly higher on Friday as a result of Kuroda’s comments combined with the possibility of sooner-than-expected US tax reform.

Despite the end-of-week recovery, Asian equities had their biggest weekly loss of 2017 as increased regulatory scrutiny and a crackdown on leveraged trading outweighed positive economic data and comments. The looming reality of decreased market participants due to additional regulation is seen as largely bearish news, because there will be less liquidity in times of need.

In the world of commodities, crude oil suffered a stout weekly loss as US shale production continued to climb and gasoline inventories swelled. Despite positive comments from Saudi Arabia’s Energy Minister describing that a tentative deal has been made with several OPEC members to extend the production cut beyond May, it was surprisingly not enough to lift prices.

Uncertainty regarding the timeline for future policy and tax reform definitely abated this week, so gold understandably declined minimally. The yellow metal within striking distance of it’s YTD high.

From a macro view, all eyes seem to be watching the result of the first round of the French presidential election. Although the actual President of France won’t be determined until May 7th, the vote still has the possibility of sending shockwaves through markets around the world if an upset occurs.

If investors have learned one thing in the past year (between Brexit and the US election), it’s to expect the unexpected.

Insider Activity Illustrates the Value of Gold

Posted onThe equities rally is still going strong. Despite a few setbacks the S&P 500 is up 9 percent since the U.S. Presidential election. However, there is one group that hasn’t joined the party: the people running the companies. Corporate insiders are purchasing shares of their business at the slowest rate in 29 years. Meanwhile, their selling activity is above average. If investors are having such fun why are CEO’s sitting on their hands?

“The fact that we’ve gotten more selling is a sign of concern that maybe the market has gone a little too far too fast,” remarked one strategist at investment research firm Ned Davis. His comment echoes the pervasive sentiment among insiders that valuations on equities are running high.

Today, the “Buy/Sell” ratio, which compares insider buying to selling, is at the lowest rate in 29 years. This metric illustrates that insiders have muted expectations about share price growth. Insiders frequently purchase shares of their company when they believe the price is undervalued. The recent data suggests insiders have little reason to believe the share price of their companies will increase.

Nine years into the bull market some are questioning how much higher valuations can go. These questions are leading some to bolster their gold holdings. As investors become concerned with hesitant insiders, there’s renewed interest in “safe haven” assets like gold.

The term “safe haven” is a bit misleading. No asset is always safe. A risk is inherent in any investment. However, this term is fitting in the context stock market declines. Gold has often rescued investors during periods of declining S&P 500 values. This phenomenon was most apparent between 2000 and 2002 and in the period ranging from 2007 to 2009. While equities dropped 43 percent and 50 percent respectively, gold returned 16 percent and 26 percent over the same periods. Investors should view gold as part of a whole. That is, gold works best as part of a cohesive strategy. The reason: the asset helps buoy a portfolio during a downturn in equities.

Investors are beginning to mirror trepidation from insiders. Gold is now at its highest level since November. Investor purchases have driven the price up more than 11% for the year. It’s not surprising that the behavior of ordinary investors would follow insiders. CEO’s are often the first to act on available information. As the total picture of insider activity starts to develop investors eventually take note and respond accordingly.

Meanwhile, measures other than insider trading illustrate a pullback from recent optimism. The CBOE Volatility Index (VIX) or “fear gauge” grew by approximately 14% this month. This increase has put the index considerably higher that the average seen in the first quarter of this year.

These various signals are broadcasting the same message: valuations are running high, insiders are staying put, and volatility is up. This confluence of events is a reminder of how gold can buttress a portfolio if, and when, a major market downturn occurs.

This Is Your Brain on Finance

Posted onToday, investors are drowning in data. As a result, more people are resorting to the ease of intuition for a shortcut. It’s easy to see why the idea of intuition is attractive. We’re all familiar with the fun movie cliché of a detective strolling passed the police line while narrating a detailed account of a crime without any preparation. Intuition is appealing. Unfortunately, it’s also wrong most of the time.

“Behavioral finance” is a branch of psychological theory, which explores the flaws of using intuition in decisions about money. We’re all subject to these pitfalls because they’re inherent in our DNA. While scientists can identify such flaws, it’s unlikely that we’ll ever escape them. However, if we can’t avoid irrationality can we at least account for it when forecasting the market? Researchers writing for International Trade, Economics, and Finance explain why we can.

The authors of the paper “Effect of Behavioral Finance on Gold Price Trend” explore the idea that financial markets might not be as efficient as we once thought. When a market is “efficient,” it immediately responds to changes in the fundamental value of its components. That is, all stock and commodity prices always reflect all relevant information. For example, factors like consumer behavior, international economies, and quarterly earning reports all move the market as soon as they change.

There is, however, an unseen force influencing markets and you won’t find it on a balance sheet. “Financial assets appear as uncorrelated with their fundamentals,” explain the authors.

This phenomenon is evident in the gold market. The researchers aimed to factor in human psychology to more accurately predict gold price trends. Instead of relying purely on economic factors like supply and demand they include a “behavioral component for a better representation of markets reality,” to explain the “observed discrepancy between actual and expectable commodity value.”

Here’s what they found:

Several biases are in play among those investing in the market. One example cited in the paper is the “Anchoring Bias.” This term describes our tendency to rely too heavily on the first piece of information we encounter. Subsequent information, therefore, has less influence in decision-making. The researchers hypothesize that “investors under-react to analysts’ predictions.”

Meanwhile, as investors ignore such predictions, they often place too much emphasis on the prevailing mood of the market. This tendency, the “Safe Value Bias,” is characterized by the fact that “gold demand significantly correlates with markets instability.” Historically, gold has offered a low correlation to most other asset classes. Therefore, when market sentiment becomes fearful, investors turn to gold. While gold can have a stabilizing effect on a portfolio, purchasing the commodity based on short-term outlook is a flawed decision. Instead, gold should be considered a long-term investment that yields value year over year. Too often short-term purchases are driven my shortsighted thinking.

The researchers remind us that cognitive biases are ever-present when investing. Many of us can become more rational investors if we occasionally ask ourselves how emotional impulses influence our choices.

Russia Dominates In Global Gold Purchases

Posted onThe latest numbers are out and the Russian central bank continues to gobble up large amounts of gold in 2017. During the month of February, the Russians were the largest buyers in the world with official purchases totaling 10 tonnes, according to new data from the World Gold Council.

The Russian central bank has dominated global gold purchases in recent years and has built up its official gold holdings to 1,655.4 tonnes, or 16.8% of its total reserve assets, making it the seventh biggest gold owner in the world.

A Major Shift Seen In This Decade

Central banks around the world have been heavy gold buyers since the global financial crisis hit in 2008. Prior to that central banks had been net sellers of gold for nearly 20 years.

In fact, 2016, marked the seventh consecutive year that central banks were net purchasers of gold and Russia, China and Kazakhstan were the biggest buyers. Central banks have shown an insatiable appetite for gold in recent years and notably in this decade have shifted from being sellers of gold to buyers of gold.

3 Reasons Central Banks Buy Gold

Central banks purchase gold for the same reason that individual investors do:

- Portfolio Diversification. Many emerging market central banks have large foreign currency reserves in the range $200-$300 billion stored in U.S. dollar or euros. They are turning to gold as a way to reduce foreign currency reserves and the risk associated with those country-specific currencies. Central bankers see gold as an asset that can be relied upon if there is another financial crisis. Especially, in the case of emerging market central banks, which have had strong allocations to the U.S. dollar and the euro in recent years – they are looking to spread out reserve asset risk across other currencies including the Chinese renminbi, Australian dollar, Canadian dollar and gold.

- Lack of Credit Risk. There is no country-specific credit risk associated with gold.

- Liquid Asset. In times of economic crisis, paper money can shift dramatically in value, but gold has intrinsic value recognized by all nations around the globe.

A Little History

Many older industrial nations like the United States, Germany and even Italy and France possess large official gold holdings as a legacy of the gold standard years. However, emerging market central banks weren’t a part of that era, and subsequently have been under allocated to gold. Emerging market nations have been in catch-up mode in recent years as they strive to diversify their reserves away from U.S. dollars.

Since the global financial crisis hit, China, the Philippines, Mexico, Korea, Brazil and Russia have all been adding gold to increase their allocation to gold relative to foreign currencies.

China: A Big Player in Gold

Historically, 2009 stands out as a key moment for gold as that marked the year the Chinese central bank officially announced the addition of gold to its monetary reserves. In the second quarter of 2009, Chinese officials reported to the IMF an increase in its gold holdings from 599.98 tons to 1054.09 tones and they have been buying ever since. The Chinese action was the largest central bank purchase recorded in 2009. There is speculation that gold purchases and official holdings are under-reported from China and that they could be holding much greater amounts of gold in reserve.

Big Picture

Central banks continue to buy gold for their official reserves because of heightened economic and financial uncertainty. The global economy remains on very fragile ground. Yields in major industrialized economies remain historically low. The dramatic central bank monetary policy experiments post-2008 have yet to be unwound. The jury is still out on what the negative interest rates and massive balance sheet expansion will mean long-term to the value of fiat money.

Follow the Smart Money

Central banks are smart money, long-term investors. Follow the smart money and diversify your portfolio now with hard assets while gold prices remain at a relative bargain price compared to 2016 levels. Gold prices are already rising up about 9% since the start of the year. Now is the time to take action.

Markets Dump, Gold Soars

Posted onWith a shortened trading week due to a holiday, domestic equity markets closed in the red last week as more news came into the spotlight regarding renewed military action in the Middle East. This marks the second consecutive weekly loss for stocks.

On Thursday afternoon, the US announced it had deployed the largest nonnuclear bomb in history on an ISIS tunnel complex in Afghanistan. Equity markets did not react well to the news, to say the least.

The financial sector took a particularly severe hit, declining 2.6% for the week. Despite the fact that two of the largest banks in the country, JP Morgan Chase and Citigroup, both beat analysts’ expectations for revenue and adjusted earnings per share last week, both companies saw dramatic declines in their stock prices after news of the military strike in Afghanistan.

When asked if the bomb serves a message to North Korea, President Trump said, “I don’t know if this sends a message. It doesn’t make any difference if it does or not. North Korea is a problem. The problem will be taken care of.” Judging by the market reaction, investors did not interpret this as a particularly calming and reassuring statement. As such, the typical “fear asset,” gold, rapidly transformed into the biggest buying frenzy of the week.

Gold soared to its highest level of 2017 and posted its best weekly gain in almost a year. Precious metals are once again the best performing asset class of 2017, with silver and palladium topping the charts with 15.38% and 16.37% gains, respectively. Gold’s 11.36% YTD gain is finally enough to outshine the Nasdaq 100’s YTD gain of 10.22% for the first time, thereby making gold one of the top performing assets this year.

“We’re in a wait-and-see mode at the moment,” said Kate Warne, a principal and investment strategist at Edward Jones. This certainly seems to be the case as investors are facing unprecedented military and policy events left, right, and center. Moreover, going into the close, gold and volatility (as an asset class) hardly declined at all. In fact, gold rallied into the close and finished only $0.60 away from the YTD high it made early Thursday morning.

For now, it seems “the fundamentals have and will continue to drive the market,” Ms. Warne went on to say. She noted how a group of upbeat earnings reports could lift equities in the coming weeks.

However, if JPM and Citigroup are any indication of what’s to come for stocks, the outlook may not be as optimistic as the strategists ad Edward Jones would like it to be. Meaning, two of the biggest banks in the US posted incredibly positive and solid earnings, but both stocks significantly declined on news of the direct military action in Afghanistan. What does this tell investors?

Well, it has left many investors scratching their heads, because earnings can’t be any more upbeat for blue-chip companies than they were for JPM and Citigroup. Therefore, if declining markets are the reaction to upbeat earnings reports, what will the market reaction will be if a collection of earnings reports are not upbeat? This is the scary reality facing investors today.

This possibility, combined with the potential for more news of US military strikes and stone-cold tensions with North Korea could easily worsen the existing equity market sell-off and instigate a completely uncontrolled tailspin that simultaneously sends precious metals into even more of a buying frenzy.

GFMS Report: Black Swan Events Support Gold Demand

Posted onThe gold market has been on a tear, recently climbing to a fresh 5-month high. Investors around the globe are pouring into gold as a safe-haven asset.

Some may wonder if gold is overpriced at current levels following the recent gains. To the contrary, most professional investors believe the gold market is going to continue higher from here.

At the end of March, Thomson Reuters GFMS released its Gold Survey 2017, which analyzes developments in the gold market and looks at the trend for prices. Here are the main findings of the report.

The GFMS team sees continued demand for gold as a safe-haven investment especially around two key potential “Black Swan” events – unforeseen events that disrupt and shock financial markets. Here’s two they highlighted:

- Anti-EU election result in one of the European nations.

- Unorthodox policies adopted by President Trump

Other potential black swan events include:

- U.S. equity market downturn

- Risk aversion due to heightened geopolitical tensions

Analysts say if any of these events unfold gold prices are expected to move significantly higher.

4 More Gold Bullish Factors

Central Banks continue to buy gold. In 2016, central buyers were net buyers of gold for the seventh year in a row. GFMS forecasts 250 tonnes of central bank gold purchases in 2017. Russia is expected to lead in purchases, with China closely behind it.

Wealthy Chinese citizens are buying physical gold. Another highly respected gold organization also released its 2017 outlook recently. The consultancy Metals Focus said in its Gold Focus 2017 report that China’s private gold investment rose in 2016. This includes wealthy households, family offices, and professional investors who wanted protection from the weakening Chinese currency and diversification following the January 2016 crash in the Shanghai and Shenzhen stock market.

Real interest rates are negative. The Metals Focus report called the U.S. Federal Reserve’s policies “gold friendly,” as it fails to keep pace from inflation. The authors emphasized the importance of “real interest rates.”

Real interest rate = interest rate minus the rate of inflation

U.S. CPI numbers have climbed above the Fed’s target rate. On a year-over-year basis, the March consumer price index showed a 2.4% gain and that compares to the Fed funds rate currently at 0.75-1.00%.

Key takeaway: the U.S. real interest rate is negative right now.

The supply/demand forecasts for 2017 show a deficit. That means higher gold prices ahead.

Is your portfolio properly diversified? Many Blanchard clients are choosing to re-balance their portfolios and trim equity exposure following the first quarter rally in stocks. They are shifting a portion of those profits into physical gold and silver. Contact Blanchard for a personalized portfolio review at 1-800-880-4653.

Two Points for Triangulating Gold’s Future

Posted onIt’s difficult to forecast the movement of gold because of so many factors influence prices. However, can the multitude of data points, in fact, be an advantage to analysts? The answer might be yes.

Triangulation is the process of determining an unknown location by using two known points. Surveyors often use this method to orient themselves. From two points, they identify their position by creating a triangle. This technique of using relative measurements offers interesting implications for gold investors. Amid the spectrum of data, are there two key points that can help forecast the future of gold? Perhaps two pieces of information about today and tomorrow can help place gold’s future.

Today: Geopolitical Uncertainty

Markets and the world continue to wait and wonder about the fate of global politics. Brexit awoke many to the fact that the unexpected can happen. Reinforcing this lesson was the election of Trump. Polls and media outlets initially dismissed the candidate. Today, many are questioning if expectations of globalism are misplaced.

In France, populist candidate Marine Le Pen is tied with independent candidate Emmanuel Macron to win the first-round vote on April 23rd. Le Pen’s well-publicized ambitions to pull out of the eurozone echo Britain’s latest move. Meanwhile, U.S. strikes against Syria have left many on both sides unclear on Trump’s international stance.

How has this uncertainty influenced gold? “Gold prices shot to their highest level in five months,” reported The Wall Street Journal just days ago. While that movement is short-term, there is reason to believe the trend could continue. Elections and international policy continue to steer us away from globalism. As a result, renewed interest in gold and its identity as a hedge may boost prices.

As senior asset strategist with NN Investment Partners remarked: “Over longer periods, correlation between broad commodity prices and policy uncertainty is low to slightly negative.” However, he pointed out that “exceptions include precious metals with a more pronounced positive correlation.”

Tomorrow: Mining Industry

The nationalistic stance of our leaders today is mirrored in the mining industry of tomorrow. “Many governments have not softened their stances around resource nationalism,” remarked authors of an industry report from Deloitte. This isolation slows supply growth because countries are unwilling to grant permits for mining operations. The Deloitte report laments the burden of taxes, fees, and royalties on miners. Increasingly, miners are learning that gold is more expensive to source.

Compounding these balance sheet problems are labor issues. Countries rich with potential for miners are hesitant to engage in a relationship. The reason: countries see mining firms as exploitative of the workforce. “It doesn’t help that mining company taxes do not translate into direct infrastructure investments, making it difficult for many stakeholders to understand the real contribution miners are making in their communities,” explains the same report.

Some have suggested that miners should return more wealth to the countries in which they’re operating. Others urge miners to engage host countries in a dialogue about long-term benefits to GDP resulting from resource extraction. While some of these ideas may work, they will require time to implement. Additionally, more time will be needed to see the results of these new efforts. In the meantime, demand will outstrip supply and prices are likely to rise.

Both recent geopolitical uncertainty and long-term mining woes underpin a bullish outlook on gold as an investment for the future. These two separate points help locate where gold may go in the years or even decades to come.