The Blanchard Economic Update – April 2017

Posted on — Leave a commentThe “animal spirits” are alive and well in the U.S. economy in early 2017. Economist John Maynard Keynes pointed to so-called animal spirits to describe how emotion and instinct guide human decisions, which can drive (or contract) overall economic activity.

Despite the political turmoil in Washington, the U.S. economy continues to chug along in its eighth year of expansion. The U.S. economy is projected to grow at 2.3% pace in 2017, according to S&P Global forecasts and the Federal Reserve is expected to raise interest rates two more times this year, pushing the benchmark fed funds rates to 1.25-1.50% by December.

Metals Produce Out sized Returns

The precious metals markets trounced equities in the first quarter 2017 as palladium and silver delivered out sized returns. Global investors continue to pour money into precious metals amid growing uncertainty over the scope and size of Trump Administration proposals regarding tax cuts and infrastructure spending.

Here’s a quick snapshot of market returns through March 31, 2017:

Palladium + 16.70%

Silver + 13.80%

Gold + 8.06%

Platinum + 4.69%

S&P 500 + 5.53

Data source: barchart.com, CNN Money

Here is a look at six economic indicators gold investors should consider now.

1. The Labor Market Is Hot

Employers continue to pump out new jobs and 235,000 new non-farm jobs were created in February. The so-called “Quit Rate,” which represents the number of workers who quit their jobs each month and is considered a gauge of confidence in the labor market matched its post-crisis high at 2.2% in January.

2. Inflation Hits 5-Year High

The Federal Reserve’s “preferred” inflation gauge – the personal consumption expenditures index hit a 2.1% annualized reading in February, the highest level since March 2012 for that price measure.

3. Stock Market: The stock market is overstretched, and overvalued.

- Equity Market Risk: Extremely High – especially once the seasonally weak May-November stock market period

“Price-to-earnings (PE) ratios look stretched relative to historical ratios. The widely used cyclically adjusted Shiller PEratio is 28x, well above the pre-crisis peak and not far off the average dot-com bubble levels of around 34x. Forward PE ratios also are well above their historical average,” according to Standard and Poor’s.

4. Consumer Spending

Cracks in the picture have emerged on the consumer side in recent months. U.S. consumer spending fell in February, with weather and delayed tax refunds weighing on the consumer. In February, consumer spending fell 0.1%, following a 0.2% decline in January. The February decline leaves real consumer spending up only 0.5% on an annualized three-month basis, which is the weakest since 2013.

5. Eye on Washington

In the wake of the failed attempt to repeal and replace the Affordable Care Act, the Republicans are shifting their focus to tax reform. The size and scope of the package that is passed will be important to financial markets. The stock market has already priced in expectations of significant tax reform that will boost corporate earnings growth down the road.

6. Federal Debt and Deficit

The federal debt has increased substantially over the past decade and as a share of GDP is the highest since 1948. Additionally, federal deficits and debt are expected to increase further in coming years, Nomura says.

Investing Insights

The current environment includes many political and economic risks. Inflation is rising. The stock market is vulnerable to a sell-off and uncertainty remains high regarding the future of the European Union as France readies for a new presidential vote in April and May.

Gold and silver prices are trading well below their 2016 price highs. Current levels represent a relative bargain for long-term investors seeking effective portfolio diversification. Investing in physical tangible assets, including gold and silver, reduces overall portfolio volatility especially during times of severe stock market stress. Call Blanchard at 1-800-880-4653 for a personalized portfolio review.

As The First Quarter Ends, Here’s What to Expect in Q2

Posted on — Leave a commentThe first fiscal quarter of 2017 officially ended on Friday of last week as US equities posted another solid weekly and monthly gain. Despite the longer-term trend of decent gains, equities around the world were mostly mixed during trading on Friday.

For equities in Asia, Hong Kong’s Hang Seng Index was down 0.78%, while Japan’s benchmark Nikkei 225 was down 0.81% for the day. Trading was not much better in Europe either, as London’s FTSE 100 closed down 0.63% for the day.

Analysts are attributing the lackluster final day of Q1 trading to the incredibly persistent political and economic uncertainty that started late last year and has ceased to abate. This is especially the case for equities in Europe, as British Prime Minister Theresa May signed and invoked Article 50 and officially started Brexit.

From when the article was invoked on Wednesday of last week, there are now less than two years and counting before the UK physically withdraws from the EU. In spite of the 24-month time-frame before any changes are felt, the signing of Article 50 seemed to unnerve some investors.

In terms of commodities, crude oil is back above $50 per barrel and ended with a sizable weekly gain of over 5.50%. Gold and silver are slightly negative for the month, but both metals posted an impressive gain of over 8% and 13%, respectively, for the first quarter.

Coming off a failed health-care reform attempt last week and a subsequent market sell-off of equities and other risk assets, investors looked towards economic data this week to gauge the direction of the economy.

Because of this, overall investor worry (measured by the VIX index) declined last week after a multitude of outstanding economic data was released. In fact, equities rallied nicely on Tuesday after consumer confidence exploded to the highest level since 2001. Domestic equities continued their gradual upward drift throughout the week.

As the second quarter is now here, so is a new earnings season. Judging by the surprisingly upbeat economic data released in the past few weeks, it’s safe to say market participants will not be overly shocked to see companies releasing solid earnings. If earnings reports are strong, markets will, as a result, edge higher. Earnings reports are only released four times per year, and they are one of the major drivers of overall market direction.

But many investors are not so sure Q2 will be full of rainbows and sunshine. With political uneasiness that just refuses to go away, apprehensions about the market are commonplace. Moreover, margin debt, or the amount of money retail and institutional investors borrow against their brokerage accounts for additional buying power, hit an all-time high in February.

This means market participants are using a lot of leverage with the expectation that prices will rise. If, however, prices fall dramatically, things could turn sour very quick due to the unprecedented level of leverage.

All-time market highs, all-time margin debt, and shocking political upsets (Brexit and the US election) all occurred during Q1, defying almost everyone’s expectations. So what does Q2 hold for the markets? The simple answer is: it’s anyone’s guess.

Gold Climbs: Inflation Hits Fed’s Target

Posted on — Leave a commentThe government doesn’t need to tell you that prices are rising on just about everything. Anyone who pays rent, buys health insurance or has a kid in college knows that prices have been rising in recent years.

Government inflation figures have been low in recent years, but finally, the official numbers are catching up to the reality consumers face each day.

The Federal Reserve’s “preferred” inflation gauge – the personal consumption expenditures index hit a 2.1% annualized reading in February, the Commerce Department reported Friday. That is the highest level since March 2012 for that price measure and now exceeds the Fed’s stated 2% inflation target.

Gold prices climbed on Friday gaining strength after a Federal Reserve official reiterated that it made sense to raise interest rates at a gradual pace in 2017. Spot gold traded up to $1,248.20 an ounce on Friday, up from $1,150 per ounce at the start of the year. Gold traditionally outperforms during inflationary periods and will continue to gain support as rising price pressures continue to spread throughout the economy.

Fed Officials Not In a Rush

The Federal Reserve’s forecast of two more interest rate hikes this year seems reasonable, New York Fed President William Dudley said on Friday in an interview with Bloomberg TV. The Fed president is a voting member of the Fed’s monetary policy committee. Gold prices gathered strength from these comments.

That follows a speech on Thursday where Dallas Fed President Rob Kaplan also reiterated a patient approach to raising rates in an interview with MarketWatch. The federal funds rate stands a historically ultra-low rate of 0.75-1.00% right now, which remain an extremely accommodative stance.

Oil Prices Jump

In related market action, the price of crude oil, another closely watched inflation gauge, surged last week, as June Comex crude oil futures climbed from $47.63 a barrel to $50.92. The price of oil gained amid renewed fighting in Libya, which disrupted oil production there and amid speculation that OPEC members will extend their output cuts beyond the current June deadline. Rising oil prices tend to feed inflationary pressures throughout the entire economy, and are considered to be gold-bullish.

Big Picture

The gold market raked in gains of roughly 8% in the first quarter 2017, boosted by the weaker dollar and concerns surrounding President Trump’s proposals for new tax cuts and infrastructure spending.

Looking Ahead: Challenges In D.C.

Market watchers are keeping a close eye on developments on Capitol Hill. Optimism that President Trump can push through his legislative agenda is waning following the recent failed attempt to “repeal and replace” the Affordable Care Act, or Obamacare. This calls into question the extent and success the Republicans may have on key tax cut and infrastructure spending bills.

“President Donald Trump has already run into difficulty in implementing his initiatives, most notably the judicial blocking of two executive orders on immigration and the failure of House Republicans’ plan to repeal and replace the Affordable Care Act (ACA). It’s not hard to imagine that he may find it hard to push through the sweeping tax reforms he has promised,” says Beth Ann Bovino, U.S. chief economist at S&P Global Ratings.

“The Trump presidency is off to a slow start and is inexperienced in getting legislation passed. The administration has been slow to put critical staff in place and has largely left legislative strategy to the Republican leadership in Congress. Looking ahead, it now seems much less likely that the President and the Republican-led Congress will be able to fully implement their ambitious agenda,” adds Mark Doms, senior economist at Nomura.

Market watchers are rolling back the size and scope of their expectations for new policy initiatives. “In our baseline forecast, a tough legislative environment reduces chances of seeing a comprehensive tax reform pass Congress. The White House and Congress will likely cut their losses and instead push through a simple across-the-board reduction in personal income and corporate tax rates – worth $500 billion, with just about equal shares of cuts to households and corporations – by the end of 2017 while letting the deficit rise somewhat on the insistence that faster growth will pay for the tax cuts in the 10-year budget horizon,” Bovino says.

What It Means For Markets

The stock market has rallied significantly in recent months boosted by expectations of a number of these key policy proposals becoming reality. If scaled back legislation is passed, the stock market will be vulnerable to an adjustment lower.

The stock market is ripe for a so-called “Second Half Fade.” Typically gold rallies strongly when equities fall in a corrective phase or bear market. Gold prices are a relative bargain now compared to the highs seen in 2016. If stocks begin to reverse lower, gold prices could shoot higher.

Is your portfolio properly diversified? Protection – in the form of gold diversification – is relatively cheap now, but could quickly become more expensive once the stock market turns.

Managing Volatility With Gold

Posted on — Leave a commentIt’s been said that the market can manage bad news; It’s the uncertainty that kills. For investors, uncertainty carries the name volatility. In recent months volatility, as seen by the CBOE “Fear Index,” has been flat. This calm presumably permits investors to embrace the market rally without trepidation, right? Maybe not.

There is an unseen phenomenon at work. “Days when the VIX or VStoxx goes up have normally in the past been days when the stock market falls, as higher expected volatility shows more risk is anticipated,” remarks Wall Street Journal Author James Mackintosh. However, “That link has partially broken down, with stock prices often rising when implied volatility rises.” This bravado among investors may be explained by blindness to volatility because “big swings by sectors within the S&P 500 have largely offset each other,” explains Mackintosh.

Volatility is rising even if the VIX isn’t.

Such nascent volatility underscores the need for investors to remain proactive in their risk mitigation. Gold has shown effectiveness in achieving this end. Research from BlackRock dating back to 1994 illustrates that “In months when volatility rose, gold outperformed the S&P 500 price return by roughly 2% on average.” This relationship amplifies during periods of excessive volatility. That is when the VIX rises above already heightened levels gold becomes an even more effective hedge. The same data from BlackRock shows that when the VIX pushes north of 20 gold delivered performance 5% above the S&P 500. These are valuable lessons for investors who, perhaps unknowingly, rest their portfolio above a fault line in the U.S. and global economy.

Additional research has reinforced the connection between gold and periods of heightened investor anxiety. There is a clear correlation between the price of gold and the spread between the 3-month interbank rate and the 3-month T-Bill rate. The divergence of the interbank rate and the T-Bill rate is called the “TED Spread.” The measurement is an internationally accepted gauge of credit risk in the overall economy. An increasing ‘TED’ spread indicates greater risk in the market. Decades of measurements show that as credit risk grows gold rises thereby proving its hedge characteristics. Periods of pronounced uncertainty elucidate this correlation particularly “in the 1970s when massive spikes in the ‘Ted’ spread were associated with sharp rises in gold,” according to research from Oxford Economics. This same body of research determined that gold “has a zero or negative correlation with other assets, so its inclusion in the portfolio reduces the overall volatility.” The authors posit that even an allocation of 5% towards gold in a portfolio allows investors to benefit from the stability offered by an asset that responds differently to market conditions.

Investing is a long game. However, in the long-term volatility is inevitable. Investors are wise to embrace this truth rather than fight it. The smart way to withstand the rise and fall of the market is to buttress your portfolio with a diverse asset allocation that ventures beyond the traditional mix of stocks and bonds. Historically, gold fulfills this role by rising amid periods of anxiety and uncertainty. As topics like overvaluation in the equities market continue to escalate, it seems likely that gold will once again prove its mettle.

Lessons Learned From the Great Depression and the 2008 Financial Crisis

Posted on — Leave a commentIt may be a foreign thought that at one point American’s weren’t allowed to own gold. But, as recently as 1973, the American government banned individual gold ownership. Here is the story of how that unfolded.

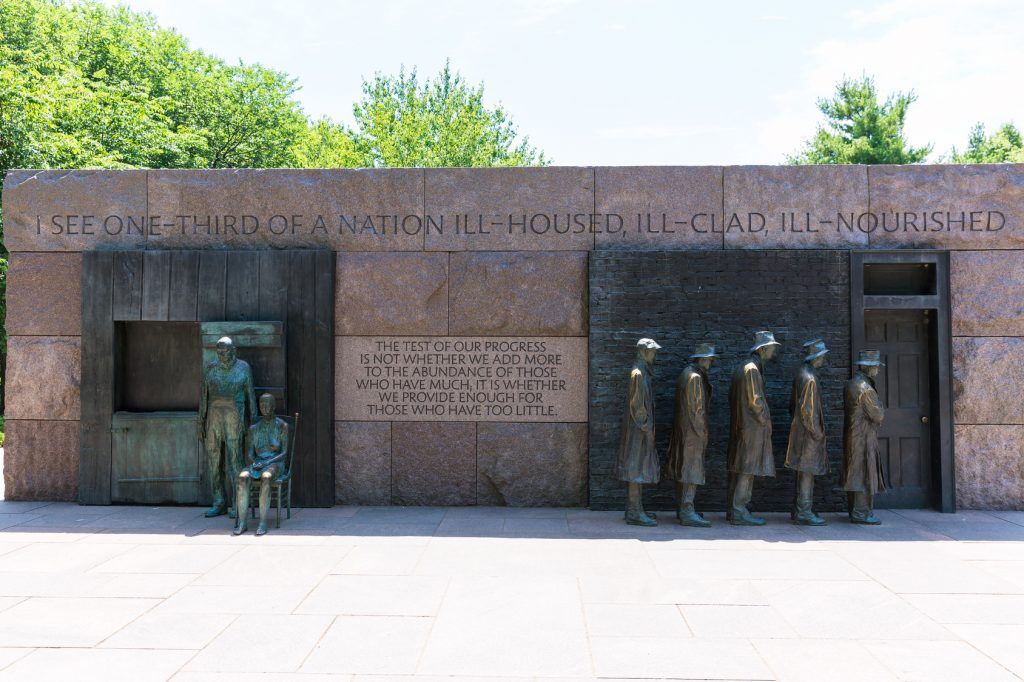

It was a time of panic and fear. In 1933, the Great Depression had triggered a severe banking crisis. A growing number of banks were failing. A significant number of institutions shut their doors, leading to a reduction in the overall money supply and slowing commerce and economic activity even further. President Franklin D. Roosevelt knew he had to act.

Fearful Americans had been flocking to Federal Reserve banks to convert their paper money to gold. This sparked a massive outflow of gold from the Federal Reserve as individuals revealed their preference to hold physical gold over paper money.

Amid concerns that the Federal Reserve Bank of New York could no longer honor its commitment to convert paper money to gold, President Roosevelt declared a banking holiday in March 1933. He then issued an Executive Order requiring all Americans to surrender all the gold they owned to a Federal Reserve bank and then prohibited the private holdings of all gold coins and bullion.

Our Proud History

Blanchard and Company has deep roots in America’s gold history. In the early 1970’s, one of our company’s founders – Jim Blanchard– rose to prominence as a supporter of American’s right to own gold. Blanchard gained national attention when he arranged for a biplane to tow a banner proclaiming “Legalize Gold” over President Richard Nixon’s inauguration in January 1973.

Blanchard’s lobbying efforts were a success and after more than 40 years, Congress once again legalized private ownership of gold bullion, effective Dec. 31, 1974. Once gold restrictions were lifted, Blanchard founded our company in 1975, building it into one of the nation’s largest and most respected tangible asset investments firms.

Lessons from the Depression – Impact Still Seen Today

During the most recent global financial crisis that occurred in 2008, then Federal Reserve Chairman Ben Bernanke, who was a keen student of Great Depression history, relied on lessons learned during that period to implement his then controversial measures. The Great Depression lasted a decade beginning in 1929 and ending during World War II.

Former Fed Chair Bernanke publicly acknowledged in a 2002 speech that central bankers exacerbated the tight credit conditions of the time and made the Depression last longer. The Federal Reserve actually raised interest rates in 1928 and 1929. The goal was to limit speculation in the equity markets, but the end result was that it slowed economic activity.

Today, the U.S. economy continues to be on the mend from the economic damage that occurred during the 2008 global financial crisis and the Federal Reserve still hasn’t normalized interest rates.

A Quick Look Back

The implosion on Wall Street began in mid-September 2008. Historic and unprecedented moves unfolded which dramatically changed the nature of the U.S. banking and financial system. The week of September 15, 2008 has been etched in the financial history books, with some of the largest upheavals ever seen. The week started with the Fannie Mae and Freddie Mac takeover, the Lehman bankruptcy, and the AIG bailout, and ended with the introduction of massive government legislation to buy the “toxic” mortgage debt. The ensuing global financial crisis took its toll on economies around the world and the global economy is still attempting to climb back to growth levels seen before 2008.

While Bernanke has had many critics in recent years, there are others who credit him as a knight in shining armor who rode in aggressively and saved the U.S. economy from the brink of a second Great Depression. Bernanke specifically pointed to the mistakes central bankers made around the Great Depression and did just the opposite. He tugged interest rates to near zero and flooding the financial system with huge amounts of liquidity.

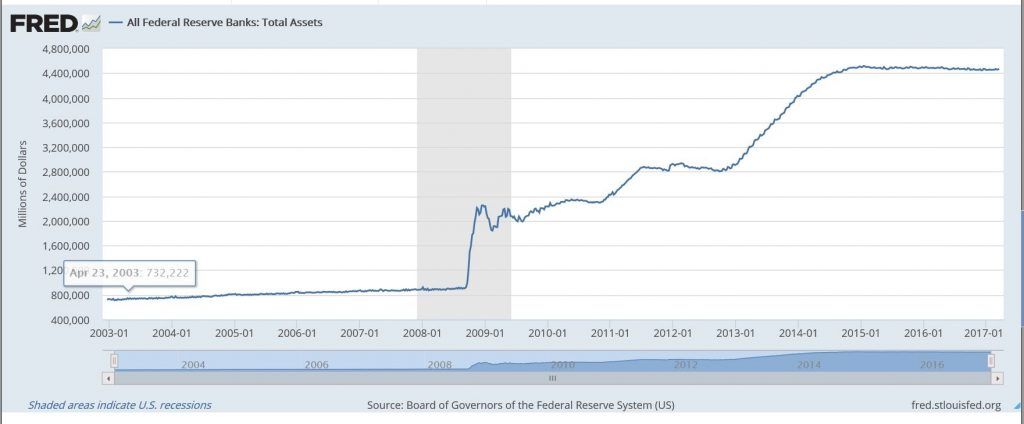

In November 2008, the Fed announced they would go to unconventional policies with Large Scale Asset Purchases (LSAP). It was totally unprecedented in Fed history; there was never anything on that scale before. That was just the beginning, as the first quantitative easing (QE) program was established in December 2008 and added to in March 2009, followed by QE2 in November 2010. In September 2012, the Fed announced open ended purchases of $85 billion per month.

Fast Forward to Today

The Fed’s balance sheet stands at around $4.5 trillion. This needs to be unwound and normalized. The Federal Reserve is still navigating in completely uncharted waters. The risk remains that at some point this massive money supply translates into runaway inflation. See Figure 1 below:

While some say that Ben Bernanke may have staved off a second Great Depression, there remains significant challenges ahead for central bankers, who have to unwind the massive amount of liquidity injected into circulation without triggering inflation.

Gold has been rallying in recent years amid concerns about the global central banker’s experiments. While the economy may be growing, the final chapter has not yet closed on how the Federal Reserve will unwind its massive expanse of money supply. This remains one of the many factors that supports the price of gold ahead.

Equities Finally Dive as Investors Move to Precious Metals

Posted on — Leave a commentLast week was not a good week for US equities, to say the least. Tuesday saw the first intraday decline of more than 1% since the beginning of the year.

After a record breaking period of low volatility and market complacency, investors were rapidly caught off guard when the major benchmark indices in the US sharply sold off by more than 1% Tuesday morning on fears that the new health-care bill might fail to pass The House of Representatives.

The possibility of a failed vote “adds to concerns that Trump lacks enough house support (even among Republicans) and that he may struggle to get approval for all the stimulus policies he pledged,” analysts at Accendo Markets told clients in a note this week. This means tax-cuts and financial regulation reform could take longer than expected, and high hopes for these changes indubitably contributed to the market rally since Trump’s victory.

Equities were mixed the remainder of the week and, again, suffered sharp sell-off attempts on Thursday as news broke that the healthcare vote would be delayed until Friday. On Friday, GOP leaders shocked investors as they pulled the bill in the final few minutes of equity index trading.

This time, however, the breaking news from the GOP of the pulled bill led to a recovery of Friday’s losses.

Presumably, from a political standpoint, a pulled healthcare deal was better than a failed healthcare deal, and this logic was the impetus behind the last-minute decision. Regardless, it helped investors as equities recouped their intraday losses of 0.50% when the Associated Press reported the decision.

Looking overseas, the US health-care vote and its corresponding volatility had a surprising impact on Europe and Asia where stocks mostly declined, led by financial and energy shares.

London’s FTSE 100 logged its worst week since January, declining more than 1.1% for the week.

Whenever sharp down moves occur in the stock market and volatility increases, investors usually flock to the haven of precious metals. This is precisely what happened last week as gold had its best gain since Brexit.

Gold for April delivery gained more than 4% in six days as the reality of partisan politics finally hit investors. “Trump has so far failed to follow up on any of his grand announcements,” said analysts from Commerzbank AG.

Although gold stumbled in the last 30 minutes of trading on Friday after news broke that the healthcare bill was pulled and stocks rallied, gold is showing a lot of strength and continuing to hang around the $1250 level.

The failed health-care vote was the first real test since the beginning of the year of the robustness of lofty equity valuations versus the fundamental demand of gold, and by the looks of it, the battle is just beginning.

Is Your Portfolio Ready for the Second Half “Fade”?

Posted on — Leave a commentIs the equity market bull beginning to crack?

Last week, on March 21, the S&P 500 experienced its first 1%+ closing decline since October as the market tumbled 1.25% at the final bell and dragged 10 if its 11 sectors down with it.

There is a growing chorus on analysts on Wall Street who are warning about the potential for a stock market retrenchment ahead. “Our analysis suggests it is likely the S&P 500 rally will fade in the second half of this year as concerns over wage inflation in 2018 and possible Fed rate action may create equity headwinds,” said Scott Wren, senior global equity strategist at Wells Fargo Investment Institute.

What Lies Ahead For Stocks

First-quarter 2017 S&P 500 earnings season starts during the week of April 10, and the “Sell in May and Go Away Period” will begin April 30.

The May through October period are notoriously the bleakest months of the year for the U.S. stock market. Most of the market’s infamous stock market crashes have occurred during September and October.

After decades of historical research, the folks at The Stock Trader’s Almanac discovered that most market gains occur during the months November through April.

“Since 1950 the DJIA is up 7.4% on average during the Best Six Months November-April, while it is up only 0.4% during the worst six months May-October.” – Stock Trader’s Almanac.

What drives this phenomenon? It’s driven by the annual business cycle and the fact that Wall Street business activity dries up during the summer months from Memorial Day- Labor Day as well as the impact of quarterly portfolio adjustments of fund managers, according to the Stock Trader’s Almanac.

The “E” Needs To Catch Up With the “P”

The stock market is about to face a flurry of first quarter earnings news, as well, during a time of historically expensive stock prices. The S&P 500 is currently trading at a Price/Earnings ratio of 19.5 which is a 13% premium to its median average since 1988. That’s expensive and underscores how the recent stock market gains since Election Day have put the cart before the horse.

“The stock market rally over the last several months had been built on the notion that President Trump would come in, pass sweeping pro-business reforms and launch infrastructure spending programs quickly and efficiently and with little opposition, boosting corporate earnings this year,” says Colin Cieszynski, chief market strategist, at CMC Markets.

“These dreams, however, are starting to run into reality and because of this, stocks are starting to crumble. The tipping point appears to be the ongoing debate over health care reform. The inability of Republicans to agree among themselves has spooked traders concerned that tax reform may also be more difficult to achieve than previously thought with border taxes particularly contentious,” Cieszynski adds.

Gold Benefits From Save Haven Buying

The growing political risk in the United States has sparked a flight of capital and gold is benefitting as a safe haven. The outlook for gold, silver and other precious metals remains bullish. Gold and silver prices are climbing and we are likely seeing the lowest price points for buyers in 2017 right now.

Two “Outside” Markets Gold Investors Should Watch

Posted on — Leave a commentThere is an old saying among traders: No market trades in a vacuum. Just like economies are interrelated in today’s global economy, various markets rise and fall and impact each other.

If you are investing in gold, there are two other markets you could consider keeping an eye on as well. These two markets can offer clues regarding the direction that gold (and other precious metals) are heading and the potential strength of that trend. Here they are:

1. Dollar Index

Many traders like to keep an eye on the U.S. dollar index as a proxy for whether the U.S. currency is strengthening or weakening.

The U.S. dollar index is a “basket” of six component currencies,

which includes the euro, the Japanese yen, the British pound, Canadian

dollar, Swedish krona and Swiss franc. The euro takes the biggest chunk

of the U.S. dollar index, accounting for 58%, which does give it some

outsize influence. The yen is the next biggest weight at 14%.

The U.S. conducts plenty of trade with both the Euro zone and Japan, which does make this a useful index. There are some currencies left out (Chinese yuan, Mexico peso and Korean won) and the U.S. does do a lot of business with these countries. But, from a trading signal standpoint, traders tend to rely on the U.S. Dollar index when it comes to gold.

Why this matters to gold? The short answer is that gold tends to have an inverse relationship to the U.S. dollar index. The simple reason is that gold is bought and sold on world markets in U.S. dollars. A rising U.S. dollar trend makes gold more expensive to foreign buyers and tends to weigh on demand.

2. Crude Oil

The price of a barrel of crude oil can be important indicator for the gold market as well. The trend in crude oil prices is one factor (but certainly not the whole picture), which impacts the trend of inflation or higher prices.

Energy prices are a major component for inflation with a “trickle-down” impact throughout our economy. If the price of a barrel of crude oil is trending higher, that makes gasoline at the pump more expensive for consumers. But, it goes much farther beyond that. Just think of jet fuel for cargo and delivery (FedEx and UPS), and passenger airplanes and diesel fuel for trucks. Rising crude means higher transportation costs for everything. The food that is trucked across country. The boxes of goods that are delivered to your local Target store via truck. The price of your plane ticket to visit your new grandchild.

Rising transportation costs affect just about every area of the economy and those costs are passed along to consumers in the form of higher prices. Gold is a traditional inflation hedge and rising inflation is a supportive factor to the gold market.

Typical Relationship

Crude Oil Up = Gold Up

Crude Oil Down = Can be a gold-negative or neutral

Not all market relationships are 100% correlated all of the time. Relationships do break down. But, these are two of the general outside markets that can influence the price of gold.

Market Snapshot Now:

- S. Dollar Index – from its 2017 peak to trough, the U.S. dollar index is down 4.42%

- Crude Oil – From its 2015 low at $26.05 per barrel, crude oil skyrocketed 112% to its 2017 high at $55.24 per barrel.

How Gold Avoids The Market Psychology Undermining Equities

Posted on — Leave a commentAmid continued outperformance, everyone is asking the same question: Can stocks go higher? Many believe they can, in fact, continue their ascent. The problem? This growth is widely thought to come from investor euphoria rather than sound, long-term fundamentals. “The market’s not really worth more, but exuberant buyers will chase shares higher anyway,” theorizes The Wall Street Journal.

However, many are happy to accept any explanation because, after all, growth is welcome whether it comes from the balance sheet or the psyche. However, growth emerging from investor psychology is tenuous. Gold is different. There are no earning calls or strategic press releases. The value is intrinsic. Shares emerge from boardrooms, but gold emerges from the Earth. This difference is critical to understanding why gold enjoys a degree of freedom from the psychological underpinnings of the stock market.

“You’re not making it as an investor,” remarks the founder of Yardeni Research. “You’re making it as a speculator,” he warns. Valuations continue to perplex experts struggling to reconcile outsized stock prices with the voracious appetite of investors. One theory: investors are wholeheartedly buying into some of the recent positive notes on the economy. Examples include data from the University of Michigan citing year-over-year increases in the Index of Consumer Sentiment, and the Index of Consumer Expectations. These are positive numbers to be sure but are the rooted in any inherent value within the economy or stock market, perhaps not.

Shares of publicly traded companies are based in confidence much like the dollars used to purchase them. This trust is waning. Over the last century gold has proven more valuable than all the key currencies. The primary reason for this trend “is that the available supply of gold changes little over time – growing only 2% per year through mine production,” according to the World Gold Council. Conversely, fiat currencies are merely printed. Bonds face a similar problem; they can just be issued at will and are backed only by faith in the underwriting institution. Moreover, rising interest rates undermine the efforts of those turning to bonds as a means of mitigating risk. Combine these factors with a slowing rate of productivity within the U.S., and you have elevated risk in portfolios traditionally considered diversified.

Gold enjoys more practical uses than paper. The metal serves a critical application in electronics, medicine, and aerospace. This ‘real world’ characteristic of the asset is becoming more important as wealth in equities continues to mount atop a loose structure of great expectations.

The fact remains: equities are an invention of man and man is beset by cognitive biases giving way to irrationality. One such bias, herd behavior, tells us how today’s investors are succumbing to impracticality. Herd behavior is characterized by individuals making choices designed to mimic the crowd despite the fact that if they were to act independently, they might choose another option. There are reasons to believe such a phenomenon is unfolding in the market today. Could this same bias drive gold up? Yes, gold can also rise and fall at the whims of our psychological flaws. However, when it comes to gold, these changes don’t alter the fundamental truth that it is a finite resource. As a result the value linked to it will always be more firmly fixed to reality.

Since first coined in Asia Minor in 600 B.C. gold has been accepted as currency around the world. Today, the global supply could fit in a cube less than 70 feet wide, small enough to fit in a baseball infield. Perhaps the best reason to own the metal is the fact that we cannot change the total of its availability.

Fed Hikes Rates, As Expected

Posted on — Leave a commentWhat did not come as a surprise to markets around the world, the Federal Open Market Committee hiked their benchmark lending rate last week by 25 basis points, or 0.25%, to the current rate of 1%. Fed fund futures traded on the CME showed about a 94% probability of a rate hike going into Wednesday’s announcement.

Despite the virtual certainty of a rate hike, there were dramatic moves in the financial markets across a wide range of instruments.

The S&P 500 immediately rallied after the announcement, and, along with the Nasdaq and Dow, finished the week with a noticeable gain of around 0.50%. “Stocks in general are much more attractive relative to other liquid asset classes,” said Diane Jaffee, portfolio manager at TCW, a Los Angeles-based asset manager with nearly $200 billion under supervision.

But stocks weren’t the only asset class that popped. On the fixed-income front, Treasury note and bond futures absolutely surged after the announcement. The yields on 10-year Treasury and 30-year bonds notes saw an instantaneous increase and finally broke a two-week-long losing streak.

For currencies, the US dollar index tumbled to the lowest level in over a month as a result of the Fed’s slightly hawkish outlook. The weak US dollar gave rise to higher gold and silver prices, as the most popular precious metals in the world are dominated in US dollars.

In terms of commodities, gold, silver, and palladium were all up well over 2% for the week to post the best week since February. Most of the losses for precious metals in the past couple of weeks have been recouped. Generally speaking, higher interest rates are bad for assets like equities and gold, because an increase in borrowing costs means it gets more expensive to borrow money to purchase these assets.

Nevertheless, the CEO of investment firm Amplify Investments said, “I am bullish on gold prices as I believe the U.S. dollar will continue to weaken.” From a global-macro perspective, a weakening US dollar is certainly not out of the cards, and this would ultimately benefit precious metal assets and other commodities, yet a weak dollar is not the only bullish argument for gold; global political uncertainty is definitely contributing to the rise.

Despite the gold/interest rate logic, investors seemed largely unfazed by the reality of an increased cost of borrowing. In fact, many interpreted it as an overall positive sign that the economy is finally normalizing and moving away from a zero interest-rate environment.

As noted in her speech, Fed Chair Janet Yellen expects the FOMC to raise rates at least two more times this year and at least three times in 2018. For reference, rates were only raised once in 2016.

Contrary to the current state of politics in the US and abroad, the state of US monetary policy seems to be pretty clear: the era of free loans is officially over, and policy is tightening to the direct benefit of stocks and dollar-dominated commodities, like gold.