Trump Tax Cuts Expire After 2025: Are You Ready?

Posted onAs the presidential election starts to heat up, expect to hear more about taxes on the campaign trail this summer and fall. Why? There are potentially sweeping tax law changes on the horizon.

Most Americans have paid lower income taxes since 2018, due to former President Donald Trump’s Tax Cuts and Jobs Act of 2017.

Yet, many of these tax breaks are set to expire next year, unless Congress acts.

The 2017 tax law temporarily changed major provisions like lower tax brackets, a higher standard deduction and an increase to a number of deductions. After the Trump tax cuts expire in 2025, here’s just a few of the taxes that will increase: individual tax bracket rates, pass-through rates, health insurance surcharges, the global minimum tax, Inflation Reduction Act taxes and housing taxes.

High Net-Worth Americans Face Changes to Estate Tax Law

For ultra-wealthy Americans there are looming changes that could substantially limit the amount that families can transfer tax-free to the next generation. For example, in 2024 the tax-free limits on gifts increased to $13.61 million per person. Once the Trump era tax cuts expire, that limit will fall by about half in 2026, without new legislation from Congress.

Given the sweeping tax changes that are on the horizon, many high net worth individuals are making lifetime gifts now to remove assets from their estate.

Gold Is an Excellent Vehicle for the Private Preservation of Wealth.

With the estate tax level set to fall nearly in half after 2025, that significantly reduces the wealth you can give to your heirs, as the government will take a much larger portion of your family’s money.

There is a solution. Gold bullion and rare coins have long been touted by trust attorneys as an efficient and discreet method of transferring wealth from one generation to another.

Taxes Are Set to Rise after 2025: You Still Have Time to Prepare

Americans of all income levels will face higher tax rates and lose out on a number of deductions, meaning your bill to Uncle Sam will be higher than it has in recent years. You can’t control what tax legislation Congress passes or doesn’t pass. You can control how you prepare and position your finances to limit the impact of taxes reverting back to 2017 levels.

If you take action now, you still have time to re-position some of your holdings to get in front of the expiration of the 2017 tax cuts. Contact a Blanchard portfolio manager for a confidential portfolio review – and to explore proven strategies with tangible assets to protect, preserve and grow your wealth.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

The Most Popular Variety of Connecticut Coppers: The 1787 Horned Bust

Posted onFollowing the Revolutionary war in colonial America, a lack of national coinage for everyday commerce began to pose problems. Fraud and counterfeiting began to run rampant.

The Articles of Confederation, ratified in 1781, had authorized states to create their own coinage. So, the state of Connecticut took action and stepped in to help solve the problem locally, while the nation debated opening a national mint.

The Connecticut legislature authorized a private firm to mint what is fondly known today in numismatic circles as Connecticut Coppers.

Connecticut Coppers Were Minted between 1785 and 1789

These coins, while never legal tender, were trusted and used extensively in everyday commerce. Today, collectors are captivated by their colorful names, which includes varieties like “African Head,” “Hercules Head,” and “Draped Bust” styles.

Connecticut Coppers were struck in many varieties. Today, one of the most popular carries the intriguing name: the 1787 Horned Bust.

1787 Horned Bust Design

The Connecticut Coppers design took inspiration from the British halfpenny. The coins typically showcased a man’s head on the obverse and an elaborate seated personification of Liberty on the reverse.

The 1787 Horned Bust Connecticut Copper is one of the most beloved in the entire series. The obverse features of bust of Liberty facing left, but what makes this variety special and highly sought after is the eponymous “horn” seen in the lower left of the coin’s obverse.

A Chip in the Die Created the Horn

However, the horn was not an intended part of the coin’s design! A chip in the die that produced the coin created that horn. Early examples of the obverse die are perfect and reveal no trace of a horn.

Yet, as the die was used more and more, the chip in the die appears on the coin as a raised chunk of metal. Notably, throughout time, as more coins were struck, the horn got bigger and bigger! Some numismatics specialize in the 1787 Horned Bust, and create a unique collection showing the progression of the horn enlarging over time.

The coin’s reverse features a clothed Liberty seated on a small throne, holding an olive branch in one hand and a capped pole in the other, with the date 1787 at bottom.

A Unique Copper

Collectors appreciate the historical significance, rarity and unusual story behind the “horn” on the 1787 Horned Bust Connecticut Copper. The most recent auction record for a 1787 Horned Bust stands at $7,475

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

5 Most Interesting Coins from the Manila Mint

Posted onYou may not be aware (many aren’t) that the United States Mint operated a mint in the Philippine Islands. In fact, the Manila Mint is the only U.S. branch mint that was located outside the continental United States! Today we’ll explore five of the most interesting coins from the historic and under the radar Manila Mint in the Philippine Islands.

A Little History

After the U.S. defeated Spain in the Spanish-American War in 1898, the Philippines became a U.S. territory. In 1920, the U.S. government reopened the Manila Mint, which had originally been built by the Spanish government in order to produce sorely needed currency to be used in the U.S. territory.

The Philippine economy was too weak to use the U.S. dollar, a much stronger currency. So the U.S. government created special lower denomination currency modeled after Spanish denominations just for the Philippine territory.

The Manila Mint produced coinage until 1922 and then again from 1925-1941, when the Japanese invasion of the Philippines during WWII halted U.S. operations there. Now, let’s take a look at five of the most interesting coins from the Manila Mint.

1. One Centavo Coin

2. Five Centavos Coin

3. Fifty Centavos Coins

4. One Peso Commemorative Coins

5. Leper Colony Coinage

One Centavo Coin

The lowest denomination coin produced by the Manila Mint was the one centavo. This coin featured a male Filipino with a hammer, sitting on an anvil. These coins were legal tender in both the U.S and the Philippines. Between July 1920 and December 1941 the Manila Mint produced a whopping 142,317,095 regular issue one centavo coins, more than all other denominations combined. This was widely used in everyday commerce and quickly helped to ease the coinage shortage there.

Five Centavos Coin

The five centavos coin continued the theme of the male Filipino worker. The 1920 and 1921 five centavos design featured a young Filipino male sitting next to an anvil. He holds a hammer in his right hand, his left arm raised, and in the background is a dramatic volcano spewing molten lava. The reverse design features an eagle with spread wings perched on top of an American shield.

The five centavos coins were produced with 75% silver and 25% copper. The silver content meant the coins intrinsic value was greater than their face value. Today, finding five centavos in good condition can be a challenge for collectors as many were melted down over the years. This coin was widely used in everyday transactions and was an essential part of the local currency system.

Fifty Centavos Coins

The fifty centavos issued under U.S. rule from the Manila Mint featured a distinctive and visually appealing design with a lovely female figure carrying a hammer that rested on an anvil. A billowing volcano is also seen in the background on this coin.

These coins were also struck from 75% silver and 25% copper. Today, the 1921 issue, with a mintage of 2,317,000, is easier to find, while the 1920 issue with a smaller mintage of 420,000 mintage is scarcer and typically more desired by astute collectors.

One Peso Commemorative Coins

In 1936, the Manila Mint produced two Commemorative Pesos. The first commemorative peso features the portraits of the first President of the Philippines, Manual L. Quezon, and U.S. President Franklin D. Roosevelt. The obverse of the other commemorative Peso features portraits of President Quezon and Frank Murphy, the last U.S. Governor General of the Philippines. The reverse for the 1936 commemoratives highlights the seal of the Commonwealth of the Philippines with United States of America placed above and the date centered below.

Leper Colony Coinage

The Manila Mint was also tasked with striking Leper Colony coinage for the Philippine Health Service. From 1920 through 1930, the Manila Mint produced five issues of Leper Colony coins.

These include the 1920 issue (ten centavos, twenty centavos and one peso) which carry no mint mark. The 1922 issue (twenty centavos and one peso) were stamped with the encircled initials “PM” (representing Philippine Mint). The 1925 (one peso) and 1927 (one centavo and five Centavos) issues show the Mint Marks “P” and “M” on the reverse to the right and left of the value. The 1930 issue (one centavo and ten centavos) show no mint marks.

The End of an Era

No U.S. coins were produced at the Manila Mint after 1941 during the Japanese occupation or until the Philippine independence occurred in 1946. Sadly, the Manila Mint were decimated by heavy bombing during the liberation of the islands. While these historic coins often fly under the radar, they remain important reminders of this unique U.S. Mint branch that briefly

produced coins outside the continental United States. These coins are also tangible legacy of the close ties and special relationship the United States and the people of the Philippines.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Brasher Gold Doubloon: One of the Most Valuable Coins in the World

Posted onIf you’ve been around coin collecting for a while, you may have heard of the legendary “EB” counter stamp that Ephraim Brasher marked on coins that he issued back in the late 1780’s. For those who aren’t familiar with Brasher, he was practically a celebrity in colonial America.

Brasher was a patriot of the American Revolution, a successful businessman and neighbor of George Washington. A well-respected jeweler and coiner, Brasher was known for his integrity and excellent workmanship, and his “EB” counter stamp was widely accepted as a guarantee of quality and value.

Today, numismatics can only dream about owning one of his most famous and rarest creations of all—the 1787 New York style Brasher doubloon.

Some private gold coin experts believe that the gold doubloons minted by Brasher in 1787 were our country’s first private gold coins, yet there is no detailed evidence to prove that. Nonetheless, these coins have earned an important status in American numismatic history.

After the Revolutionary War ended, the colonies were in need of coinage. In 1787, Brasher applied to the New York Assembly for a contract to produce coppers for the state. While waiting for an answer, Brasher took the initiative to issue his now legendary gold doubloons.

Doubloon is Spanish for “double” and is the name of the Two Escudo gold coin that was minted in Spain and the Americas with gold found in the New World.

Brasher’s gold doubloon featured the Great Seal of the United States, an eagle clutching an olive branch and arrows. Encircling the eagle is the national motto: ‘UNUM E PLURIBUS’ (One from many). The date 1787 is at the bottom. Brasher counter stamped “EB” on the reverse as his personal guarantee of quality.

On the coin’s reverse, Brasher displayed the New York coat of arms: a sun spreading rays of light over a mountain with the sea at front. Surrounding the image is the inscription, ‘NOVA EBORACA COLUMBIA EXCELSIOR’ (New York, America, Ever Higher). Brasher included his last name underneath the image.

While Brasher typically stamped his initials on the reverse, there was one notable exception. He created one coin with his initials stamped on the chest of the eagle, possibly the last coin made. In 2011, Blanchard sold this iconic “chest punch” Brasher Doubloon for almost $7.4 million.

Ephraim Brasher’s contributions to American numismatics extend beyond the creation of the Brasher Doubloon. His work set a precedent for the quality and integrity of American coinage, influencing subsequent generations of coin makers. Brasher’s emphasis on precision, artistry, and trustworthiness became the standard for U.S. currency.

The Brasher Doubloon also symbolizes the innovative spirit of early American entrepreneurs. In a time of economic uncertainty, Brasher’s initiative to create a gold coin exemplified the entrepreneurial drive and resourcefulness that would come to define the American ethos.

They are ultra-rare and wildly expensive. Only seven survivors of this astounding coin are known today. In 2021, a Brasher gold doubloon sold for $9.36 million.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

The Shocking Scandal Behind the Beloved $4 Gold Stella

Posted onIf you ever saw an episode of the HBO TV drama: The Gilded Age, you understand how exciting this period in U.S. history truly was.

Starting in the 1870’s the U.S. economy was booming. Railroads were built coast to coast. The steel and coal mining industries were growing fast. Titans of industry like John D. Rockefeller, Cornelius Vanderbilt, Henry Ford and Andrew Carnegie built great fortunes.

During this historic time one of the most fascinating and highly desired U.S. rare coins was produced: the $4 gold Stella coin.

Today, these $4 gold coins are extremely rare and in high demand as an example of America’s outstanding numismatic art. And, there’s scandal too which only adds allure to the coin’s dramatic history. Today, that $4 gold coin is reverently known as Stella. How did it get its name? The Latin word for star is Stella and the coin features a five-pointed star on its reverse.

The beautiful Stella was only minted in tiny amounts in 1879 and 1880 as a pattern coin to show Congress, as they debated how it could be used in international trade. The proposed $4 gold coin would roughly equate to the value of the Spanish 20-peseta, the Italian 20-lire and the British sovereign.

However, shortly after the brand new $4 gold pattern coins were released to the Congressman for their review, scandal broke out. These dazzling gold coins were being worn as medallion necklaces dangling over madam’s bosoms in Washington D.C.’s high-end brothels that were known to be frequented by illustrious clientele – like U.S. Congressman!

The numismatic community was dismayed and outraged. While it was said that no coin collector could obtain a Stella from the U.S. Mint, the Congressman who had received the special order apparently used them as gifts and perhaps even payment!

Now remember, this was the Gilded Age and these opulent brothels were famous for large oil paintings, fancy red plush parlor furniture, pricey European carpets, and real silver on the table alongside porcelain dishware. Guests and residents feasted on gourmet meals including high and mid-priced cuts of beef, pork and goat, alongside exotic items for their day – like coconut and Brazil nut. The expensive French champagne was ever-flowing.

And it was in these brothels, that Washington D.C.’s most famous madams proudly flaunted these exceedingly ultra-rare coins! Even today, some Stellas’ can be found that reveal traces of the necklace loops.

In the end, Congress rejected the idea of an international coin. Stella, struck for only two years, was never a circulating coin. Yet, collectors then and for generations have coveted these illustrious and historic coins.

The Stella pattern was only minted in tiny amounts in 1879 and 1880 in two types. Two of America’s most famous coin designers created the Stella patterns.

Chief Engraver Charles Barber created a design that featured a portrait of Liberty facing left with long, flowing hair on the obverse, known today as the Flowing Hair type.

George T. Morgan, the creator of the famous Morgan silver dollars, developed the Coiled Hair type. The reverse of the $4 Stella reveals the motto DEO EST GLORIA, which translates into “God is Glorious.”

These coins are scarce. It is estimated that a mere 425 Flowing Hair coins were minted in 1879, with only 12 known Coiled Hair types from 1879. In 1880, there are only 17 known Flowing Hair types and 8 Coiled Hair. Notably, because the coin goals were international commerce, the obverse states its gold content on the obverse of the coin in the metric system:

“★6★G★.3★S★.7★C★7★G★R★A★M★S★”

This ultra-rarity is beyond the reach of most collectors. Yet, demand for these iconic coins far outstrips supply. On the rare occasions they surface for sale it’s typically from a time-honored, monumental collection of historic U.S. coins. Indeed, the $4 Stella is a historic gem from this exciting time in American history. Imagine the stories these coins could tell, only if they could talk…

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

10 Unique Rare Error Coins

Posted onOffering a unique opportunity to diversify and enrich their numismatic collections, error coins are particularly appealing for collectors. Indeed, boasting intriguing backstories, they add depth and significance to any coin collection. This piece will explore rare coin errors and the history behind them, focusing on:

- Iconic US coin anomalies.

- Famous international error coins.

- Where to source unique error coins.

Watch this informative video to learn more about different types of coin errors:

Rare US error coins

Error coins, esteemed anomalies within the realm of numismatics, offer a glimpse into the intricacies and variations of the minting process. Each of the following rare US error coins showcases unique and intriguing types of errors, ranging from missing mint marks to striking anomalies.

1. The 1943 Copper Penny, with its incorrect planchet composition, stands out among rare US error coins.

One of the most sought-after rare coin errors in US numismatic history, the 1943 Copper Penny, is highly coveted by collectors for its scarcity and historical significance. Amid the pressures of World War II in 1943, the United States minted pennies using steel due to the shortage of copper, which was reserved for wartime needs.

However, a few copper planchets from the previous year’s production remained in the coining press hopper and were struck with the 1943 dies. This resulted in a small number of pennies being minted in copper, creating a rarity among the vast majority of steel pennies produced that year.

While the error was discovered shortly after production began, a handful of copper pennies managed to slip into circulation. Only a few dozen are known to exist, making this coin a prized possession among numismatists:

1943 Copper Penny

- Metal: Copper

- Year: 1943

Photo by PCGS

2. A prime example of rare error coins, the 1955 Doubled Die Lincoln Cent showcases prominent doubling.

A remarkable rare coin to look for is the 1955 Doubled Die Lincoln Cent, renowned for the prominent doubling effect on its obverse. During the minting process, four of the coin’s main design elements, i.e. President Lincoln’s profile, the inscriptions “LIBERTY,” “IN GOD WE TRUST,” and the date, were struck onto it twice instead of once.

This error happened due to a misalignment or misregistration of the coin die during the hubbing. As a consequence, the design elements were impressed onto the coin’s surface slightly offset from their intended position, causing a prominent doubling effect that is easily visible to the naked eye, distinguishing it from regular strikes.

Despite efforts to correct the error, a significant number of these doubled die cents entered circulation, making them highly desirable among collectors for their unique appearance.

1955 1 Cent Doubled Die Obverse

- Metal: Copper

- Year: 1955

Photo by PCGS

3. The 1982 No Mint Mark Roosevelt Dime ranks among rare US coin errors thanks to its notable absence of a mint mark.

Another one of the most intriguing rare US error coins is the 1982 No Mint Mark Roosevelt Dime. Typically, US coins bear a mint mark indicating where they were produced, such as “P” for Philadelphia or “D” for Denver. Mint marks are punched onto the coin die before striking, but in the case of this 1982 Roosevelt Dime, the mint mark was either omitted or the die used lacked the mint mark altogether.

Although the absence of a mint mark on the 1982 dime was unintentional and likely occurred due to a technical error during the minting process, the error’s exact cause remains uncertain. Some numismatists speculate that the absence of a mint mark on some 1982 Roosevelt Dimes could be attributed to the fact that 1982 was a transitional period for US coinage, where the US Mint transitioned from striking coins with a composition of 90% silver to a copper-nickel clad composition.

1982 10 Cents No Mintmark

- Metal: 75% Copper, 25% Nickel

- Year: 1982

Photos by PCGS

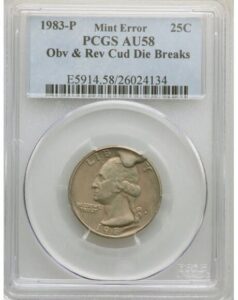

4. A prized find among rare US error coins, the 1983-P Washington Quarter is notable for its cud die breaks.

An extraordinary error coin, the 1983-P Washington Quarter with obverse and reverse cud die breaks, is a fantastic addition to any numismatic collection. This coin exhibits distinctive die breaks, or “cuds”, on both its obverse and reverse faces, setting it apart as a remarkable specimen.

The prominent cuds, characterized by raised areas or blob-like features near the edges of the coin, are a testament to the anomalies encountered during the minting process. These remarkable die breaks are believed to have resulted from damage or deterioration to the coin dies.

Beyond its high rare error coins value, this 1983-P Washington Quarter serves as a tangible reminder of the intricacies involved in minting coins, perpetually capturing the imagination of coin enthusiasts.

1983-P Washington Quarter with Obverse and Reverse Cud Die Breaks

- Metal: 75% Copper, 25% Nickel

- Year: 1983

5. A standout among rare mint error coins, the 2000-P Sacagawea Cheerios Dollar showcases a distinct tail feather design error.

The 2000-P Sacagawea Cheerios Dollar is a highly sought-after and valuable error coin that originated from a unique promotional campaign by General Mills. During the launch of the Sacagawea dollar coin, the American multinational food company General Mills distributed a small number of these coins encased in plastic capsules as part of a marketing promotion with boxes of Cheerios cereal.

These coins, often referred to as “Cheerios Dollars,” were minted using a unique method distinct from regular Sacagawea dollars. This resulted in a tail feather design error, noticeably different from the smoother, less defined tail feather pattern found on standard Sacagawea dollars.

Due to their limited distribution and distinct design, these error coins are considered rare and highly collectible among numismatists, representing a unique find for those seeking rare no date Sacagawea coins with errors and more.

2000-P Sacagawea Cheerios Dollar

- Metal: Copper

- Year: 2000

Browse through Blanchard’s extensive selection of rare US error coins here.

Rare mint error coins from all over the world

Shifting our focus to error coins beyond the borders of the United States, these international rarities offer a fascinating glimpse into the intricacies of coin production and the diversity of errors found in global currency.

1. One of the UK’s most coveted rare error coins, the 1983 ‘New Pence’ 2p coin is renowned for its misprinted inscription.

The 1983 ‘New Pence’ 2p coin is one of the most remarkable rare mint error coins in British numismatics. Amidst a transitional period in British coinage during 1982, the Royal Mint was in the process of updating the inscription on the 2p coin from “New Pence” to “Two Pence.” However, a peculiar occurrence arose when a fraction of the 1983-dated 2p coins were inadvertently struck with the outdated “New Pence” inscription instead.

The presence of the incorrect inscription renders the 1983 ‘New Pence’ 2p coin a rare and sought-after piece among collectors, highlighting the evolving nature of British currency during that time.

1983 New Pence 2p

- Metal: Bronze

- Year: 1983

Photo by The Britannia Coin Company

2. With its unusually large date, Canada’s 1969 10 Cents is a standout among rare mint error coins.

The 1969 Canadian 10 Cents coin stands out among Canadian numismatic treasures due to a unique error. Unlike standard issues, some coins from this year feature noticeably larger date digits.

This error likely occurred due to a misalignment or the use of a different die during the minting process. Notably, fewer than 20 examples of this coin exist, making it an exceptionally valuable find for collectors of Canadian rare error coins.

Elizabeth II 10 Cents 1969 Large Date

- Metal: Nickel

- Year: 1969

3. Featuring a distinctive curved clip, the 1981 Curved Clip 10 Cent is a special find among rare error coins.

A significant example of a rare Australian 10 Cent coin error is the 1981 Curved Clip 10 Cent, which features a pronounced curve along the edge, distinguishing it from standard issue of the coin. This anomaly happened when a portion of the coin’s metal strip was inadvertently clipped during minting, resulting in a distinctive curved shape along one edge of the coin. This clipping error is typically caused by the minting equipment improperly feeding the coin strip into the press.

Despite its small size, a curved clip significantly affects the appearance and value of the coin, and collectors eagerly seek out such error coins for their uniqueness, making the 1981 Curved Clip 10 Cent coin highly sought-after.

1981 Ten Cent Curved Clipped Planchet Error

- Metal: Copper Nickel

- Year: 1981

Photo by The Purple Penny

4. One of Australia’s most coveted rare mint error coins, the 2010 Upset Error 50 Cent demonstrates significant striking misalignment.

When it comes to rare australian 50 cent coin errors, the Australian 2010 Upset Error 50 Cent coin exhibits a fascinating anomaly in its design. During its minting process, a 30 degree misalignment of the obverse and reverse dies caused the coin’s design elements to be off-center or tilted. As a result, they appear tilted or askew in relation to the coin’s edge. Collectors are particularly drawn to this unique error for its unconventional and visually striking features.

2010 50 Cent Upset Error

- Metal: Cupro-Nickel

- Year: 2010

Photo by The Purple Penny

Learn more about Australian rare coins here.

5. A unique example of rare coin errors, the 1907 10 Centavos from Mexico features a lamination anomaly.

As one of the most important rare error coins in circulation that the Mexican government is in the process of withdrawing, this 1907 10 Centavos coin is considered a special stand in numismatic circles due to an unusual error. Struck on a laminated planchet, this error is visibly apparent on the coin’s obverse. The lamination process, involving layers of metal bonded together, resulted in a distinct appearance that differs from standard coins of the series, adding to the coin’s appeal.

1907 10 Centavos Lamination Error

- Metal: Silver

- Year: 1907

Photo by NGC Collectors Society

Where to buy rare coins

Error coins, both from the United States and around the world, hold a captivating allure for collectors and enthusiasts alike. From intriguing misprints to die breaks and incorrect planchet composition, each error coin tells a story of its own, showcasing the fascinating complexities of minting processes and the rich history of numismatics.

To enhance your coin collection with rare coins, Blanchard‘s unparalleled offerings are the perfect choice. Consulting Blanchard’s team of experts for further guidance and insights into rare error coins value and more.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

March Inflation Still High: 3 Portfolio Moves for Investors Now

Posted onFor Americans living in the Atlantic basin, hurricane season starts soon. Yet, stormy weather appears to be descending on the U.S. economy and the stock market too.

The Federal Reserve got several doses of bad economic news in recent weeks—an uncomfortable combination of slower economic growth and rising inflation. Financial markets took notice. Stocks plunged and gold hit a new all-time record high. For investors, we offer three portfolio moves to consider now to batten down the hatches and help keep your wealth safe. First the numbers.

March Inflation Data Jumps

Americans still feel like prices on everyday goods and services are rising. Recent economic data confirms that is true.

The March Personal Consumption Expenditures inflation data came in stronger-than-expected as the headline number rose from 2.5% to 2.7%. This confirms the recent rise in the March Consumer Price Index, which rose on an annual basis to 3.5%, up from the February 3.2% reading.

The Fed can’t be happy that inflation is going in the wrong direction. This will most likely push out the timing of any interest rate cuts in 2024.

First Quarter Growth Slows

While inflation remains high, economic growth is slowing down. First quarter gross domestic product data revealed a sharply lower-than-expected 1.6% growth rate—well below the 2.5% consensus forecast. That shows the U.S. economy is growing at its slowest pace in nearly two years!

It’s no surprise, Americans are increasingly concerned about the fresh rise in inflation and slowing economy. The latest University of Michigan Consumer Sentiment survey revealed a drop in the Current Conditions sentiment index from 82.5 to 79.0.

Stocks Stumble: Bears Come Out of Hibernation

Meanwhile, stock market bears have come out of their caves from hibernation and they are growling, hungry and mad.

Investors began dumping stocks in April following this spate of worse than expected economic news. Disappointing earnings from big name tech stocks like Meta also dragged down the broader market in April. Meta’s shares plunged nearly 11% and other so-called “Magnificent Seven” stocks weren’t looking so magnificent as Alphabet, Amazon and Microsoft also saw heavy selling.

Gold Prices Touch Fresh Highs

In the midst of the disappointing economic news and stock market selling, gold prices rallied since mid-February in a historic and unprecedented fashion. After surging over 8% in March, gold climbed over 3% in April, touching a new all-time record high above $2,300 an ounce. Physical investment demand for gold bars and coins has been rising in anticipating of even further price gains in precious metals.

Portfolio Moves You Can Consider Now

Just as a farmer tends to his fields in the spring so he can reap his harvest later, taking care of your portfolio now can help keep your capital safe and your money growing. Here are three portfolio moves you can consider now.

- Rebalance your investments: Rebalancing simply means selling a portion of your stock allocation and buying more of other asset classes like gold and silver.

- Prepare for more stock market volatility ahead: Investing too heavily in the stock market can put you at risk if the stock market goes into a downturn or even a crash. Americans who need cash might have no choice but to pull money out of the stock market at a significant loss.

- Diversify with an increased allocation to gold and silver: Gold and silver bullion in physical form is an appropriate asset for a portion of any properly diversified investment portfolio and we recommend investing up to 10% of your overall portfolio in gold, depending on your financial goals and risk tolerance levels.

If you would like to discuss a personalized precious metals investing strategy tailored to your long-term investment goals, risk tolerance and time horizon, call a Blanchard portfolio manager today.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

3 Most Valuable Morgan Dollars

Posted onOften referred to as the “King of America’s coins,” the Morgan Dollar is a widely cherished numismatic treasure, fascinating collectors for decades. Despite their ubiquity, however, the values of these iconic coins exhibit an exceptionally diverse range. This article will explore why that is and answer the question “What are the most valuable Morgan Silver Dollars?”, highlighting:

- The origins of these legendary coins.

- The elements that make Morgan Dollars valuable.

- The three most valuable Morgan Dollars.

For a comprehensive list of which Morgan Dollars are valuable, watch this informative video:

What makes a Morgan Silver Dollar valuable

Before answering the question of “What is the most valuable Morgan Silver Dollar today?”, let us first review some fundamental attributes of this esteemed coin.

Where valuable Morgan Dollars were minted

Since their inception in 1878, Morgan Dollars have been minted at various locations across the United States, with each mint leaving its distinctive mark on these iconic coins. Exploring the regional nuances in production reveals subtle variations that enhance the individuality and desirability of Morgan Dollars. As most coin connoisseurs will know, these are the distinct mint marks that characterize valuable Morgan Dollars’ different production locations:

- Philadelphia: No mint mark.

- San Francisco: “S” mint mark.

- Carson City: “CC” mint mark.

- Denver: “D” mint mark.

- New Orleans: “O” mint mark.

Purity of the most valuable Morgan Silver Dollars

Morgan Silver Dollars minted between 1878 and 1921 were crafted from a durable composition of 90% silver and 10% copper. This alloy adhered to the specifications outlined in the Coinage Act of 1837, a law designed to ensure the consistency and reliability of coins by regulating their metal content. Essentially, the Act aimed to prevent fluctuations in the value of currency by establishing a standardized composition for coins.

Notably, a commemorative issue of the Morgan Dollar released in 2021 marked a departure from the coin’s traditional alloy with a composition of 99.9% pure silver. This adjustment aimed to acknowledge contemporary numismatic preferences while upholding the coin’s enduring legacy and intrinsic value.

Browse through more rare silver coins beyond valuable Morgan Silver Dollars.

What year Morgan Dollars are valuable?

With a substantial minting period spanning four decades, from 1878 to 1921, the Morgan Dollar series naturally encompasses several key dates. Numerous Morgan Dollar coins stand out as rare or significant, presenting collectors with a diverse range of numismatic treasures. Some examples of the most valuable Morgan Silver Dollar years carrying unique historical and numismatic importance include, but are not limited to, the following:

- 1878: Morgan Dollars produced in the series’ inaugural year hold a special appeal as the first standard silver dollars minted since the enactment of the 1873 Coinage Act. Struck in Philadelphia, three different reverse designs were created that year, with the first variety featuring an eagle with eight tail feathers being especially highly prized.

- 1879-CC: Carson City Mint has always held a certain mystique, due to its relatively brief operational period, adding to the desirability of the 1889-CC Morgan Dollar. With a low survival rate, this coin constitutes a particularly hard-to-find issue.

- 1884-S: The uniqueness of the 1884-S coin lies in its departure from the typical fate of Morgan Dollars. Unlike most of its counterparts, which were bagged and stored for future release, almost all of the 1884-S Morgan Dollars were circulated.

- 1892-S: The 1892-S Morgan Dollar, while minted in higher numbers compared to its Philadelphia counterpart, is considered exceptionally rare, particularly in mint state. This is because the majority of San Francisco coins either entered circulation or were melted in 1918.

- 1893-S: What makes the 1893-S coin a key date in the series is that only a mere 100,000 of it were struck, marking it as the lowest mintage for any business strike in the Morgan Dollar series.

- 1895: An anomaly in the series, the 1895 Morgan Dollar holds unparalleled value as one of the most valuable Morgan Dollars. With no official circulation coins minted that year, the few proof coins produced make it a numismatic gem.

- 1903-O: The 1903-O Morgan Dollar, once deemed the rarest in the series, gained legendary status due to its scarcity. Originally believed nearly extinct despite a mintage of 4.5 million, its unexpected resurgence in the early 1960s, when a cache of coins stored in Philadelphia vaults was discovered, astonished collectors.

- 1921: What makes a 1921 Morgan Silver Dollar valuable is that it was the final year of Morgan Dollar production, marking the end of an era. Coins from the Philadelphia Mint and especially the Denver Mint from this year carry historical weight, appealing to collectors drawn to the concluding chapter of the series.

Are Morgan Silver Dollars valuable for any other reasons?

As exemplified by the key date coins discussed above, Morgan Dollars command numismatic interest for a wide array of reasons. Among the factors that make Morgan Silver Dollar most valuable and contribute to their status as numismatic gems are the following:

- Historical significance: Morgan Dollars connect collectors to pivotal moments in American history, as they were minted during a transformative era in American history. Emerging in the aftermath of the Coinage Act of 1873, Morgan Dollars encapsulate the nation’s economic and social evolution.

- Noteworthy design: Crafted by George T. Morgan, Chief Engraver at the US Mint between 1876 and 1925, the Morgan Silver Dollar is celebrated for its elegant design. This features Lady Liberty’s profile on the obverse and the heraldic eagle on the reverse. Notably, the inaugural issue of the coin displays eight tail feathers on the eagle, with the fascinating 7 over 8 Tail Feathers variety adding a unique touch to certain coins.

- Limited production numbers: Morgan dollars exhibit varying mintage numbers throughout their production, with later editions often surpassing earlier releases. The factors influencing mintage, such as economic conditions and silver supply considerations, contribute to the rarity of specific years, irrespective of high production numbers.

- Survival rates: Numerous Morgan Dollars have low survival rates. Many coins were subject to melting, circulation wear, or hoarding, leading to a reduced number of well-preserved specimens and making the Morgan Dollar most valuable in the world of numismatics.

- Minting Errors and varieties: The Morgan Dollar series showcases complexity and diversity, captivating collectors with the thrill of numerous unique anomalies. Variations including double dies, overdates, and the distinctive Carson City mint mark contribute to the series’ rich numismatic tapestry.

3 most valuable Morgan Dollar coins

As mentioned earlier, the price spectrum for Morgan Dollars is extensive. On the lower end of the scale, collectors can acquire these iconic coins for as little as $30. This affordability renders them an excellent choice for entry-level collectors to begin their numismatic journey.

However, the coin series also allows numismatists with a bigger budget to explore more exclusive and rare specimens, with some Morgan Dollars reaching several thousand dollars or even more in the upper echelons of the market. For those seeking high-value acquisitions, we will now highlight three of the most valuable Morgan Silver Dollar value coins that will make a great addition to your collection.

1891-CC: one of the most valuable VAM Morgan Dollars

1891-CC Morgan $1 Top-100 VAM-3 Spitting Eagle NGC MS65

- Country: United States

- Metal: Silver

- Year: 1891

- Why it is valuable: Most coin connoisseurs will, beyond a doubt, give the same answer to the question “What are the most valuable Morgan Dollars?”, citing the 1891 “Spitting Eagle” variety of the coin. Minted in Carson City and considered a minting anomaly due to a die clash, i.e. where the dies clashed during the striking process, this coin is characterized by the fact the eagle on its reverse appears to have an open beak, creating an illusion that it is “spitting” feathers. The “VAM” designation of this specific coin signifies that it is a recognized variety by numismatists, adding to the coin’s historical and collectible value.

- Check our most current price here.

1892-CC: one of the most valuable CC Morgan Dollar coins

- Country: United States

- Metal: Silver

- Year: 1892

- Why it is valuable: The 1892-CC Morgan Silver Dollar is considered one of the most valuable Morgan Dollar coins for several reasons. Firstly, it was minted by the Carson City Mint in what were relatively low numbers for that year. Moreover, this coin boasts a storied history, with its scarcity shifting dramatically in the late 1950s with a Treasury release that prompted a surge in prices in the 1960s and 1970s. High-grade specimens of this coin are very rare, with estimates plummeting from MS-60 to MS-65 or better.

- Get our most current price here.

Photo by PCGS

1889-CC: one of the most valuable Morgan Dollar dates

- Country: United States

- Metal: Silver

- Year: 1889

- Why it is valuable: The 1889-CC $1 Morgan stands as a numismatic treasure with a compelling backstory. Minted in the final quarter of 1889 at the Carson City Mint, only 350,000 were struck, primarily entering circulation. As the most elusive Carson City Morgan and what many consider the most valuable Morgan Silver Dollar today, its scarcity is underscored by the low survival rate, making high-grade examples exceptionally rare.

- View our most current price here.

Photo by PCGS

To read more about the 1889-CC coin, i.e. one of the most valuable Morgan Silver Dollar dates, click here.

Where to buy the most sought-after Morgan silver dollars

With a rich and eventful history that traces its origins to the late 1800s, Morgan Silver Dollars have transcended their utilitarian origins to become cherished artifacts in the world of coin collecting.

To acquire the most sought-after Morgan Silver Dollars that have stood the test of time, consider using Blanchard. Renowned for its expertise in the field and unwavering commitment to authenticity, Blanchard stands as one of the most reliable sources for coin enthusiasts looking to enhance their collections. Blanchard’s long-standing presence in the numismatic community attests to its dedication to preserving the legacy of iconic rare American coins and providing collectors with genuine pieces of history.

Do not hesitate to reach out to Blanchard’s team of experts for valuable insights, including guidance on which Morgan Silver Dollars are valuable and more.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Fed fails to act at today’s meeting, Gold up 23% in 6 months

Posted onStill-Rising Inflation Forced Fed to Keep Interest Rates at 23-Year High

The Federal Reserve failed to surprise anyone as it left interest rates unchanged at the end of its Wednesday meeting. Recent economic data has revealed inflation higher-than-expected for the past three months. What’s more, inflation levels are once again rising—not falling.

meeting. Recent economic data has revealed inflation higher-than-expected for the past three months. What’s more, inflation levels are once again rising—not falling.

The Fed’s long battle with inflation is far from over, and the road to get to a 2% inflation level could be a bumpy ride ahead. At it’s last meeting, the Fed hinted at plans to cut interest rates three times in 2024. Notably, the Fed’s post-meeting statement today failed to deliver any signs that it plans to lower interest rates anytime soon.

Wednesday’s inaction by the Fed leaves the benchmark rate at 5.25% to 5.5% for the sixth meeting in a row.

The Fed acknowledged that: “Inflation has eased over the past year but remains elevated. In recent months, there has been a lack of further progress toward the Committee’s 2 percent inflation objective.”

The Fed added that: “The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.”

Market Reaction Muted

Financial markets didn’t show a strong reaction to the news, which was widely expected by most on Wall Street. Stocks were little changed from pre-announcement levels. The U.S. dollar index revealed the strongest reaction to the Fed news, tumbling sharply to fresh lows on the day. Gold hung onto gains achieved before the meeting ended, with spot gold recently trading at $2,320.70 an ounce. Silver was also trading higher after the Fed meeting concluded at $26.70.

Where is Inflation Right Now?

The most recent March Consumer Price Index rose on an annual basis to 3.5%, up from the February 3.2% reading. That’s well above the Fed’s stated 2% target rate and unfortunately for Americans going in the wrong direction.

The Labor Department delivered additional concerning news on the inflation front when it said that total compensation for U.S. workers increased 1.2% in the first quarter. That marks a 0.9% increase from the end of last year. Why does this matter? Increasing levels of wage growth could further stoke broad inflation if employers pass higher labor costs to consumers through price increases.

Gold Prices up Astonishing 23% in Last Six Months

In the face of the Fed’s struggling battle against inflation and amid broader worries around slumping stocks and slowing economy, gold has served as a safe-haven for investors.

Gold has climbed a remarkable 23% over the last six months, recently touching a new all-time record high above $2,300 an ounce. Physical investment demand for gold bars and coins has been rising in anticipating of even further price gains ahead in precious metals.

Today’s action reveals the Fed’s holster is empty and out of bullets in the inflation battle. The Fed meets next on June 12 and current market projections reveal only a 6% chance of a Fed rate cut at that meeting, according to the CME Fed Watch tool.

With few ways left to fight the still-rising inflation levels, gold will continue to act as a safe-haven for investors in this challenging economic environment.

Gold has served as a way to protect, preserve and grow wealth for 5,000 years. The time is ripe now for you to rebalance your portfolio and increase your allocation to gold. Wondering how much of an allocation to gold is right for you? Call Blanchard today and we can provide a personalized recommendation based on your long-term investment goals, your risk tolerance level and time horizon. We are here for you.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Top Five Unique U.S. Pattern Coins

Posted onWithin numismatics, pattern coins are an intriguing and historically significant group of U.S. rare coins. Before striking new designs for circulation, the U.S. Mint produces a pattern coin to see how the proposed features work in three dimensions. Collectors are attracted to pattern coins as many boast unusual features that were never adopted for circulation. Let’s take a look at five of the most unique U.S. pattern coins:

- 1792 Copper Birch Cent J-4

- 1792 Cent J-C1792-1, Dickeson Restrike

- 1849 Gold $1 J-115

- 1860 Transitional Half Dime J-267

- 1866 Indian Head Cent J-456

1. 1792 Copper Birch Cent J-4

It is believed that Robert Birch, one of the original U.S. Mint employees in 1792, engraved the large copper pattern coins known today as “Birch cents.” This 1792 Copper Birch Cent with a Lettered Edge reveals two stars on the edge and this inscription on the edge: TO BE ESTEEMED*BE USEFUL*. This Birch Cent is a highly sought after and scarce pattern coin, with only seven or eight survivors.

2. 1792 Cent J-C1792-1, Dickeson Restrike

This pattern coin, also struck in 1792 is a privately issued token, known as the 1792 “Trial Piece” struck by Dr. Montroville Dickeson. This interesting coin features an eagle die from a revenue stamp with a reverse die inscription: TRIAL PIECE DESIGNED FOR THE UNITED STATES, implying it had been used at the U.S. Mint to produce the coins, which it had not!

3. 1849 Gold $1 J-115

What makes this gold dollar unique? It has a hole in the middle of it. In 1849, the U.S. Mint began striking $1 gold coins for circulation. However, they had a tiny diameter, because there wasn’t much gold in them. Soon after, the U.S. Mint began receiving complaints about the coin—specifically that its small size at 14.3 millimeters made it easy to lose. This pattern coin shows one of the ideas that Mint had to increase the coin’s diameter—putting a hole in the middle of it! It was a thinner, larger coin that still contained a dollar’s worth of gold. There are only a handful of these unique rarities know to survive today.

4. 1860 Transitional Half Dime J-267

In 1859, the U.S. Mint decided to move the inscription UNITED STATES OF AMERICA from the reverse of the half dime to the obverse. This transitional pattern coin minted in 1860 combined a Stars obverse with the new, larger wreath on the reverse. However, neither sides of the coin showed the name of our country! The reason? The inscription had been removed from the reverse die, but not yet added to the obverse! The omission of UNITED STATES OF AMERICA only adds to the intrigue around these ultra-rare pattern coins.

5. 1866 Indian Head Cent J-456

This 1866 Indian Head Cent pattern is made from copper and nickel. Yet, this coin should have been made of bronze! Even today, numismatic historians don’t fully understand how or why this coin was created. Since the last copper-nickel cents were struck in 1864, there is speculation this is an off-metal error coin. However, because there about half a dozen known survivors, another theory suggests this was an off-metal coin deliberately produced for sale to collectors. Either way, this 1866 Indian Head pattern is a highly desired coin by collectors of this series.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.