Two Points for Triangulating Gold’s Future

Posted onIt’s difficult to forecast the movement of gold because of so many factors influence prices. However, can the multitude of data points, in fact, be an advantage to analysts? The answer might be yes.

Triangulation is the process of determining an unknown location by using two known points. Surveyors often use this method to orient themselves. From two points, they identify their position by creating a triangle. This technique of using relative measurements offers interesting implications for gold investors. Amid the spectrum of data, are there two key points that can help forecast the future of gold? Perhaps two pieces of information about today and tomorrow can help place gold’s future.

Today: Geopolitical Uncertainty

Markets and the world continue to wait and wonder about the fate of global politics. Brexit awoke many to the fact that the unexpected can happen. Reinforcing this lesson was the election of Trump. Polls and media outlets initially dismissed the candidate. Today, many are questioning if expectations of globalism are misplaced.

In France, populist candidate Marine Le Pen is tied with independent candidate Emmanuel Macron to win the first-round vote on April 23rd. Le Pen’s well-publicized ambitions to pull out of the eurozone echo Britain’s latest move. Meanwhile, U.S. strikes against Syria have left many on both sides unclear on Trump’s international stance.

How has this uncertainty influenced gold? “Gold prices shot to their highest level in five months,” reported The Wall Street Journal just days ago. While that movement is short-term, there is reason to believe the trend could continue. Elections and international policy continue to steer us away from globalism. As a result, renewed interest in gold and its identity as a hedge may boost prices.

As senior asset strategist with NN Investment Partners remarked: “Over longer periods, correlation between broad commodity prices and policy uncertainty is low to slightly negative.” However, he pointed out that “exceptions include precious metals with a more pronounced positive correlation.”

Tomorrow: Mining Industry

The nationalistic stance of our leaders today is mirrored in the mining industry of tomorrow. “Many governments have not softened their stances around resource nationalism,” remarked authors of an industry report from Deloitte. This isolation slows supply growth because countries are unwilling to grant permits for mining operations. The Deloitte report laments the burden of taxes, fees, and royalties on miners. Increasingly, miners are learning that gold is more expensive to source.

Compounding these balance sheet problems are labor issues. Countries rich with potential for miners are hesitant to engage in a relationship. The reason: countries see mining firms as exploitative of the workforce. “It doesn’t help that mining company taxes do not translate into direct infrastructure investments, making it difficult for many stakeholders to understand the real contribution miners are making in their communities,” explains the same report.

Some have suggested that miners should return more wealth to the countries in which they’re operating. Others urge miners to engage host countries in a dialogue about long-term benefits to GDP resulting from resource extraction. While some of these ideas may work, they will require time to implement. Additionally, more time will be needed to see the results of these new efforts. In the meantime, demand will outstrip supply and prices are likely to rise.

Both recent geopolitical uncertainty and long-term mining woes underpin a bullish outlook on gold as an investment for the future. These two separate points help locate where gold may go in the years or even decades to come.

What Happens When a $1.88 Trillion Player Enters the Gold Market?

Posted onEarly in 2017, The World Gold Council (WGC) published a report forecasting changes in the gold market. Now, with the first quarter at a close, we’re beginning to see how these projections are unfolding.

The authors were optimistic about the growing global interest in gold. Moreover, increased access, they argue, will empower nascent markets to become significant gold purchasers. “Gold is becoming more mainstream,” the WGC writes. They explain that in the previous decade gold ETFs created easy access for investors. However, in the coming years, other markets will become key players leading to “structurally higher demand.” The WGC forecasts that while China and Japan will drive demand, the biggest player might be the Muslim market. Here’s why:

In November of 2016 newly enacted Shariah-compliant regulations made gold an acceptable investment in Islamic finance. The Accounting and Auditing Organization for Islamic Financial Institutions values this industry at $1.88 trillion. The move is expected to unleash pent-up demand among the world’s 1.6 billion Muslim population.

That total represents nearly 25 percent of the planet.

“This is a ground-breaking initiative for Islamic investors and for the gold industry at large,” remarked the CEO of WGC. Data from the Islamic Finance Stability Board indicates that Shariah-compliant assets under management will grow to US$6.5 trillion by 2020. The WGC explains “just a 1% allocation to gold would equate to nearly US$65 billion or 1,700 tonnes in new demand.” Only four months have passed since the ruling, but the market is already experiencing some encouraging signs. Gold is up 10.75 percent for the year. It’s still early to know to what extent the growth comes from this new market, but the forecast remains encouraging.

In the meantime, gold purchases in other nations remain equally robust. As volatility in the equity market grows, investors are seeking haven instruments to preserve wealth. Increasing instability within the White House is a contributing factor. “Faith in the Trump trade is shaken,’’ remarked the head of global interest-rate strategy at TD Securities.

Additionally, China has a growing appetite for the commodity. In recent years ordinary investors have been able to purchase gold through a new investment product affordably. “Gold Accumulation Plans” on the Shanghai Gold Exchange create a dollar averaging system for making regular investments in gold. It’s reasonable to estimate that this innovation has contributed to the furious pace of purchases within the country.

These changes from the Accounting and Auditing Organization for Islamic Financial Institutions illustrate the global underpinnings of the gold market. As gold ETFs become Shariah-compliant, we’re likely to see gold prices increase further. We’ve previously discussed why ETFs lack benefits of owning physical gold. However, the ease of purchasing these funds for Islamic investors taking advantage of the ruling may very well rally prices.

Investment decisions, especially commodities, are best viewed from an international perspective. The return on investment goes beyond the inherent value. Mining, geopolitical events and now an entirely new market are all weighing in on long-term price appreciation.

Gold Soars To 5-Month High on Syrian Strike, Weak Jobs Report

Posted onGold prices skyrocketed to a five-month higher on Friday in a traditional flight-to-safety move after President Trump ordered a U.S. missile strike on a Syrian air base in retaliation for a chemical weapons attack on Syrian citizens.

Market Reaction

- Gold: The gold market tacked on additional gains on Friday after the Labor department reported a mere 98,000 new jobs were created in March, dramatically lower than the 175,000 new jobs expected by economists.

Safe-haven buying and ideas that the weak jobs report could delay or slow future Fed interest rate hikes propelled spot gold to an intraday high at $1,272.10 an ounce, a five month high.

- Stocks: The broad stock market swung slightly higher and fell to a modestly lower close Friday. Defense stocks were big winners as shares of Raytheon, Lockheed Martin, and Northrop Grumman closed out with strong gains.

- Crude Oil: The potential for additional escalation in Syria also sent crude oil prices sharply higher on Friday, which is also supportive to the gold market from an inflationary perspective. Crude oil spiked higher amid concerns that President Trump could be now taking a more interventionist approach to the region and if conflict were to spread to Iraq it could disrupt crude oil production.

Rising Risks on the Horizon

Rising geopolitical uncertainty and concerns about cracks in the economic picture have created fresh investor appetite for gold. Increasing tensions with North Korea and upcoming French elections are boosted demand for gold as a safe-haven investment.

Potential Conflict with Russia

The U.S. missile strike against Syria puts the U.S. relationship with Russia at risk. On Friday, Russian President Vladimir Putin called the missile strike President Trump ordered against Syria “an act of aggression against a sovereign state delivered in violation of international law under a far-fetched pretext.” Also Russia initiated an emergency meeting of the United Nations Security Council to discuss the incident. On Friday afternoon it was reported that Russian warships were steaming toward the U.S. Navy warships that launched the Syrian attack.

Meeting with Chinese Leader

Also on the radar, on Monday financial markets will be digesting any fall-out from the weekend meeting between Chinese President Xi Jinping and President Trump, which concludes on Saturday.

Good Buying Levels Are Seen Now

Gold slipped off its highs on Friday, pressured in part by strength in the U.S. dollar. Current levels continue to offer investors a relative bargain compared to prices recorded in 2016.

Last July, gold prices traded as high as the $1,390 an ounce level. Precious metals traders are monitoring the $1,265 an ounce level closely and sustained strength above that zone could be the green light for another strong rally wave in the yellow metal with the $1,300 level as the next bullish chart objective.

Middle East and Russian tensions are rising. Missiles are flying and the economic picture may not be as strong as Fed officials believed earlier.

How much of your portfolio is invested in stocks? Financial advisors warn that holding too much of your assets in stocks could leave you exposed to more risk and volatility than you may be comfortable with.

Take the time to assess your risk tolerance level. Research has shown that diversifying a portfolio with up to 20% of precious metals exposure can reduce volatility and produce better longer-term returns. Plus, you may be able to sleep better at night knowing that your portfolio is properly diversified.

Are you ready to protect your assets? Contact Blanchard today for a free, personalized portfolio review at 1-800-880-4653.

Some Lawmakers Seek to End Capital Gains Tax on Gold

Posted onA tax on capital gains from the sale of gold is a tax on inflation. That sentiment is the underpinning of Republican Ron Paul’s arguments for a gold tax exemption in Arizona. The 2014 bill comes from Rep. Mark Finchem.

Paul urged the state Senate in Arizona to tax citizens “more honestly” while arguing that it’s unfair to punish people for attempting to safeguard against inflation.

The argument is timely. In February consumer inflation exceeded the Federal Reserve’s targeted annual gain of 2%. The trend marks a welcome departure from the unemployment and excess capacity that slowed the economy in previous years. Fed Chairwoman Janet Yellen was clear in her March press conference. “We expect core inflation to move up,” she remarked.

The importance of this 2% milestone is significant. The U.S. still experiences reverberations from the global financial crisis nearly a decade later. Inflation has been below 2% since May of 2012. Many gold purchasers keep a close eye on such figures. Gold has become more attractive for investors in our low-rate environment. It’s easier for investors to ignore interest-bearing instruments for gold when yields are depressed. Moreover, recent equity market volatility amid a tumultuous new administration will likely invigorate interest in gold. There is no perfect inverse relationship between stocks and gold. However, the commodity is useful as a diversification strategy. “You need to have the insurance when the fire happens,” remarked the CEO of one gold ETF firm.

Paul, however, met with resistance while testifying before the Senate Finance Committee. Democratic Senator Steve Farley from Tucson dismissed statements from Paul calling the measure merely a “tax giveaway to coin collectors.”

The pivot point in the debate centers on face value. While Paul argued that it’s illogical to tax money, Farley countered that a coin with a $20 face value is worth far more today. Speculators who are choosing gold as an investment, he claims, should be taxed just like those owning stocks and bonds. Paul maintained that stocks and bonds are different because they aren’t money. It appears the argument did not convince Farley.

The debate illustrates two different perspectives. Farley contends that over the decades gold has risen in value. Paul, however, remains firm that the inherent value of a gold coin is unchanged. Paul believes that the price appreciation of a coin is merely a relative measure; the coin hasn’t increased in value. Instead, paper money has dropped he argues.

Beneath the philosophical musings of Paul and Farley are likely more pragmatic impulses. Perhaps Paul and his constituents have personal financial stakes in the outcome of a lesser tax burden. Meanwhile, Farley, if ultimately unsuccessful may see a significant drop in state tax receipts.

The bill passed the House and eventually received a 4-3 vote approval in the Senate Finance Committee. The next hurdle will be the full Senate where some remain opposed. Similar measures have seen success in other states. In March of this year, the Idaho House of Representatives voted to end all state taxation on gold and silver by a 56-13 margin.

The Blanchard Economic Update – April 2017

Posted onThe “animal spirits” are alive and well in the U.S. economy in early 2017. Economist John Maynard Keynes pointed to so-called animal spirits to describe how emotion and instinct guide human decisions, which can drive (or contract) overall economic activity.

Despite the political turmoil in Washington, the U.S. economy continues to chug along in its eighth year of expansion. The U.S. economy is projected to grow at 2.3% pace in 2017, according to S&P Global forecasts and the Federal Reserve is expected to raise interest rates two more times this year, pushing the benchmark fed funds rates to 1.25-1.50% by December.

Metals Produce Out sized Returns

The precious metals markets trounced equities in the first quarter 2017 as palladium and silver delivered out sized returns. Global investors continue to pour money into precious metals amid growing uncertainty over the scope and size of Trump Administration proposals regarding tax cuts and infrastructure spending.

Here’s a quick snapshot of market returns through March 31, 2017:

Palladium + 16.70%

Silver + 13.80%

Gold + 8.06%

Platinum + 4.69%

S&P 500 + 5.53

Data source: barchart.com, CNN Money

Here is a look at six economic indicators gold investors should consider now.

1. The Labor Market Is Hot

Employers continue to pump out new jobs and 235,000 new non-farm jobs were created in February. The so-called “Quit Rate,” which represents the number of workers who quit their jobs each month and is considered a gauge of confidence in the labor market matched its post-crisis high at 2.2% in January.

2. Inflation Hits 5-Year High

The Federal Reserve’s “preferred” inflation gauge – the personal consumption expenditures index hit a 2.1% annualized reading in February, the highest level since March 2012 for that price measure.

3. Stock Market: The stock market is overstretched, and overvalued.

- Equity Market Risk: Extremely High – especially once the seasonally weak May-November stock market period

“Price-to-earnings (PE) ratios look stretched relative to historical ratios. The widely used cyclically adjusted Shiller PEratio is 28x, well above the pre-crisis peak and not far off the average dot-com bubble levels of around 34x. Forward PE ratios also are well above their historical average,” according to Standard and Poor’s.

4. Consumer Spending

Cracks in the picture have emerged on the consumer side in recent months. U.S. consumer spending fell in February, with weather and delayed tax refunds weighing on the consumer. In February, consumer spending fell 0.1%, following a 0.2% decline in January. The February decline leaves real consumer spending up only 0.5% on an annualized three-month basis, which is the weakest since 2013.

5. Eye on Washington

In the wake of the failed attempt to repeal and replace the Affordable Care Act, the Republicans are shifting their focus to tax reform. The size and scope of the package that is passed will be important to financial markets. The stock market has already priced in expectations of significant tax reform that will boost corporate earnings growth down the road.

6. Federal Debt and Deficit

The federal debt has increased substantially over the past decade and as a share of GDP is the highest since 1948. Additionally, federal deficits and debt are expected to increase further in coming years, Nomura says.

Investing Insights

The current environment includes many political and economic risks. Inflation is rising. The stock market is vulnerable to a sell-off and uncertainty remains high regarding the future of the European Union as France readies for a new presidential vote in April and May.

Gold and silver prices are trading well below their 2016 price highs. Current levels represent a relative bargain for long-term investors seeking effective portfolio diversification. Investing in physical tangible assets, including gold and silver, reduces overall portfolio volatility especially during times of severe stock market stress. Call Blanchard at 1-800-880-4653 for a personalized portfolio review.

As The First Quarter Ends, Here’s What to Expect in Q2

Posted onThe first fiscal quarter of 2017 officially ended on Friday of last week as US equities posted another solid weekly and monthly gain. Despite the longer-term trend of decent gains, equities around the world were mostly mixed during trading on Friday.

For equities in Asia, Hong Kong’s Hang Seng Index was down 0.78%, while Japan’s benchmark Nikkei 225 was down 0.81% for the day. Trading was not much better in Europe either, as London’s FTSE 100 closed down 0.63% for the day.

Analysts are attributing the lackluster final day of Q1 trading to the incredibly persistent political and economic uncertainty that started late last year and has ceased to abate. This is especially the case for equities in Europe, as British Prime Minister Theresa May signed and invoked Article 50 and officially started Brexit.

From when the article was invoked on Wednesday of last week, there are now less than two years and counting before the UK physically withdraws from the EU. In spite of the 24-month time-frame before any changes are felt, the signing of Article 50 seemed to unnerve some investors.

In terms of commodities, crude oil is back above $50 per barrel and ended with a sizable weekly gain of over 5.50%. Gold and silver are slightly negative for the month, but both metals posted an impressive gain of over 8% and 13%, respectively, for the first quarter.

Coming off a failed health-care reform attempt last week and a subsequent market sell-off of equities and other risk assets, investors looked towards economic data this week to gauge the direction of the economy.

Because of this, overall investor worry (measured by the VIX index) declined last week after a multitude of outstanding economic data was released. In fact, equities rallied nicely on Tuesday after consumer confidence exploded to the highest level since 2001. Domestic equities continued their gradual upward drift throughout the week.

As the second quarter is now here, so is a new earnings season. Judging by the surprisingly upbeat economic data released in the past few weeks, it’s safe to say market participants will not be overly shocked to see companies releasing solid earnings. If earnings reports are strong, markets will, as a result, edge higher. Earnings reports are only released four times per year, and they are one of the major drivers of overall market direction.

But many investors are not so sure Q2 will be full of rainbows and sunshine. With political uneasiness that just refuses to go away, apprehensions about the market are commonplace. Moreover, margin debt, or the amount of money retail and institutional investors borrow against their brokerage accounts for additional buying power, hit an all-time high in February.

This means market participants are using a lot of leverage with the expectation that prices will rise. If, however, prices fall dramatically, things could turn sour very quick due to the unprecedented level of leverage.

All-time market highs, all-time margin debt, and shocking political upsets (Brexit and the US election) all occurred during Q1, defying almost everyone’s expectations. So what does Q2 hold for the markets? The simple answer is: it’s anyone’s guess.

Gold Climbs: Inflation Hits Fed’s Target

Posted onThe government doesn’t need to tell you that prices are rising on just about everything. Anyone who pays rent, buys health insurance or has a kid in college knows that prices have been rising in recent years.

Government inflation figures have been low in recent years, but finally, the official numbers are catching up to the reality consumers face each day.

The Federal Reserve’s “preferred” inflation gauge – the personal consumption expenditures index hit a 2.1% annualized reading in February, the Commerce Department reported Friday. That is the highest level since March 2012 for that price measure and now exceeds the Fed’s stated 2% inflation target.

Gold prices climbed on Friday gaining strength after a Federal Reserve official reiterated that it made sense to raise interest rates at a gradual pace in 2017. Spot gold traded up to $1,248.20 an ounce on Friday, up from $1,150 per ounce at the start of the year. Gold traditionally outperforms during inflationary periods and will continue to gain support as rising price pressures continue to spread throughout the economy.

Fed Officials Not In a Rush

The Federal Reserve’s forecast of two more interest rate hikes this year seems reasonable, New York Fed President William Dudley said on Friday in an interview with Bloomberg TV. The Fed president is a voting member of the Fed’s monetary policy committee. Gold prices gathered strength from these comments.

That follows a speech on Thursday where Dallas Fed President Rob Kaplan also reiterated a patient approach to raising rates in an interview with MarketWatch. The federal funds rate stands a historically ultra-low rate of 0.75-1.00% right now, which remain an extremely accommodative stance.

Oil Prices Jump

In related market action, the price of crude oil, another closely watched inflation gauge, surged last week, as June Comex crude oil futures climbed from $47.63 a barrel to $50.92. The price of oil gained amid renewed fighting in Libya, which disrupted oil production there and amid speculation that OPEC members will extend their output cuts beyond the current June deadline. Rising oil prices tend to feed inflationary pressures throughout the entire economy, and are considered to be gold-bullish.

Big Picture

The gold market raked in gains of roughly 8% in the first quarter 2017, boosted by the weaker dollar and concerns surrounding President Trump’s proposals for new tax cuts and infrastructure spending.

Looking Ahead: Challenges In D.C.

Market watchers are keeping a close eye on developments on Capitol Hill. Optimism that President Trump can push through his legislative agenda is waning following the recent failed attempt to “repeal and replace” the Affordable Care Act, or Obamacare. This calls into question the extent and success the Republicans may have on key tax cut and infrastructure spending bills.

“President Donald Trump has already run into difficulty in implementing his initiatives, most notably the judicial blocking of two executive orders on immigration and the failure of House Republicans’ plan to repeal and replace the Affordable Care Act (ACA). It’s not hard to imagine that he may find it hard to push through the sweeping tax reforms he has promised,” says Beth Ann Bovino, U.S. chief economist at S&P Global Ratings.

“The Trump presidency is off to a slow start and is inexperienced in getting legislation passed. The administration has been slow to put critical staff in place and has largely left legislative strategy to the Republican leadership in Congress. Looking ahead, it now seems much less likely that the President and the Republican-led Congress will be able to fully implement their ambitious agenda,” adds Mark Doms, senior economist at Nomura.

Market watchers are rolling back the size and scope of their expectations for new policy initiatives. “In our baseline forecast, a tough legislative environment reduces chances of seeing a comprehensive tax reform pass Congress. The White House and Congress will likely cut their losses and instead push through a simple across-the-board reduction in personal income and corporate tax rates – worth $500 billion, with just about equal shares of cuts to households and corporations – by the end of 2017 while letting the deficit rise somewhat on the insistence that faster growth will pay for the tax cuts in the 10-year budget horizon,” Bovino says.

What It Means For Markets

The stock market has rallied significantly in recent months boosted by expectations of a number of these key policy proposals becoming reality. If scaled back legislation is passed, the stock market will be vulnerable to an adjustment lower.

The stock market is ripe for a so-called “Second Half Fade.” Typically gold rallies strongly when equities fall in a corrective phase or bear market. Gold prices are a relative bargain now compared to the highs seen in 2016. If stocks begin to reverse lower, gold prices could shoot higher.

Is your portfolio properly diversified? Protection – in the form of gold diversification – is relatively cheap now, but could quickly become more expensive once the stock market turns.

Managing Volatility With Gold

Posted onIt’s been said that the market can manage bad news; It’s the uncertainty that kills. For investors, uncertainty carries the name volatility. In recent months volatility, as seen by the CBOE “Fear Index,” has been flat. This calm presumably permits investors to embrace the market rally without trepidation, right? Maybe not.

There is an unseen phenomenon at work. “Days when the VIX or VStoxx goes up have normally in the past been days when the stock market falls, as higher expected volatility shows more risk is anticipated,” remarks Wall Street Journal Author James Mackintosh. However, “That link has partially broken down, with stock prices often rising when implied volatility rises.” This bravado among investors may be explained by blindness to volatility because “big swings by sectors within the S&P 500 have largely offset each other,” explains Mackintosh.

Volatility is rising even if the VIX isn’t.

Such nascent volatility underscores the need for investors to remain proactive in their risk mitigation. Gold has shown effectiveness in achieving this end. Research from BlackRock dating back to 1994 illustrates that “In months when volatility rose, gold outperformed the S&P 500 price return by roughly 2% on average.” This relationship amplifies during periods of excessive volatility. That is when the VIX rises above already heightened levels gold becomes an even more effective hedge. The same data from BlackRock shows that when the VIX pushes north of 20 gold delivered performance 5% above the S&P 500. These are valuable lessons for investors who, perhaps unknowingly, rest their portfolio above a fault line in the U.S. and global economy.

Additional research has reinforced the connection between gold and periods of heightened investor anxiety. There is a clear correlation between the price of gold and the spread between the 3-month interbank rate and the 3-month T-Bill rate. The divergence of the interbank rate and the T-Bill rate is called the “TED Spread.” The measurement is an internationally accepted gauge of credit risk in the overall economy. An increasing ‘TED’ spread indicates greater risk in the market. Decades of measurements show that as credit risk grows gold rises thereby proving its hedge characteristics. Periods of pronounced uncertainty elucidate this correlation particularly “in the 1970s when massive spikes in the ‘Ted’ spread were associated with sharp rises in gold,” according to research from Oxford Economics. This same body of research determined that gold “has a zero or negative correlation with other assets, so its inclusion in the portfolio reduces the overall volatility.” The authors posit that even an allocation of 5% towards gold in a portfolio allows investors to benefit from the stability offered by an asset that responds differently to market conditions.

Investing is a long game. However, in the long-term volatility is inevitable. Investors are wise to embrace this truth rather than fight it. The smart way to withstand the rise and fall of the market is to buttress your portfolio with a diverse asset allocation that ventures beyond the traditional mix of stocks and bonds. Historically, gold fulfills this role by rising amid periods of anxiety and uncertainty. As topics like overvaluation in the equities market continue to escalate, it seems likely that gold will once again prove its mettle.

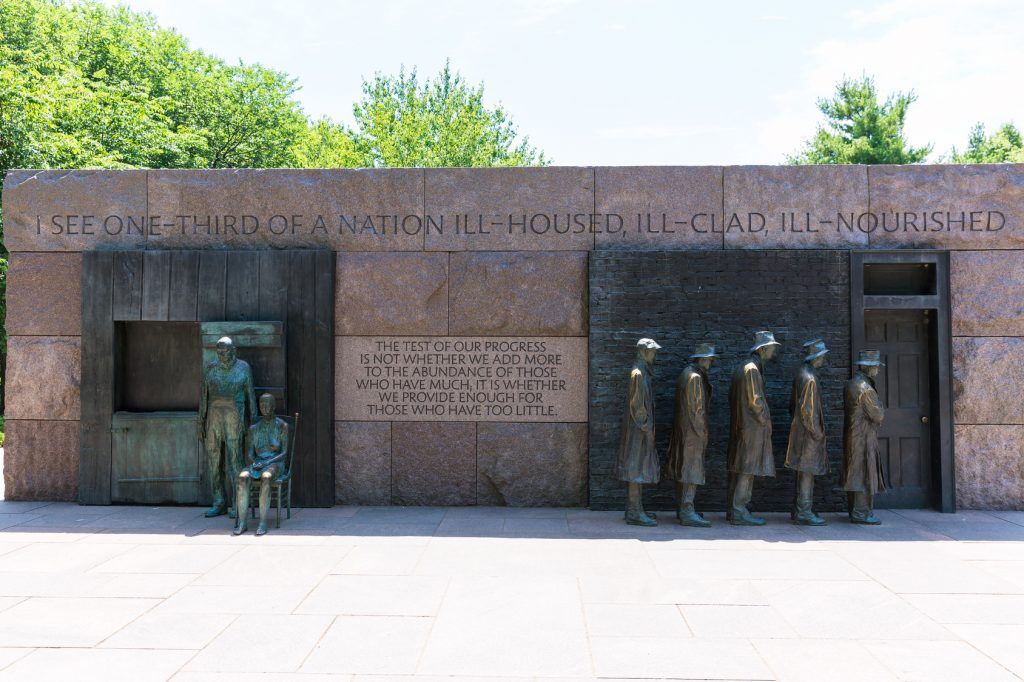

Lessons Learned From the Great Depression and the 2008 Financial Crisis

Posted onIt may be a foreign thought that at one point American’s weren’t allowed to own gold. But, as recently as 1973, the American government banned individual gold ownership. Here is the story of how that unfolded.

It was a time of panic and fear. In 1933, the Great Depression had triggered a severe banking crisis. A growing number of banks were failing. A significant number of institutions shut their doors, leading to a reduction in the overall money supply and slowing commerce and economic activity even further. President Franklin D. Roosevelt knew he had to act.

Fearful Americans had been flocking to Federal Reserve banks to convert their paper money to gold. This sparked a massive outflow of gold from the Federal Reserve as individuals revealed their preference to hold physical gold over paper money.

Amid concerns that the Federal Reserve Bank of New York could no longer honor its commitment to convert paper money to gold, President Roosevelt declared a banking holiday in March 1933. He then issued an Executive Order requiring all Americans to surrender all the gold they owned to a Federal Reserve bank and then prohibited the private holdings of all gold coins and bullion.

Our Proud History

Blanchard and Company has deep roots in America’s gold history. In the early 1970’s, one of our company’s founders – Jim Blanchard– rose to prominence as a supporter of American’s right to own gold. Blanchard gained national attention when he arranged for a biplane to tow a banner proclaiming “Legalize Gold” over President Richard Nixon’s inauguration in January 1973.

Blanchard’s lobbying efforts were a success and after more than 40 years, Congress once again legalized private ownership of gold bullion, effective Dec. 31, 1974. Once gold restrictions were lifted, Blanchard founded our company in 1975, building it into one of the nation’s largest and most respected tangible asset investments firms.

Lessons from the Depression – Impact Still Seen Today

During the most recent global financial crisis that occurred in 2008, then Federal Reserve Chairman Ben Bernanke, who was a keen student of Great Depression history, relied on lessons learned during that period to implement his then controversial measures. The Great Depression lasted a decade beginning in 1929 and ending during World War II.

Former Fed Chair Bernanke publicly acknowledged in a 2002 speech that central bankers exacerbated the tight credit conditions of the time and made the Depression last longer. The Federal Reserve actually raised interest rates in 1928 and 1929. The goal was to limit speculation in the equity markets, but the end result was that it slowed economic activity.

Today, the U.S. economy continues to be on the mend from the economic damage that occurred during the 2008 global financial crisis and the Federal Reserve still hasn’t normalized interest rates.

A Quick Look Back

The implosion on Wall Street began in mid-September 2008. Historic and unprecedented moves unfolded which dramatically changed the nature of the U.S. banking and financial system. The week of September 15, 2008 has been etched in the financial history books, with some of the largest upheavals ever seen. The week started with the Fannie Mae and Freddie Mac takeover, the Lehman bankruptcy, and the AIG bailout, and ended with the introduction of massive government legislation to buy the “toxic” mortgage debt. The ensuing global financial crisis took its toll on economies around the world and the global economy is still attempting to climb back to growth levels seen before 2008.

While Bernanke has had many critics in recent years, there are others who credit him as a knight in shining armor who rode in aggressively and saved the U.S. economy from the brink of a second Great Depression. Bernanke specifically pointed to the mistakes central bankers made around the Great Depression and did just the opposite. He tugged interest rates to near zero and flooding the financial system with huge amounts of liquidity.

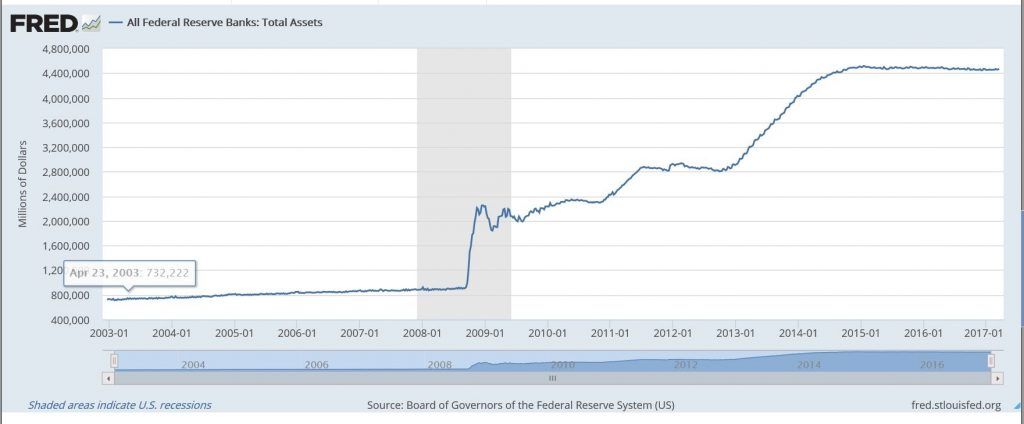

In November 2008, the Fed announced they would go to unconventional policies with Large Scale Asset Purchases (LSAP). It was totally unprecedented in Fed history; there was never anything on that scale before. That was just the beginning, as the first quantitative easing (QE) program was established in December 2008 and added to in March 2009, followed by QE2 in November 2010. In September 2012, the Fed announced open ended purchases of $85 billion per month.

Fast Forward to Today

The Fed’s balance sheet stands at around $4.5 trillion. This needs to be unwound and normalized. The Federal Reserve is still navigating in completely uncharted waters. The risk remains that at some point this massive money supply translates into runaway inflation. See Figure 1 below:

While some say that Ben Bernanke may have staved off a second Great Depression, there remains significant challenges ahead for central bankers, who have to unwind the massive amount of liquidity injected into circulation without triggering inflation.

Gold has been rallying in recent years amid concerns about the global central banker’s experiments. While the economy may be growing, the final chapter has not yet closed on how the Federal Reserve will unwind its massive expanse of money supply. This remains one of the many factors that supports the price of gold ahead.

Equities Finally Dive as Investors Move to Precious Metals

Posted onLast week was not a good week for US equities, to say the least. Tuesday saw the first intraday decline of more than 1% since the beginning of the year.

After a record breaking period of low volatility and market complacency, investors were rapidly caught off guard when the major benchmark indices in the US sharply sold off by more than 1% Tuesday morning on fears that the new health-care bill might fail to pass The House of Representatives.

The possibility of a failed vote “adds to concerns that Trump lacks enough house support (even among Republicans) and that he may struggle to get approval for all the stimulus policies he pledged,” analysts at Accendo Markets told clients in a note this week. This means tax-cuts and financial regulation reform could take longer than expected, and high hopes for these changes indubitably contributed to the market rally since Trump’s victory.

Equities were mixed the remainder of the week and, again, suffered sharp sell-off attempts on Thursday as news broke that the healthcare vote would be delayed until Friday. On Friday, GOP leaders shocked investors as they pulled the bill in the final few minutes of equity index trading.

This time, however, the breaking news from the GOP of the pulled bill led to a recovery of Friday’s losses.

Presumably, from a political standpoint, a pulled healthcare deal was better than a failed healthcare deal, and this logic was the impetus behind the last-minute decision. Regardless, it helped investors as equities recouped their intraday losses of 0.50% when the Associated Press reported the decision.

Looking overseas, the US health-care vote and its corresponding volatility had a surprising impact on Europe and Asia where stocks mostly declined, led by financial and energy shares.

London’s FTSE 100 logged its worst week since January, declining more than 1.1% for the week.

Whenever sharp down moves occur in the stock market and volatility increases, investors usually flock to the haven of precious metals. This is precisely what happened last week as gold had its best gain since Brexit.

Gold for April delivery gained more than 4% in six days as the reality of partisan politics finally hit investors. “Trump has so far failed to follow up on any of his grand announcements,” said analysts from Commerzbank AG.

Although gold stumbled in the last 30 minutes of trading on Friday after news broke that the healthcare bill was pulled and stocks rallied, gold is showing a lot of strength and continuing to hang around the $1250 level.

The failed health-care vote was the first real test since the beginning of the year of the robustness of lofty equity valuations versus the fundamental demand of gold, and by the looks of it, the battle is just beginning.