Trump Proposal To Slash Taxes Could Hike Deficit

Posted on — Leave a commentAs the April 15 income tax filing deadline looms, taxes are on many American’s minds. The Trump administration is readying a proposal that could slash corporate tax rates, with the intended goal of boosting economic growth. A lower tax rate could be a boon to large corporations and encourage more spending, hiring and boost corporate earnings over the longer-term.

But, with every positive there is a negative.

The double edged sword behind tax cuts includes the potential to increase the United States debt and deficit unless there is legislation passed to raise revenue to match the cuts. Let’s take a deeper look at the dynamics at play.

The Current Landscape

A number of major U.S. corporations currently hold mega-bucks in overseas bank accounts including Apple to the tune of $230 billion, Microsoft with over $110 billion parked on foreign shores, Pfizer with $80 billion overseas and Exxon-Mobil with over $50 billion held offshore.

Why? These companies are bypassing U.S. tax laws by holding profits earned in other countries in offshore accounts.

The top U.S. corporate tax rate currently stands at 35%. There are a number of deductions that companies can take, which lowers the average effective tax rate for companies in the S&P 500 to about 26%. President Trump has proposed a plan that would slash the statutory tax rate to 15%.

No doubt U.S. corporations would cheer at a major tax cut. Who wouldn’t like to pay less in taxes?

What Does It Mean For the Deficit?

Whether or not the current U.S. tax rate is too high on corporations is not the issue. The key point going forward is what could a major tax cut mean for the U.S. debt? The U.S. national debt is creeping toward the $20 trillion mark. At the end of FY 2017 the gross US federal government debt is estimated to be $20.1 trillion, according to the FY17 Federal Budget.

There’s no getting around it – that’s a lot of debt.

The Congressional Budget Office reported that the U.S. government received roughly $300 billion in revenues from corporate tax payments in 2016. If the Trump Administration proposal passes as a pure tax cut – without any offset to increase revenues – that means a bigger federal deficit.

Another proposal looming on the horizon from the Trump Administration is the plan to spend $1 trillion on infrastructure spending. Unless new revenue is generated from the government from other sources, this will also increase the overall debt and deficit.

Why This Matters to Gold

As the United States (and other advanced industrialized nations) remain weighed down by debt it hurts long-term economic growth prospects. Currently, the United States has the unique opportunity to pay extremely low interest on its debt –around 2.40% on 10-year notes. But, that is extremely low by historical standards. Looking back in recent decades:

- 2007 – 10-year yield at 5.31%

- 2000 – 10-year yield at 6.80%

- 1994 – 10-year yield at 8.16%

Just as a consumer who is paying back debt off a credit card – the higher the interest rate – the more the consumer has to pay. In this case, the government’s low interest rate is unlikely to last for much longer. Treasury yields hit a generational low at 1.33% in 2016 and the only direction for them to go is up.

Looking ahead, the more debt a nation has and the more interest a nation has to pay on its debt, means it has less funds available to spend on things its citizens want – including education, roads, police and fire safety and other basic benefits.

Rising debt levels ultimately degrade the value of the U.S. dollar, which means less purchasing power for every dollar that you hold.

Gold is a currency without a government. There is no counter-party risk and there are no devaluations. Gold is accepted as a store of value around the globe.

While a tax cut sounds great for everyone, there is the double edged sword as it relates to our country’s long-term fiscal health. In the end, policies that swell the nation’s deficit boost the value of gold, especially in relation to the dollar. Gold is a store of wealth that cannot be destroyed by a national debt.

Take the time to properly diversify your portfolio today. Blanchard and Company has been advising individuals on how to protect and grow their wealth for over 40 years. Contact us at 1-800-880-4653.

Owning an ETF Isn’t the Same as Owning Gold.

Posted on — Leave a comment

Technology enables instant gratification among investors all around the world. In minutes you can own ETFs holding assets ranging from livestock to carbon emissions credits. This easy accessibility in the market enables fast transactions, and as a result investors seeking to bolster their portfolio with gold often resort to the ease of a precious-metal ETF. However, the problem is these investors don’t own gold; they own paper.

First, consider the cost of owning ETF shares. A review of 22 popular precious-metal ETFs reveals that the average expense ratio is 0.58. This cost is in perpetuity, and every year you will pay managers to oversee the fund. While this fee doesn’t sound like much, the compounding effect equals a total cost of $1,666 over a 20-year period, assuming 6% annual growth. The discrepancy between the initial costs of purchasing gold versus an ETF grows as the burden of the expense ratio increases over time. This cost means the ETF will always under-perform the market price of precious metals. Furthermore, this expense also represents an opportunity cost. If this $1,666 total were put to use as an investment (again, at a 6% annual return over 20 years) it would grow to $5,343. The ones making the real money here are the fund managers. Investors face inflation, market downturns, and political upheaval; we don’t need the headwind of onerous expense ratios added to the list.

Second, holding shares in a precious-metal ETF gives you no claim to the physical asset. Many of these funds hold gold, silver, and platinum in large, industrial bars that exceed the value of the average holder’s shares, making liquidation impossible. Even those with more substantial holdings might be surprised by the fine print. Many of these ETFs include language in their prospectus stating that the fund has the option to settle in cash rather than physical gold. In other words, the prospectus governs the terms and conditions. This document was written to benefit the fund managers and the underlying institution, not the investor. Though many cite the simplicity of an ETF solution, there is nothing simple about teasing apart the esoteric language of such a report.

Finally, the spectrum of risk widens with the ETF option due to “counterparty risk.” This risk comes from the decision to engage financially with another party. When the other party defaults or fails in any way to meet their obligations, you have succumbed to counterparty risk. Such risks are not hypothetical. The most recent example of counterparty risk occurred during the financial crisis sparked by defaulted collateralized debt obligations. With the purchase of a physical asset, the relationship is between you and the precious metal. Conversely, the decisions of the fund managers, rather than pure market movements, influence the ultimate value of the ETF. For many investors owning gold is about gaining control of their assets. This goal becomes difficult when it is dependent on unseen managers who are often not liable for damaged or stolen property.

If you want to own gold, then you must own gold. ETFs merely serve as an indirect and costly alternative to having the asset in hand.

Build Long-Term Wealth, One Day at a Time

Posted on — Leave a commentWho doesn’t want to “Buy Low and Sell High?” You may be sitting on that exact opportunity right now without even realizing it.

You’ve probably heard the advice that it is important to rebalance your portfolio. But, then something more fun or seemingly more important comes up, and that falls to the wayside. Busy family lives, kid’s sports schedules, or even just going to the gym can take up your precious time.

The recent rally in the U.S. stock market to all-time highs could have left you holding more equity exposure – and along with that – more risk than you wanted or even realized.

Pull Out Your Statements and Take a Look

It is important to analyze your total financial picture and current asset allocations at least once a year to make sure recent market fluctuations haven’t stretched your stock, bond and tangible asset allocations in the wrong direction.

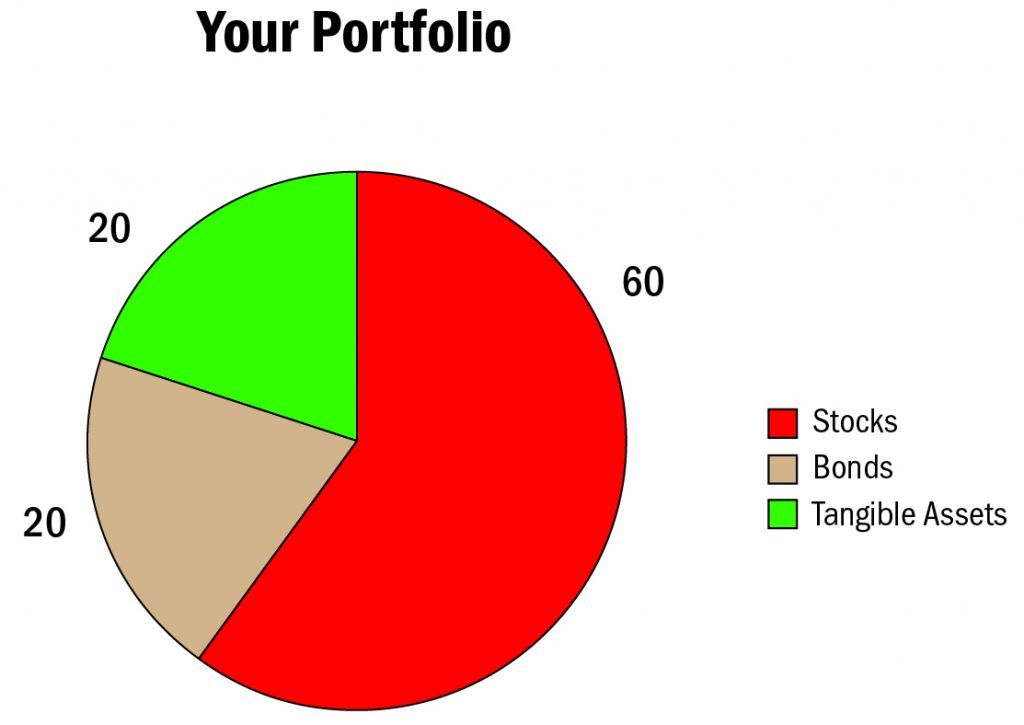

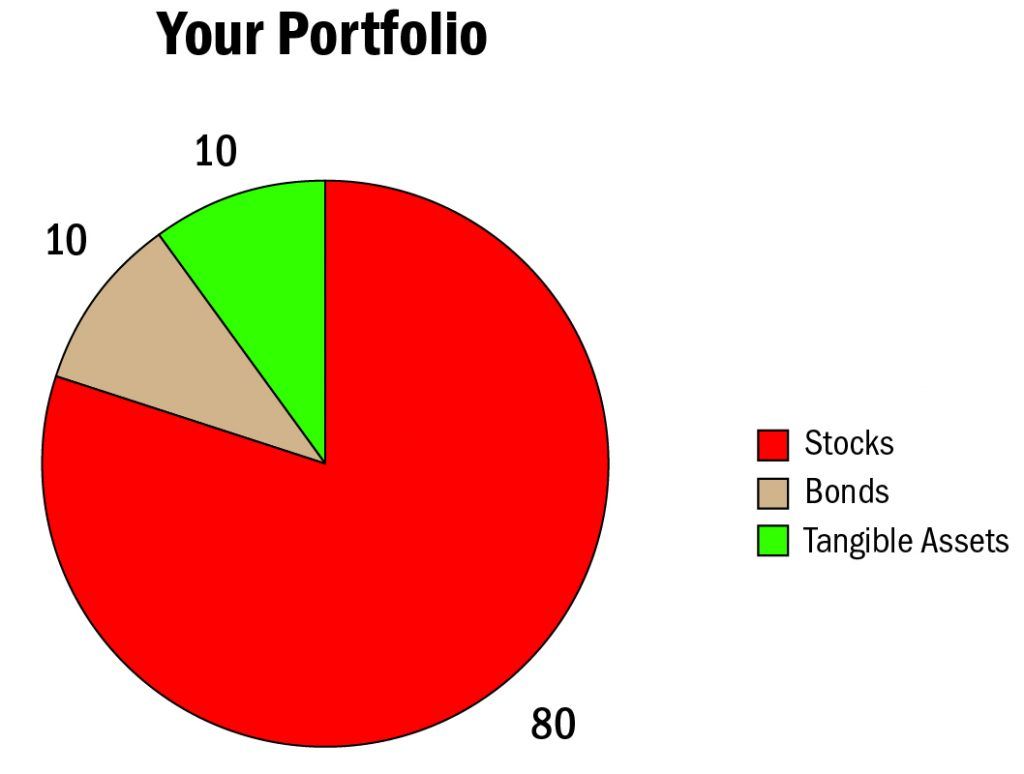

Here’s how it works. Let’s say you have a hypothetical portfolio allocation of 60 percent stocks and 20 percent bonds and 20 percent tangible assets.

The stock market has rallied to all-time highs recently. This is what your portfolio may actually look like now. You could be sitting on an 80 percent stock, 10 percent bond allocation and 10 percent tangible asset allocation without even realizing it.

Rebalance So You Can Sleep At Night

Many investors right now may have larger allocations and greater exposure to stocks than they want or even realize that they have. If a bear market cycle in stocks emerges, that could wreak havoc on your long-term financial goals. Rebalancing will bring your portfolio back into alignment with your goals and risk tolerance level.

- Rebalancing is a tool that investors can use to maintain their long-term desired investment allocations.

- Rebalancing can help with risk control.

- Rebalancing your portfolio may ultimately deliver higher returns than a portfolio that is not rebalanced.

Sell Your Winners

Getting started: Rebalancing your portfolio is as simple as selling a portion of your stock allocation and buying more tangible assets to bring you back to your original goals. Gold is at lower price levels that we saw in 2016 – which offers long-term investors a better value and buying opportunity.

How Risk Averse Are You?

It is worth taking some time to develop a portfolio that you are comfortable with and will allow you to sleep at night. A properly diversified portfolio includes non-correlated assets that can help smooth market volatility and boost overall returns. Gold and other precious metals have a low correlation to stocks. When stocks turn negative and plunge sharply, gold tends to rise in price significantly. A properly diversified portfolio that includes gold can help protect your wealth.

Be Consistent

Decide when to rebalance. Pick a time and do it regularly. How hands on do you want to be with your money? You can rebalance once a year, quarterly or semi-annually. The important thing is to be regular and consistent over the years. Mark your calendar and follow-through

It’s also smart to rebalance if you have inherited money or if you experience a significant change that affects your financial holdings.

Blanchard has advised individual investors for over 40 years on portfolio diversification through tangible assets purchases. Our portfolio manager can work with you to discuss your long-term financial goals and overall risk tolerance levels. We can offer a personalized investment plan tailored specifically to help you meet your goals. Contact Blanchard at 1-800-880-4653.

Stocks Officially Crash Up

Posted on — Leave a commentThere’s no question that 2017 is shaping up to be the most unique year for stocks in over a quarter-century. Last week, all the major US indices continued their gradual march higher to officially mark the longest stretch of consecutive daily gains since 1992.

During the last two weeks, the Nasdaq composite index has made a new all-time high on every single trading day. Believe it or not, there was not a single negative trading day during this entire multi-week stretch. Because of this intense rally, many investors are saying that stocks have officially melted up. That is, stocks definitely crashed – only they didn’t crash down. The inability for stocks to decline even a negligible amount has certainly spooked some investors.

As such, gold and silver have not given up much of their hard-fought gains at all as investors have purchased the precious metals as a currency and equity hedge. In fact, while gold has had a positive gain for the last three weeks, silver has closed positive every week since the beginning of the year. Despite the unprecedented rally in stocks, silver continues to outperform every other assent, while gold is currently outperforming stocks and bonds except for the Nasdaq.

Lukman Otunuga, a research analyst at FXTM, noted how “the cocktail of dollar weakness and ongoing Trump developments encouraged bullish investors to pounce.” He went on to say that gold “remains bullish in the short term amid the rising political risks across the globe and could edge higher towards $1,250 if the revived [U.S. Federal Reserve] uncertainty bolsters the yellow metal’s attraction further.”

Essentially, the equity and precious metals markets are sending the exact same message since the beginning of the year: everybody is largely unsure of what the global and domestic political risks are, especially with European countries potentially following in the UK’s footsteps, so investors are moving a lot of their cash over to gold and silver.

Federal Reserve uncertainty doesn’t exactly ease global worries, either. During congressional testimony last week, Federal Reserve Chair Janet Yellen highlighted the dangers of waiting too long to tighten fiscal policy and raise the benchmark lending rate by 25 basis points. This caused mixed reactions in the fixed income market, where the 30-year US treasury bond yield experienced modest volatility.

In the coming weeks, President Trump will deliver a much-anticipated speech to congress, and key economic data will be released by the Bureau of Labor Statistics. Market participants will indubitably have their ears and eyes glued to both events in an attempt to gage the direction the economy is going towards.

Regardless if stocks maintain their upward drift or sell-off dramatically, judging by the underlying macro events and trading action this year, precious metals will likely continue to shine and outperform the rest of the market.

Inflation Watch: Crude Oil Prices Surge Over 100%

Posted on — Leave a comment

If you are planning to hit the road for a spring break driving trip – buckle up for higher prices ahead.

You’ve probably noticed it already – that slow creep higher at the gasoline pump each time you fill up your tank. Gasoline prices have been steadily rising and are forecast to go even higher.

The national average for a gallon of gas stood at $2.27 as of Feb. 13, which is 58 cents higher than year-ago levels.

The culprit is the massive surge in the price of crude oil.

From a low at around $26 per barrel in February 2016 – the price of crude oil skyrocketed 112% into the January 2017 high at $55 per barrel.

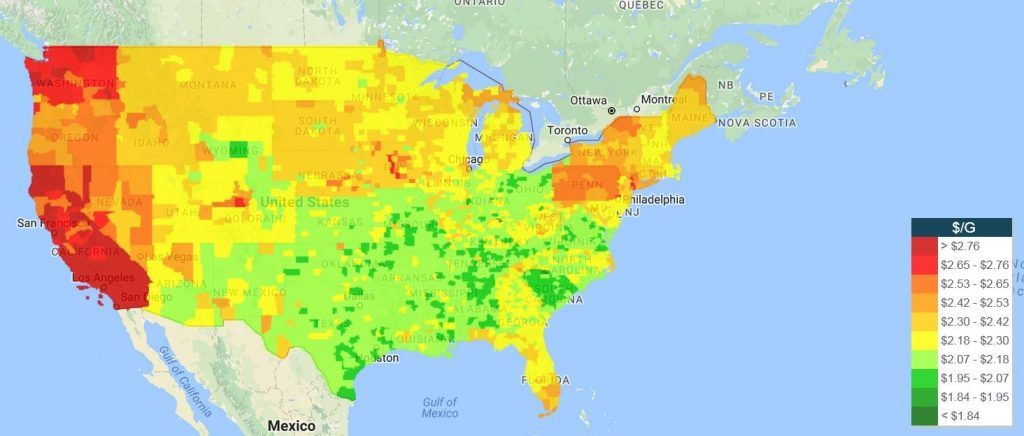

The heat map below shows the average price of gas according to region in the United States, according to GasBuddy.com.

Blame It on the Seasonal Switch

What is the trigger for higher prices ahead? Refineries across the country are preparing for the annual seasonal switch to a cleaner burning gasoline. The prices hikes will be due in part to summer’s more expensive blend of gasoline, required by the Environmental Production Agency (EPA) and the Clean Air Act, according to Gasbuddy.com.

$3.00 Gasoline Here We Come

Here are four predictions from petroleum analysts on what lies ahead:

- Average gasoline prices will rise 35-75 cents between recent lows and peak prices, just in time for spring break travel plans. Gas prices will likely plateau in May.

- America’s daily gasoline bill will swell from today’s $788 million to as much as $1.1 billion daily by Memorial Day. This is $312 million more spent every 24 hours.

- Some of the nation’s largest cities will be $3 a gallon gasoline very soon, including Los Angeles, New York, Chicago, Washington, D.C. and Seattle, with other large cities possibly joining due to various stringent summer gasoline requirements.

- Watch out for more gas price volatility in the Great Lakes and West Coast versus other areas, based on prior year outages at refineries in these areas. As a result, there may be temporary gas price spikes.

What This Means for Gold

Gold is a traditional inflation hedge. Rising levels of inflation, which are triggered in part by higher energy costs, are a bullish factor for the gold market.

Inflation is also occurring in other areas of the economy. Notably, higher prices for rental apartments and homes have been seen in recent months along with a steep jump in health care costs. Wage inflation is occurring as tightness in the labor market forces employers to offer higher wages in order to attract and retain works.

After years of worries about the potential for deflation, the inflation cycle is beginning to pick up steam and head higher, and this will provide long-term support to the price of gold.

How can investors protect against inflation? It is well known that gold holds its value and often increases significantly during inflationary periods. What is not as well known is that rare coins are an even better hedge and tend to rise in price even faster than gold during inflationary periods. Blanchard recommends a tangible asset diversification strategy that includes both gold bullion and rare coins to achieve the highest levels of returns – especially in an inflationary environment.

Blanchard portfolio managers can offer you individualized investment recommendations appropriate for your level of risk tolerance and to help you achieve your long-term financial goals. Call for a consultation today at 1-800-880-4653.

Yellen Testimony: Every Fed Meeting Is Live

Posted on — Leave a comment

Fed Chair Janet Yellen concluded her two days of semi-annual testimony before Congress on Wednesday. The key takeaway for financial markets? Every meeting is “live” and there is potential for an interest rate hike to come as early as March if the economic data supports that.

Dancing Around the Date

Prior to Yellen’s testimony, the market had priced in very low odds of a rate hike at the March meeting, with June seen as the earliest time for a policy shift. She declined to name a specific date for a rate hike during her trip to Capitol Hill this week, but added that waiting too long “would be unwise.”

Yellen generally painted an optimistic picture of the economy noting that the employment rate is in line with long-term normal levels, alongside signs of continuing economic expansion. She pointed to a healthy rise in consumer spending, along with steady income gains, and rising home values. Inflation is rising, but still below the Fed’s target rate, she added. Yellen made it clear that the central bank is prepared to move quickly if inflationary pressures gain steam.

Hawks and Doves

This week, financial markets interpreted the Fed Chair’s comments as “hawkish” – or more tilted toward the possibility of a rate hike sooner than previously expected. She wants to avoid being labeled a “dove” and seen as being behind the curve when it comes to fighting inflation.

When it comes to monetary policy, “hawks” are a term used to describe those who are more concerned about inflation and willing to act faster to prevent it from spiraling out of control. “Doves” refer to those who are willing to tolerate higher inflation for the sake of preserving jobs.

Market Reaction

On Tuesday: In an initial market reaction, the gold market gave up its early gains and turned lower after Yellen’s prepared comments, while the U.S. dollar and Treasury bond yields rose.

On Wednesday: Gold prices swung higher as the market shrugged off the impact of potential rate hikes sooner than expected. Leaving worries about the Fed behind, gold traders refocused on the uncertainty about the economic impact of the new Administrations policies as they bid the gold market higher.

Fiscal Policy Intersects With Monetary Policy

Yellen’s comments were filled with the normal disclaimers and she noted that “considerable uncertainty attends the economic outlook. Among the sources of uncertainty are possible changes in U.S. fiscal and other policies, the future path of productivity growth, and developments abroad.”

She commented on the proposed fiscal policy, which included a massive infrastructure spending proposal by the new Administration and said: “I would also hope that fiscal policy changes will be consistent with putting U.S. fiscal accounts on a sustainable trajectory.”

Balance Sheet Isn’t Shrinking Soon

In the Q&A portion of Wednesday’s testimony, Chair Yellen responded to a question about the size of the balance sheet, which has swollen to historically large levels in the wake of the global financial crisis. She indicated that the committee remains a long way from beginning the process of shrinking the size of the balance sheet, and that process would begin after the hiking cycle is well underway.

Yellen Defends Independent Fed

Chair Yellen also defended the central bank’s policies in recent years. She repeated her opposition to proposals to rein in the central bank, including calls for an audit, warning that could threaten the bank’s independence.

What This Means for Precious Metals Investors

The Federal Reserve is attempting to normalize monetary policy after nearly a decade of historically low interest rates. Since the global financial crisis, the Fed has kept interest rates artificially low in an attempt to jumpstart economic activity.

The current Fed rate stands at the 0.50-0.75% level, which is well below a more historically normal rate in the 3.5-4.0% region. Even if the Fed were to hike rates two or three times in 2017, the Fed funds rate would still be well below historical norms.

If the Fed does pull the trigger on an interest rate hike in March it could briefly weigh on gold and silver prices in a knee-jerk type of reaction. That would offer long-term investors a buying opportunity.

Fed policy is only one of many factors that impact the precious metals markets. Other factors that provide long-term support to the metals markets include concerns about the degradation of the value of the U.S. dollar. There are significant concerns about the international power struggle between the East and the West, as China attempts to take a larger role on the world stage. Geopolitical instability in Europe and rising inflation are also factors that will support the current rising trend in gold prices.

Any modest blip lower in gold prices offers long-term investors a solid buying opportunity.

4 Reasons Silver Is Outpacing Gold In 2017

Posted on — Leave a comment

The precious metals sector is off to the races in the first six weeks of 2017, as returns in both gold and silver are beating the S&P 500. The silver market is the best performer –with nearly double the gains seen in gold. Here’s a quick look at the numbers:

| Silver | +11% |

| Gold | +6% |

| Copper | +11% |

| S&P 500 | +4% |

Why is silver outperforming gold? Here are four reasons:

1. Silver is Both a Precious and an Industrial Metal

This creates a dual demand base for the metal from both investors and from the manufacturing and industrial community. A less expensive cousin than gold, silver offers investors many of the same properties as gold including portfolio diversification and a hedge against in inflation as gold and silver typically trend in the same direction.

Silver attracts nearly 50% of its demand from industrial buyers for use in electronics, autos, nano silver applications, medical devices and solar panels. Both the electronics and solar panel industries that use silver are expected to grow strongly, triggering even stronger demand.

2. The World Silver Supply Is Shrinking

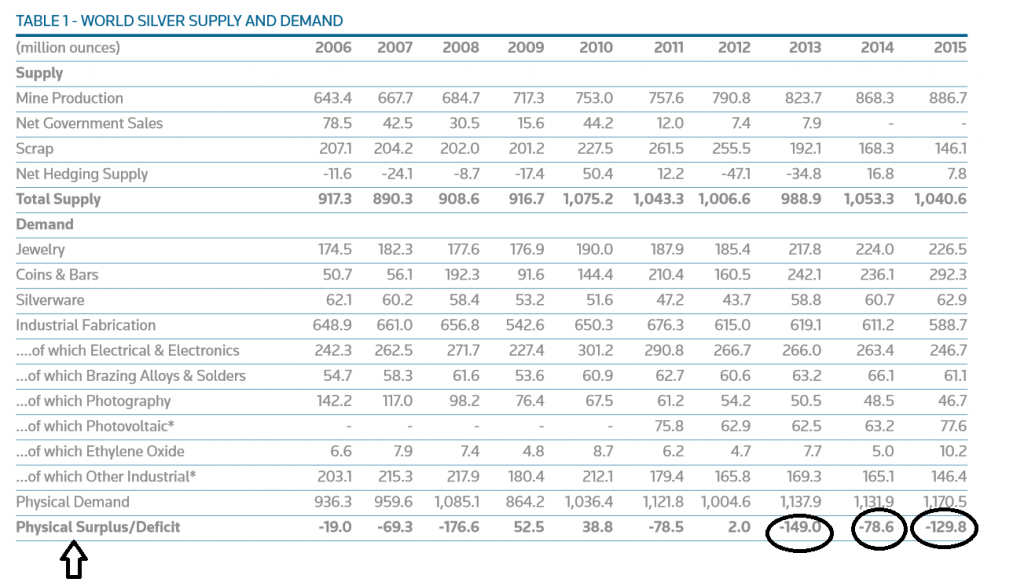

The world uses more silver than it produces. The silver supply deficit may be one of the most overlooked and most positive factors for the metal ahead. Older silver mines have been producing less. And, there has been less interest in exploration for new silver mines amid the lower current price level for silver. It’s historically cheap: Spot silver at around $17.90 an ounce currently is well below the all-time high at $49.51 an ounce in 2011. That sets the market up for a potential supply squeeze amid forecasts for rising demand from both the investment and industrial side.

The 2016 Thomson Reuters GFMS Annual Survey shows a silver deficit for the past three years in which data is available. See Figure 1 below:

3. Dr. Copper Is Warning Of Inflation

3. Dr. Copper Is Warning Of Inflation

Copper prices, another widely used industrial metal are also up sharply since the start of 2017. Copper is a key building component across a broad array of uses from construction to wiring, plumbing, heating and cooling and automobiles.

This metal has earned the nickname: Dr. Copper – due it its ability to presage global economic activity. Typically, rising copper prices signal rising global economic activity ahead. That adds up to more inflation and is bullish for both bold and silver.

4. The Silver Trend Is Your Friend

The current technical chart pattern for silver is stronger than gold. The silver market is trading above its 50-day and 100-day moving averages, which are bullish signals for trend following traders.

Buying tactics: Spot silver is currently trading around $17.90 an ounce. Short-term retreats to the 17.50 an ounce or $17.25 an ounce zone would offer good buying opportunities for long-term investors if silver sees a price pullback.

The Long-Term View

Looking ahead, silver prices are expected to rise toward $18.21 an ounce in 2017 and $20.21 an ounce in 2018, according to a BofA Merrill Lynch Global Research report.

It is only a matter of time before silver hits the $18.00 an ounce mark. Consider adding these coins to your portfolio now:

- 1 ounce Silver American Eagle

- 1 ounce Silver Canadian Maple Leaf

- 1 ounce Silver Round

- 2 ounce Silver Queen’s Beast

There are also silver bullion bars that are easy for investors to store at home:

- 10 ounce silver bar

- 100 ounce silver bar

Blanchard and Company has advised individual investors on tangible asset purchases for over 40 years. We believe that gold and silver bullion in physical form is an appropriate asset for a small portion of any properly diversified investment portfolio. Contact Blanchard at 1-800-880-4653.

Stocks Surpass Records, Again

Posted on — Leave a commentUS equity markets extended gains for a third consecutive day on Friday as they continued to climb and make new all-time highs. The Nasdaq 100 composite index closed in positive territory every single day of the last seven consecutive trading days, while the Dow and S&P 500 have experienced a vigorous three-day-long rally.

The recent, and by some people’s definition, extended, rally in US stocks has created somewhat of a division among bulls and bears as to where the market will go from here.

Omar Aguilar, the chief investment officer of equities at Charles Schwab with over $2.5 trillion in client assets noted how “we’re really seeing a bifurcation in views about the market, but that’s healthy. When some people are too optimistic and others are too pessimistic, it ends up that fundamentals wind up as the driver.”

There’s certainly no shortage of bullish fundamental information to keep pushing stocks past record levels. For the first time in six fiscal quarters, corporate earnings, as a whole, have been positive and the labor market is enjoying its longest-ever streak of job creation – ever. Moreover, there is chatter of increased fiscal spending and tax reductions for corporations, which would stimulate the economy and increase the bottom line of companies, respectively.

Omar also noted how markets could likely maintain their current trading action well into the first half of 2017. “If stocks took a leg higher we’d see people selling and taking profits, and if stocks fell you’d see people seeking opportunities and buying in,” he said.

Ultimately, stocks are showing a lot of strength, yet they are still underperforming precious metals. Gold and silver both recovered from a sell-off on Thursday and finished positive for the week. For the year, gold is up 6.74% and silver is up 12.08%, compared with just 3.5% for the S&P 500.

Analysts interpret the fact that gold market keeps moving north and recovering from sell-offs, even in the face of rising equity markets, as largely bullish for the precious metal. Usually, investors have a tendency to reduce their gold positions as equities rally, because as markets edge up, investor fear edges down and, therefore, the desire to own gold decreases as well.

On a weekly basis, gold and silver have rallied despite the recent uptick in the US dollar. When the dollar appreciates, gold and silver become more expensive for foreign buyers to purchase, so the metals tend to slump – but this has not been the case since the start of 2017.

Of course, everything in the market is open to interpretation, but judging by the correlation between precious metals and equities, if the equity rally continues, then the gold rally is likely to continue (as it has been doing since the beginning of the year). But if the equity rally comes to an abrupt halt and a surprise sell-off catches everyone off guard, then gold will likely see a substantial rally for all the right reasons.

No matter which way one looks at it, the thesis to own gold is looking pretty convincing.

Four Facts You Need To Know About Bear Markets

Posted on — Leave a commentGold prices surged for the second week in a row last week, continuing the strong rally phase that has been in place since late December.

The gold and silver markets are on fire since the start of 2017, as investors pour money into the metals arena. Concerns over rising inflation, uncertainty over the impact of certain Trump administration economic including potential protectionist moves, and by political divisiveness in Europe as rising populist movements gain steam especially in France, are driving metals prices higher.

The Stock-Gold Connection

What is interesting for investors right now is that precious metals are rising at the same time that stocks are hitting new all-time highs.

Can this last? History says no.

Fact One: The current rising cycle in U.S. stocks is set to hit its eighth birthday in March, that will make it the second longest running bull market in history since World War II. A bear market is defined as a sell-off of 20% or more.

Fact Two: The average bear market in U.S. stocks (measured by the S&P 500) lasts about 272 days, with declines of about 28 percent, according to a JP Morgan study. More recent bear markets have been more severe.

Fact Three: The Bear Market that began in March 2000 saw a -40% decline.

Fact Four: The Bear Market that began in October 2007 saw a -57% decline.

What This Means for Your Portfolio

Professional money managers and family offices have been gravitating toward gold as a hedge. Historically, gold tends to rise – often significantly – when equity markets are falling. Gold also acts as a hedge against inflation. The price of gold also increases during inflationary period, which many economists believe we are entering into now.

During the double-digit hyperinflation that emerged here in the U.S. in the 1970s, gold appreciated significantly and far outpaced the rate of inflation. That preserves wealth and purchasing power for those who own gold in their portfolio.

What to Watch This Week

Gold traders will be monitoring political developments in the Trump administration, a Congressional appearance by Federal Reserve Chair Janet Yellen and a number of key economic reports this week.

Tuesday

- January producer price index is scheduled for release (inflation gauge and the producer level)

- Fed Chair Janet Yellen will testify on the state of the U.S. economy before the Senate Banking Committee House.

Wednesday

- Fed Chair Janet Yellen will testify on the U.S. economy before the House Financial Services Committee.

- January Consumer Price Index data is scheduled for release.

- January Retail Sales report is slated for release and will offer clues on the health of consumer spending at the start of the year.

Gold and Silver – Best Buying Levels Of the Year Could Be Now

Gold and silver prices have surged since the beginning of 2017, and are already outpacing the gains in the stock market. Silver is up over 11% since the start of the year, Gold is up 6.50%, while the S&P 500 is up 3.33%.

Here is a chart that shows the price of spot gold over the last 15 years.

Signs of higher inflation and faster consumer activity will support the current uptrend in the gold and silver market. Higher prices are forecast for the metals markets throughout 2017 and current levels may offer the best buying opportunities of the year.

Current price: Spot gold is trading around $1,220 an ounce, while silver is trading at $17.80 an ounce.

Gold is approaching a key psychological resistance zone at the $1,250 level. This still remains well below the $1,340 an ounce level that gold traded in the wake of the U.S. presidential election on November 9.

Rare Coins Appreciate Faster Than Gold

The latest Knight Frank Wealth Report for 2016 confirms that ultra-high-net worth individuals prefer collectibles to bullion and for good reason. The price of gold and rare coins does not always move in lockstep. Studies have shown that rare coins typically rising during inflationary periods and outpace the gains seen in the price of spot gold.

Connecting “Frexit” to the Gold Surge

Posted on — Leave a commentIn recent months, the characterization of gold as a desirable investment only during periods of flailing stocks has been upended. Despite positive economic data gold futures reached a three-month high of $1,230 per troy ounce on February 7th. The simultaneous upward movement of stocks and gold is uncommon. Historically, investors seeking stability during equity market turmoil resort to gold. Given the enormous research behind this relationship, why have we seen both assets increase? Some have cited uncertainties stemming from Trump’s behavior as the reason for a flock to gold. However, political news from abroad may be more influential.

French populist leader Marine Le Pen has been resolute in her drive to break France free from the European Union (“Frexit”). Such a move would restore the franc as the official currency of the country. While this change is far from certain, the latest headlines are painting an increasingly clear picture of France’s future. Le Pen is the front-runner in nearly all the polls. Moreover, former French Prime Minister Francois Fillon who is also running for the same position is battling a scandal. In late January, investigative journalists in the country alleged that Fillon’s wife received large state payments for a job she never fulfilled.

How have French investors greeted these developments? Many are anxious. EuroNews reports “Investor uncertainty about France’s presidential election took its toll on French bonds on Monday, pushing up the premium investors demand for holding French over German government bonds to its highest in almost four years.” Meanwhile, “Investors have responded by piling into gold, sending prices up 7% this year,” according to The Wall Street Journal.

These political events invite comparisons to the aftershocks radiating from the Brexit decision. In early July, just days after the UK referendum gold surged to a two-year high resulting from concerns over the global economy. A similar phenomenon may be playing out in its earliest stages now. With the French election looming investors are growing nervous. Additionally, there is a significant difference this time around: Currency valuations will fluctuate if France jettisons the euro. This dynamic adds a layer of complexity that was not present during Brexit, as the UK has never used the euro.

World politics continue to exact growing pressure on financial markets. The international community is witnessing a significant retreat to nationalistic policies. If Le Pen is successful, it will mark the third decisive movement towards populism in less than one year. Many are beginning to view these events as the start of a chain reaction in which politics, rather than central banks, will be the key influencer of worldwide economic growth.

The lockstep rise of gold may underscore a pervasive notion that stocks are overvalued. While equity investors fared well in 2016 gold appears to be developing as an insurance policy. If Trump fails to deliver on infrastructure plans and a reinvigorated economy, these stocks may suffer under the weighted of their huge earnings expectations. In such a case gold will become even more valuable than it is today. With such uncertainty across the globe, there is one stable outlook; the quaking ground of our political landscape is unlikely to settle anytime soon. This continued turbulence will buoy gold and ultimately lift it further.